Answered step by step

Verified Expert Solution

Question

1 Approved Answer

prepare journal entries plz . LE on Joumal the following business machos in journal om. You may If no journal entry is mquid, you must

prepare journal entries plz

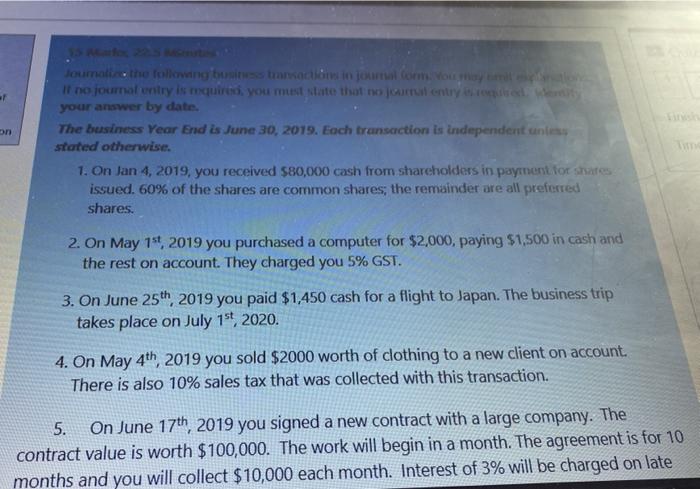

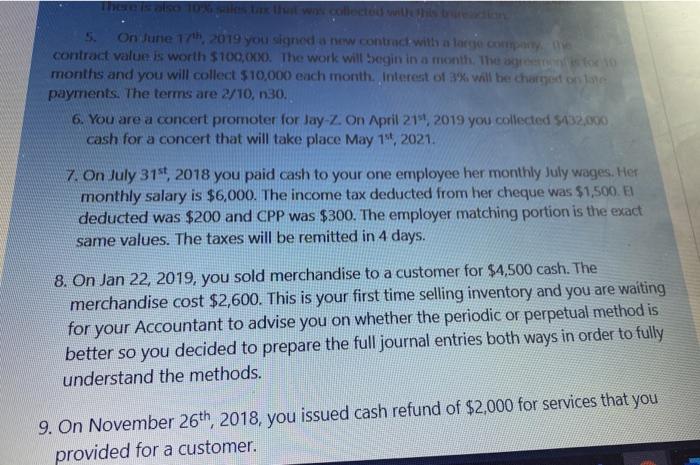

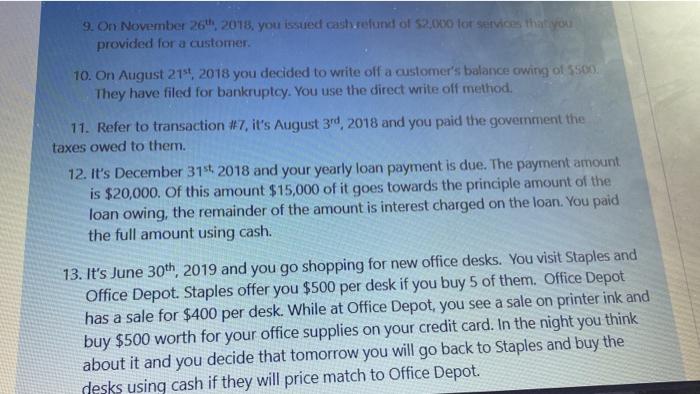

. LE on Joumal the following business machos in journal om. You may If no journal entry is mquid, you must state that no juntry to your answer by date The business Year End is June 30, 2019. Each transaction is independent unless stated otherwise. 1. On Jan 4, 2019, you received $80,000 cash from shareholders in payment for states issued. 60% of the shares are common shares the remainder are all preferred shares. 2. On May 15, 2019 you purchased a computer for $2,000, paying $1,500 in cash and the rest on account. They charged you 5% GST. 3. On June 25th, 2019 you paid $1,450 cash for a flight to Japan. The business trip takes place on July 15, 2020. 4. On May 4th, 2019 you sold $2000 worth of clothing to a new client on account. There is also 10% sales tax that was collected with this transaction. 5. On June 17th, 2019 you signed a new contract with a large company. The contract value is worth $100,000. The work will begin in a month. The agreement is for 10 months and you will collect $10,000 each month. Interest of 3% will be charged on late There is a 10 woollecto 5. On June 17, 2019 you signed a new contract with a large company contract value is worth $100,0XX). The work will begin in a month. The months and you will collect $10,000 each month. Interest of 3% will be charged on a payments. The terms are 2/10, n30. 6. You are a concert promoter for Jay-Z. On April 21, 2019 you collected $132.000 cash for a concert that will take place May 1, 2021 7. On July 31st, 2018 you paid cash to your one employee her monthly July wages. Her monthly salary is $6,000. The income tax deducted from her cheque was $1,500. deducted was $200 and CPP was $300. The employer matching portion is the exact same values. The taxes will be remitted in 4 days. 8. On Jan 22, 2019, you sold merchandise to a customer for $4,500 cash. The merchandise cost $2,600. This is your first time selling inventory and you are waiting for your Accountant to advise you on whether the periodic or perpetual method is better so you decided to prepare the full journal entries both ways in order to fully understand the methods. 9. On November 26th, 2018, you issued cash refund of $2,000 for services that you provided for a customer. 9. On November 26, 2015, you issued cash refund of 52,000 for services that you provided for a customer. 10. On August 21, 2018 you decided to write off a customer's balance owing of 5500 They have filed for bankruptcy. You use the direct write off method. 11. Refer to transaction #7, it's August 3rd, 2018 and you paid the government the taxes Owed to them. 12. It's December 31, 2018 and your yearly loan payment is due. The payment amount is $20,000. Of this amount $15,000 of it goes towards the principle amount of the loan owing, the remainder of the amount is interest charged on the loan. You paid the full amount using cash. 13. It's June 30th, 2019 and you go shopping for new office desks. You visit Staples and Office Depot. Staples offer you $500 per desk if you buy 5 of them. Office Depot has a sale for $400 per desk. While at Office Depot you see a sale on printer ink and buy $500 worth for your office supplies on your credit card. In the night you think about it and you decide that tomorrow you will go back to Staples and buy the desks using cash if they will price match to Office Depot. 13. It's June 30, 2019 and you go shopping for den Office Depot Staples offer you 5500 per denk il you them Empat has a sale for $100 per desk. While at Office Depot, you see on petit buy $500 worth for your office supplies on your credit card in the night you third about it and you decide that tomorrow you will go back to Staples and by the desks using cash if they will price match to Office Depot. 