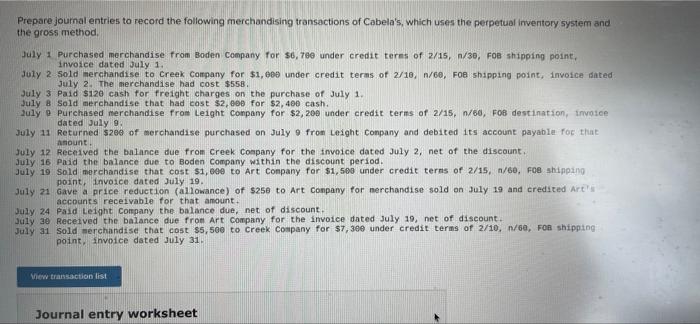

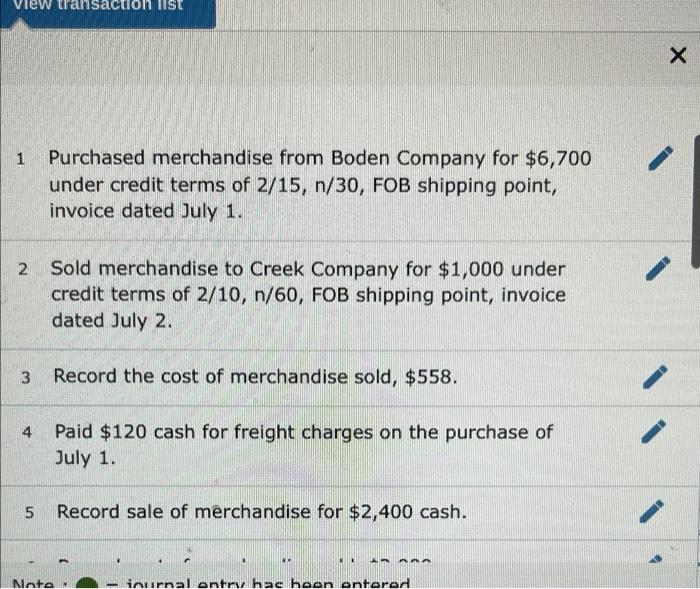

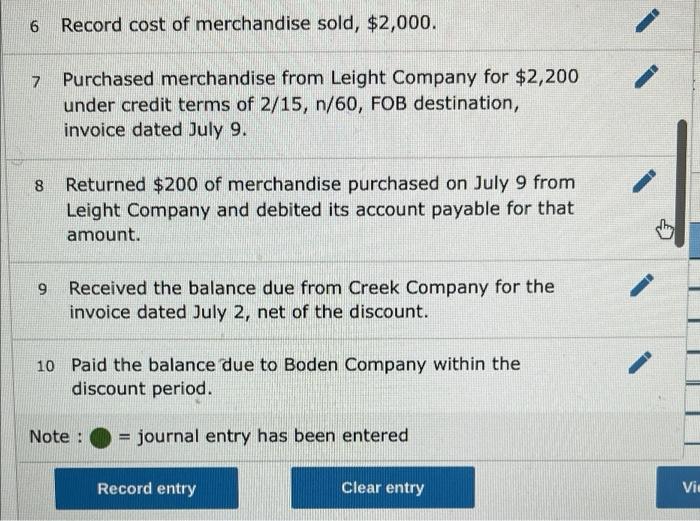

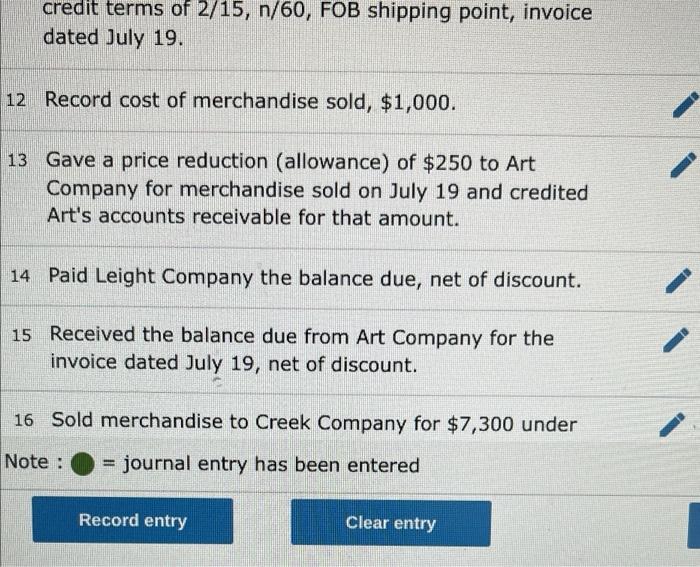

Prepare journal entries to record the following merchandising transactions of Cabela's, which uses the perpetual inventory system and the gross method. July 1 Purchased merchandise from Boden company for $6,700 under credit terms of 2/15, n/30, FOB shipping point, invoice dated July 1. July 2 Sold merchandise to Creek Company for $1,000 under credit terms of 2/10, 1/60, FOB shipping point, invoice dated July 2. The merchandise bad cost $558. July 3 Paid $120 cash for freight charges on the purchase of July 1. July 8 Sold merchandise that had cost $2,000 for $2,490 cash. July e Purchased merchandise from Leight Company for $2,200 under credit terms of 2/15, n/60, FOB destination, Invoice dated July 9 July 11 Returned s2ee of merchandise purchased on July 9 from Leight Company and debited its account payable for that amount. July 12 Received the balance due from Creek Company for the invoice dated July 2, net of the discount. July 16 Paid the balance due to Boden Company within the discount period. July 19 Sold merchandise that cost $1,Bee to Art Company for $1,500 under credit terns of 2/15, n/60, FOB shipping point, invoice dated July 19. July 21 Gave a price reduction allowance) of $250 to Art Company for merchandise sold on July 19 and credited Arts accounts receivable for that amount July 24 Paid Leight Company the balance due, net of discount July 30 Received the balance due from Art Company for the invoice dated July 19, net of discount. July 31 Sold merchandise that cost $5,500 to Creek Company for $7,300 under credit terms of 2/10, 1/60, FOR shipping point, invoice dated