Answered step by step

Verified Expert Solution

Question

1 Approved Answer

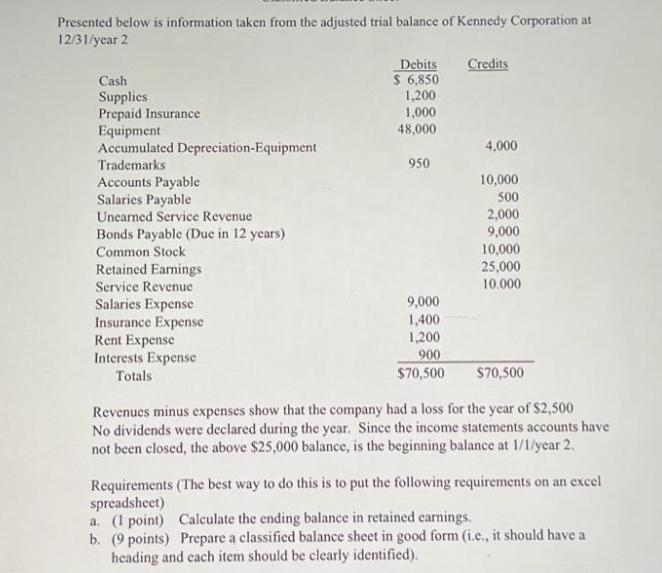

Presented below is information taken from the adjusted trial balance of Kennedy Corporation at 12/31/year 2 Cash Supplies Prepaid Insurance Equipment Accumulated Depreciation-Equipment Trademarks

Presented below is information taken from the adjusted trial balance of Kennedy Corporation at 12/31/year 2 Cash Supplies Prepaid Insurance Equipment Accumulated Depreciation-Equipment Trademarks Accounts Payable Salaries Payable Unearned Service Revenue Bonds Payable (Due in 12 years) Common Stock Retained Earnings Service Revenue Salaries Expense Insurance Expense Rent Expense Interests Expense Totals Debits Credits $ 6,850 1,200 1,000 48,000 950 9,000 1,400 1,200 900 $70,500 4.000 10,000 500 2,000 9,000 10,000 25,000 10.000 $70,500 Revenues minus expenses show that the company had a loss for the year of $2,500 No dividends were declared during the year. Since the income statements accounts have not been closed, the above $25,000 balance, is the beginning balance at 1/1/year 2. Requirements (The best way to do this is to put the following requirements on an excel spreadsheet) a. (1 point) Calculate the ending balance in retained earnings. b. (9 points) Prepare a classified balance sheet in good form (i.c., it should have a heading and each item should be clearly identified).

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the ending balance in retained earnings you can use the following formula Ending Reta...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started