Answered step by step

Verified Expert Solution

Question

1 Approved Answer

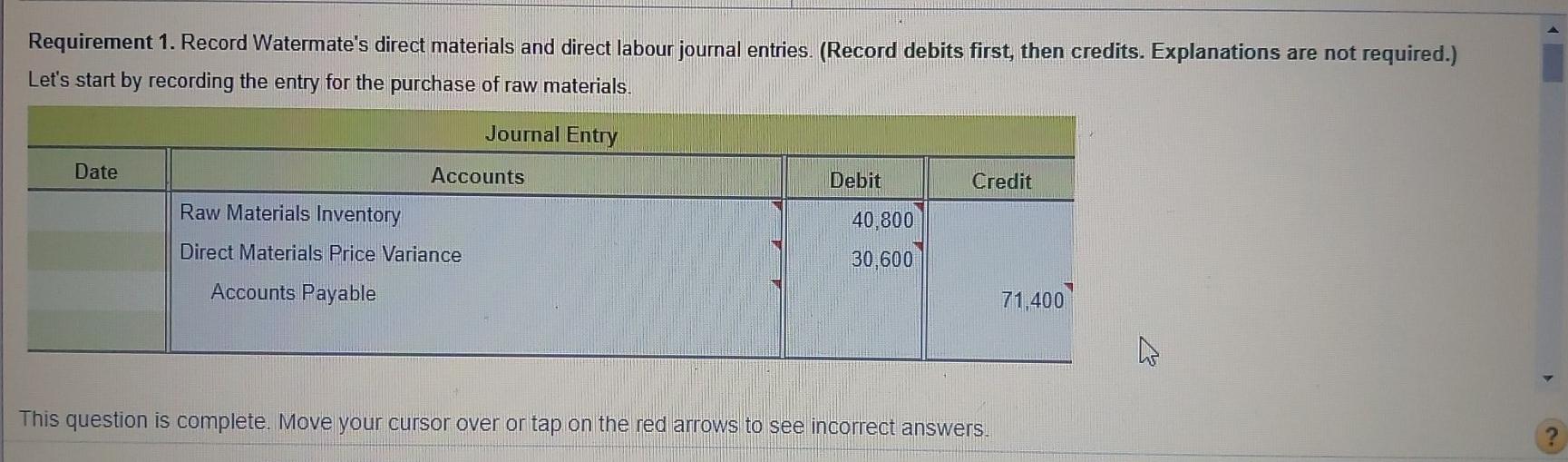

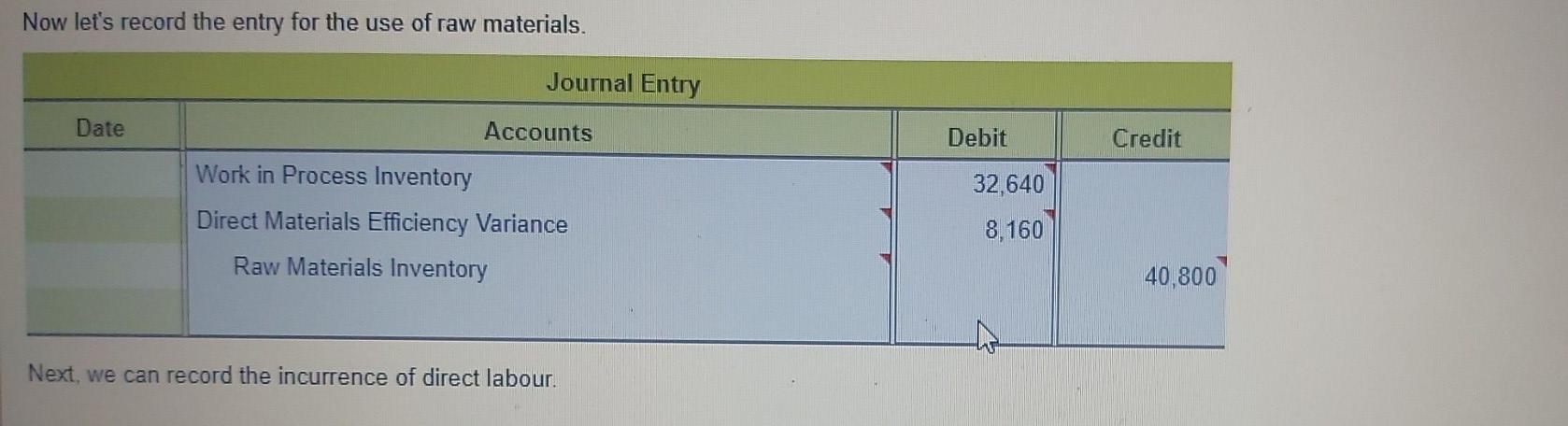

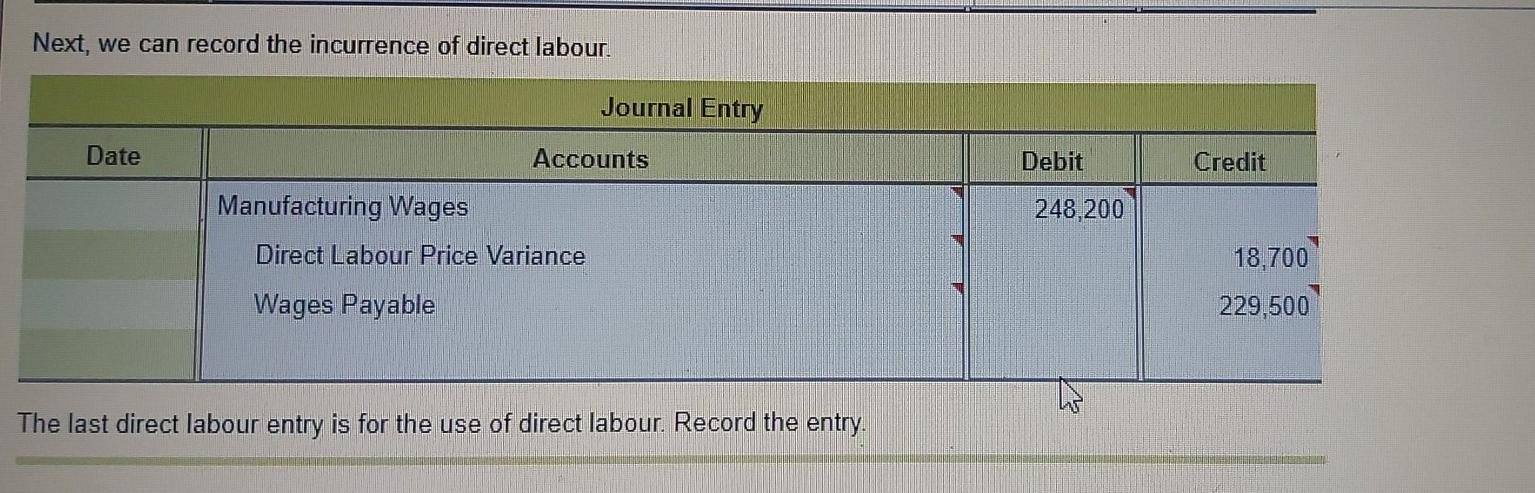

