Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare journal entries to record Holden Corp.'s transactions. Round all values to the nearest cent. December 1, 2022: Accepted a $6,300, 2-month, 12% note dated

Prepare journal entries to record Holden Corp.'s transactions. Round all values to the nearest cent.

- December 1, 2022: Accepted a $6,300, 2-month, 12% note dated this day in granting Carlos Young a time extension on the past-due account.

- December 31, 2022: Made an adjusting entry to record the accrued interest on the Carlos Young note.

- December 31, 2022: Closed the interest revenue account.

- January 1, 2023: Holden Corp. Accepted a note from Kimberly Fisher for $2,800, 4-month, 12% dated this day granting a time extension on the past-due account.

- January 31, 2023: Carlos Young's payment for the principal and interest from the note dated December 1 was received.

- Determine the date that transaction (d) matures and record the entry to show the collection.

Enter the transaction letter as the description when entering the transactions in the journal. Dates must be entered in the format dd/mmm (i.e., January 15 would be 15/Jan).

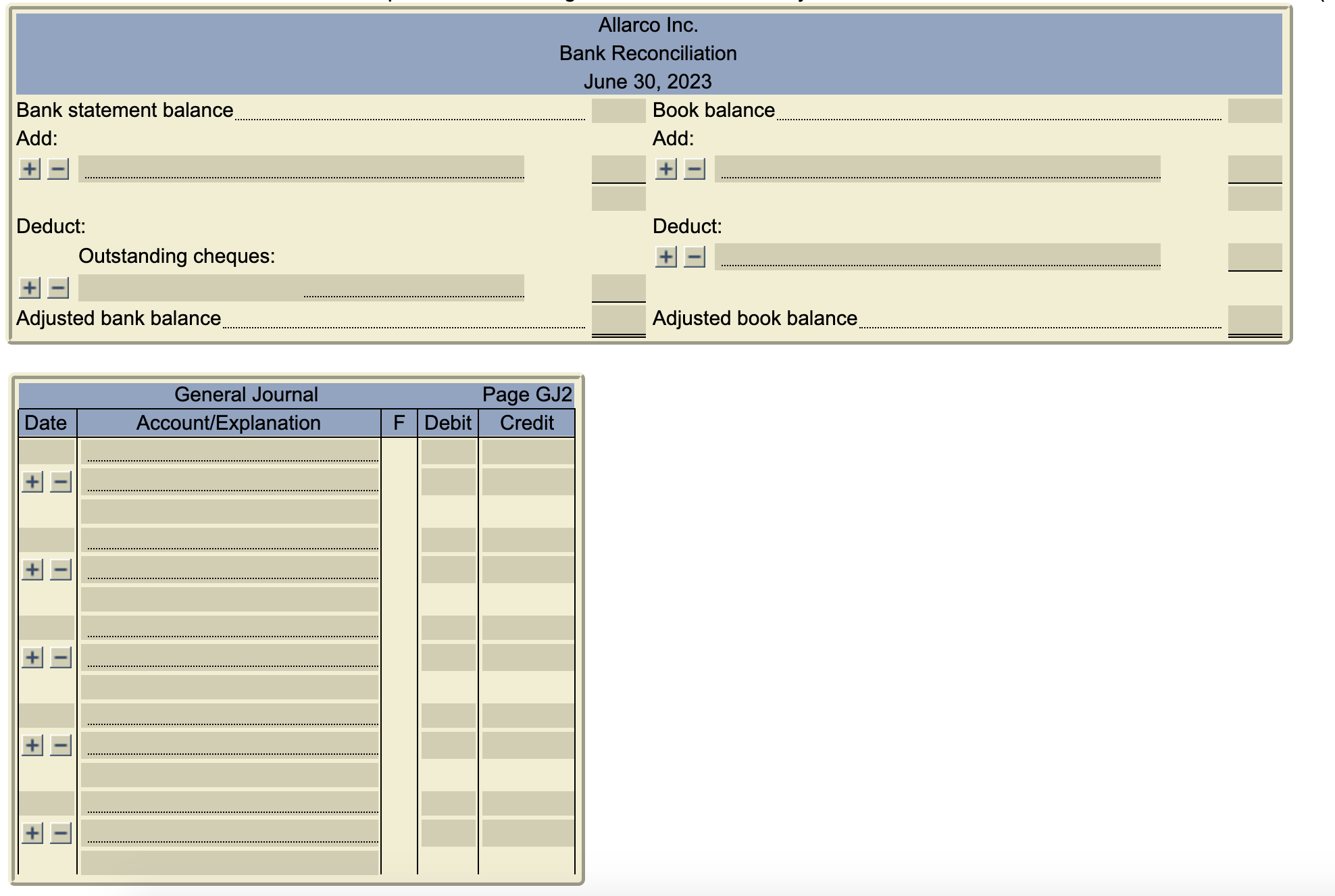

Allarco Inc. Bank Reconciliation June 30, 2023 Bank statement balance Add: \\( \\pm \\) Deduct: Outstanding cheques: Adjusted bank balance Book balance Add: \\( + \\) Deduct: \\( + \\) Adjusted book balance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started