Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare qualitative/quantitative analysis and present analysis Queen of Shaves On Friday, January 7, 2000, Kelsey Koeler, the newly appointed Product Manager for hand and body

Prepare qualitative/quantitative analysis and present analysis

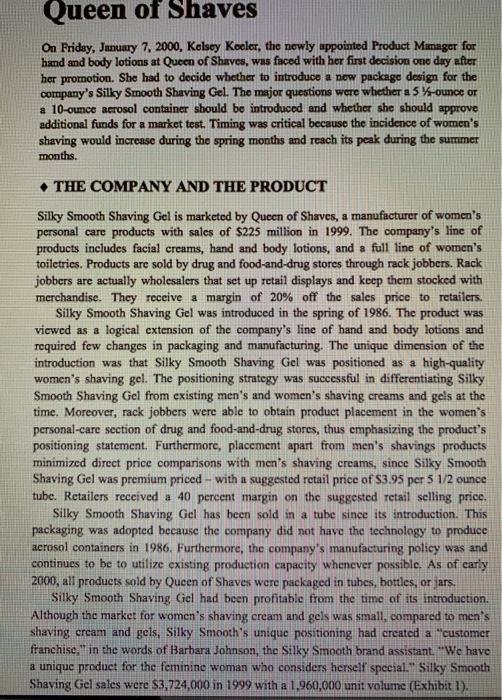

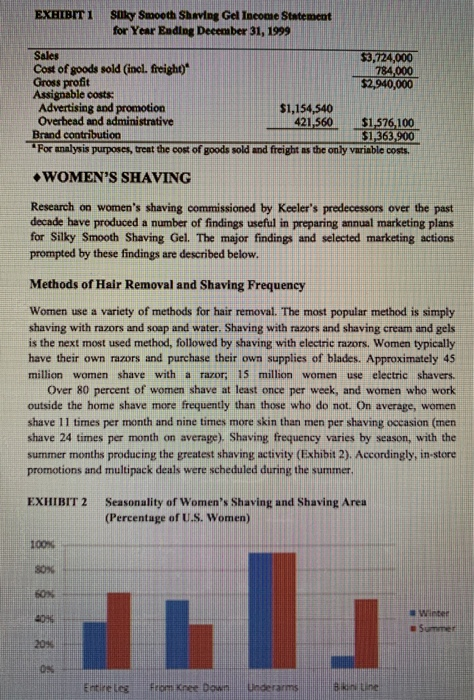

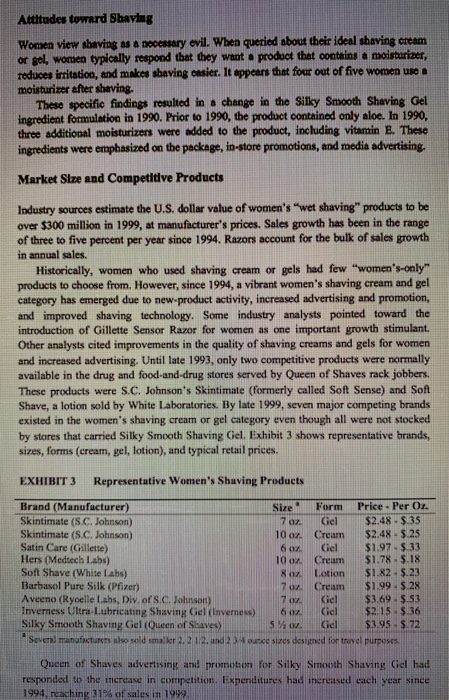

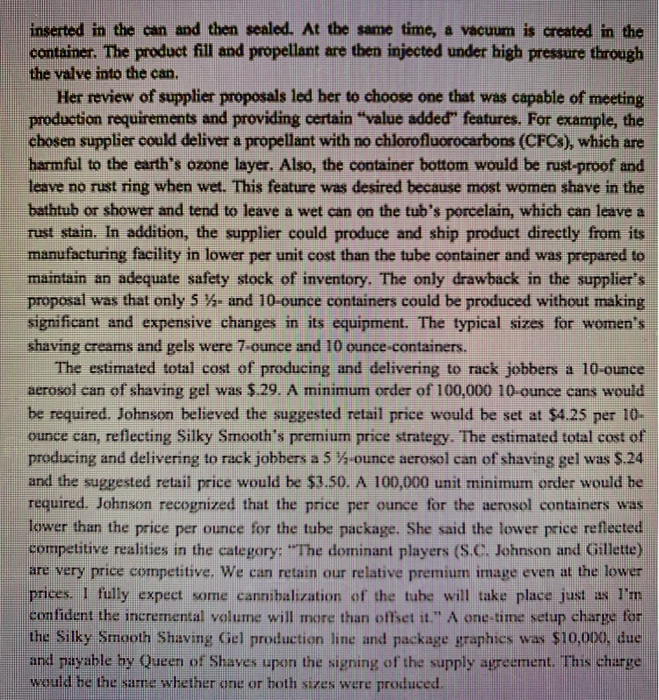

Queen of Shaves On Friday, January 7, 2000, Kelsey Koeler, the newly appointed Product Manager for hand and body lotions at Queen of Shaves, was faced with her first decision one day after her promotion. She had to decide whether to introduce a new package design for the company's Silky Smooth Shaving Gel. The major questions were whether a 5 V-ounce or a 10-ounce acrosol container should be introduced and whether she should approve additional funds for a market test. Timing was critical because the incidence of womens shaving would increase during the spring months and reach its peak during the summer months. THE COMPANY AND THE PRODUCT Silky Smooth Shaving Gel is marketed by Queen of Shaves, a manufacturer of women's personal care products with sales of $225 million in 1999. The company's line of products includes facial creams, hand and body lotions, and a full line of women's toiletrics. Products are sold by drug and food-and-drug stores through rack jobbers. Rack jobbers are actually wholesalers that set up retail displays and keep them stocked with merchandise. They receive a margin of 20% off the sales price to retailers. Silky Smooth Shaving Gel was introduced in the spring of 1986. The product was viewed as a logical extension of the company's line of hand and body lotions and required few changes in packaging and manufacturing. The unique dimension of the introduction was that Silky Smooth Shaving Gel was positioned as a high-quality women's shaving gel. The positioning strategy was successful in differentiating Silky Smooth Shaving Gel from existing men's and women's shaving creams and gels at the time. Moreover, rack jobbers were able to obtain produet placement in the women's personal-care section of drug and food-and-drug stores, thus emphasizing the product's positioning statement. Furthermore, placement apart from men's shavings products minimized direct price comparisons with men's shaving creams, since Silky Smooth Shaving Gel was premium priced - with a suggested retail price of $3.95 per 5 1/2 ounce tube. Retailers received a 40 percent margin on the suggested retail selling price. Silky Smooth Shaving Gel has been sold in a tube since its introduction. This packaging was adopted because the company did not have the technology to produce acrosol containers in 1986. Furthermore, the company's manufacturing policy was and continues to be to utilize existing production capacity whenever possible. As of early 2000, all products sold by Queen of Shaves were packaged in tubes, bottles, or jars. Silky Smooth Shaving Gel had been profitable from the time of its introduction. Although the market for women's shaving cream and gels was small, compared to men's shaving cream and gels, Siky Smooth's unique positioning had created a "customer franchise," in the words of Barbara Johnson, the Silky Smooth brand assistant. "We have a unique product for the feminine woman who considers herself special." Silky Smooth Shaving Gel sales were $3,724,000 in 1999 with a 1,960,000 unit volume (Exhibit 1), EXHIBIT 1 Slky Smooth Sharving Gel Income Statement for Year Ending Decemmber 31, 1999 Cost of goods sold (inol. freight) Gross proft Assignable costs $3,724,000 784.000 $2,940,000 $1,154,540 Overhead and administrative Brand contribution "For analysis purposes, trent the cost of goods sold and freight as the only variable costs. 