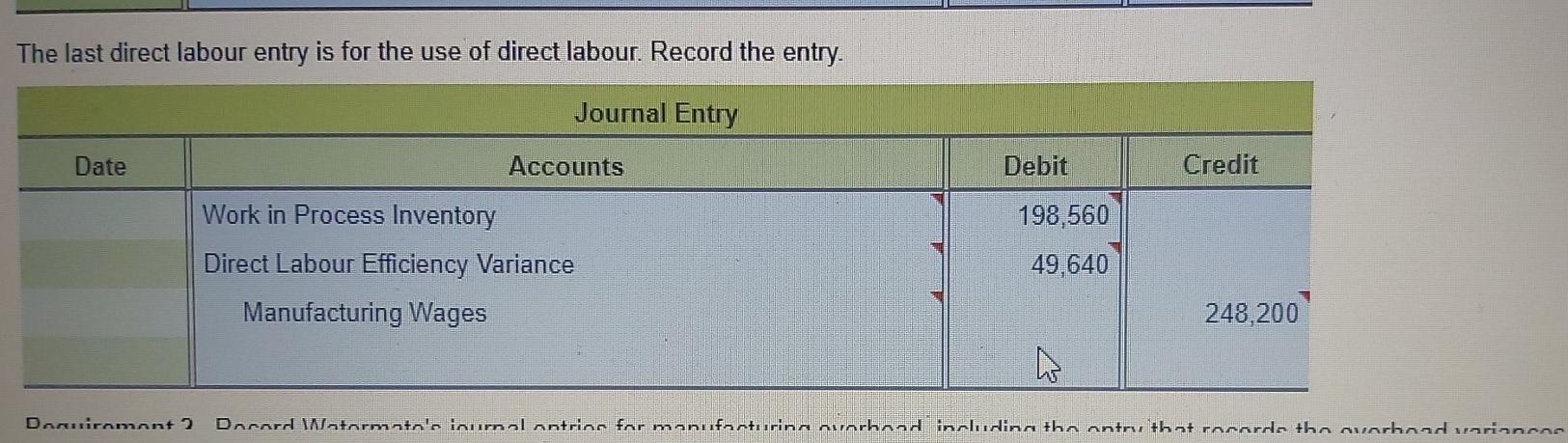

requirement 1 requirement 2 requirement 3 Question info Requirement 1. Record Watermate's direct materials and direct labour journal entries. (Record debits first, then credits. Explanations

