Prepare schedules showing the individual components and final balances for the following: (be sure to clearly present and label all supporting computations)

H) Interest Expense for the year ended 12/31/X2

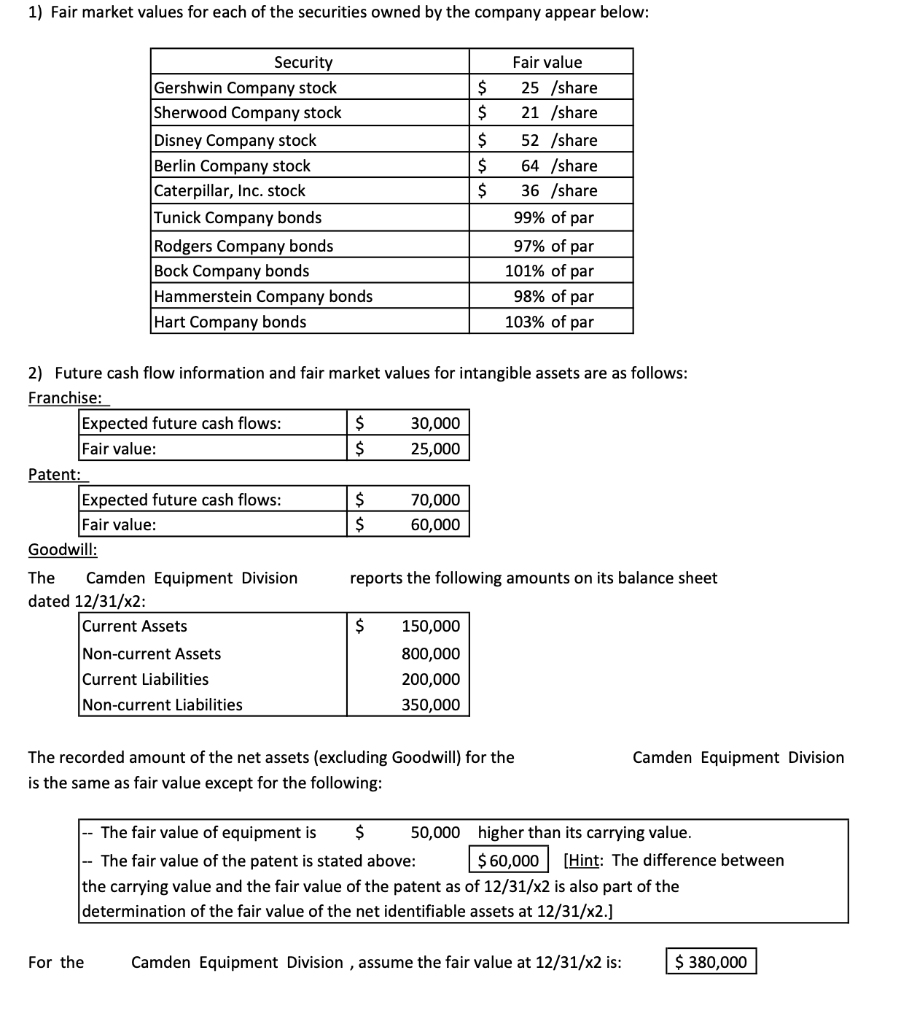

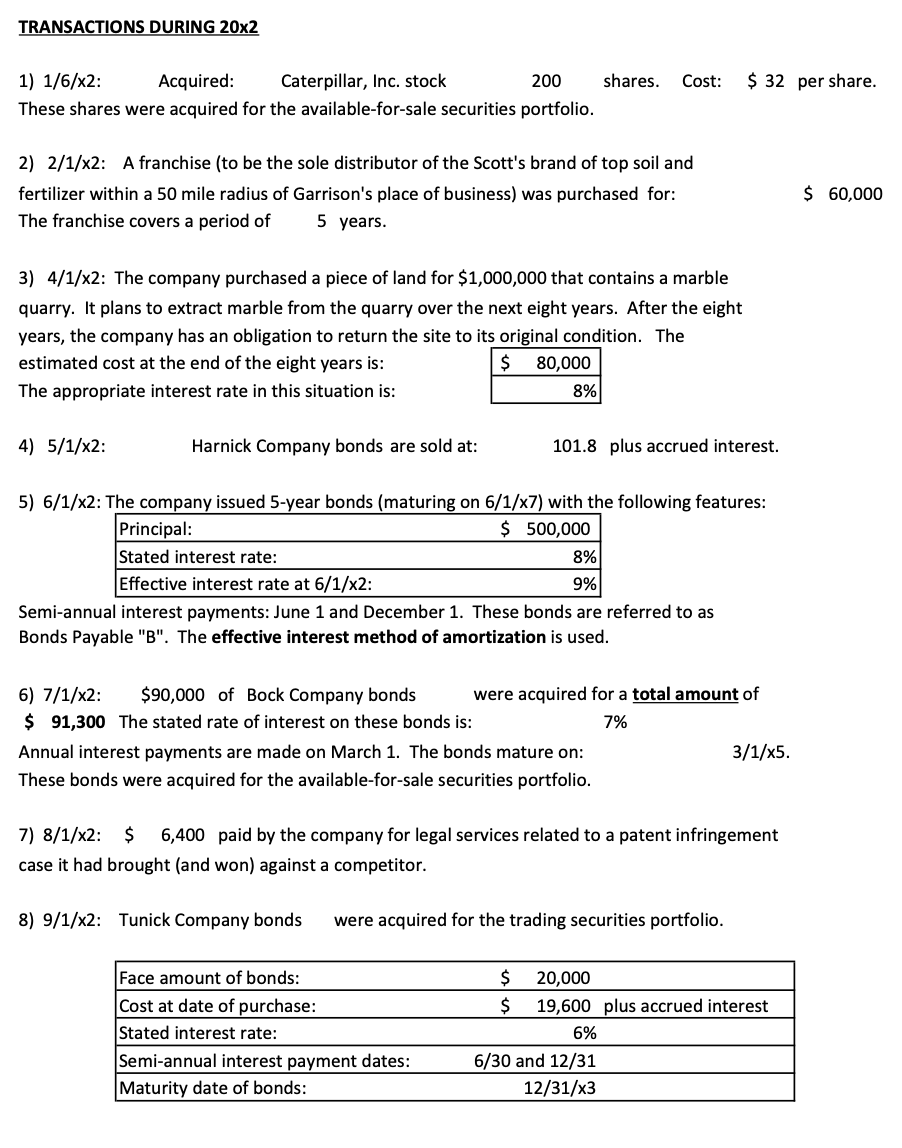

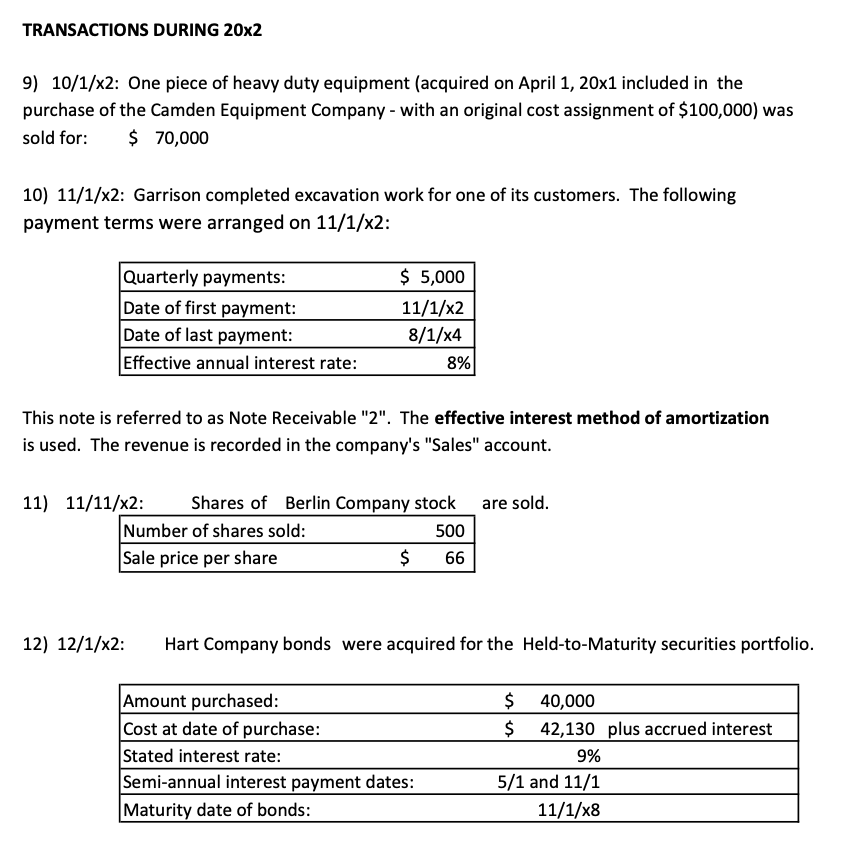