421560 $1576 100 WOMEN'S SHAVING Research on women's shaving commissioned by Keeler's predecessors over the past decade have produced a number of findings useful in preparing annual marketing plans for Silky Smooth Shaving Gel. The major findings and selected marketing actions prompted by these findings are described below. Methods of Hair Removal and Shaving Frequency Women use a variety of methods for hair removal. The most popular method is simply shaving with razors and soap and water. Shaving with razors and shaving cream and gels is the next most used method, followed by shaving with electrie razors. Women typically have their own razors and purchase their own supplies of blades. Approximately 45 million women shave with a razor, 15 million women use electric shavers. Over 80 percent of women shave at least once per week, and women who work outside the home shave more frequently than those who do not. On average, women shave 11 times per month and nine times more skin than men per shaving occasion (mern shave 24 times per month on average). Shaving frequency varies by season, with the summer months producing the greatest shaving activity (Exhibit 2). Accordingly, in-store promotions and multipack deals were scheduled during the summer EXHIBIT 2 Seasonality of Women's Shaving and Shaving Area (Percentage of U.S. Women) 100% 80% 60% 40% t 20% aWinber e Summer 0% Entire Leg on Kree Down, Linderarms l awn Line Attitudes toward Shaving Women view sheving as a necessery evil. When queried about their ideal shaving cream or gel, women typically respond that they wantproduct that oontains a moisturizer, reduces irritation, and makes shaving casier. It appeers that four out of five women use a moisturizer after shaving. These specific findings resulted in a change in the Silky Smooth Shaving Gel ingredient formulation in 1990. Prior to 1990, the product contained only aloe. In 1990, three additional moisturizers were added to the product, including vitamin Tese ingredients were emphasized on the package, in-store promotions, and media advertising Market Size and Competitive Products Industry sources estimate the U.S. dollar value of women's "wet shaving" products to be over $300 million in 1999, at manufacturer's prices. Sales growth has been in the range of three to five percent per year since 1994. Razors account for the bulk of sales growth in annual sales Historically, women who used shaving cream or gels had few "women's-only" products to choose from. However, since 1994, a vibrant women's shaving cream and gel category has emerged due to new-product activity, increased advertising and promotion, and improved shaving technology. Some industry analysts pointed toward the introduction of Gillette Sensor Razor for women as one important growth stimulant Other analysts cited improvements in the quality of shaving creams and gels for women and increased advertising. Until late 1993, only two competitive products were normally available in the drug and food-and-drug stores served by Queen of Shaves rack jobbers. These products were S.C. Johnson's Skintimate (formerly called Soft Sense) and Soft Shave, a lotion sold by White Laboratories. By late 1999, seven major competing brands existed in the women's shaving cream or gel category even though all were not stocked by stores that carried Silky Smooth Shaving Gel. Exhibit 3 shows representative brands sizes, forms (cream, gel, lotion), and typical retail prices. EXHIBIT 3 Representative Women's Shaving Products Brand (Manufacturer) Skintimate (S.C. Johnson) Skintimate (S.C. Johnson) Satin Care (Gillette Hers (Medsech Labs) Soft Shave (White Labs) Barbasol Pure Silk (Pfizer) Aveeno (Ryoelle labs, Div of S.C. Johnson Inverness Ultra Lubricating Shaving Ciel (Invermess) 6 ozGiel $2.15 $ 36 Silky Smooth Shaving Gel (Queen of Shaves) Several manufacturers albso sold smalker 2.2 1/2, and2 ounice sizes designed for tr Size Form Price Per Oz. 7 oz. Gel $2.48 -$.35 10 oz. Cream $2.48-$.25 6 oz. Giel $1.97-$33 10 oz. Cream $1.78- 5.18 8 oz. Lotion $1.82-$.23 7oz Cream $1.99 $.28 7 oz. Giel $3.69 $.53 i $3.95 $.72 vel purposcs. Queen of Shaves advertising and promoton for Silky Smovth Shaving Gel had responded to the imcrease in competition, Fxpenditures had inereased each year since 1994, reaching 31% of sales in 1999 1999, te dominant packaging for women's shaving aeam or gels had become the serosol container. Oaly a few sbaving gels and brands were sold in tubes or plastio