requirement 1

requirement 2

requirement 3

Question info

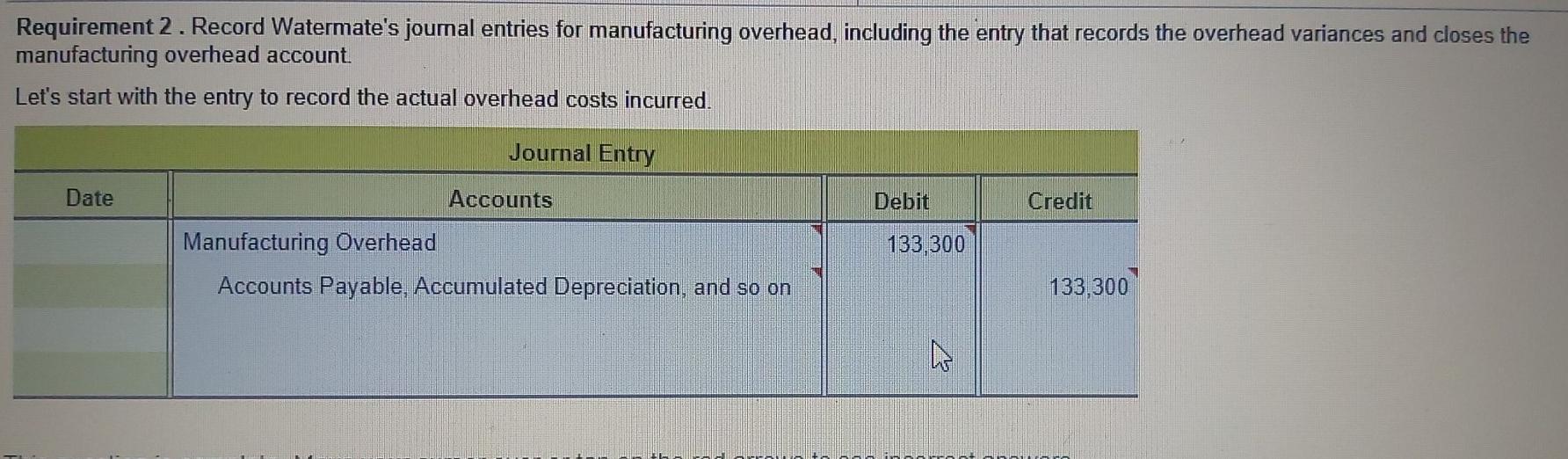

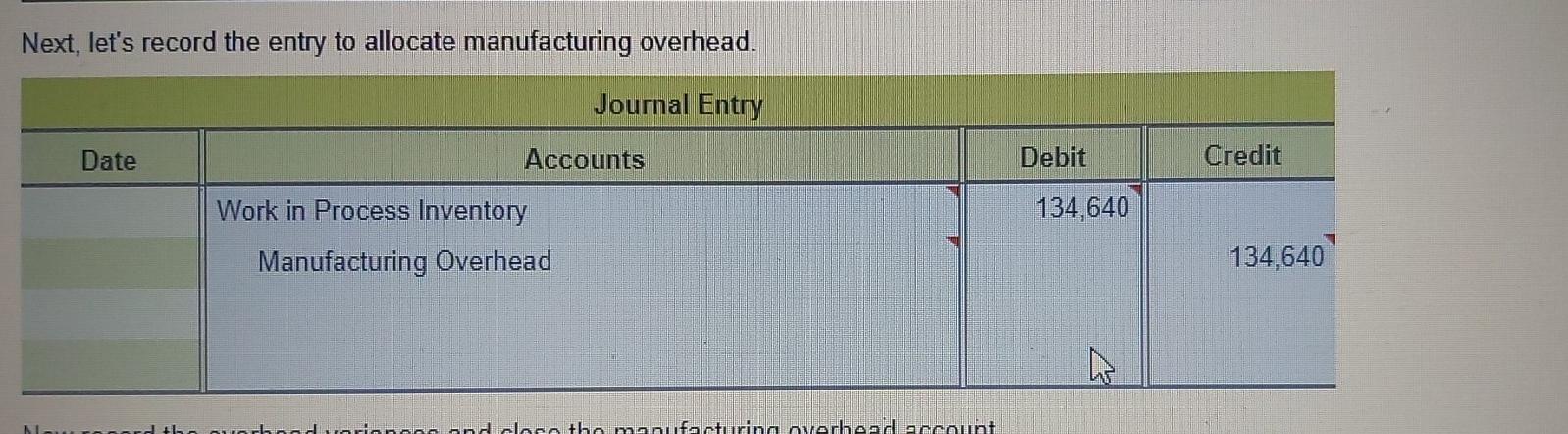

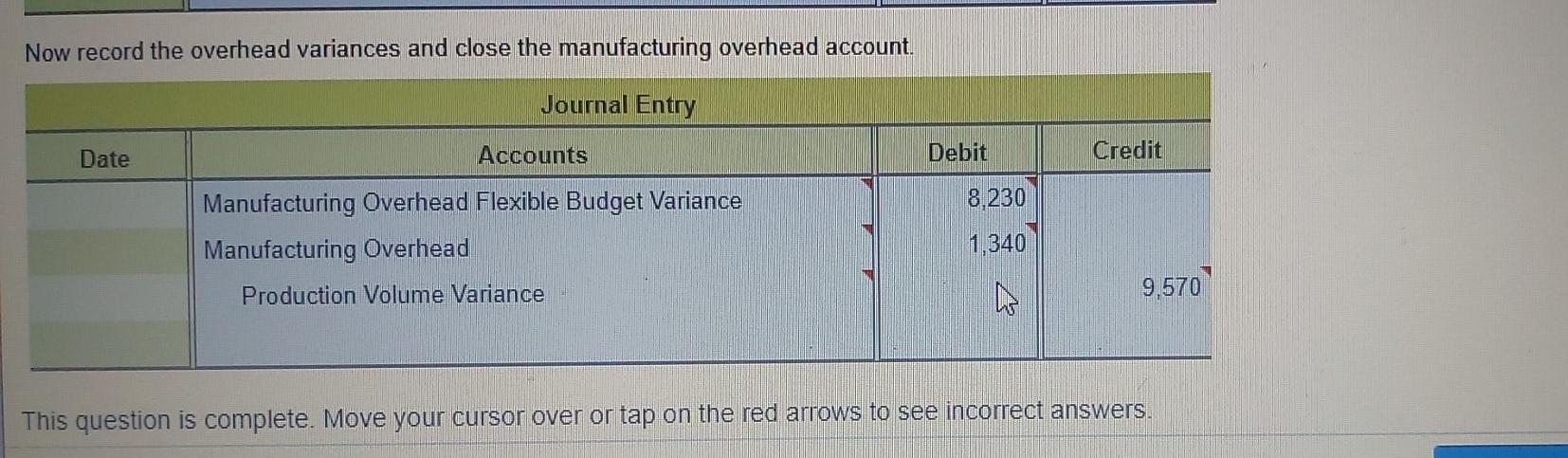

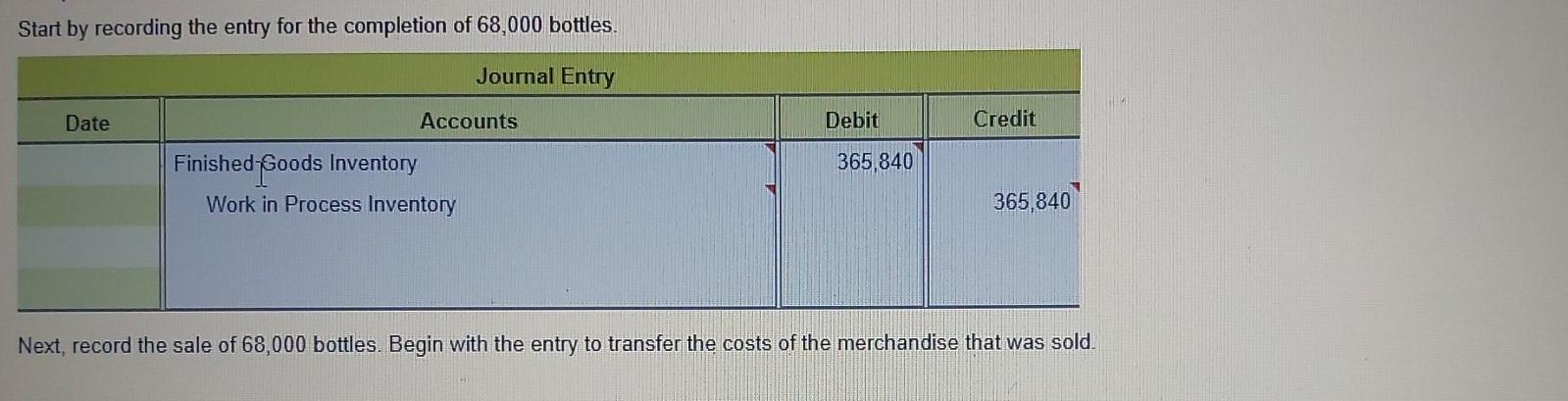

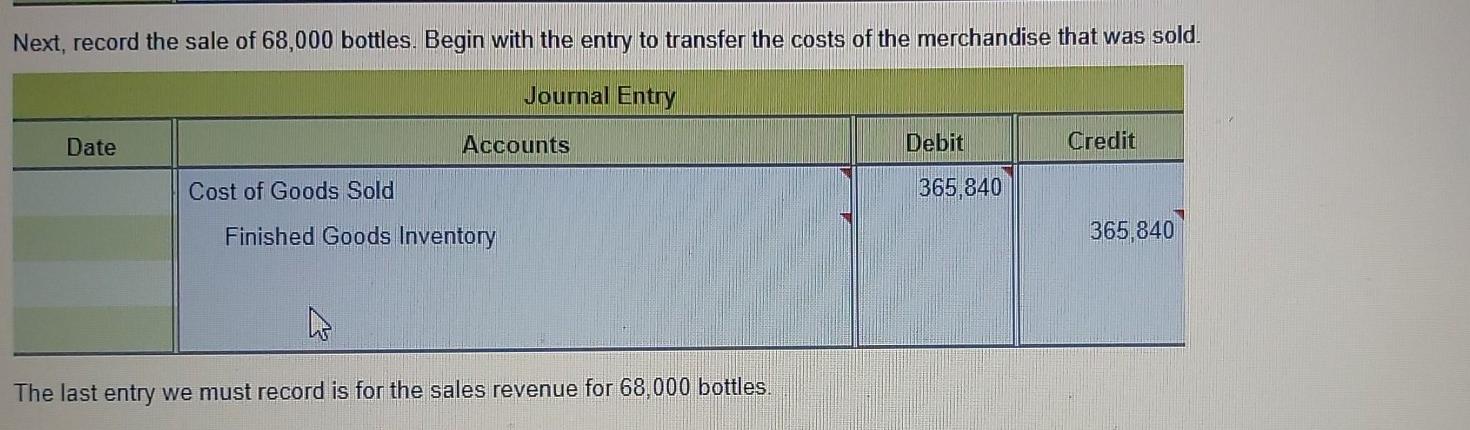

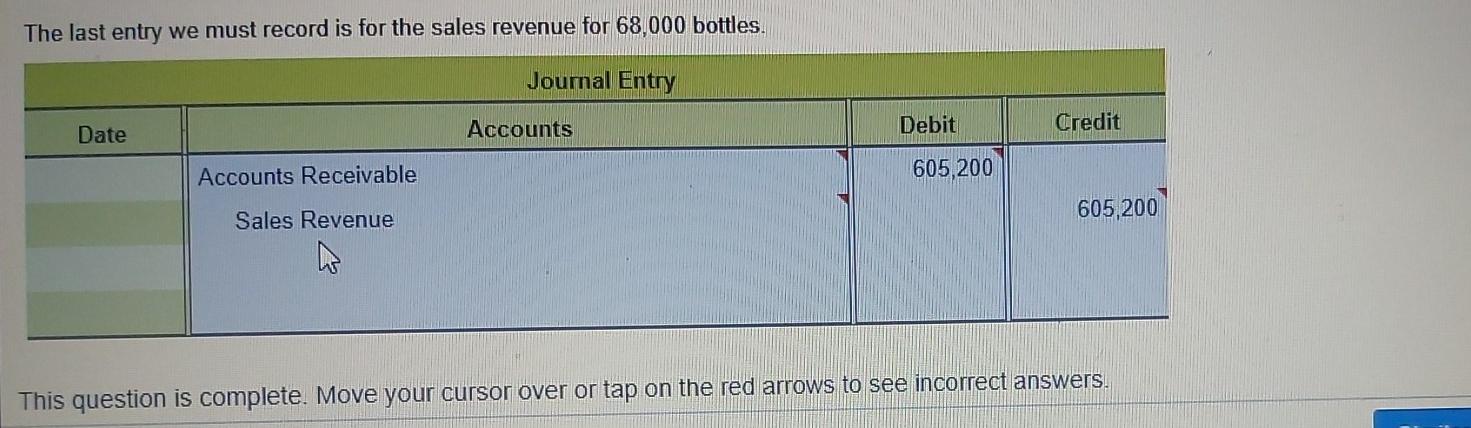

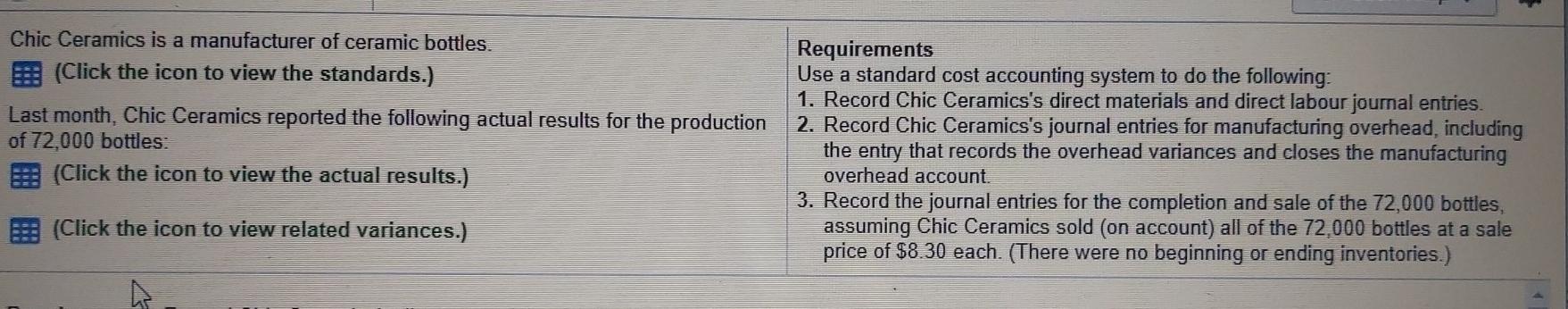

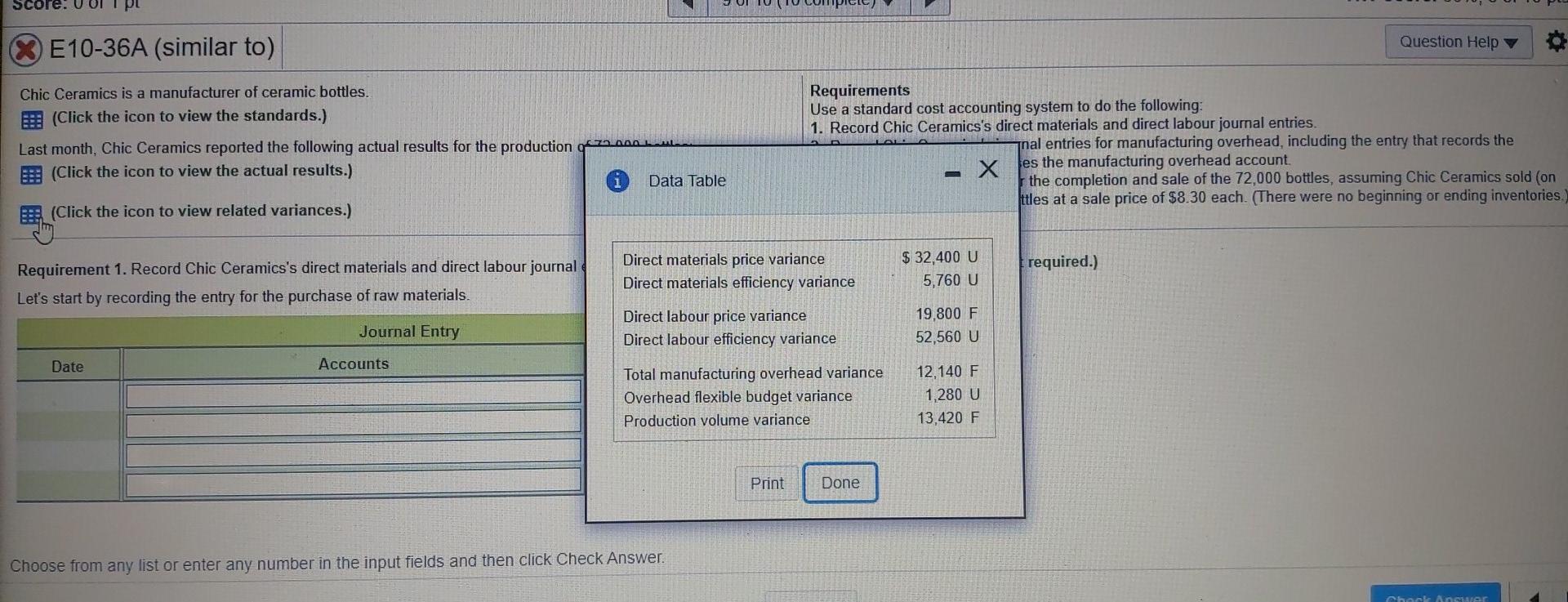

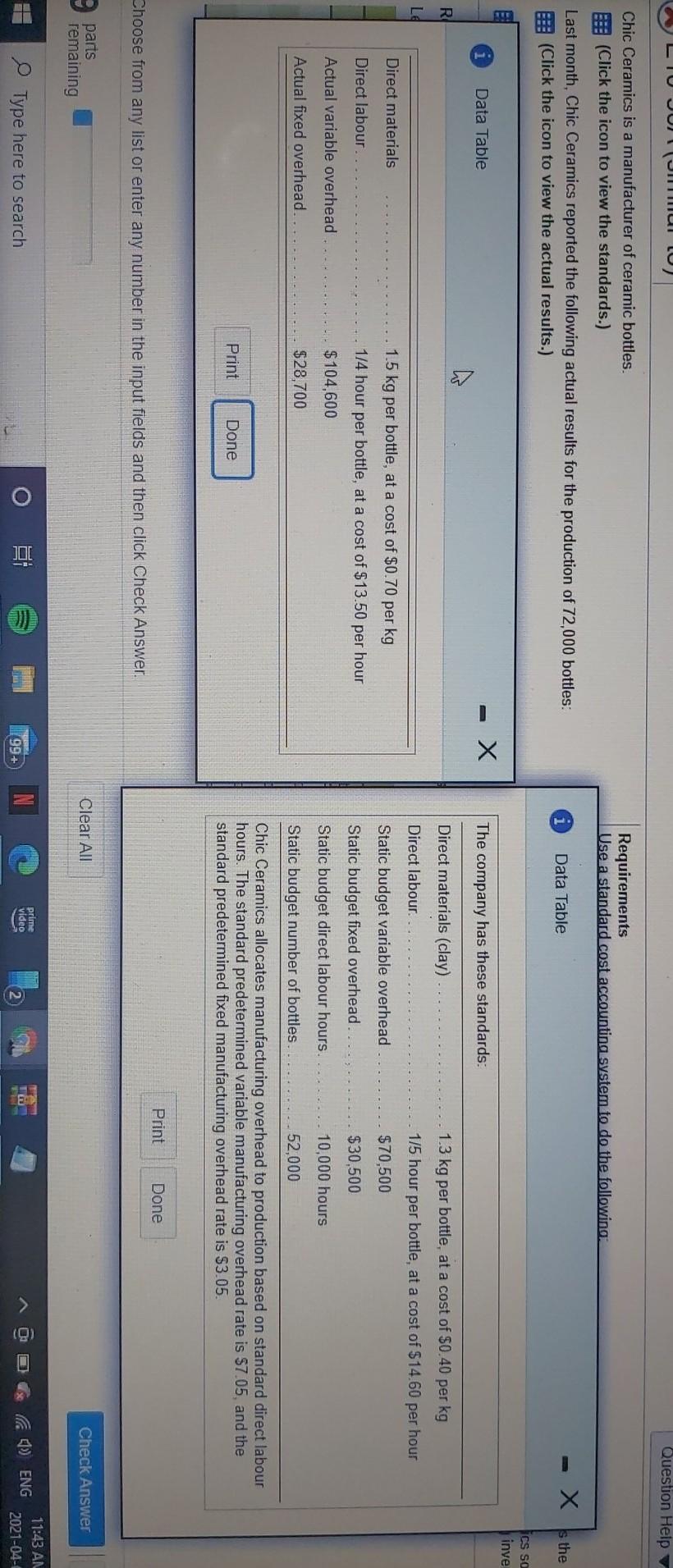

Requirement 1. Record Watermate's direct materials and direct labour journal entries. (Record debits first, then credits. Explanations are not required.) Let's start by recording the entry for the purchase of raw materials. Journal Entry Date Accounts Debit Credit Raw Materials Inventory 40.800 Direct Materials Price Variance 30.600 Accounts Payable 71,400 This question is complete. Move your cursor over or tap on the red arrows to see incorrect answers. Next, we can record the incurrence of direct labour Journal Entry Date Accounts Debit Credit Manufacturing Wages 248,200 Direct Labour Price Variance 18,700 229,500 Wages Payable w The last direct labour entry is for the