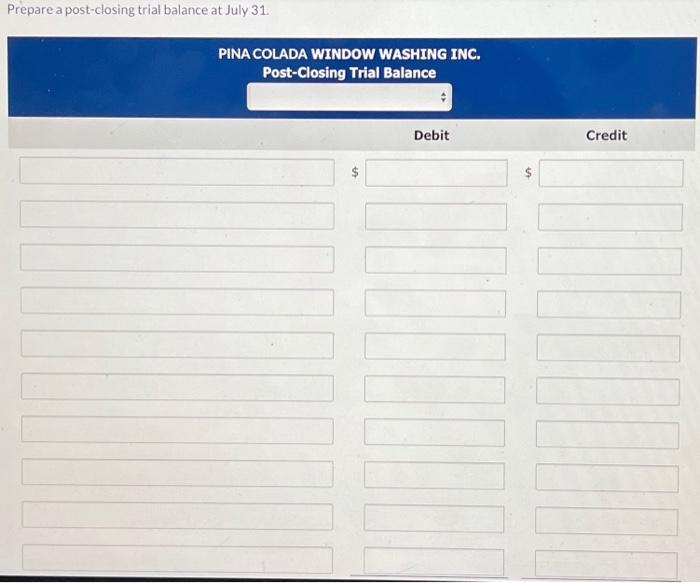

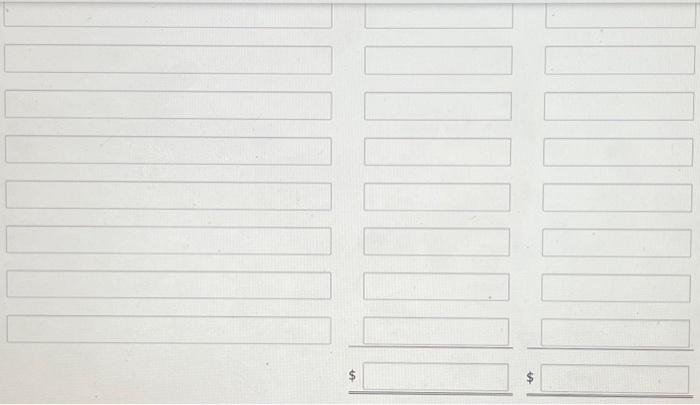

prepare post closing trail balance at july 31 for pina colada window washing inc.

