Answered step by step

Verified Expert Solution

Question

1 Approved Answer

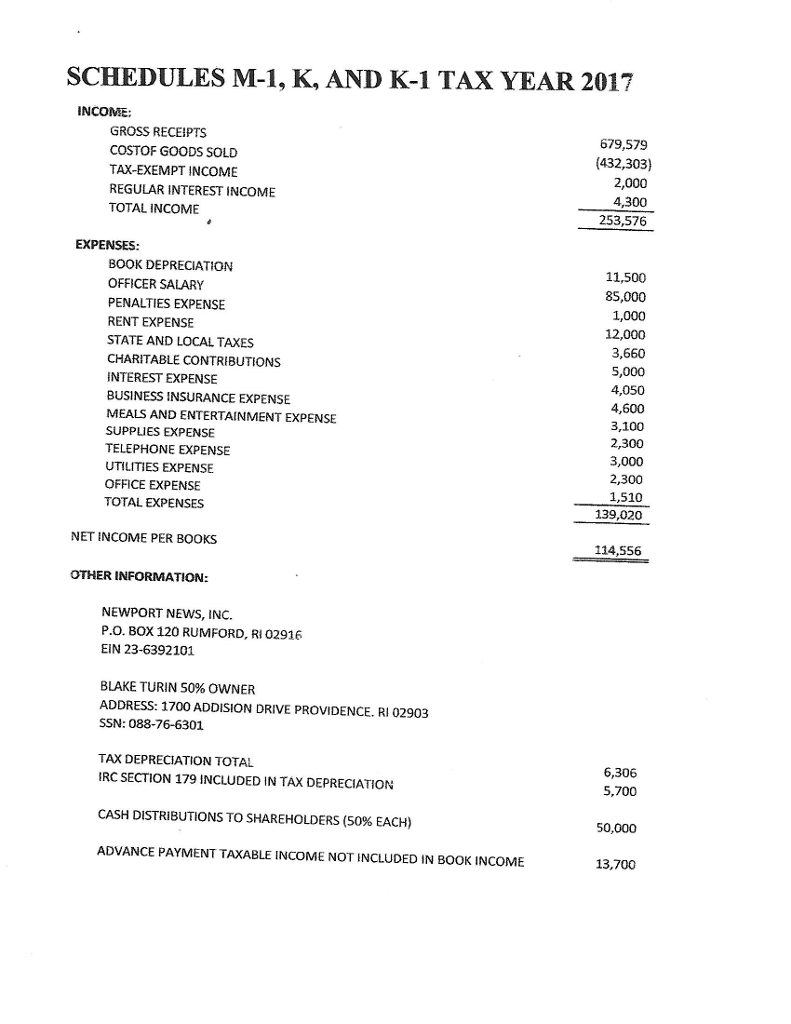

Prepare Schedules M-1, K, and K-1 (for Blake Turin only) for tax year 2017. See attached set of facts and tax forms. If needed, refer

Prepare Schedules M-1, K, and K-1 (for Blake Turin only) for tax year 2017. See attached set of facts and tax forms. If needed, refer to the tax form instructions available at the IRS website in the Research Tax Materials folder. Hint: ordinary income is $140,400. Income reconciliation is $134,000.

Link to forms:

https://www.irs.gov/pub/irs-access/f1120fm1_accessible.pdf (M-1)

https://www.irs.gov/pub/irs-pdf/f1065sk1.pdf (Schedule K-1)

https://www.irs.gov/pub/irs-pdf/f1120s.pdf (Schedule K and L)

Please use forms

SCHEDULES M-1, K, AND K-1 TAX YEAR 2017 INCOME: GROSS RECEIPTS COSTOF GOODS SOLD TAX-EXEMPT INCOME REGULAR INTEREST INCOME TOTAL INCOME 679,579 (432,303) 2,000 4,300 253,576 EXPENSES BOOK DEPRECIATION OFFICER SALARY PENALTIES EXPENSE RENT EXPENSE STATE AND LOCAL TAXES CHARITABLE CONTRIBUTIONS INTEREST EXPENSE BUSINESS INSURANCE EXPENSE MEALS AND ENTERTAINMENT EXPENSE SUPPLIES EXPENSE TELEPHONE EXPENSE UTILITIES EXPENSE OFFICE EXPENSE TOTAL EXPENSES 11,500 85,000 1,000 12,000 3,660 5,000 4,050 4,600 3,100 2,300 3,000 2,300 1,510 139,020 NET INCOME PER BOOKS 114,556 OTHER INFORMATION: NEWPORT NEWS, INC. P.O. BOX 120 RUMFORD, RI 02916 EIN 23-6392101 BLAKE TURIN 50% OWNER ADDRESS: 1700 ADDISION DRIVE PROVIDENCE. RI 0290:3 SSN: 088-76-6301 TAX DEPRECIATION TOTAL 6,306 IRC SECTION 179 INCLUDED IN TAX DEPRECIATION CASH DISTRIBUTIONS TO SHAREHOLDERS (50% EACH) ADVANCE PAYMENT TAXABLE INCOME NOT INCLUDED IN BOOK INCOME 5,700 50,000 13,700 SCHEDULES M-1, K, AND K-1 TAX YEAR 2017 INCOME: GROSS RECEIPTS COSTOF GOODS SOLD TAX-EXEMPT INCOME REGULAR INTEREST INCOME TOTAL INCOME 679,579 (432,303) 2,000 4,300 253,576 EXPENSES BOOK DEPRECIATION OFFICER SALARY PENALTIES EXPENSE RENT EXPENSE STATE AND LOCAL TAXES CHARITABLE CONTRIBUTIONS INTEREST EXPENSE BUSINESS INSURANCE EXPENSE MEALS AND ENTERTAINMENT EXPENSE SUPPLIES EXPENSE TELEPHONE EXPENSE UTILITIES EXPENSE OFFICE EXPENSE TOTAL EXPENSES 11,500 85,000 1,000 12,000 3,660 5,000 4,050 4,600 3,100 2,300 3,000 2,300 1,510 139,020 NET INCOME PER BOOKS 114,556 OTHER INFORMATION: NEWPORT NEWS, INC. P.O. BOX 120 RUMFORD, RI 02916 EIN 23-6392101 BLAKE TURIN 50% OWNER ADDRESS: 1700 ADDISION DRIVE PROVIDENCE. RI 0290:3 SSN: 088-76-6301 TAX DEPRECIATION TOTAL 6,306 IRC SECTION 179 INCLUDED IN TAX DEPRECIATION CASH DISTRIBUTIONS TO SHAREHOLDERS (50% EACH) ADVANCE PAYMENT TAXABLE INCOME NOT INCLUDED IN BOOK INCOME 5,700 50,000 13,700Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started