use of direct labour. Record the entry. The last direct labour entry is for the use of direct labour. Record the entry. Journal Entry Date Accounts Debit Credit 198,560 Work in Process Inventory Direct Labour Efficiency Variance Manufacturing Wages 49,640 248,200 Dormiramant 2 Dnear Watarmato's inumol antrinn for manufacturina nwarhand includina tha antr, that records tha avarhand varianne Now record the overhead variances and close the manufacturing overhead account. Journal Entry Date Accounts Debit Credit 8,230 Manufacturing Overhead Flexible Budget Variance Manufacturing Overhead 1,340 Production Volume Variance 9,570 This question is complete. Move your cursor over or tap on the red arrows to see incorrect answers. Start by recording the entry for the completion of 68,000 bottles. Journal Entry Date Accounts Debit Credit Finished Goods Inventory 365,840 Work in Process Inventory 365,840 Next, record the sale of 68,000 bottles. Begin with the entry to transfer the costs of the merchandise that was sold. Next, record the sale of 68,000 bottles. Begin with the entry to transfer the costs of the merchandise that was sold. Journal Entry Date Accounts Debit Credit Cost of Goods Sold 365,840 Finished Goods Inventory 365,840 The last entry we must record is for the sales revenue for 68,000 bottles The last entry we must record is for the sales revenue for 68,000 bottles. Journal Entry Accounts Debit Date Credit Accounts Receivable 605,200 Sales Revenue 605,200 This question is complete. Move your cursor over or tap on the red arrows to see incorrect answers. Chic Ceramics is a manufacturer of ceramic bottles. 3 (Click the icon to view the standards.) Last month, Chic Ceramics reported the following actual results for the production of 72,000 bottles: E: (Click the icon to view the actual results.) Requirements Use a standard cost accounting system to do the following: 1. Record Chic Ceramics's direct materials and direct labour journal entries. 2. Record Chic Ceramics's journal entries for manufacturing overhead, including the entry that records the overhead variances and closes the manufacturing overhead account. 