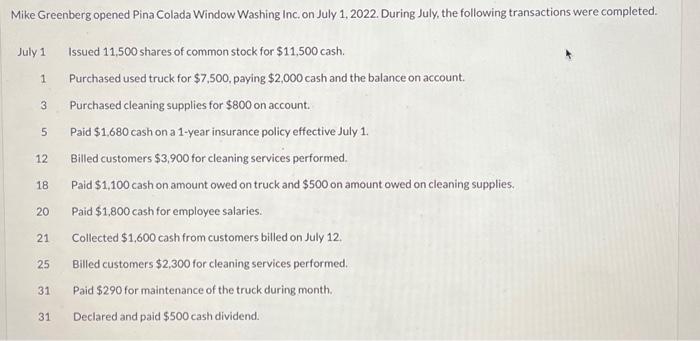

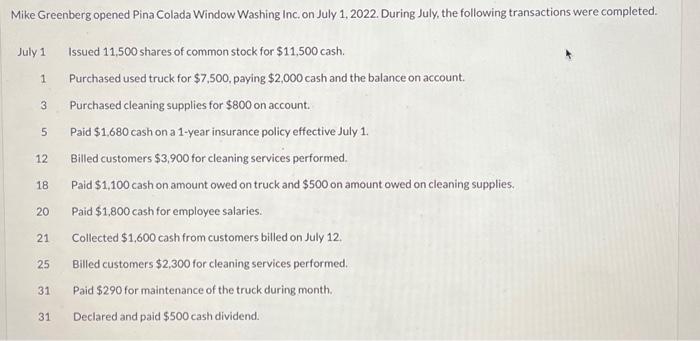

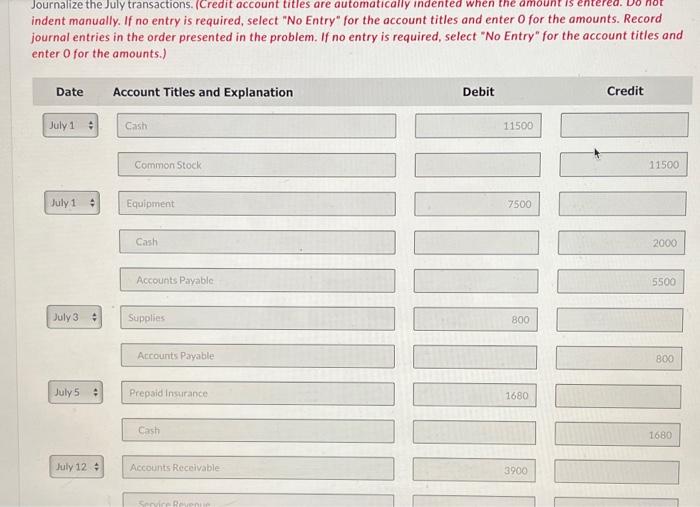

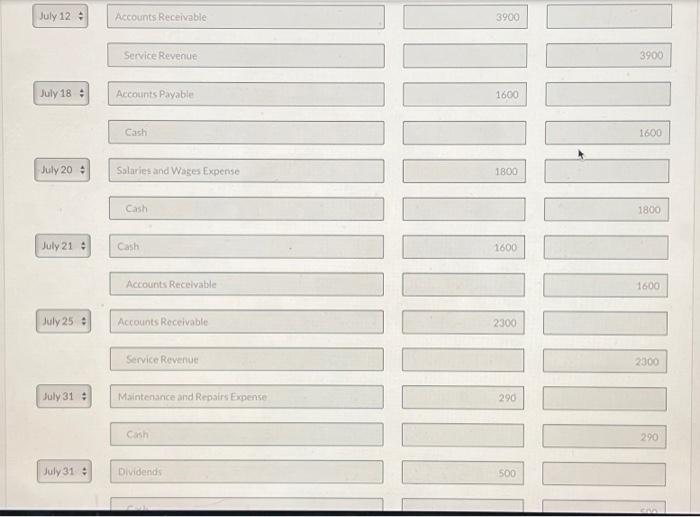

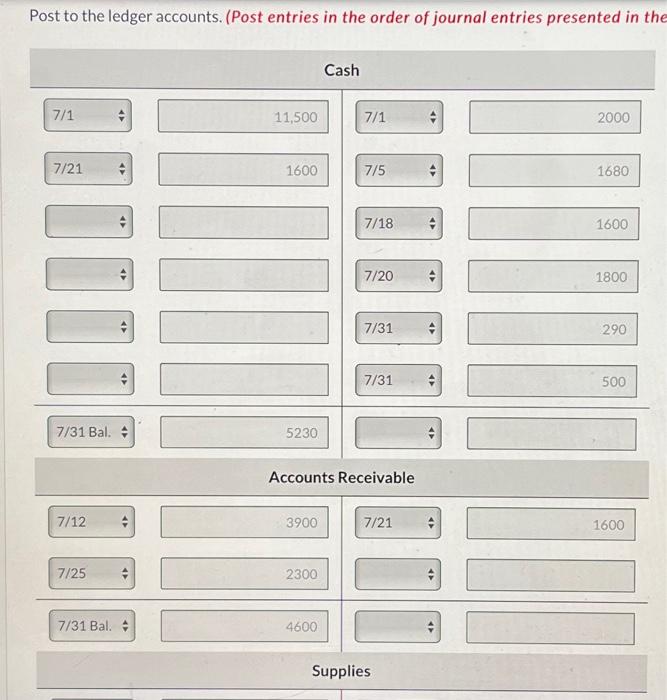

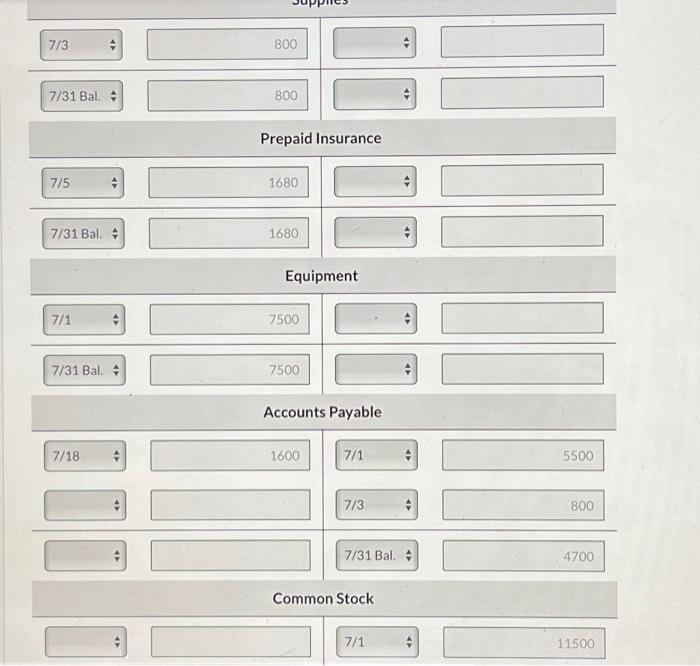

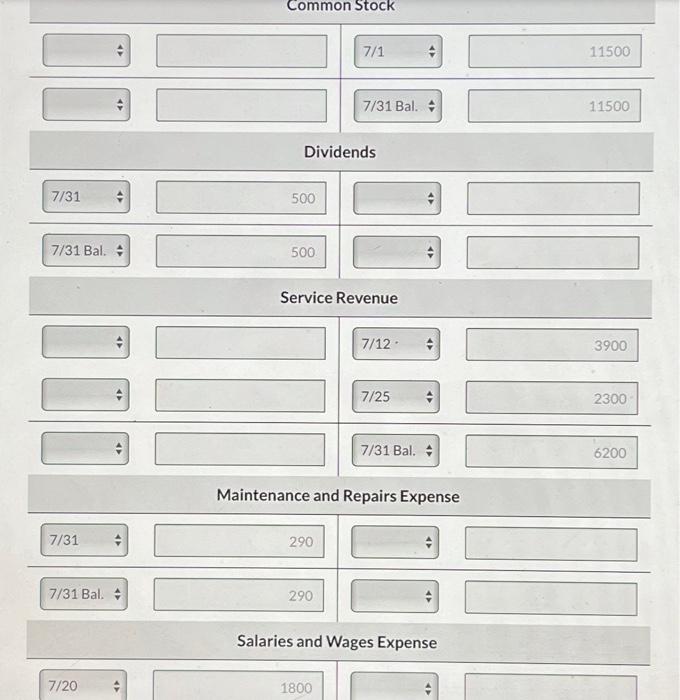

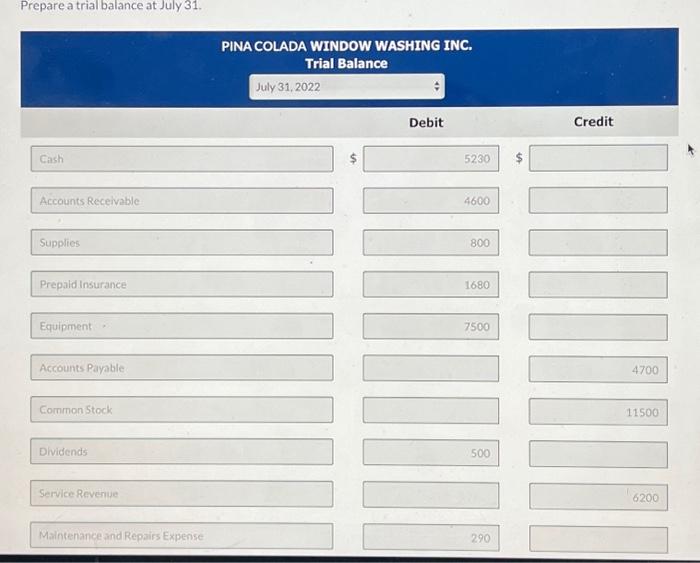

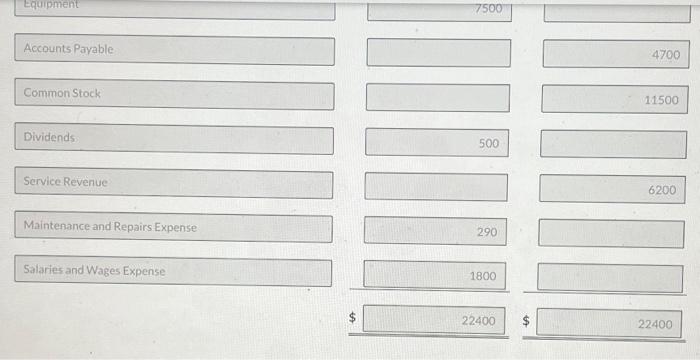

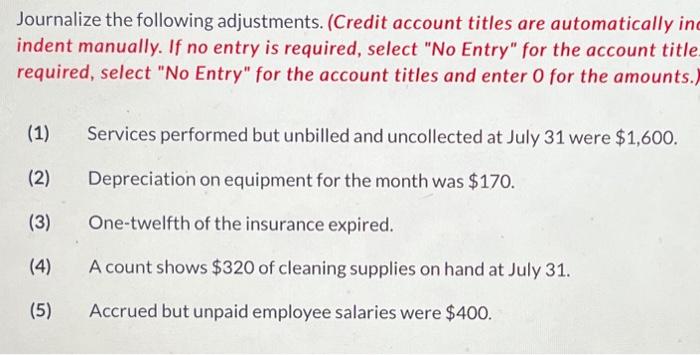

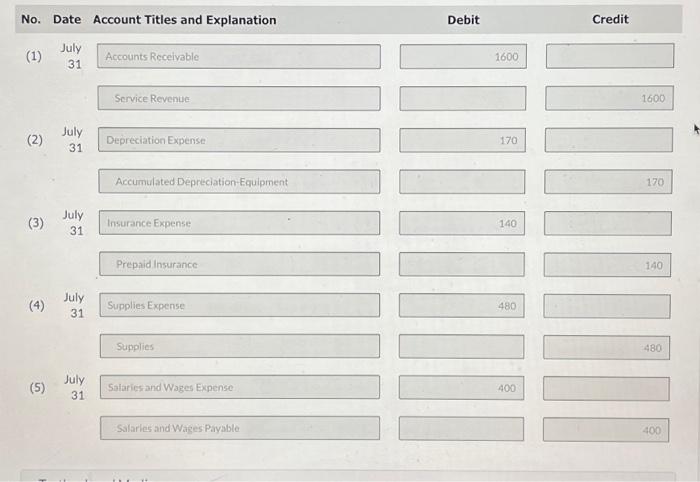

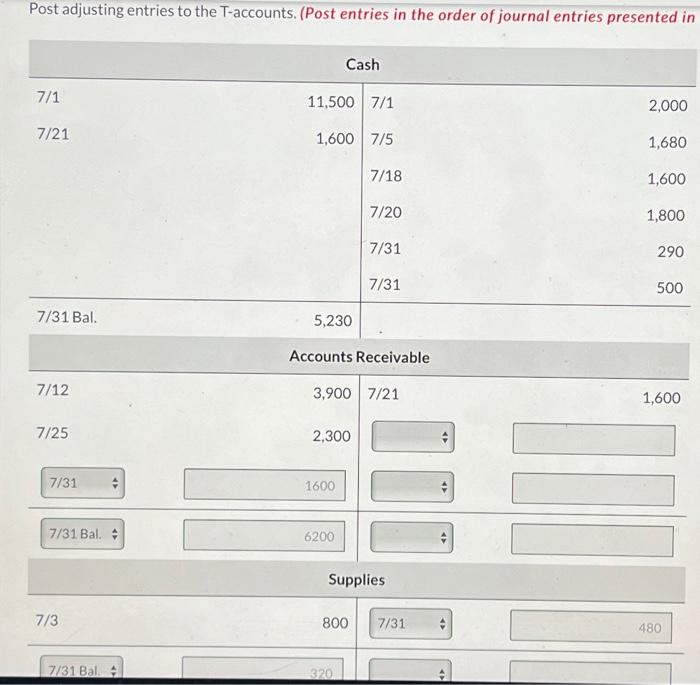

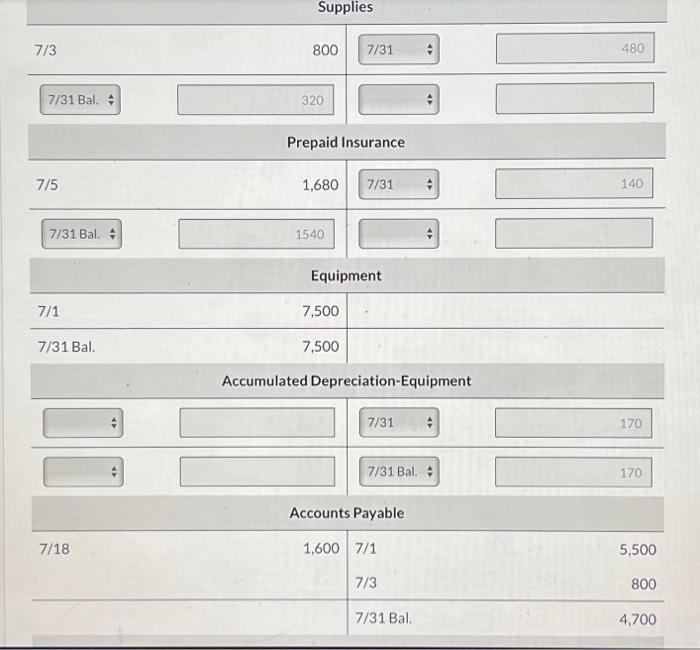

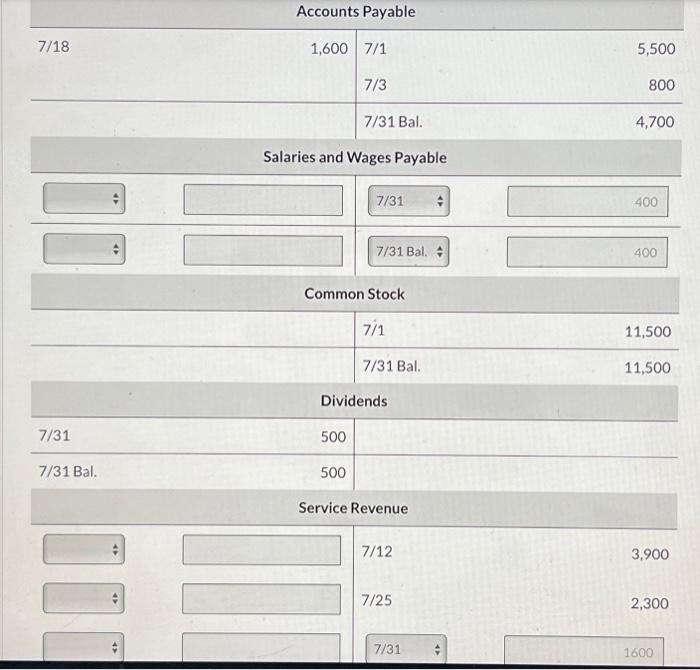

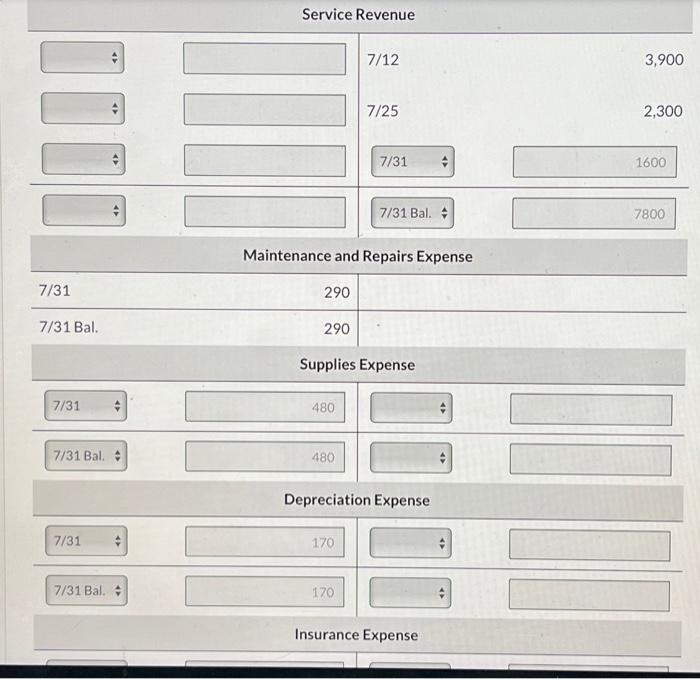

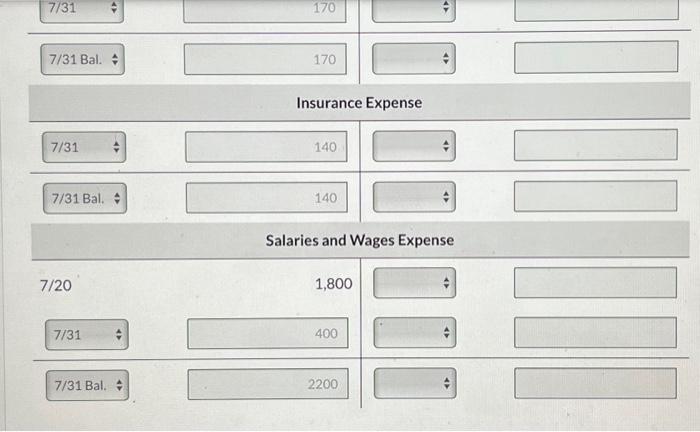

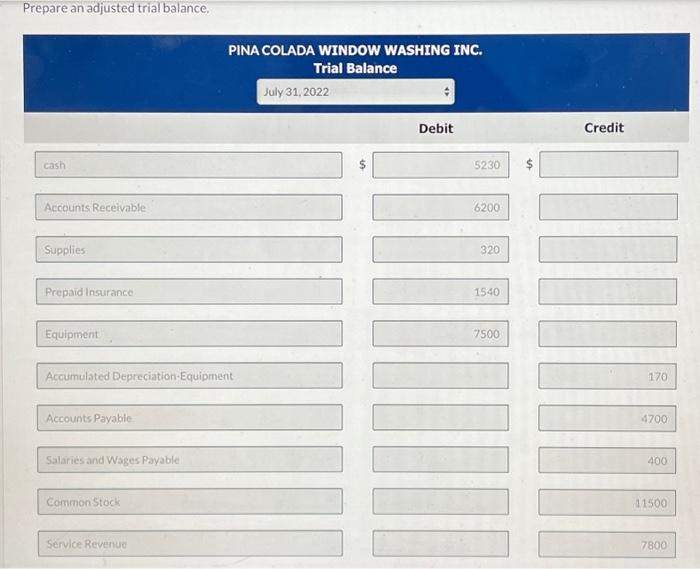

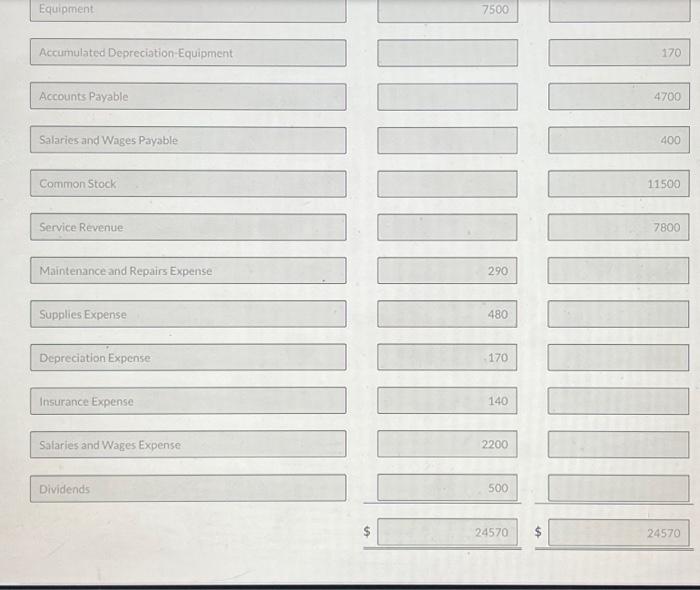

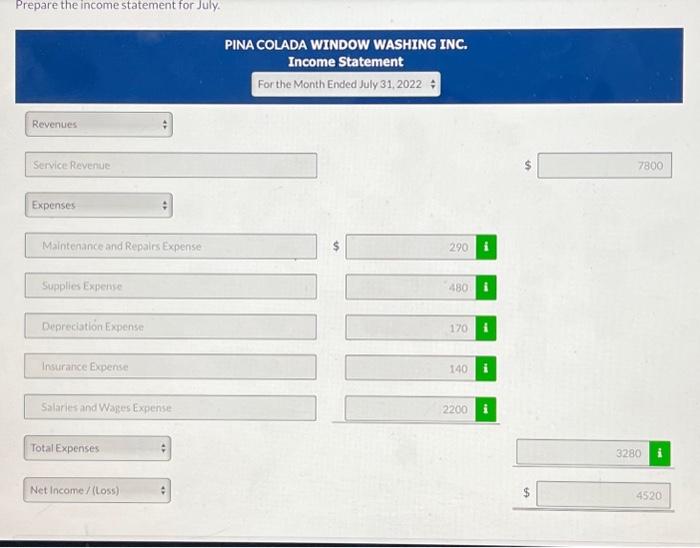

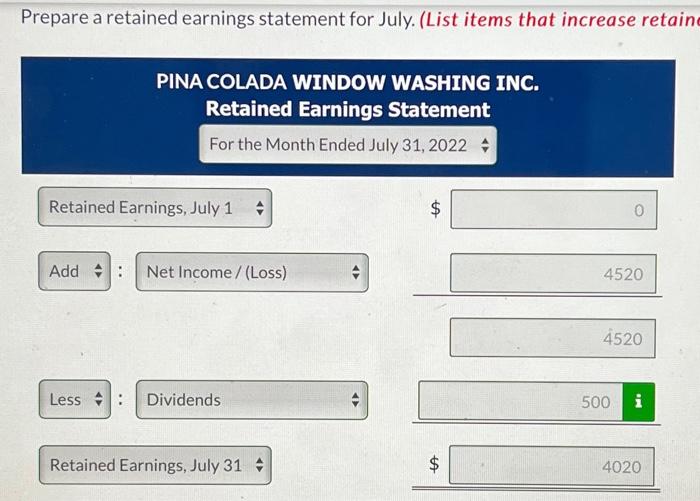

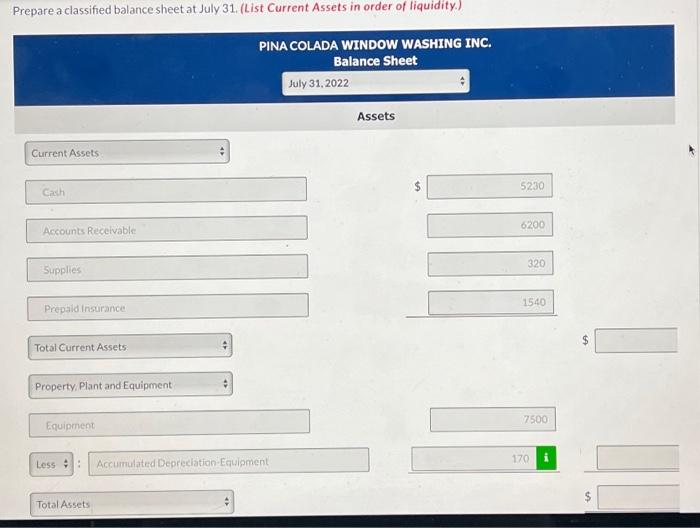

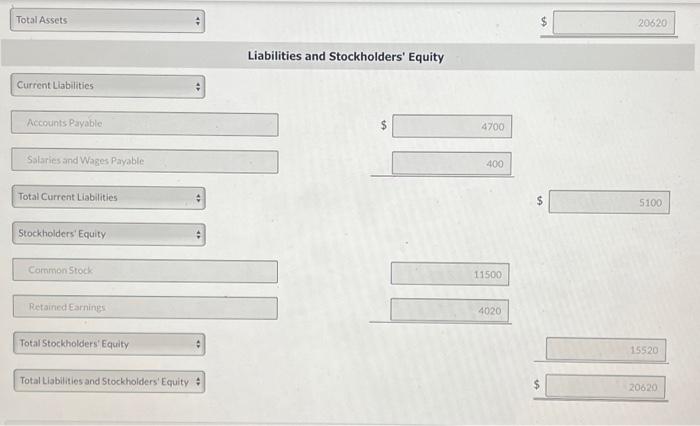

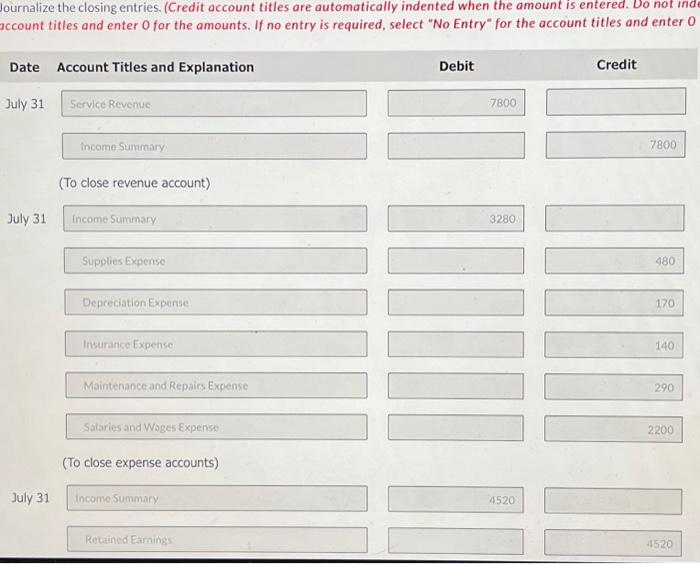

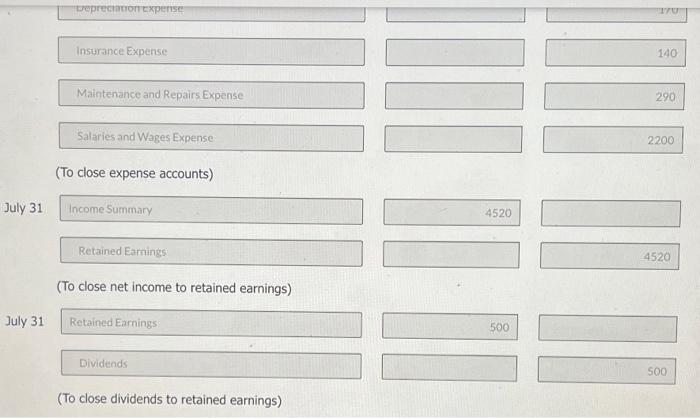

