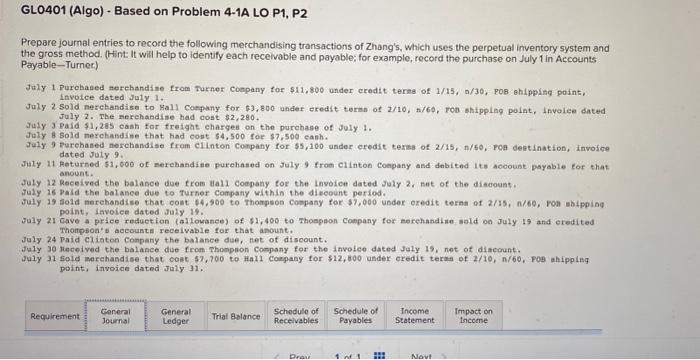

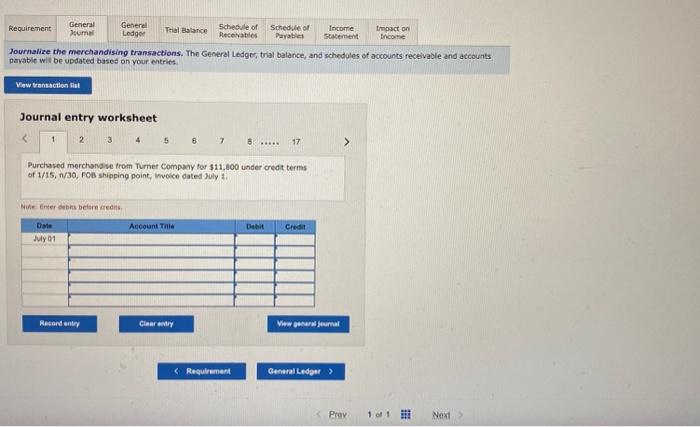

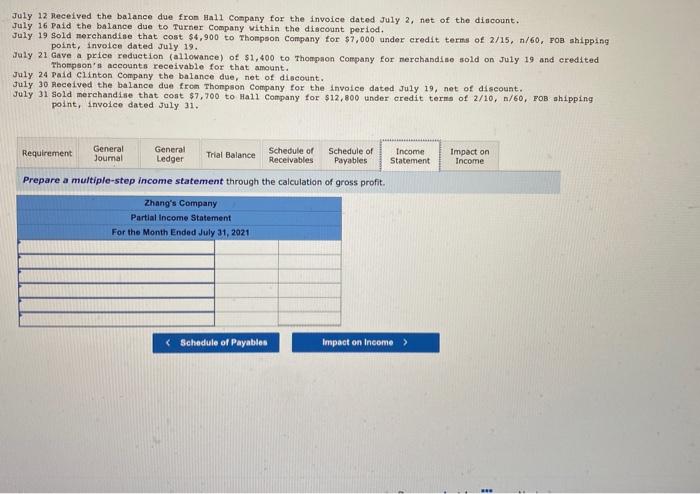

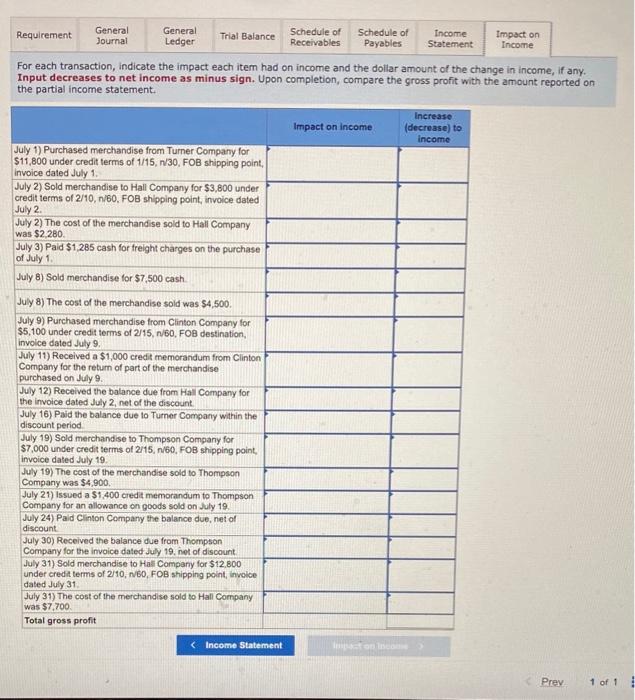

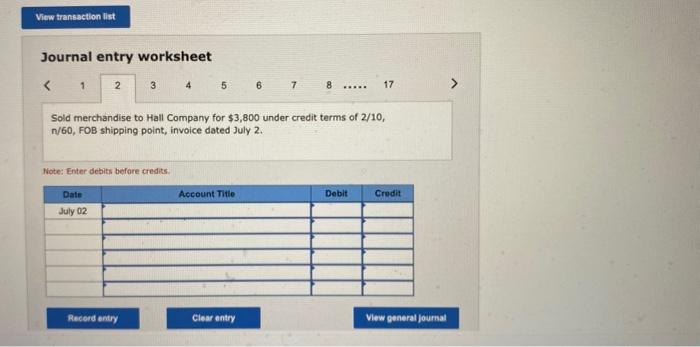

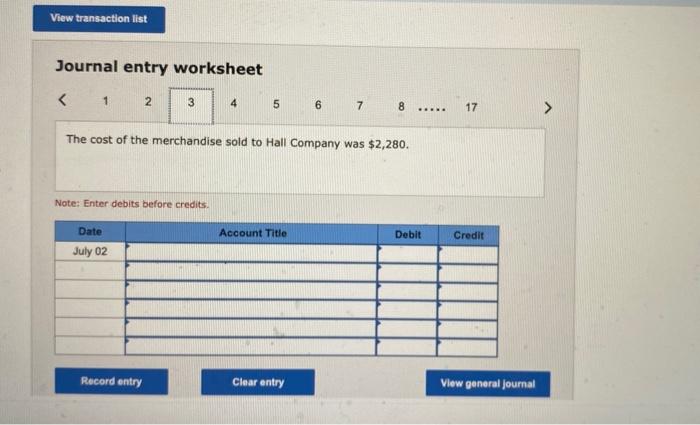

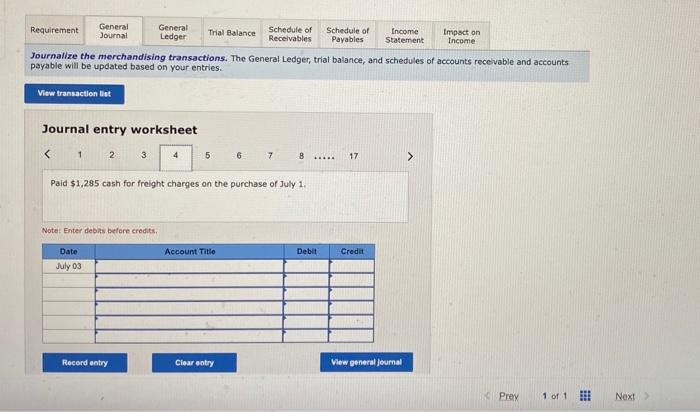

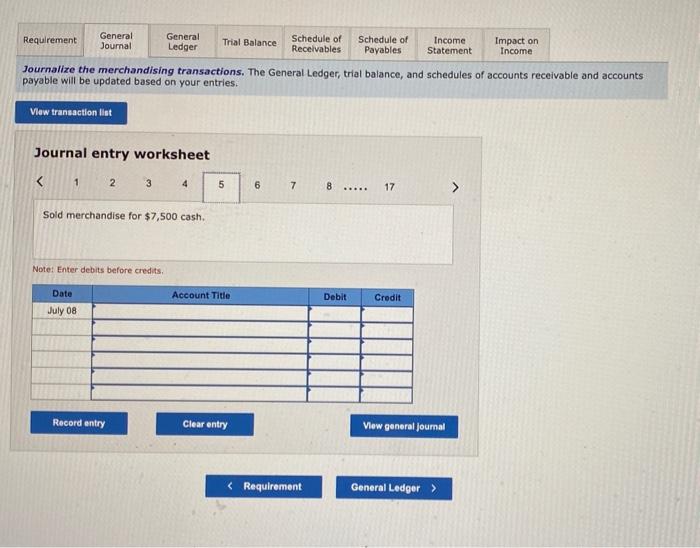

Prepare journal entries to record the following merchandising transactions of Zhang's, Which uses the perpetual inventory system and the gross method. (Hint It will help to identify each receivable and payable; for example, rocord the purchase on July 1 in Accounts Payable-Turner) Jaly 1 Purchased merchandine from Turner conpany tor \$11,800 under credit teres of 1/15, a/30, Pos shippiag point, involce dated July 1 . July 2 Sold nerehandise to Ba11 Coepany for $3,800 under eredit terma of 2/10, n/6e, roo shipplag point, lnvolee dated July 2 . The merehandine had coat $2,280. July J Pald $1,255 eash for freight eharges on the purchase of July 1 . Jaly 8 sold nerchandine that had oont 54,500 for $7,500 eanh. July 9 Furchased nerchandise from clinton conpany for 55,100 under oredit terza of 2/15, n/60, Fon deatination, invofoe dated July 9. July 11 Returned $1,000 of nerehandine purehaned on July 9 from clinton Coepany and dabitnd Its acoount payable for that anount. July 12 Received the balasce due fros llall coepany tor the lnvoice dated July 2. nat of the diacount. July 16 paid the balanee