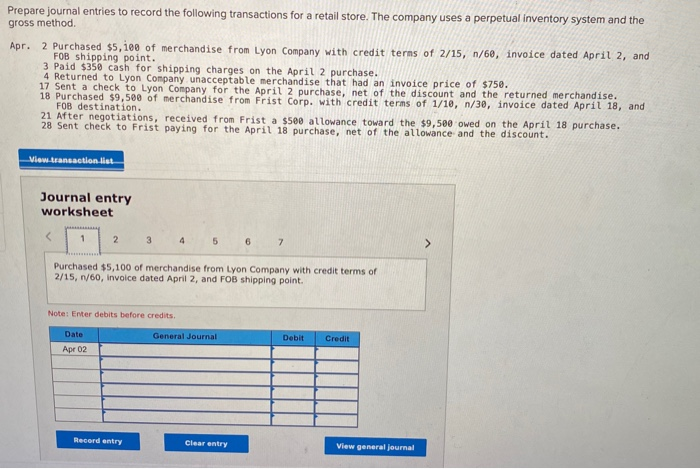

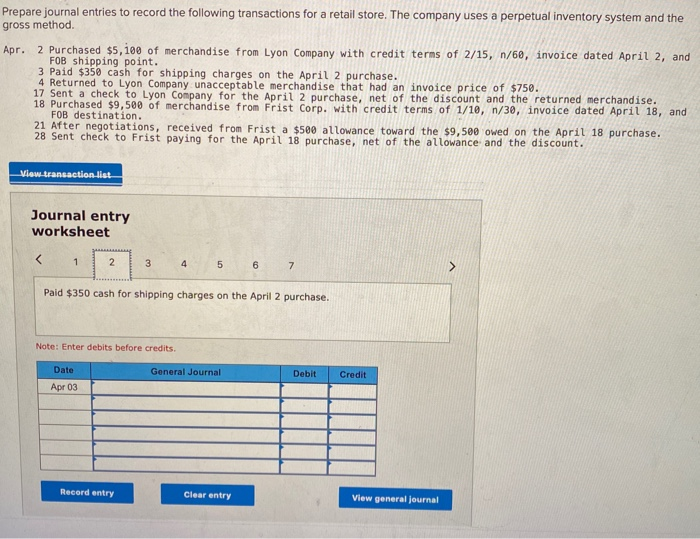

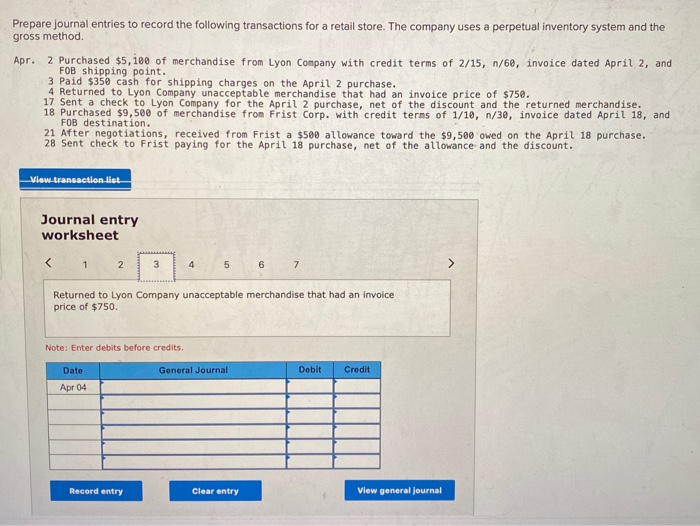

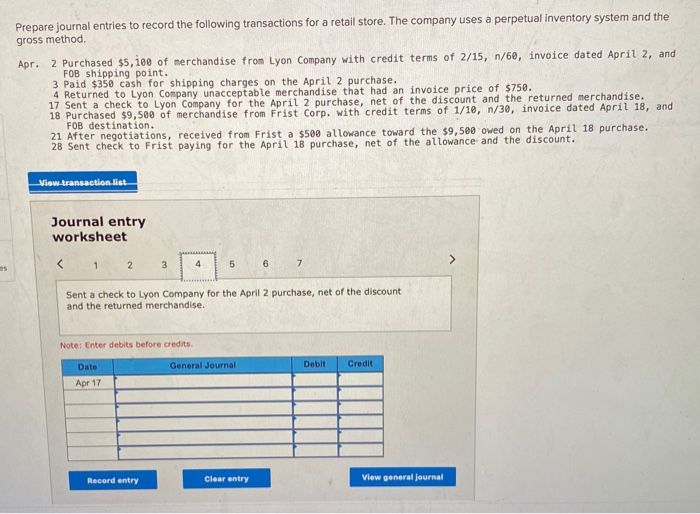

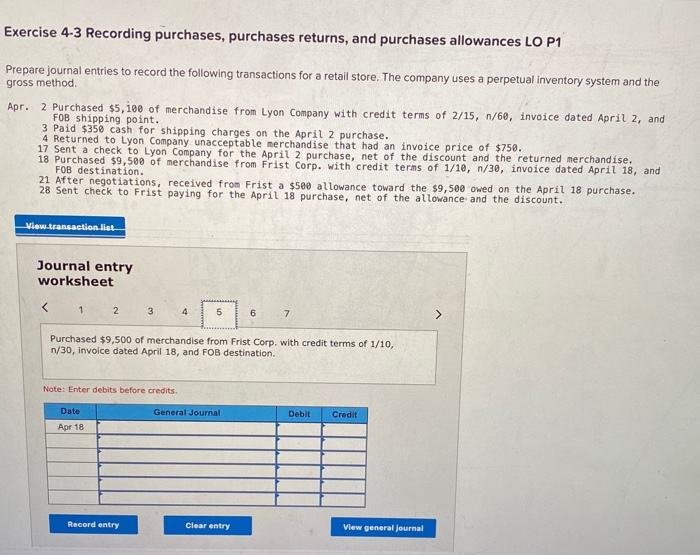

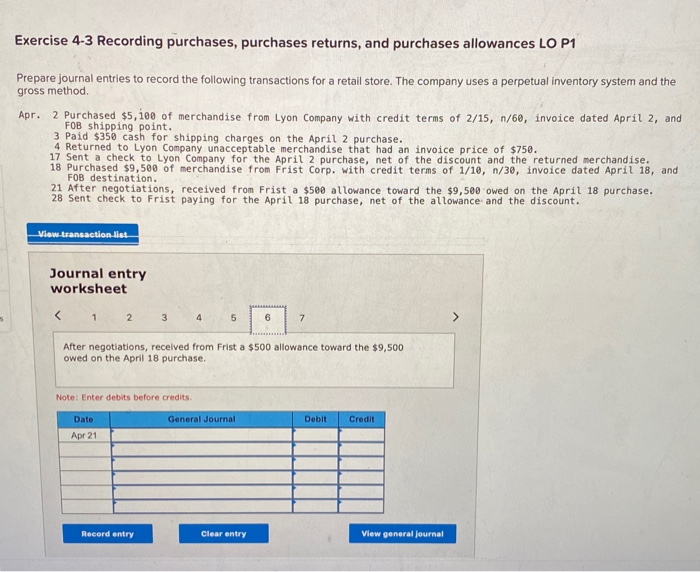

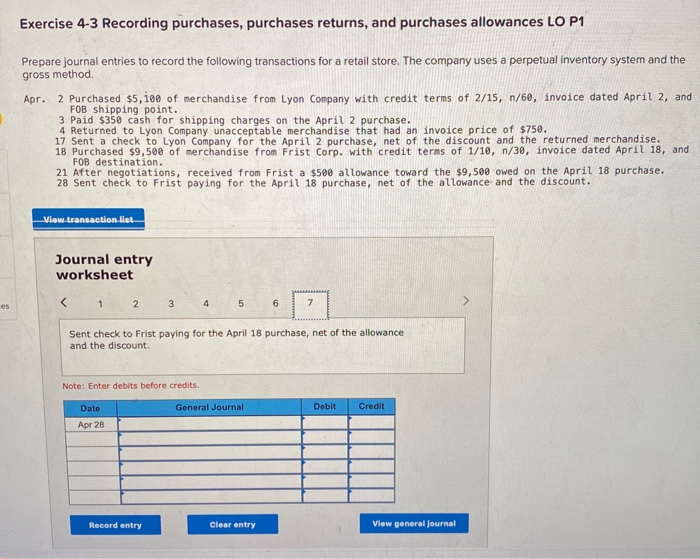

Prepare journal entries to record the following transactions for a retail store. The company uses a perpetual inventory system and the gross method. Apr. 2 Purchased $5,100 of merchandise from Lyon Company with credit terms of 2/15, 1/60, invoice dated April 2, and FOB shipping point. 3 Paid $350 cash for shipping charges on the April 2 purchase. 4 Returned to Lyon Company unacceptable merchandise that had an invoice price of $750. 17 Sent a check to Lyon Company for the April 2 purchase, net of the discount and the returned merchandise. 18 Purchased $9,50 of merchandise from Frist Corp. with credit terms of 1/10, n/30, invoice dated April 18, and FOB destination. 21 After negotiations, received from Frist a $500 allowance toward the $9,500 owed on the April 18 purchase. 28 Sent check to Frist paying for the April 18 purchase, net of the allowance and the discount. View-transaction list Journal entry worksheet 1 2 3 5 6 7 > Purchased $5,100 of merchandise from Lyon Company with credit terms of 2/15, 1/60, invoice dated April 2, and FOB shipping point. Note: Enter debits before credits General Journal Date Apr 02 Debit Credit Record entry Clear entry View general Journal Prepare journal entries to record the following transactions for a retail store. The company uses a perpetual inventory system and the gross method. Apr. 2 Purchased $5,100 of merchandise from Lyon Company with credit terms of 2/15, 1/60, invoice dated April 2, and FOB shipping point. 3 Paid $350 cash for shipping charges on the April 2 purchase. 4 Returned to Lyon Company unacceptable merchandise that had an invoice price of $750. 17 Sent a check to Lyon Company for the April 2 purchase, net of the discount and the returned merchandise. 18 Purchased $9,500 of merchandise from Frist Corp. with credit terms of 1/10, n/30, invoice dated April 18, and 21 After negotiations, received from Frist a $500 allowance toward the $9,500 owed on the April 18 purchase. 