bottles, including Silky Smooth Shaving Gel, Soft Shave Lotion, and Inverness Ultra- Lubricating Shaving Gel. NEW PACKAGE DESIGN The iden for a new package design was provided by Keeler's brand assistant, Barbara Johnson. She originally proposed a new package to Keeler's predecessor in July 1999 Her recommendation was based on four developments. First, unit sales volume for Silky Smooth Shaving Gel had platesued and then declined in recent years (Exhibit 4). Second, the growth of Silky Smooth Shaving Gel had strained manufacturing capacity. In the past, production of Silky Smooth Shaving Gel had been easily integrated into the firm's production schedules; however growth in the entire line of hand and body lotions, coupled with Silky Smooth Shaving Gel sales, had overburdened production capacity and scheduling. Moreover, inspection of shipping records indicated that the product's fill rate (that is, Queen of Shaves ability to supply quantities requested by retailers) had dropped leading to an out of stock situations and lost sales. Third, the company had no manufacturing capacity expansion plans for the next three years. And finally, acrosol packaging had become the dominant design for women's shaving creams and gels by 1999, EXHIBIT 4 Silky Smooth Shaving Gel Unit Sales Volume, 1986-1999 2,000.000 1,800,000 1,600,000 1400,000 1.200 00 1,000,000 800,000 600,000 400,000 200 000 Johnson's observations prompted a preliminary study of outsourcing opportunities for a new package design. Iler study included visits to several firms specialiring in contrect filling und requests for production proposals. A contract fler purchases cans, propellants, caps, and valves from a variety of sources and then assernbles these components, including the product fill (that is, shavimg gel), into the finul container. The production method is called pressure illing. In this method. the eap and valve are inserted in the can and then sealed. At the same time, a vacuum is created in the container. The product fill and propellant are then injected under high pressure through the valve into the can Her review of supplier proposals led her to choose one that was capable of meeting production requirements and providing certain "value added" features. For example, the chosen supplier could deliver a propellant with no chlorofluorocarbons (CFCs), which are harmful to the earth's ozone layer. Also, the container bottom would be rust-proof and leave no rust ring when wet. This feature was desired because most women shave in the bathtub or shower and tend to leave a wet can on the tub's porcelain, which can leave a rust stain. In addition, the supplier could produce and ship product directly from its manufacturing facility in lower per unit cost than the tube container and was prepared to maintain an adequate safety stock of inventory. The only drawback in the supplier's proposal was that only 5 %-and 10-ounce containers could be produced without making significant and expensive changes in its equipment. The typical sizes for women's shaving creams and gels were 7-ounce and 10 ounce-containers. The estimated total cost of producing and delivering to rack jobbers a 10-ounce aerosol can of shaving gel was $.29. A minimum order of 100,000 10-ounce cans would be required. Johnson believed the suggested retail price would be set at $4.25 per 10- ounce can, reflecting Silky Smooth's premiun price strategy. The estimated total cost of producing and delivering to rack jobbers a 5%-ounce aerosol can of shaving gel was $24 and the suggested retail price would be $3.50. A 100,000 unit minimum order would be required. Johnson recognized that the price per ounce for the aerosol containers wa lower than the price per ounce for the tube package. She said the lower price reflected competitive realities in the category: "The dominant players (S.C. Johnson and Gillette) are very price competitive. We can retain our relative premium image even at the lower prices. I fully expect some cannibalization of the tube will take place just as lm confident the incremental volume will more than offset it." A one-time setup charge for the Silky Smooth Shaving Giel