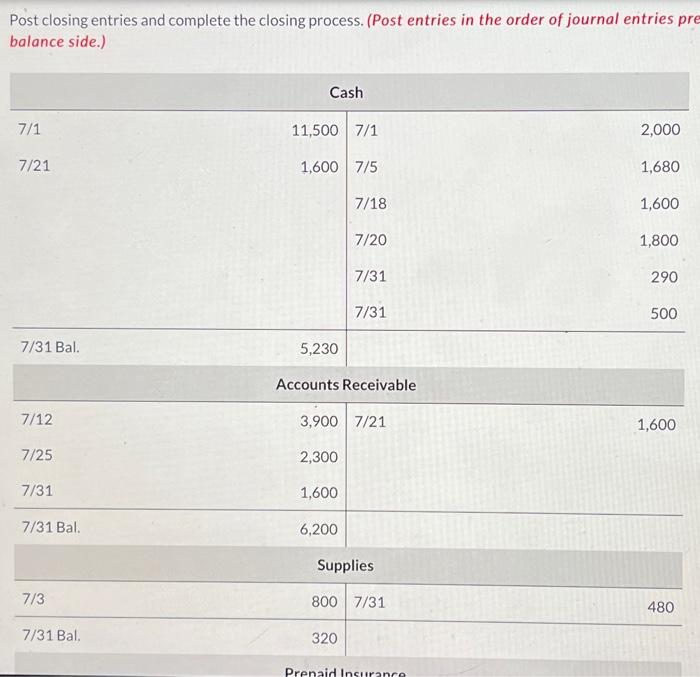

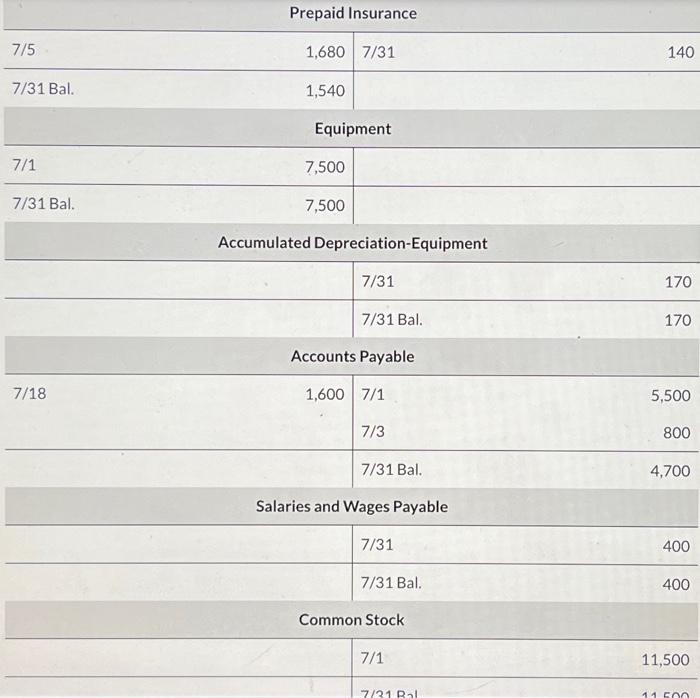

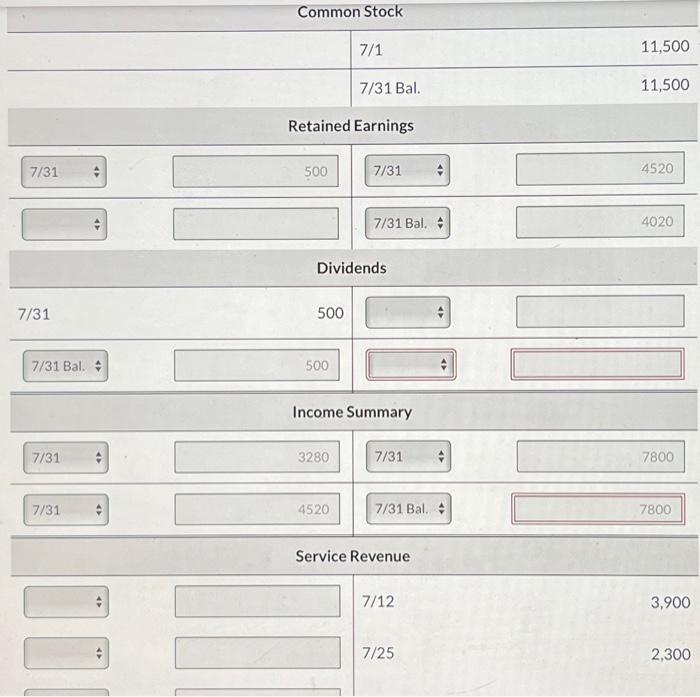

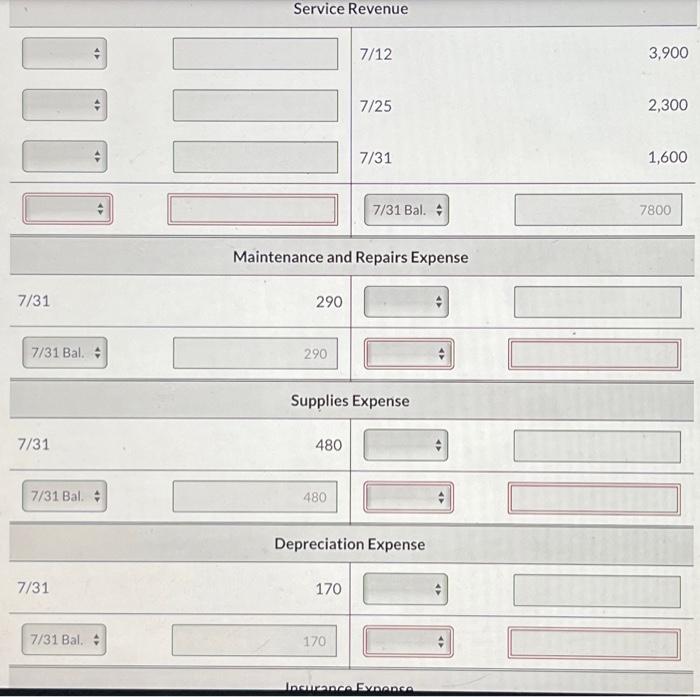

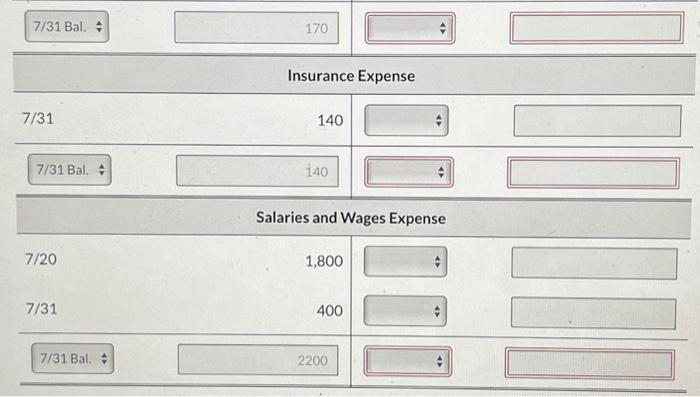

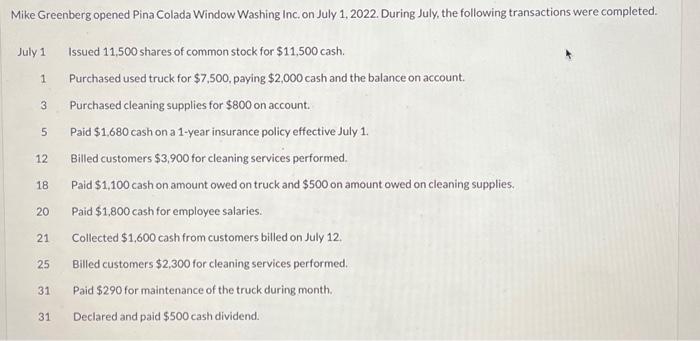

Mike Greenberg opened Pina Colada Window Washing Inc. on July 1, 2022. During July, the following transactions were completed. July 1 Issued 11,500 shares of common stock for $11,500 cash. 1 Purchased used truck for $7,500, paying $2,000 cash and the balance on account. 3 Purchased cleaning supplies for $800 on account. 5 Paid $1,680 cash on a 1-year insurance policy effective July 1 . 12 Billed customers $3,900 for cleaning services performed. 18 Paid $1,100 cash on amount owed on truck and $500 on amount owed on cleaning supplies. 20 Paid $1,800 cash for employee salaries. 21 Collected $1,600 cash from customers billed on July 12 . 25 Billed customers $2,300 for cleaning services performed. 31 Paid $290 for maintenance of the truck during month. 