3. Record the journal entries for the completion and sale of the 72,000 bottles, assuming Chic Ceramics sold (on account) all of the 72,000 bottles at a sale price of $8.30 each. (There were no beginning or ending inventories.) BBB (Click the icon to view related variances.) Requirement 1. Record Watermate's direct materials and direct labour journal entries. (Record debits first, then credits. Explanations are not required.) Let's start by recording the entry for the purchase of raw materials. Journal Entry Date Accounts Debit Credit Raw Materials Inventory 40.800 Direct Materials Price Variance 30.600 Accounts Payable 71,400 This question is complete. Move your cursor over or tap on the red arrows to see incorrect answers. Next, we can record the incurrence of direct labour Journal Entry Date Accounts Debit Credit Manufacturing Wages 248,200 Direct Labour Price Variance 18,700 229,500 Wages Payable w The last direct labour entry is for the use of direct labour. Record the entry. The last direct labour entry is for the use of direct labour. Record the entry. Journal Entry Date Accounts Debit Credit 198,560 Work in Process Inventory Direct Labour Efficiency Variance Manufacturing Wages 49,640 248,200 Dormiramant 2 Dnear Watarmato's inumol antrinn for manufacturina nwarhand includina tha antr, that records tha avarhand varianne Now record the overhead variances and close the manufacturing overhead account. Journal Entry Date Accounts Debit Credit 8,230 Manufacturing Overhead Flexible Budget Variance Manufacturing Overhead 1,340 Production Volume Variance 9,570 This question is complete. Move your cursor over or tap on the red arrows to see incorrect answers. Start by recording the entry for the completion of 68,000 bottles. Journal Entry Date Accounts Debit Credit Finished Goods Inventory 365,840 Work in Process Inventory 365,840 Next, record the sale of 68,000 bottles. Begin with the entry to transfer the costs of the merchandise that was sold. Next, record the sale of 68,000 bottles. Begin with the entry to transfer the costs of the merchandise that was sold. Journal Entry Date Accounts Debit Credit Cost of Goods Sold 365,840 Finished Goods Inventory 365,840 The last entry we must record is for the sales revenue for 68,000 bottles The last entry we must record is for the sales revenue for 68,000 bottles. Journal Entry Accounts Debit Date Credit Accounts Receivable 605,200 Sales Revenue 605,200 This question is complete. Move your cursor over or tap on the red arrows to see incorrect answers. Chic Ceramics is a manufacturer of ceramic bottles. 3 (Click the icon to view the standards.) Last month, Chic Ceramics reported the following actual results for the production of 72,000 bottles: E: (Click the icon to view the actual results.) Requirements Use a standard cost accounting system to do the following: 1. Record Chic Ceramics's direct materials and direct labour journal entries. 2. Record Chic Ceramics's journal entries for manufacturing overhead, including the entry that records the overhead variances and closes the manufacturing overhead account. 3. Record the journal entries for the completion and sale of the 72,000 bottles, assuming Chic Ceramics sold (on account) all of the 72,000 bottles at a sale price of $8.30 each. (There were no beginning or ending inventories.) BBB (Click the icon to view related variances.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started