Prepare journal entries to record the adjustments entered on the six-column table. Assume Bug-Off's adjusted balance for Merchandise Inventory matches the year-end physical count.

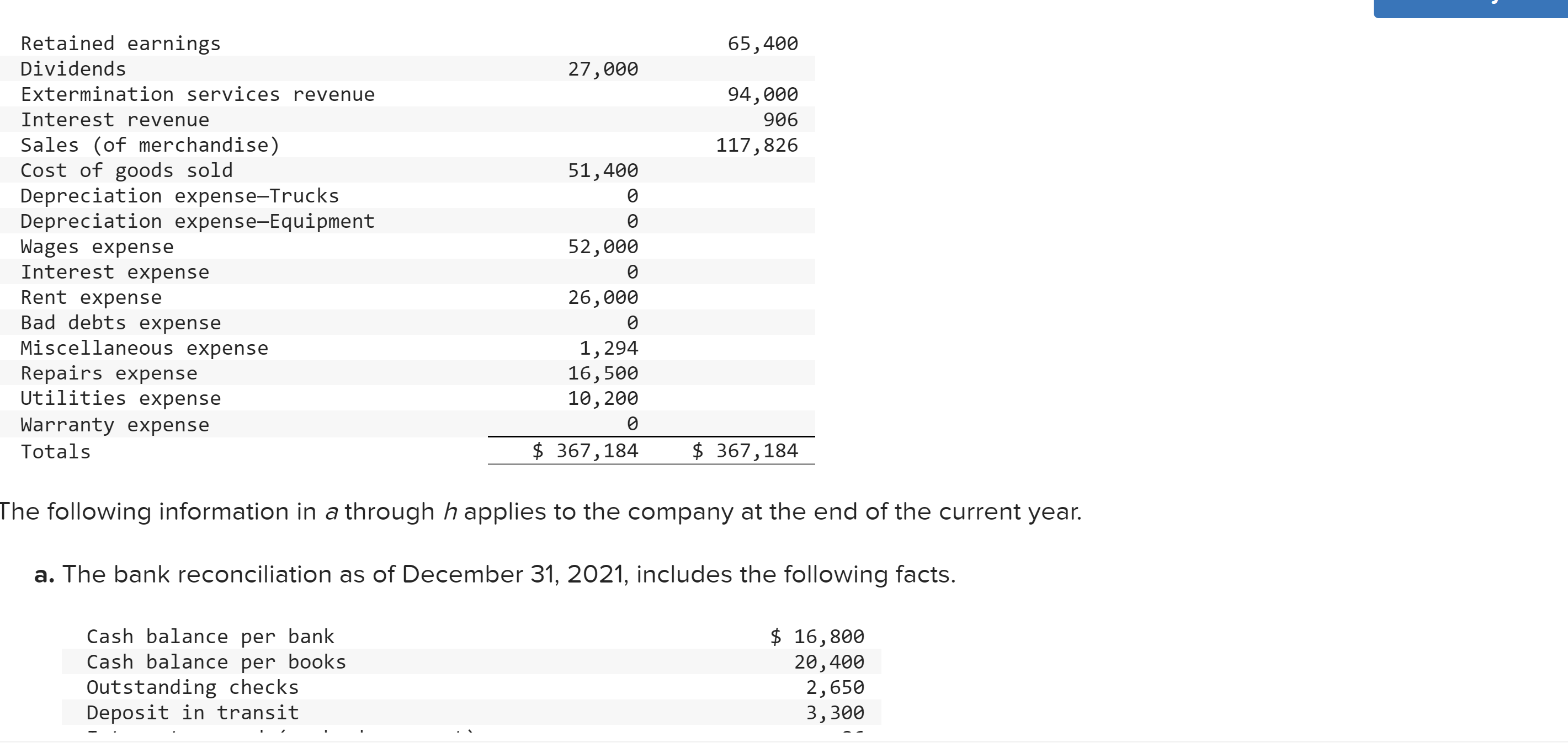

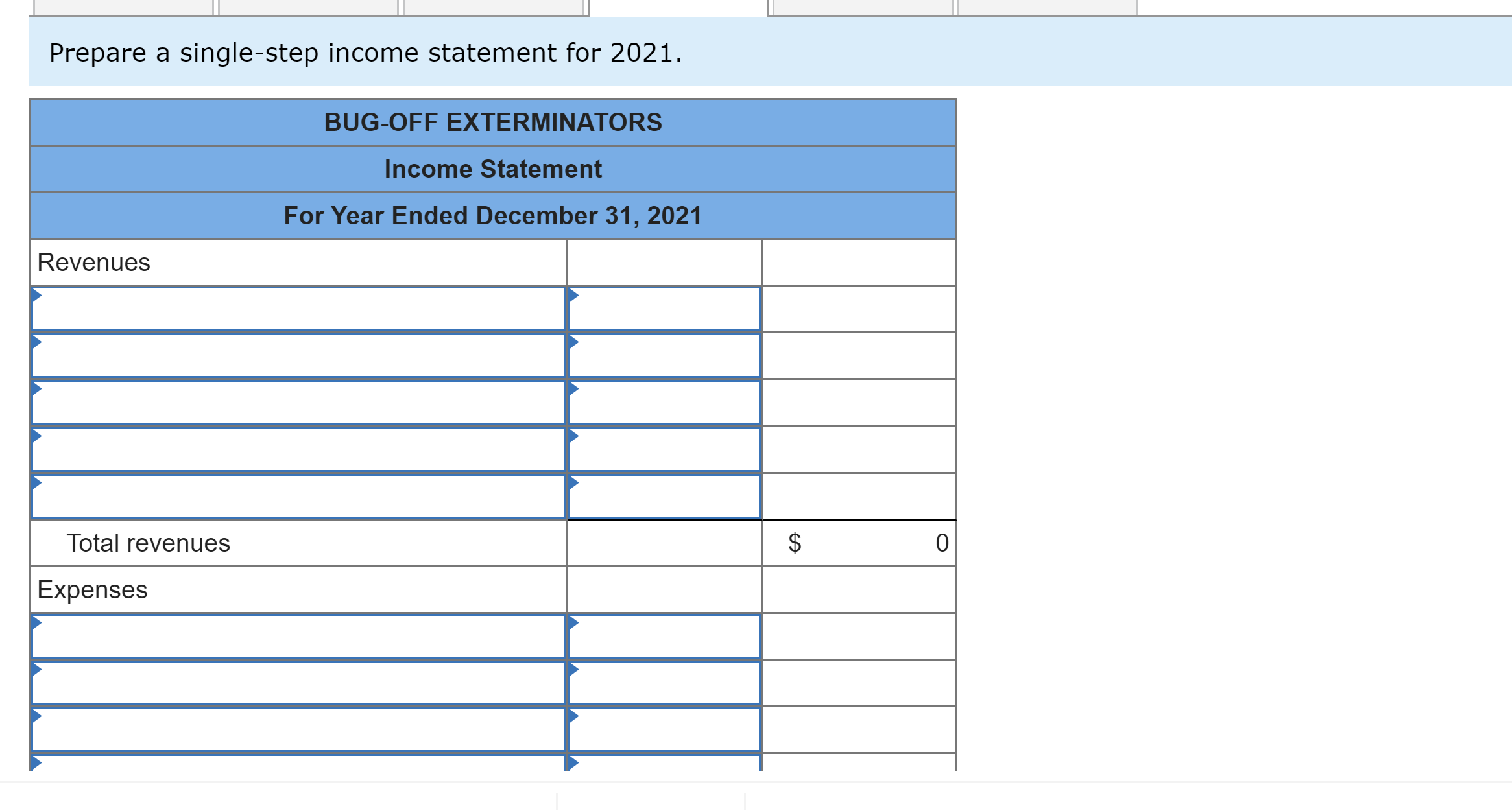

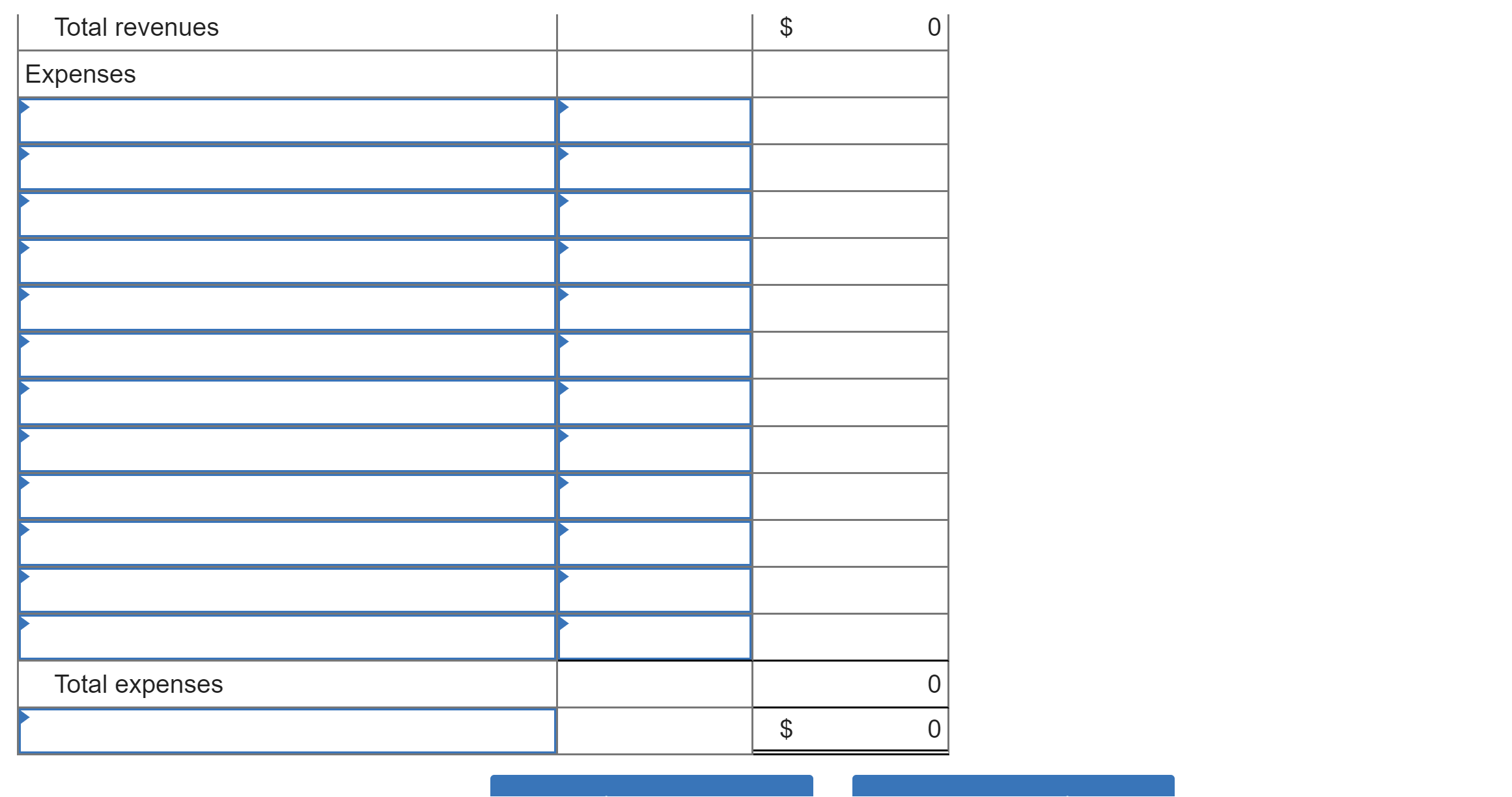

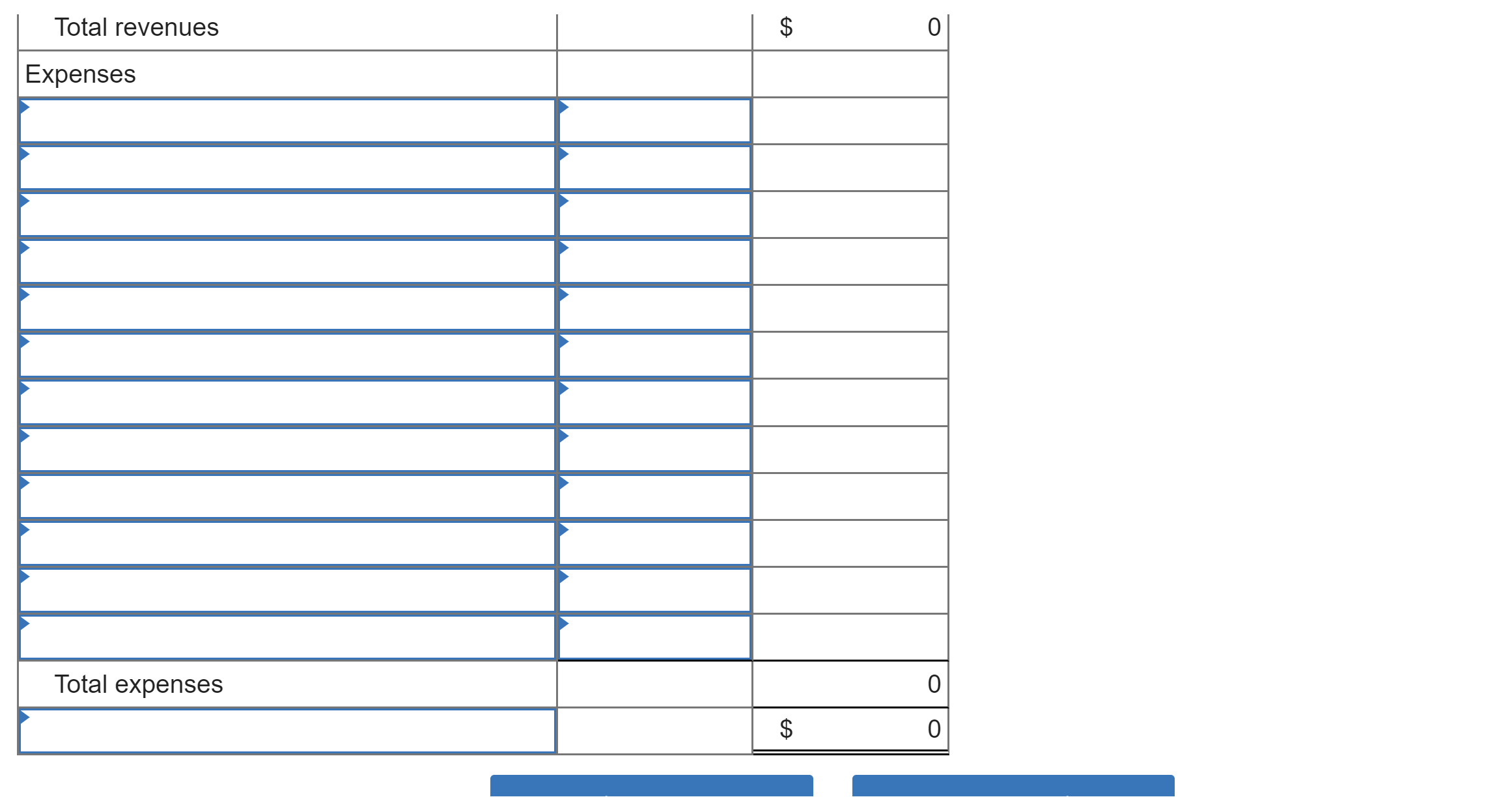

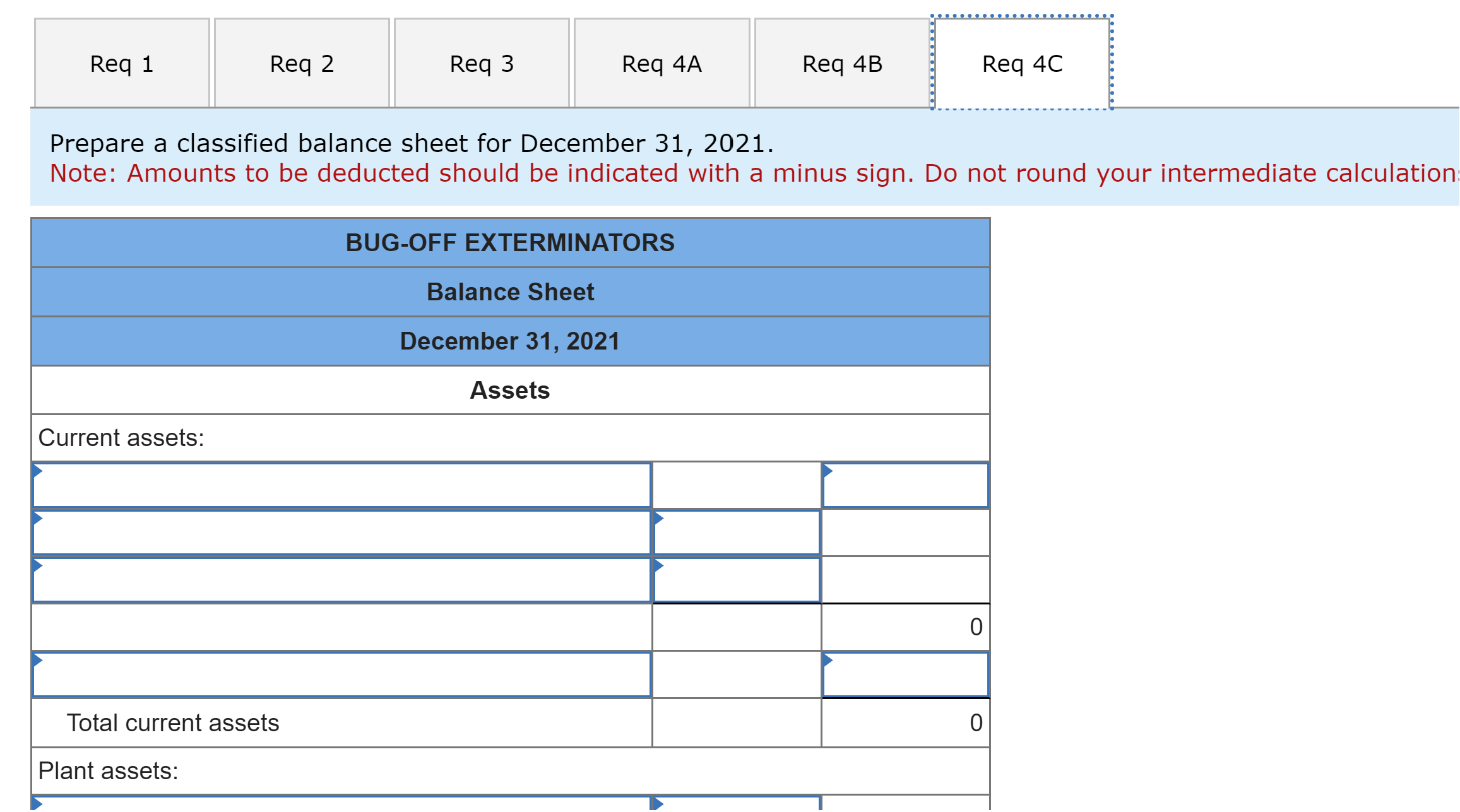

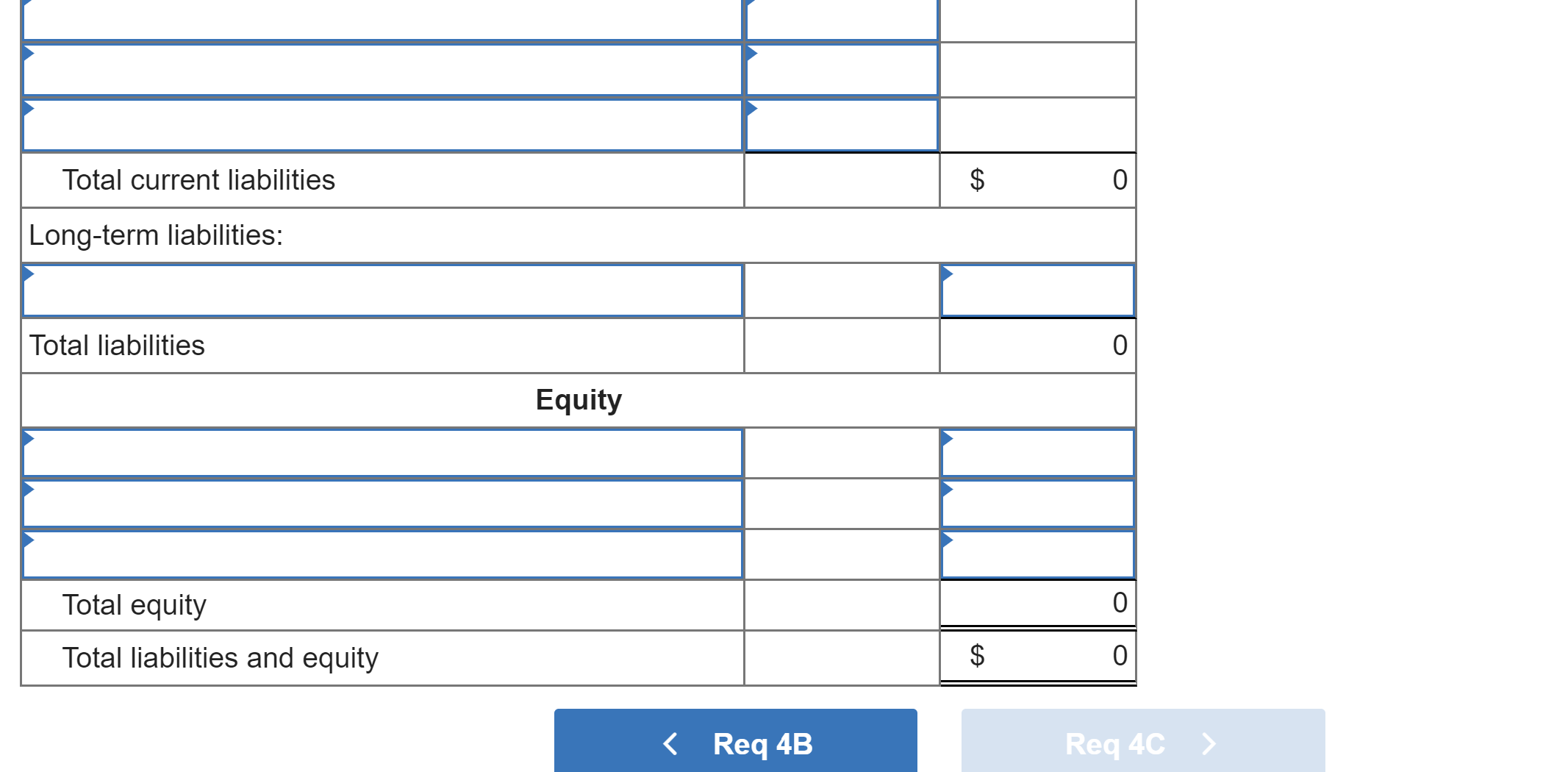