28 Sent check to Frist paying for the April 18 purchase, net of the allowance and the discount. View transaction list Journal entry worksheet 2 3 4 5 6 7 Paid $350 cash for shipping charges on the April 2 purchase. Note: Enter debits before credits Date General Journal Debit Credit Apr 03 Record entry Clear entry View general journal Prepare journal entries to record the following transactions for a retail store. The company uses a perpetual inventory system and the gross method. Apr. 2 Purchased $5,100 of merchandise from Lyon Company with credit terms of 2/15, n/60, invoice dated April 2, and FOB shipping point. 3 Paid $350 cash for shipping charges on the April 2 purchase. 4 Returned to Lyon Company unacceptable merchandise that had an invoice price of $750. 17 Sent a check to Lyon Company for the April 2 purchase, net of the discount and the returned merchandise. 18 Purchased $9,500 of merchandise from Frist Corp. with credit terns of 1/10, n/30, invoice dated April 18, and FOB destination. 21 After negotiations, received from Frist a $500 allowance toward the $9,500 owed on the April 18 purchase. 28 Sent check to Frist paying for the April 18 purchase, net of the allowance and the discount. View transaction list Journal entry worksheet Returned to Lyon Company unacceptable merchandise that had an invoice price of $750. Note: Enter debits before credits General Journal Debit Credit Date Apr 04 Record entry Clear entry View general Journal Prepare journal entries to record the following transactions for a retail store. The company uses a perpetual inventory system and the gross method. Apr. 2 Purchased $5,100 of merchandise from Lyon Company with credit terms of 2/15, n/60, invoice dated April 2, and FOB shipping point. 3 Paid $350 cash for shipping charges on the April 2 purchase. 4 Returned to Lyon Company unacceptable merchandise that had an invoice price of $750. 17 Sent a check to Lyon Company for the April 2 purchase, net of the discount and the returned merchandise. 18 Purchased $9,500 of merchandise from Frist Corp. with credit terms of 1/10, n/30, invoice dated April 18, and FOB destination. 21 After negotiations, received from Frist a $500 allowance toward the $9,500 owed on the April 18 purchase. 28 Sent check to Frist paying for the April 18 purchase, net of the allowance and the discount. View transaction list Journal entry worksheet Purchased $9,500 of merchandise from Frist Corp. with credit terms of 1/10, n/30, invoice dated April 18, and FOB destination. Note: Enter debits before credits General Journal Date Apr 18 Debit Credit Record entry Clear entry View general journal Exercise 4-3 Recording purchases, purchases returns, and purchases allowances LO P1 Prepare journal entries to record the following transactions for a retail store. The company uses a perpetual inventory system and the gross method Apr. 2 Purchased $5,100 of merchandise from Lyon Company with credit terms of 2/15, n/60, invoice dated April 2, and FOB shipping point. 