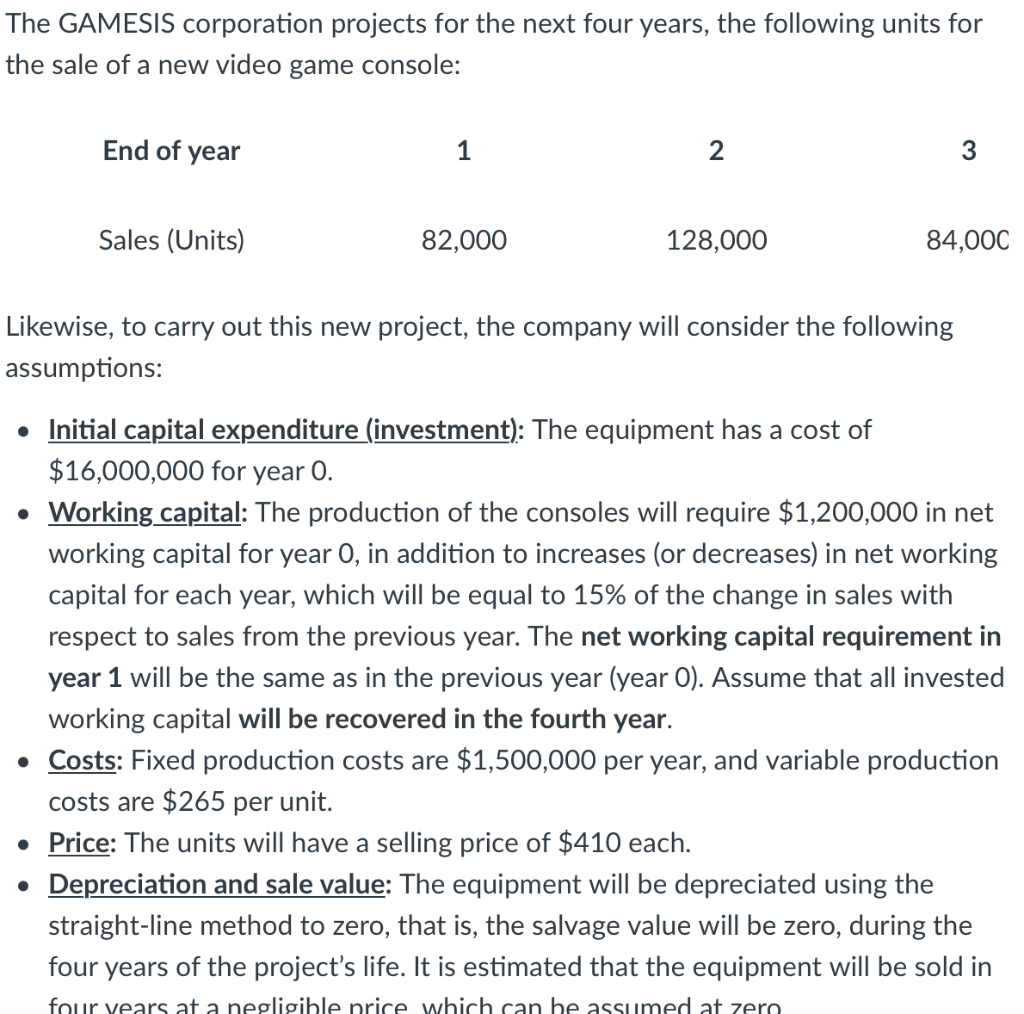

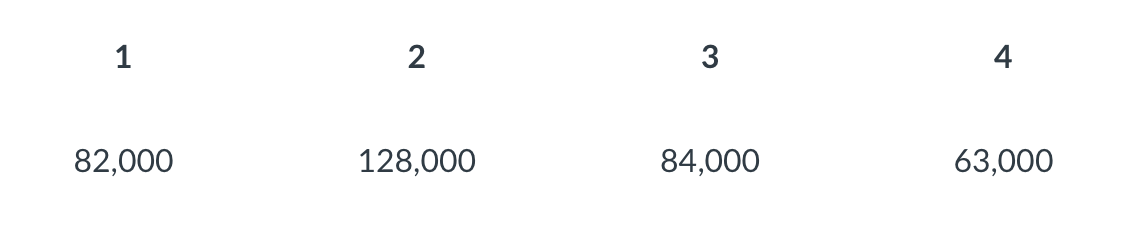

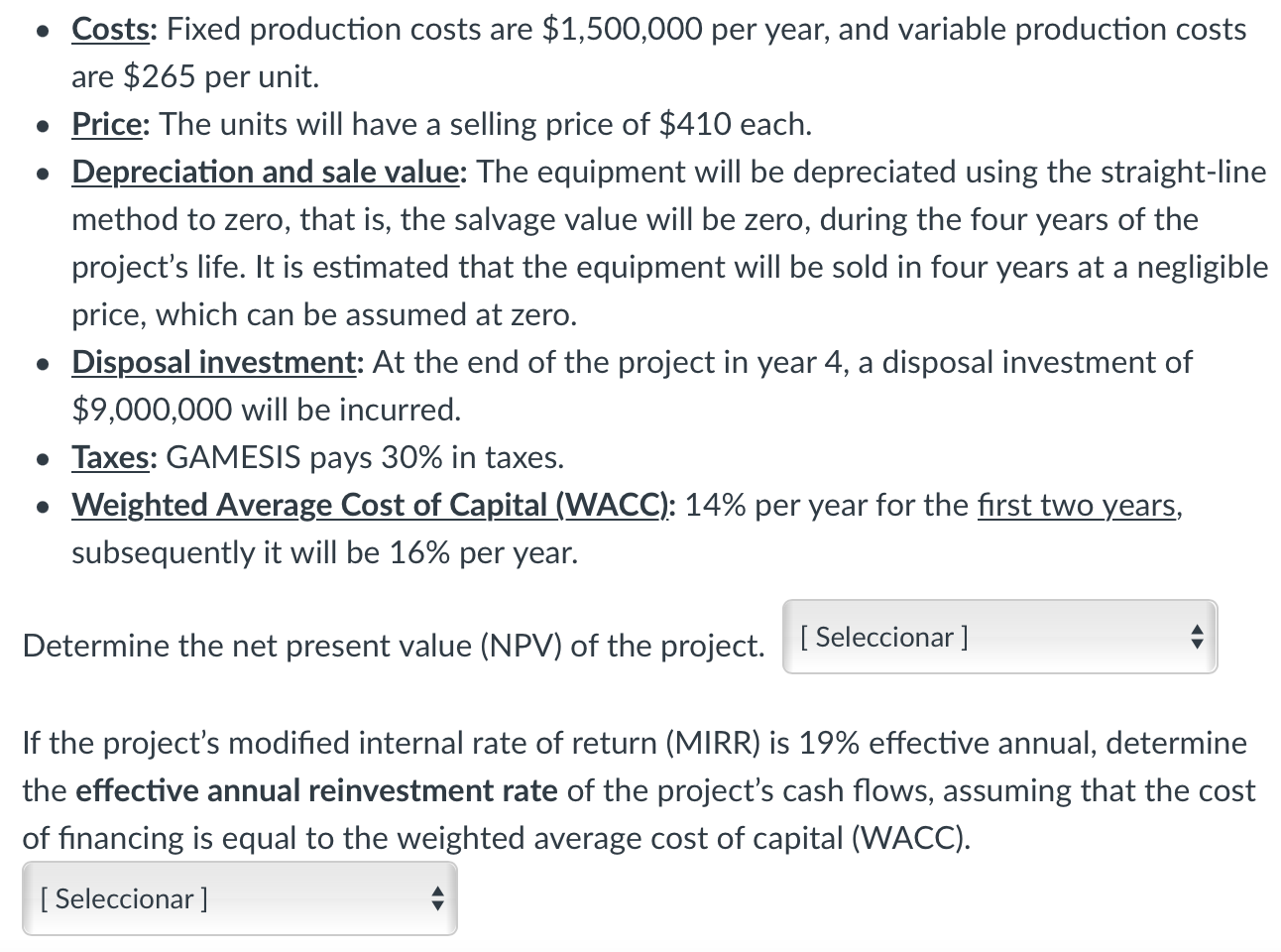

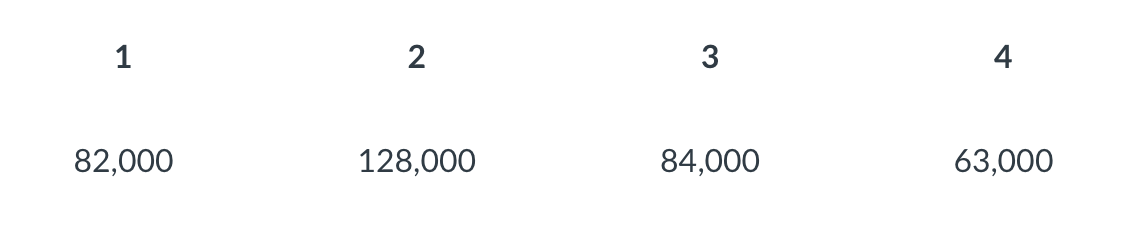

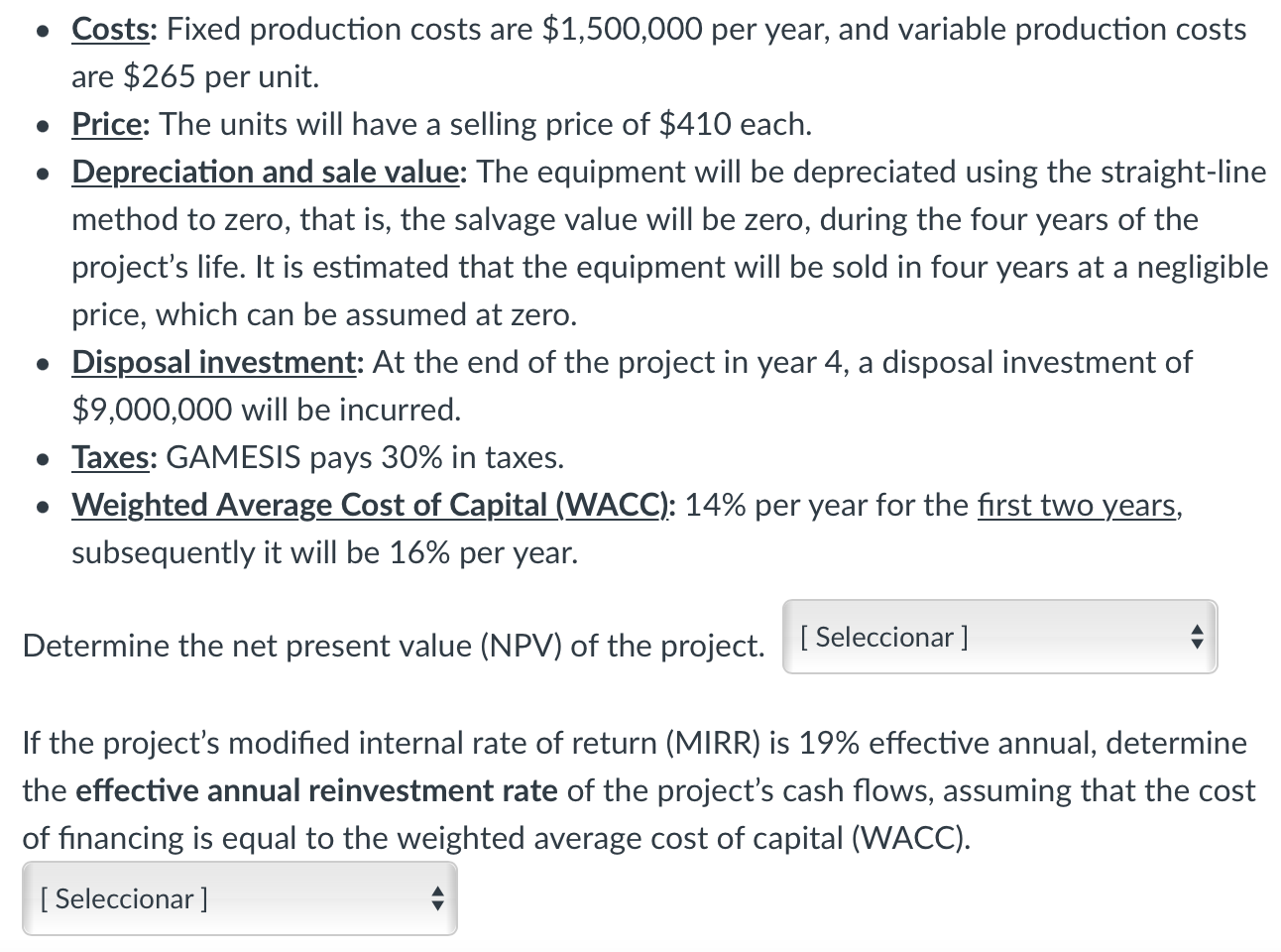

The GAMESIS corporation projects for the next four years, the following units for the sale of a new video game console: End of year 1 2 3 Sales (Units) 82,000 128,000 84,000 Likewise, to carry out this new project, the company will consider the following assumptions: Initial capital expenditure (investment): The equipment has a cost of $16,000,000 for year 0. Working capital: The production of the consoles will require $1,200,000 in net working capital for year 0, in addition to increases (or decreases) in net working capital for each year, which will be equal to 15% of the change in sales with respect to sales from the previous year. The net working capital requirement in year 1 will be the same as in the previous year (year O). Assume that all invested working capital will be recovered in the fourth year. Costs: Fixed production costs are $1,500,000 per year, and variable production costs are $265 per unit. Price: The units will have a selling price of $410 each. Depreciation and sale value: The equipment will be depreciated