31 Declared and paid $500 cash dividend. indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Record journal entries in the order presented in the problem. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Accounts Receiveble Service Revenue July 18 Accounts Payable \begin{tabular}{|l|r|} \hline Cash & \\ \hline Salaries and Wages Experise & 1800 \\ \hline \end{tabular} \begin{tabular}{|c|r|} \hline Cash & \\ \hline Cash & \\ \hline \end{tabular} Accounts Receivable July 25: Accounts Receivable Service Reverue Jisly 31 Maintenance and Repairs Expense Cash July 31 Post to the ledger accounts. (Post entries in the order of journal entries presented in th Prepaid Insurance Equipment Accounts Payable 7/18 Common Stock 7/1 Common Stock 1150011500 Dividends Service Revenue 7/12 3900 7/257/31Bal. \begin{tabular}{|r|} \hline 2300 \\ \hline 6200 \\ \hline \end{tabular} Maintenance and Repairs Expense 7/31Bal.7^290 Salaries and Wages Expense Predare a trial balance at Julv 31. Accounts Payable Common Stock Dividends Service Revenue Maintenance and Repairs Expense Salaries and Wages Expense \begin{tabular}{l} \hline\( \lcm{1800} \) \\ \hline$ \\ \hline \end{tabular} Journalize the following adjustments. (Credit account titles are automatically in indent manually. If no entry is required, select "No Entry" for the account title required, select "No Entry" for the account titles and enter 0 for the amounts. (1) Services performed but unbilled and uncollected at July 31 were $1,600. (2) Depreciation on equipment for the month was $170. (3) One-twelfth of the insurance expired. (4) A count shows $320 of cleaning supplies on hand at July 31 . (5) Accrued but unpaid employee salaries were $400. No. Date Account Titles and Explanation Debit Credit (1) July Accounts Recelvable Service Revenue (2) July Depreciation Expense Accumulated Depreciation-Equipment (3) July Insurance Expense 31 (4) July Supplies Expense Supplies (5) July 31 Salaries and Wages Expense Post adjusting entries to the T-accounts. (Post entries in the order