production line and package graphics was $10,opa, due and payable by Queen of Shaves upon the signing of the supply agreement. This charge would be the same whether one or both sizes were produced Eatk Queen of Shaves On Friday, January 7, 2000, Kelsey Koeler, the newly appointed Product Manager for hand and body lotions at Queen of Shaves, was faced with her first decision one day after her promotion. She had to decide whether to introduce a new package design for the company's Silky Smooth Shaving Gel. The major questions were whether a 5 V-ounce or a 10-ounce acrosol container should be introduced and whether she should approve additional funds for a market test. Timing was critical because the incidence of womens shaving would increase during the spring months and reach its peak during the summer months. THE COMPANY AND THE PRODUCT Silky Smooth Shaving Gel is marketed by Queen of Shaves, a manufacturer of women's personal care products with sales of $225 million in 1999. The company's line of products includes facial creams, hand and body lotions, and a full line of women's toiletrics. Products are sold by drug and food-and-drug stores through rack jobbers. Rack jobbers are actually wholesalers that set up retail displays and keep them stocked with merchandise. They receive a margin of 20% off the sales price to retailers. Silky Smooth Shaving Gel was introduced in the spring of 1986. The product was viewed as a logical extension of the company's line of hand and body lotions and required few changes in packaging and manufacturing. The unique dimension of the introduction was that Silky Smooth Shaving Gel was positioned as a high-quality women's shaving gel. The positioning strategy was successful in differentiating Silky Smooth Shaving Gel from existing men's and women's shaving creams and gels at the time. Moreover, rack jobbers were able to obtain produet placement in the women's personal-care section of drug and food-and-drug stores, thus emphasizing the product's positioning statement. Furthermore, placement apart from men's shavings products minimized direct price comparisons with men's shaving creams, since Silky Smooth Shaving Gel was premium priced - with a suggested retail price of $3.95 per 5 1/2 ounce tube. Retailers received a 40 percent margin on the suggested retail selling price. Silky Smooth Shaving Gel has been sold in a tube since its introduction. This packaging was adopted because the company did not have the technology to produce acrosol containers in 1986. Furthermore, the company's manufacturing policy was and continues to be to utilize existing production capacity whenever possible. As of early 2000, all products sold by Queen of Shaves were packaged in tubes, bottles, or jars. Silky Smooth Shaving Gel had been profitable from the time of its introduction. Although the market for women's shaving cream and gels was small, compared to men's shaving cream and gels, Siky Smooth's unique positioning had created a "customer franchise," in the words of Barbara Johnson, the Silky Smooth brand assistant. "We have a unique product for the feminine woman who considers herself special." Silky Smooth Shaving Gel sales were $3,724,000 in 1999 with a 1,960,000 unit volume (Exhibit 1), EXHIBIT 1 Slky Smooth Sharving Gel Income Statement for Year Ending Decemmber 31, 1999 Cost of goods sold (inol. freight) Gross proft Assignable costs $3,724,000 784.000 $2,940,000 $1,154,540 Overhead and administrative Brand contribution "For analysis purposes, trent the cost of goods sold and freight as the only variable costs. 