14. On February 18th, 2019 you receive the full payment from a customer that you sold $10,000 of services on account on February 14th, 2019. The terms were 1/10, 1/30 . LE on Joumal the following business machos in journal om. You may If no journal entry is mquid, you must state that no juntry to your answer by date The business Year End is June 30, 2019. Each transaction is independent unless stated otherwise. 1. On Jan 4, 2019, you received $80,000 cash from shareholders in payment for states issued. 60% of the shares are common shares the remainder are all preferred shares. 2. On May 15, 2019 you purchased a computer for $2,000, paying $1,500 in cash and the rest on account. They charged you 5% GST. 3. On June 25th, 2019 you paid $1,450 cash for a flight to Japan. The business trip takes place on July 15, 2020. 4. On May 4th, 2019 you sold $2000 worth of clothing to a new client on account. There is also 10% sales tax that was collected with this transaction. 5. On June 17th, 2019 you signed a new contract with a large company. The contract value is worth $100,000. The work will begin in a month. The agreement is for 10 months and you will collect $10,000 each month. Interest of 3% will be charged on late There is a 10 woollecto 5. On June 17, 2019 you signed a new contract with a large company contract value is worth $100,0XX). The work will begin in a month. The months and you will collect $10,000 each month. Interest of 3% will be charged on a payments. The terms are 2/10, n30. 6. You are a concert promoter for Jay-Z. On April 21, 2019 you collected $132.000 cash for a concert that will take place May 1, 2021 7. On July 31st, 2018 you paid cash to your one employee her monthly July wages. Her monthly salary is $6,000. The income tax deducted from her cheque was $1,500. deducted was $200 and CPP was $300. The employer matching portion is the exact same values. The taxes will be remitted in 4 days. 8. On Jan 22, 2019, you sold merchandise to a customer for $4,500 cash. The merchandise cost $2,600. This is your first time selling inventory and you are waiting for your Accountant to advise you on whether the periodic or perpetual method is better so you decided to prepare the full journal entries both ways in order to fully understand the methods. 9. On November 26th, 2018, you issued cash refund of $2,000 for services that you provided for a customer. 9. On November 26, 2015, you issued cash refund of 52,000 for services that you provided for a customer. 10. On August 21, 2018 you decided to write off a customer's balance owing of 5500 They have filed for bankruptcy. You use the direct write off method. 11. Refer to transaction #7, it's August 3rd, 2018 and you paid the government the taxes Owed to them. 12. It's December 31, 2018 and your yearly loan payment is due. The payment amount is $20,000. Of this amount $15,000 of it goes towards the principle amount of the loan owing, the remainder of the amount is interest charged on the loan. You paid the full amount using cash. 13. It's June 30th, 2019 and you go shopping for new office desks. You visit Staples and Office Depot. Staples offer you $500 per desk if you buy 5 of them. Office Depot has a sale for $400 per desk. While at Office Depot you see a sale on printer ink and buy $500 worth for your office supplies on your credit card. In the night you think about it and you decide that tomorrow you will go back to Staples and buy the desks using cash if they will price match to Office Depot. 13. It's June 30, 2019 and you go shopping for den Office Depot Staples offer you 5500 per denk il you them Empat has a sale for $100 per desk. While at Office Depot, you see on petit buy $500 worth for your office supplies on your credit card in the night you third about it and you decide that tomorrow you will go back to Staples and by the desks using cash if they will price match to Office Depot. 14. On February 18th, 2019 you receive the full payment from a customer that you sold $10,000 of services on account on February 14th, 2019. The terms were 1/10, 1/30 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started