of journal entries presented in Supplies Prepaid Insurance \begin{tabular}{lr|rr} \hline 7/5 & 1,680 & 7/31+ & 140 \\ \hline 7/31 Bal. & 1540 & & \\ \hline \end{tabular} Equipment \begin{tabular}{ll} \hline 7/1 & 7,500 \\ \hline 7/31Bal \\ \hline \end{tabular} Accumulated Depreciation-Equipment Accounts Payable Common Stock Service Revenue 7/12 3,900 7/25 2,300 7/31 1600 Service Revenue Maintenance and Repairs Expense \begin{tabular}{lr|r|} \hline 7/31 & 290 & \\ \hline 7/31Bal. & 290 & \\ & Supplies Expense \\ \hline 7/31+480 & \\ \hline 7/31 Bal. & 480 & \\ \hline \end{tabular} Depreciation Expense 7/31 7/31 Bal. Insurance Expense 7/31 Bal. Insurance Expense Salaries and Wages Expense Prepare an adjusted trial balance. Equipment Accumulated Depreciation-Equipment Accounts Payable Salaries and Wages Payable Common Stock Service Revenue Maintenance and Repairs Expense Supplies Expense Depreciation Expense 170 Insurance Expense Salaries and Wages Expense Dividends Prepare the income statement for