421560 $1576 100 WOMEN'S SHAVING Research on women's shaving commissioned by Keeler's predecessors over the past decade have produced a number of findings useful in preparing annual marketing plans for Silky Smooth Shaving Gel. The major findings and selected marketing actions prompted by these findings are described below. Methods of Hair Removal and Shaving Frequency Women use a variety of methods for hair removal. The most popular method is simply shaving with razors and soap and water. Shaving with razors and shaving cream and gels is the next most used method, followed by shaving with electrie razors. Women typically have their own razors and purchase their own supplies of blades. Approximately 45 million women shave with a razor, 15 million women use electric shavers. Over 80 percent of women shave at least once per week, and women who work outside the home shave more frequently than those who do not. On average, women shave 11 times per month and nine times more skin than men per shaving occasion (mern shave 24 times per month on average). Shaving frequency varies by season, with the summer months producing the greatest shaving activity (Exhibit 2). Accordingly, in-store promotions and multipack deals were scheduled during the summer EXHIBIT 2 Seasonality of Women's Shaving and Shaving Area (Percentage of U.S. Women) 100% 80% 60% 40% t 20% aWinber e Summer 0% Entire Leg on Kree Down, Linderarms l awn Line Attitudes toward Shaving Women view sheving as a necessery evil. When queried about their ideal shaving cream or gel, women typically respond that they wantproduct that oontains a moisturizer, reduces irritation, and makes shaving casier. It appeers that four out of five women use a moisturizer after shaving. These specific findings resulted in a change in the Silky Smooth Shaving Gel ingredient formulation in 1990. Prior to 1990, the product contained only aloe. In 1990, three additional moisturizers were added to the product, including vitamin Tese ingredients were emphasized on the package, in-store promotions, and media advertising Market Size and Competitive Products Industry sources estimate the U.S. dollar value of women's "wet shaving" products to be over $300 million in 1999, at manufacturer's prices. Sales growth has been in the range of three to five percent per year since 1994. Razors account for the bulk of sales growth in annual sales Historically, women who used shaving cream or gels had few "women's-only" products to choose from. However, since 1994, a vibrant women's shaving cream and gel category has emerged due to new-product activity, increased advertising and promotion, and improved shaving technology. Some industry analysts pointed toward the introduction of Gillette Sensor Razor for women as one important growth stimulant Other analysts cited improvements in the quality of shaving creams and gels for women and increased advertising. Until late 1993, only two competitive products were normally available in the drug and food-and-drug stores served by Queen of Shaves rack jobbers. These products were S.C. Johnson's Skintimate (formerly called Soft Sense) and Soft Shave, a lotion sold by White Laboratories. By late 1999, seven major competing brands existed in the women's shaving cream or gel category even though all were not stocked by stores that carried Silky Smooth Shaving Gel. Exhibit 3 shows representative brands sizes, forms (cream, gel, lotion), and typical retail prices. EXHIBIT 3 Representative Women's Shaving Products Brand (Manufacturer) Skintimate (S.C. Johnson) Skintimate (S.C. Johnson) Satin Care (Gillette Hers (Medsech Labs) Soft Shave (White Labs) Barbasol Pure Silk (Pfizer) Aveeno (Ryoelle labs, Div of S.C. Johnson Inverness Ultra Lubricating Shaving Ciel (Invermess) 6 ozGiel $2.15 $ 36 Silky Smooth Shaving Gel (Queen of Shaves) Several manufacturers albso sold smalker 2.2 1/2, and2 ounice sizes designed for tr Size Form Price Per Oz. 7 oz. Gel $2.48 -$.35 10 oz. Cream $2.48-$.25 6 oz. Giel $1.97-$33 10 oz. Cream $1.78- 5.18 8 oz. Lotion $1.82-$.23 7oz Cream $1.99 $.28 7 oz. Giel $3.69 $.53 i $3.95 $.72 vel purposcs. Queen of Shaves advertising and promoton for Silky Smovth Shaving Gel had responded to the imcrease in competition, Fxpenditures had inereased each year since 1994, reaching 31% of sales in 1999 1999, te dominant packaging for women's shaving aeam or gels had become the serosol container. Oaly a few sbaving gels and brands were sold in tubes or plastio bottles, including Silky Smooth Shaving Gel, Soft Shave Lotion, and Inverness Ultra- Lubricating Shaving Gel. NEW PACKAGE DESIGN The iden for a new package design was provided by Keeler's brand assistant, Barbara Johnson. She originally proposed a new package to