Answered step by step

Verified Expert Solution

Question

1 Approved Answer

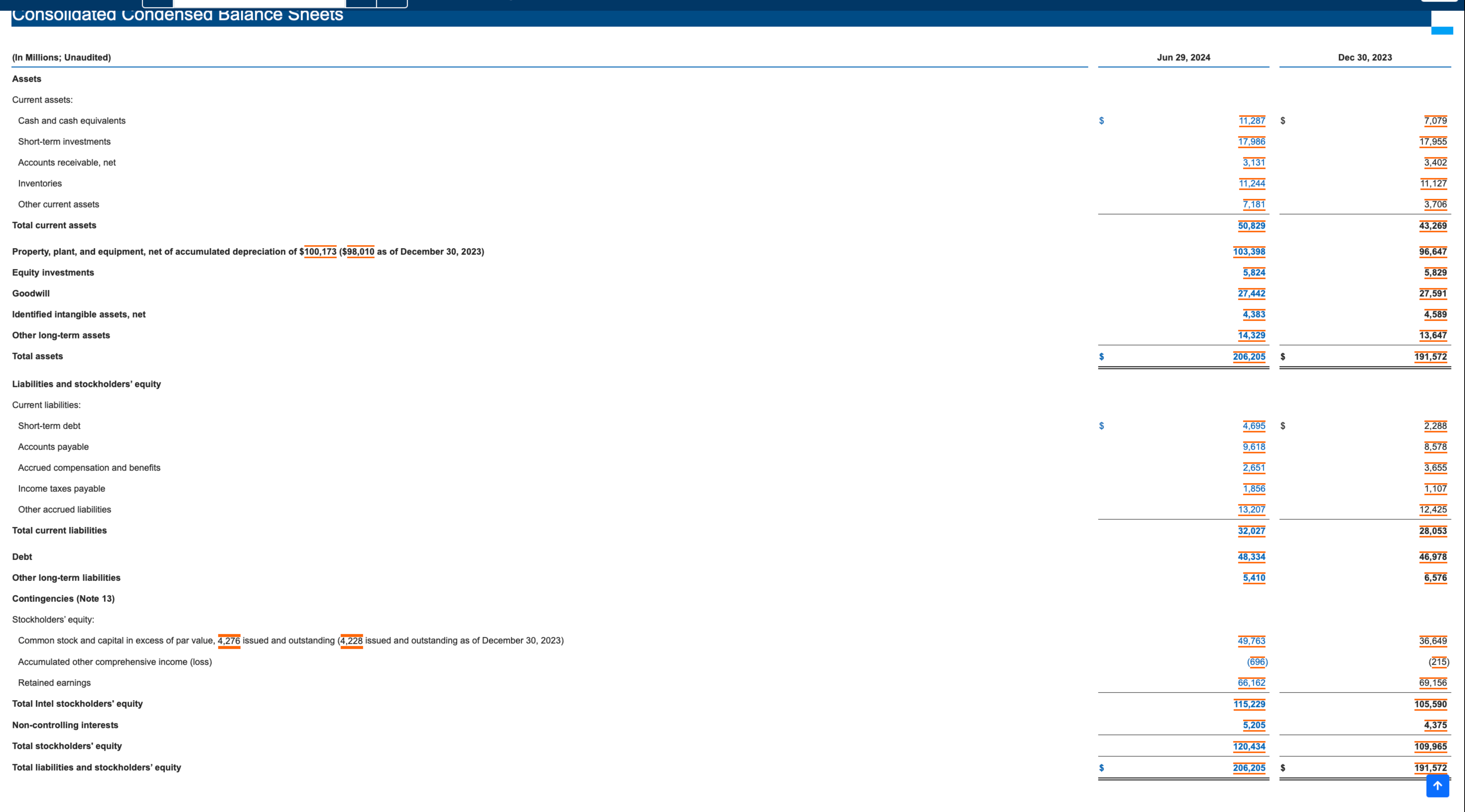

Prepare ratio analyses ( for 2 0 2 3 , and 2 0 2 4 ) for both INTEL and NVIDIA. At least, you should

Prepare ratio analyses for and for both INTEL and NVIDIA. At least, you should include the following ratios in your computations: return on equity return on assets return on financial leverage profit margin gross profit margin expense to sales asset turnover accounts receivable turnover inventory turnover PPE turnover current ratio quick ratio operating cash flow to current liability debt to equity ratio times interest earned measured at the end of the fiscal year end. Contrast these ratios between the two companies and through the period, and explain the differencesimilarity of liquidity, solvency, profitability, asset utilization, and other aspects between the two companies.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started