July. PINA COLADA WINDOW WASHING INC. Income Statement For the Month Ended July 31, 2022 * Revenues Service Revenue Expenses Maintenance and Repairs Expense Supples Experwe Bupreciationn Expense Insurance Expense Salariesand Wages Expense Total Expenses Net incomej (Loss) Prepare a retained earnings statement for July. (List items that increase retain Prepare a classified balance sheet at July 31 . (List Current Assets in order of liquidity.) PINA COLADA WINDOW WASHING INC. Balance Sheet July 31,2022 Assets Current Assets Accounts Receivable Supplies Prepaid insurance Total Current Assets $ Property, Plant and Equipment Total Assets $ Liabilities and Stockholders' Equity Current Liabilities Total Current Liabilities Stockholders' Equity Cormonstock Retainedearnings TotalStockholders' Equity Total Liabilities and Stockholders' Equity * ournalize the closing entries. (Credit account titles are automatically indented when the amount is entered. Do not ind ccount titles and enter 0 for the amounts. If no entry is required, select "No Entry" for the account titles and enter 0 Insurance Expense Maintenance and Repairs Expense Salaries and Wages Expense (To close expense accounts) July 31 Income Summary Retained Earnings (To close net income to retained earnings) July 31 Retained Earnings Dividends (To close dividends to retained earnings) Post closing entries and complete the closing process. (Post entries in the order of journal entries pre halanre side) Prepaid Insurance \begin{tabular}{lr|l} \hline 7/5 & 1,680 & 7/31 \\ \hline 7/31 Bal. & 1,540 & \\ \hline \end{tabular} Equipment \begin{tabular}{lc} \hline 7/1 & 7,500 \\ \hline 7/31Bal. & 7,500 \\ \hline \end{tabular} Accumulated Depreciation-Equipment Salaries and Wages Payable Service Revenue Maintenance and Repairs Expense 7/317/31Bal.290290 Supplies Expense \begin{tabular}{lr} 7/31 & 480 \\ \hline 7/31 Bal. & 480 \\ \hline \end{tabular} Depreciation Expense 7/31 7/31Bal.7^ 7/31. Bal. Insurance Expense Prepare a post-closing trial balance at July 31