using the straight-line method to zero, that is, the salvage value will be zero, during the four years of the project's life. It is estimated that the equipment will be sold in a four vears at a negligible price which can be assumed at zero 1 2 3 82,000 128,000 84,000 63,000 O Costs: Fixed production costs are $1,500,000 per year, and variable production costs are $265 per unit. Price: The units will have a selling price of $410 each. Depreciation and sale value: The equipment will be depreciated using the straight-line method to zero, that is, the salvage value will be zero, during the four years of the project's life. It is estimated that the equipment will be sold in four years at a negligible price, which can be assumed at zero. Disposal investment: At the end of the project in year 4, a disposal investment of $9,000,000 will be incurred. Taxes: GAMESIS pays 30% in taxes. Weighted Average Cost of Capital ( WACC): 14% per year for the first two years, subsequently it will be 16% per year. . Determine the net present value (NPV) of the project. [Seleccionar ] If the project's modified internal rate of return (MIRR) is 19% effective annual, determine the effective annual reinvestment rate of the project's cash flows, assuming that the cost of financing is equal to the weighted average cost of capital (WACC). [ Seleccionar ] A The GAMESIS corporation projects for the next four years, the following units for the sale of a new video game console: End of year 1 2 3 Sales (Units) 82,000 128,000 84,000 Likewise, to carry out this new project, the company will consider the following assumptions: Initial capital expenditure (investment): The equipment has a cost of $16,000,000 for year 0. Working capital: The production of the consoles will require $1,200,000 in net working capital for year 0, in addition to increases (or decreases) in net working capital for each year, which will be equal to 15% of the change in sales with respect to sales from the previous year. The net working capital requirement in year 1 will be the same as in the previous year (year O). Assume that all invested working capital will be recovered in the fourth year. Costs: Fixed production costs are $1,500,000 per year, and variable production costs are $265 per unit. Price: The units will have a selling price of $410 each. Depreciation and sale value: The equipment will be depreciated using the straight-line method to zero, that is, the salvage value will be zero, during the four years of the project's life. It is estimated that the equipment will be sold in a four vears at a negligible price which can be assumed at zero 1 2 3 82,000 128,000 84,000 63,000 O Costs: Fixed production costs are $1,500,000 per year, and variable production costs are $265 per unit. Price: The units will have a selling price of $410 each. Depreciation and sale value: The equipment will be depreciated using the straight-line method to zero, that is, the salvage value will be zero, during the four years of the project's life. It is estimated that the equipment will be sold in four years at a negligible price, which can be assumed at zero. Disposal investment: At the end of the project in year 4, a disposal investment of $9,000,000 will be incurred. Taxes: GAMESIS pays 30% in taxes. Weighted Average Cost of Capital ( WACC): 14% per year for the first two years, subsequently it will be 16% per year. . Determine the net present value (NPV) of the project. [Seleccionar ] If the project's modified internal rate of return (MIRR) is 19% effective annual, determine the effective annual reinvestment rate of the project's cash flows, assuming that the cost of financing is equal to the weighted average cost of capital (WACC). [ Seleccionar ] A