3 Paid $350 cash for shipping charges on the April 2 purchase. 4 Returned to Lyon Company unacceptable merchandise that had an invoice price of $750. 17 Sent a check to Lyon Company for the April 2 purchase, net of the discount and the returned merchandise. 18 Purchased $9,500 of merchandise from Frist Corp. with credit terms of 1/10, n/30, invoice dated April 18, and FOB destination. 21 After negotiations, received from Frist a $500 allowance toward the $9,500 owed on the April 18 purchase. 28 Sent check to Frist paying for the April 18 purchase, net of the allowance and the discount. View transaction list Journal entry worksheet 5 After negotiations, received from Frist a $500 allowance toward the $9,500 owed on the April 18 purchase. Note: Enter debits before credits Date General Journal Dobit Credit Apr 21 Record entry Clear entry View general Journal Exercise 4-3 Recording purchases, purchases returns, and purchases allowances LO P1 Prepare journal entries to record the following transactions for a retail store. The company uses a perpetual inventory system and the gross method Apr. 2 Purchased $5,100 of merchandise from Lyon Company with credit terms of 2/15, 1/60, invoice dated April 2, and FOB shipping point. 3 Paid $350 cash for shipping charges on the April 2 purchase. 4 Returned to Lyon Company unacceptable merchandise that had an invoice price of $750. 17 Sent a check to Lyon Company for the April 2 purchase, net of the discount and the returned merchandise. 18 Purchased $9,500 of merchandise from Frist Corp. with credit terms of 1/10, n/30, invoice dated April 18, and FOB destination. 21 After negotiations, received from Frist a $500 allowance toward the $9,500 owed on the April 18 purchase. 28 Sent check to Frist paying for the April 18 purchase, net of the allowance and the discount. View transaction list Journal entry worksheet Sent check to Frist paying for the April 18 purchase, net of the allowance and the discount. Note: Enter debits before credits Date General Journal Debit Credit Apr 28 Record entry Clear entry View general Journal