July 31. Wew transaction list Journal entry worksheet HIST 1 Purchased merchandise from Boden Company for $6,700 under credit terms of 2/15, n/30, FOB shipping point, invoice dated July 1. N Sold merchandise to Creek Company for $1,000 under credit terms of 2/10, n/60, FOB shipping point, invoice dated July 2. 3 Record the cost of merchandise sold, $558. 4 Paid $120 cash for freight charges on the purchase of July 1. 5 Record sale of merchandise for $2,400 cash. Note inurnal entry hac heen entered 6 Record cost of merchandise sold, $2,000. 7 Purchased merchandise from Leight Company for $2,200 under credit terms of 2/15, n/60, FOB destination, invoice dated July 9. 8 Returned $200 of merchandise purchased on July 9 from Leight Company and debited its account payable for that amount. 9 Received the balance due from Creek Company for the invoice dated July 2, net of the discount. 10 Paid the balance due to Boden Company within the discount period. Note : = journal entry has been entered Record entry Clear entry Vio credit terms of 2/15, n/60, FOB shipping point, invoice dated July 19. 12 Record cost of merchandise sold, $1,000. 13 Gave a price reduction (allowance) of $250 to Art Company for merchandise sold on July 19 and credited Art's accounts receivable for that amount. 14 Paid Leight Company the balance due, net of discount. 15 Received the balance due from Art Company for the invoice dated July 19, net of discount. 16 Sold merchandise to Creek Company for $7,300 under Note: journal entry has been entered Record entry Clear entry 16 Sold merchandise to Creek Company for $7,300 under credit terms of 2/10, n/60, FOB shipping point, invoice dated July 31. 17. Record cost of merchandise sold, $5,500. Note : am journal entry has been entered