Question

Prepare Schedules M-1 and K-1 (for Blake Turin only) for tax year 2019. See attached set of facts and tax forms. Please download the tax

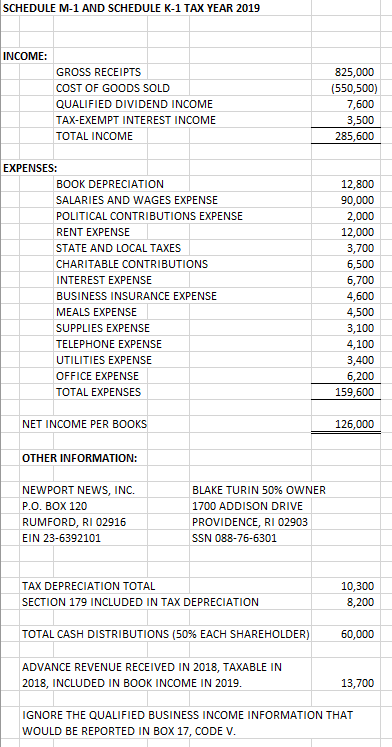

Prepare Schedules M-1 and K-1 (for Blake Turin only) for tax year 2019. See attached set of facts and tax forms. Please download the tax forms, prepare them manually, then scan and submit the assignment in PDF format. Do not use tax software. Be sure to include all names, addresses, etc. If needed, refer to the tax form instructions available at the IRS website in the Tax Research Materials folder. Also, submit your calculations for partial credit.

Hints: There are five book-tax differences. Taxable income (Schedule M-1, line 8) is $115,550. Ordinary income is $122,650.

SCHEDULE M-1 AND SCHEDULE K-1 TAX YEAR 2019 INCOME: GROSS RECEIPTS COST OF GOODS SOLD QUALIFIED DIVIDEND INCOME TAX-EXEMPT INTEREST INCOME TOTAL INCOME 825,000 (550,500) 7,600 3,500 285,600 EXPENSES: BOOK DEPRECIATION SALARIES AND WAGES EXPENSE POLITICAL CONTRIBUTIONS EXPENSE RENT EXPENSE STATE AND LOCAL TAXES CHARITABLE CONTRIBUTIONS INTEREST EXPENSE BUSINESS INSURANCE EXPENSE MEALS EXPENSE SUPPLIES EXPENSE TELEPHONE EXPENSE UTILITIES EXPENSE OFFICE EXPENSE TOTAL EXPENSES 12,800 90,000 2,000 12,000 3,700 6,500 6,700 4,600 4,500 3,100 4,100 3,400 6,200 159,600 NET INCOME PER BOOKS 126,000 OTHER INFORMATION: NEWPORT NEWS, INC. P.O. BOX 120 RUMFORD, RI 02916 EIN 23-6392101 BLAKE TURIN 50% OWNER 1700 ADDISON DRIVE PROVIDENCE, RI 02903 SSN 088-76-6301 TAX DEPRECIATION TOTAL SECTION 179 INCLUDED IN TAX DEPRECIATION 10,300 8,200 TOTAL CASH DISTRIBUTIONS (50% EACH SHAREHOLDER) 60,000 ADVANCE REVENUE RECEIVED IN 2018, TAXABLE IN 2018, INCLUDED IN BOOK INCOME IN 2019. 13,700 IGNORE THE QUALIFIED BUSINESS INCOME INFORMATION THAT WOULD BE REPORTED IN BOX 17, CODE V. SCHEDULE M-1 AND SCHEDULE K-1 TAX YEAR 2019 INCOME: GROSS RECEIPTS COST OF GOODS SOLD QUALIFIED DIVIDEND INCOME TAX-EXEMPT INTEREST INCOME TOTAL INCOME 825,000 (550,500) 7,600 3,500 285,600 EXPENSES: BOOK DEPRECIATION SALARIES AND WAGES EXPENSE POLITICAL CONTRIBUTIONS EXPENSE RENT EXPENSE STATE AND LOCAL TAXES CHARITABLE CONTRIBUTIONS INTEREST EXPENSE BUSINESS INSURANCE EXPENSE MEALS EXPENSE SUPPLIES EXPENSE TELEPHONE EXPENSE UTILITIES EXPENSE OFFICE EXPENSE TOTAL EXPENSES 12,800 90,000 2,000 12,000 3,700 6,500 6,700 4,600 4,500 3,100 4,100 3,400 6,200 159,600 NET INCOME PER BOOKS 126,000 OTHER INFORMATION: NEWPORT NEWS, INC. P.O. BOX 120 RUMFORD, RI 02916 EIN 23-6392101 BLAKE TURIN 50% OWNER 1700 ADDISON DRIVE PROVIDENCE, RI 02903 SSN 088-76-6301 TAX DEPRECIATION TOTAL SECTION 179 INCLUDED IN TAX DEPRECIATION 10,300 8,200 TOTAL CASH DISTRIBUTIONS (50% EACH SHAREHOLDER) 60,000 ADVANCE REVENUE RECEIVED IN 2018, TAXABLE IN 2018, INCLUDED IN BOOK INCOME IN 2019. 13,700 IGNORE THE QUALIFIED BUSINESS INCOME INFORMATION THAT WOULD BE REPORTED IN BOX 17, CODE VStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started