Keeler's predecessor in July 1999 Her recommendation was based on four developments. First, unit sales volume for Silky Smooth Shaving Gel had platesued and then declined in recent years (Exhibit 4). Second, the growth of Silky Smooth Shaving Gel had strained manufacturing capacity. In the past, production of Silky Smooth Shaving Gel had been easily integrated into the firm's production schedules; however growth in the entire line of hand and body lotions, coupled with Silky Smooth Shaving Gel sales, had overburdened production capacity and scheduling. Moreover, inspection of shipping records indicated that the product's fill rate (that is, Queen of Shaves ability to supply quantities requested by retailers) had dropped leading to an out of stock situations and lost sales. Third, the company had no manufacturing capacity expansion plans for the next three years. And finally, acrosol packaging had become the dominant design for women's shaving creams and gels by 1999, EXHIBIT 4 Silky Smooth Shaving Gel Unit Sales Volume, 1986-1999 2,000.000 1,800,000 1,600,000 1400,000 1.200 00 1,000,000 800,000 600,000 400,000 200 000 Johnson's observations prompted a preliminary study of outsourcing opportunities for a new package design. Iler study included visits to several firms specialiring in contrect filling und requests for production proposals. A contract fler purchases cans, propellants, caps, and valves from a variety of sources and then assernbles these components, including the product fill (that is, shavimg gel), into the finul container. The production method is called pressure illing. In this method. the eap and valve are inserted in the can and then sealed. At the same time, a vacuum is created in the container. The product fill and propellant are then injected under high pressure through the valve into the can Her review of supplier proposals led her to choose one that was capable of meeting production requirements and providing certain "value added" features. For example, the chosen supplier could deliver a propellant with no chlorofluorocarbons (CFCs), which are harmful to the earth's ozone layer. Also, the container bottom would be rust-proof and leave no rust ring when wet. This feature was desired because most women shave in the bathtub or shower and tend to leave a wet can on the tub's porcelain, which can leave a rust stain. In addition, the supplier could produce and ship product directly from its manufacturing facility in lower per unit cost than the tube container and was prepared to maintain an adequate safety stock of inventory. The only drawback in the supplier's proposal was that only 5 %-and 10-ounce containers could be produced without making significant and expensive changes in its equipment. The typical sizes for women's shaving creams and gels were 7-ounce and 10 ounce-containers. The estimated total cost of producing and delivering to rack jobbers a 10-ounce aerosol can of shaving gel was $.29. A minimum order of 100,000 10-ounce cans would be required. Johnson believed the suggested retail price would be set at $4.25 per 10- ounce can, reflecting Silky Smooth's premiun price strategy. The estimated total cost of producing and delivering to rack jobbers a 5%-ounce aerosol can of shaving gel was $24 and the suggested retail price would be $3.50. A 100,000 unit minimum order would be required. Johnson recognized that the price per ounce for the aerosol containers wa lower than the price per ounce for the tube package. She said the lower price reflected competitive realities in the category: "The dominant players (S.C. Johnson and Gillette) are very price competitive. We can retain our relative premium image even at the lower prices. I fully expect some cannibalization of the tube will take place just as lm confident the incremental volume will more than offset it." A one-time setup charge for the Silky Smooth Shaving Giel production line and package graphics was $10,opa, due and payable by Queen of Shaves upon the signing of the supply agreement. This charge would be the same whether one or both sizes were produced Eatk Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started