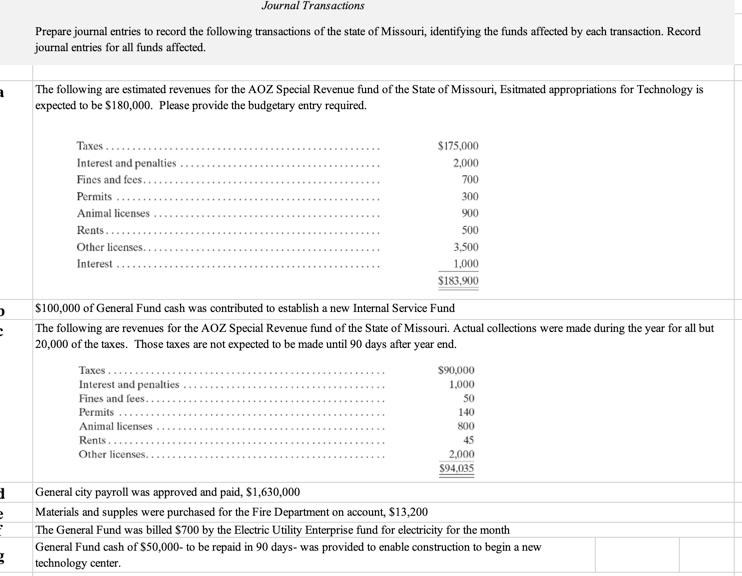

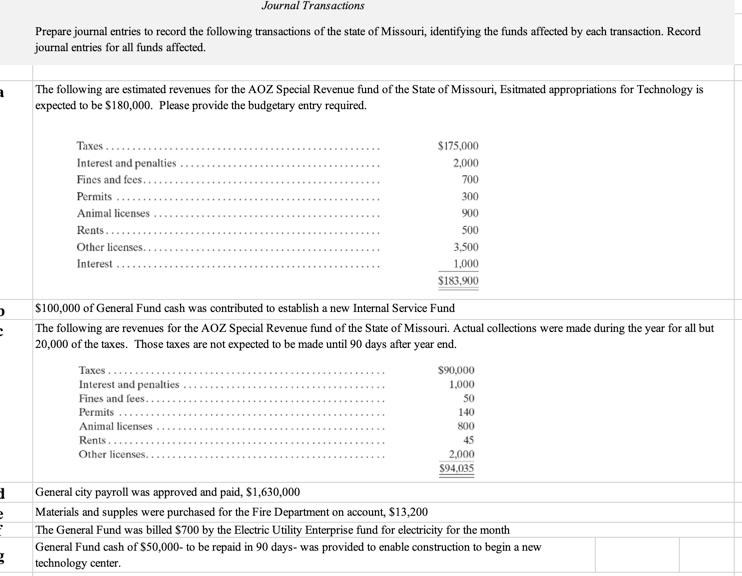

Prepare journal entries to record the following transactions of the state of Missouri, identifying the funds affected by each transaction. Record journal entries for all funds affected.  |

Journal Transactions Prepare journal entries to record the following transactions of the state of Missouri, identifying the funds affected by each transaction. Record journal entries for all funds affected. The following are estimated revenues for the AOZ Special Revenue fund of the State of Missouri, Esitmated appropriations for Technology is expected to be $180,000. Please provide the budgetary entry required. Taxes.... Interest and penalties Fines and fees. Permits Animal licenses Rents.... Other licenses. Interest $175,000 2,000 700 300 900 500 3,500 1,000 $183,900 $100,000 of General Fund cash was contributed to establish a new Internal Service Fund The following are revenues for the AOZ Special Revenue fund of the State of Missouri. Actual collections were made during the year for all but 20,000 of the taxes. Those taxes are not expected to be made until 90 days after year end. Taxes $90,000 Interest and penalties 1.000 Fines and fees.. 50 Permits Animal licenses Rents.. Other licenses. 2,000 $94.035 General city payroll was approved and paid, $1,630,000 Materials and supples were purchased for the Fire Department on account, $13,200 The General Fund was billed $700 by the Electric Utility Enterprise fund for electricity for the month General Fund cash of $50,000- to be repaid in 90 days- was provided to enable construction to begin a new technology center. 140 800 45 Journal Transactions Prepare journal entries to record the following transactions of the state of Missouri, identifying the funds affected by each transaction. Record journal entries for all funds affected. The following are estimated revenues for the AOZ Special Revenue fund of the State of Missouri, Esitmated appropriations for Technology is expected to be $180,000. Please provide the budgetary entry required. Taxes.... Interest and penalties Fines and fees. Permits Animal licenses Rents.... Other licenses. Interest $175,000 2,000 700 300 900 500 3,500 1,000 $183,900 $100,000 of General Fund cash was contributed to establish a new Internal Service Fund The following are revenues for the AOZ Special Revenue fund of the State of Missouri. Actual collections were made during the year for all but 20,000 of the taxes. Those taxes are not expected to be made until 90 days after year end. Taxes $90,000 Interest and penalties 1.000 Fines and fees.. 50 Permits Animal licenses Rents.. Other licenses. 2,000 $94.035 General city payroll was approved and paid, $1,630,000 Materials and supples were purchased for the Fire Department on account, $13,200 The General Fund was billed $700 by the Electric Utility Enterprise fund for electricity for the month General Fund cash of $50,000- to be repaid in 90 days- was provided to enable construction to begin a new technology center. 140 800 45