due to furner company within the dieeount period. point, Invoice dated July 19 . July 21 Cave a priee reduetion (aliovance) of $1,400 to Thonpeon Company for merehandike sold on July 19 and eredited Thonpson's accousta receivable for that anount. July 24 Paid clinton Company the balance due, net of discount. July 30 received the balance due from Thompon Conpany for the involee dated July 19, net of diacount. July 31 fiold merehandise that cost $7,700 to Hall Company for $12,100 ander eredit teras of 2/10, n/60, Fo ahipping point, invoice dated Jaly 31 . Journalize the merchandising transactions. Tho General Ledge, trial balance, and schedules of accounts receivable and atcounts parabie wil be uDdated based on your entries Journal entry worksheet Purchased merchandse trom Turner Company for $11,000 under credt terms of 1/15,N/30,FOB shipping point, invoice dated July 1. Wuhe Encer debis befare ifedns. July 12 Mecelved the balance due fron Hall Conpany for the invoice dated July 2 , net of the diacount. July 16 . Paid the balance due to Turner Company within the diecount period. July 19 sold merchandise that cost $4,900 to Thompson Company for $7,000 under credit terms of 2/15, n/60, Foa shipping point, invoice dated July 19 . July 21 Gaye a price reduetion. (allowance) of $1,400 to Thompaon company for nerchandiae sold on July 19 and eredited Thompson's accounts receivable for that amount. July 24 Paid clinton company the balance due, net of diseotnt. July 30 Meceived the balance due fron Thonpson Company for the Invoice dated July 19 , net of discount. July 31 sold merchandise that cost $7,700 to Ha11 conpany for $12,800 under eredit terms of 2/10, n/60, FoB ahipping point, invoice dated July 31 . Prepare a multiple-step income statement through the calculation of gross profit. For each transaction, indicate the impact each item had on income and the dollar amount of the change in income, if any. Input decreases to net income as minus sign. Upon completion, compare the gross profit with the amount reported on the partial income statement. Journal entry worksheet 34567817 Sold merchandise to Hall Company for $3,800 under credit terms of 2/10, n/60,FOB shipping point, invoice dated July 2. Note: Enter debits before credits: Journal entry worksheet 678 The cost of the merchandise sold to Hall Company was $2,280. Note: Enter debits before credits. ournalize the merchandising transactions. The General Ledger, trial balance, and schedules of accounts recevable and accounts ayable will be updated based on your entries. Journal entry worksheet 67817 Paid $1,285 cash for freight charges on the purchase of July 1 . Note: Enter deblis before credits, Journalize the merchandising transactions. The General Ledger, trial balance, and schedules of accounts receivable and accounts payable will be updated based on your entries. Journal entry worksheet