* prepare journal entries to the General ledger

* prepare unadjusted trial balance

* prepare all necessary adjusting journal entries w/ descriptions & post to the general ledger

* prepare an adjusted trial balance as of 12/31

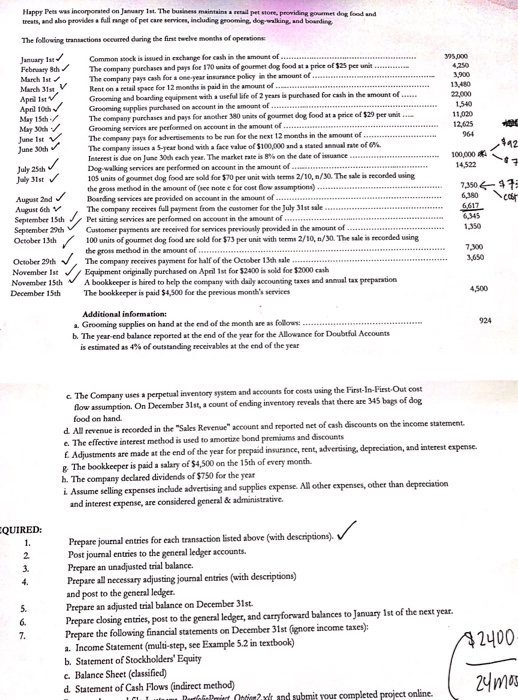

Happr Pees was incorporsted on January 1st. The business maintsins a retail pet store, providing gourmet dog food and treats, and abo providesfall range of pet care services, including grooming dog walking, and bourding The following transactions oceured daring the first twelve months of operstions Common soock is issued in exchange for cash in the smount of Febnry 8thThe company purchases and pays foe 170 units of gournet dog food st a price of $25 per un March Ist March 31st V 4,250 The company pays cash for a one year insurance policy in the amount of Rent on a retail space for 12 months in paid in the amount of Ape 1t Grooming and boarding equipment with a useful life of 2 years is purchased for cash in the smount of April 10 May 15th May 30th June 1st Te company pays for adverisements to be run for the next 12 months in the amount of une 30th Grooming supplies purchased account in the amount of The company purchases and pays for another 380 units of gourmer dog food at a price of $29 per unin Geooming services are perfoemed on account in the 11,020 mount of The company issues a 5-year bond with a face value of$100,000 andastated annual rate of6% Interest is due onJune 30th each year. The market rate is 8% on the date of issuance Deg walking services are performed on account in the amount of 100,000 July 25th 14,522 Je 3t05 unts of goummet dog food are sold foe $70 per unit with serms 2/10, n/30. The sale is recorded sing Augase 2nd August 6thV the gross method in the amount of (ee note e for cost low assumptions) Boarding senvices aze provided on account in the amount of The company receives full payment from the customer for the July 31st sale 735047 6380 September 1Sth Pet iting services are performed on account in the amount of Sepeember 2stomer payments are received for services previounly provided in the amount of 1,350 October 13th October 29th Nowember 1Sth A bookkeeper is hired to help the company with daily accounting taxes and annual tax preparation 100 units of gourmet dog food are sold for $73 per unit with terms 2/10, n/30. The sale in recorded using the gross method in the amount of The company receives payment 7,300 1,650 for half of the October 13th sale The bookkeeper is paid $4,500 for the peevious month's services Grooming supplies on hand at the end of the month are as follora is estimated as 4% of outstanding receivables at the end of the year November 1st Equipment oniginally purchased on Apeil 1st for $2400 is sold foe $2000 cas December 15th 4,500 924 b. The year-end balance reported at the end of the year for the Allowance for Doubtful Accounts c The Company uses a perpetual inventory sysem and sccounts for costs using the First-In-First Out cost flow assumpion. On December Sls,a count of ending inventory reveals that there are 345 bags of dog food on hand. d. All revenue is recorded in the "Sales Revenue account and reported net of cash discounts on e. The effective interest method is used to amortize bond premiums and discounts E. Adjustments are made at the end of the year for The bookkeeper is paid a salary of $4,500 on the 15th of every month. h. The company declared dividends of $750 for the year i Assume selling expenses include adverising and supplies expense All other expenses, other than depreciation and interest expense, are considered general & administrative. prepaid insurance, rent, advertising, depreciation, and interest QUIRED Prepare journal entries for each transaction listed above (with descripsions). Post journal entries to the general ledger accounts. Prepare an unadjusted trial balance. Prepare all necessary adjusting journal entries (with descriptions) and post to the general ledger. Prepare an adjusted trial balance on December 31st Prepare closing entries, post to the general ledger, and carnforward balances to January 1st of the next year. Prepare the following financial statements on December 31st (enore income taxe): a. Income Statement (multi-step, see Example 5.2 in textbook) b. Statement of Stockholders' Equity Balance Sheet (classified) d. Statement of Cash Flows (indirect method 2400 nt and submit your completed project online