Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare one balance sheet for each transaction of Speedy Company during the year of 2023 Jan 2-Bob invested $10,000 cash (trough bank deposit) in

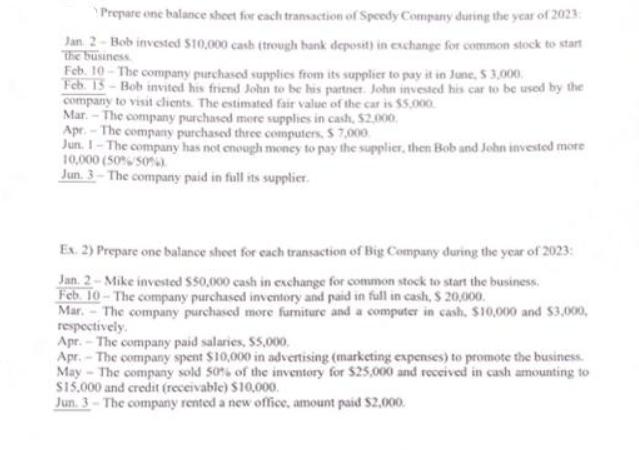

Prepare one balance sheet for each transaction of Speedy Company during the year of 2023 Jan 2-Bob invested $10,000 cash (trough bank deposit) in exchange for common stock to start the business Feb. 10-The company purchased supplies from its supplier to pay it in June, $3,000 Feb. 15-Bob invited his friend John to be his partner. John invested his car to be used by the company to visit clients. The estimated fair value of the car is $5,000 Mar. The company purchased mere supplies in cash, $2,000 Apr.-The company purchased three computers, $ 7,000 Jun. 1-The company has not enough money to pay the supplier, then Bob and John invested more 10,000 (50% 50%) Jun. 3-The company paid in full its supplier. Ex. 2) Prepare one balance sheet for each transaction of Big Company during the year of 2023: Jan. 2- Mike invested $50,000 cash in exchange for common stock to start the business. Feb. 10-The company purchased inventory and paid in full in cash, $ 20,000. Mar. The company purchased more furniture and a computer in cash, $10,000 and $3,000, respectively. Apr.-The company paid salaries, $5,000. Apr.-The company spent $10,000 in advertising (marketing expenses) to promote the business. May-The company sold 50% of the inventory for $25,000 and received in cash amounting to $15,000 and credit (receivable) $10,000. Jun. 3-The company rented a new office, amount paid $2,000.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

EX1 Speedy Company Balance Sheet as of January 2 2023 Assets Liabilities and Equity Cash A Common St...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started