Prepare journal entries to record the adjustments entered on the six-column table. Assume Bug-Off's adjusted balance for Merchandise Inventory matches the year-end physical count. Note: If no entry is required for a particular transaction, select "No journal entry required" in the first account field. Do not round your intermediate calculations. Show less Retained earnings 65,400 Dividends 27,000 Extermination services revenue 94,000 Interest revenue 906 Sales (of merchandise) 117,826 Cost of goods sold 51,400 Depreciation expense-Trucks 0 Depreciation expense-Equipment 0 Wages expense 52,000 Interest expense 0 Rent expense 26,000 Bad debts expense 0 Miscellaneous expense 1,294 Repairs expense 16,500 Utilities expense Warranty expense 10,200 0 Totals $ 367,184 $ 367,184 The following information in a through h applies to the company at the end of the current year. a. The bank reconciliation as of December 31, 2021, includes the following facts. Cash balance per bank Cash balance per books Outstanding checks Deposit in transit $ 16,800 20,400 2,650 3,300 Prepare a single-step income statement for 2021. BUG-OFF EXTERMINATORS Income Statement For Year Ended December 31, 2021 Revenues Total revenues Expenses SA 0 Total revenues Expenses E 0 0 Total expenses $ 0 Total revenues Expenses E 0 0 Total expenses $ 0 Req 1 Req 2 Req 3 Req 4A Req 4B Req 4C Prepare a classified balance sheet for December 31, 2021. Note: Amounts to be deducted should be indicated with a minus sign. Do not round your intermediate calculation BUG-OFF EXTERMINATORS Current assets: Total current assets Plant assets: Balance Sheet December 31, 2021 Assets 0 0 Total current liabilities Long-term liabilities: Total liabilities Total equity Total liabilities and equity Equity EA $ 0 0 0 $ 0 < Req 4B Req 4C >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To complete the question we need to prepare journal entries to record the adjustments based on the data given and then prepare a singlestep income sta...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started