Answered step by step

Verified Expert Solution

Question

1 Approved Answer

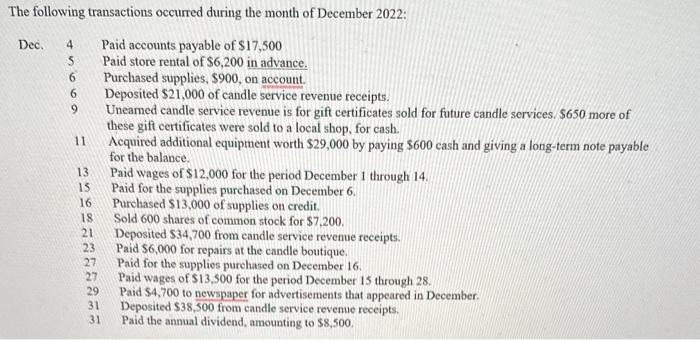

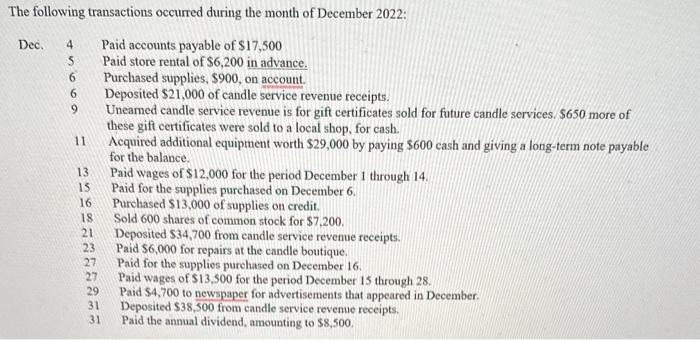

Prepare journal entries to record December Transactions The following transactions occurred during the month of December 2022: Dec. 4 Paid accounts payable of $17,500 5

Prepare journal entries to record December Transactions

The following transactions occurred during the month of December 2022: Dec. 4 Paid accounts payable of $17,500 5 Paid store rental of $6,200 in advance. 6 Purchased supplies, $900, on account. 6 Deposited $21,000 of candle service revenue receipts. 9 Unearned candle service revenue is for gift certificates sold for future candle services. $650 more of these gift certificates were sold to a local shop, for cash. 11 Acquired additional equipment worth $29,000 by paying $600 cash and giving a long-term note payable for the balance. 13 Paid wages of $12,000 for the period December 1 through 14. 15 Paid for the supplies purchased on December 6. 16 Purchased \$13,000 of supplies on credit. 18 Sold 600 shares of common stock for $7,200. 21 Deposited $34,700 from candle service revenue receipts. 23 Paid $6,000 for repairs at the candle boutique. 27 Paid for the supplies purchased on December 16. 27 Paid wages of $13,500 for the period December 15 through 28. 29 Paid $4,700 to newspaper for advertisements that appeared in December. 31 Deposited $38,500 from candle service revenue receipts. 31 Paid the annual dividend, amounting to $8,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started