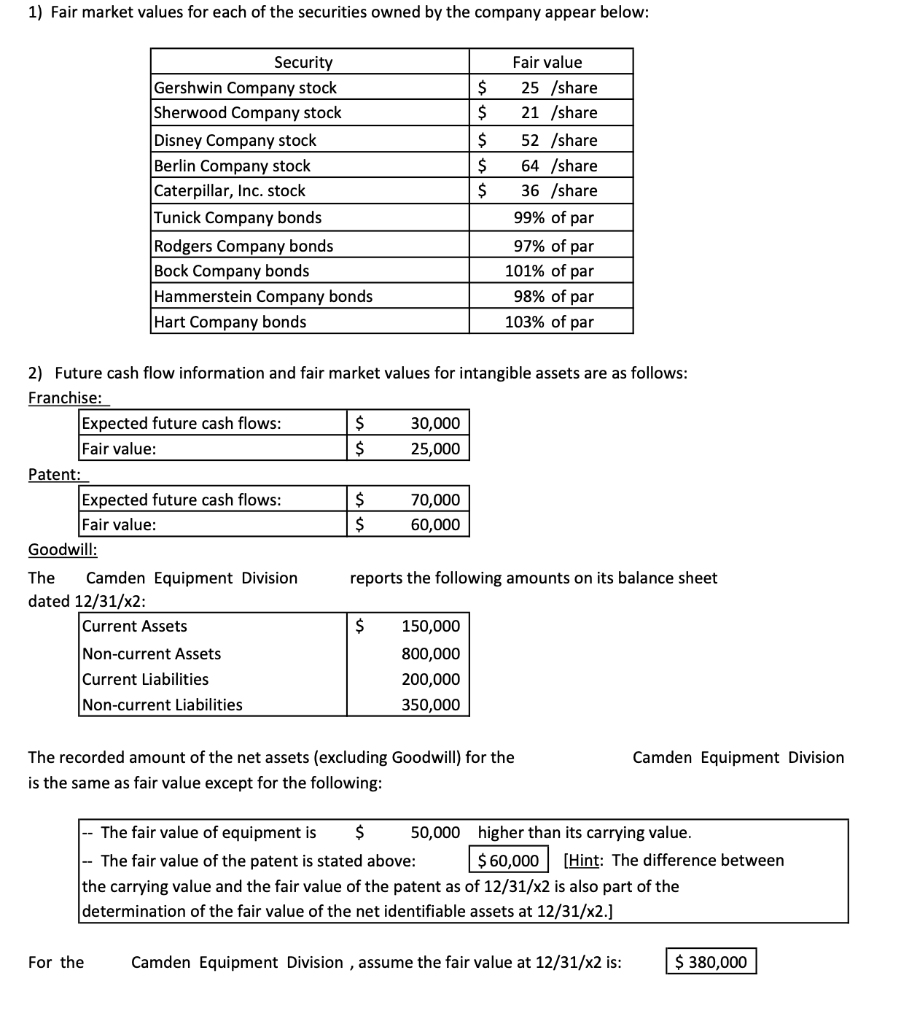

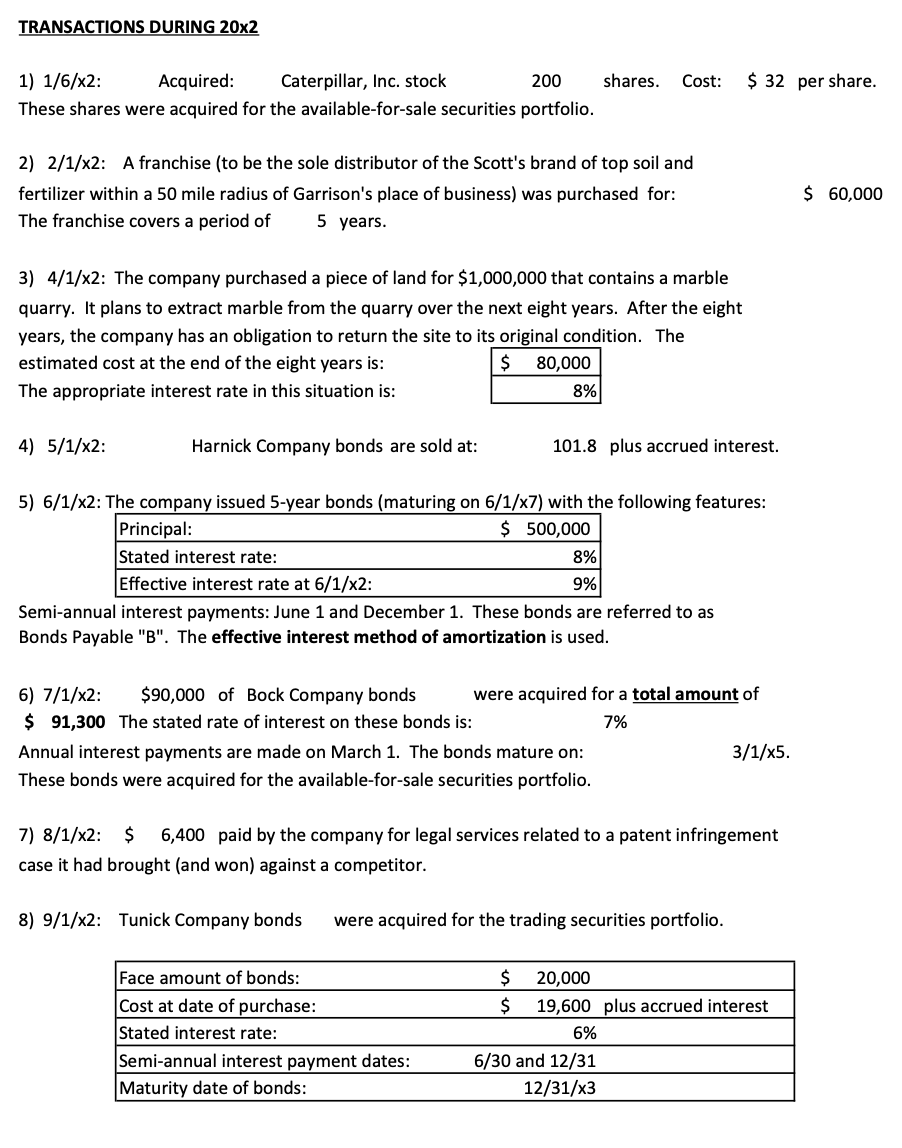

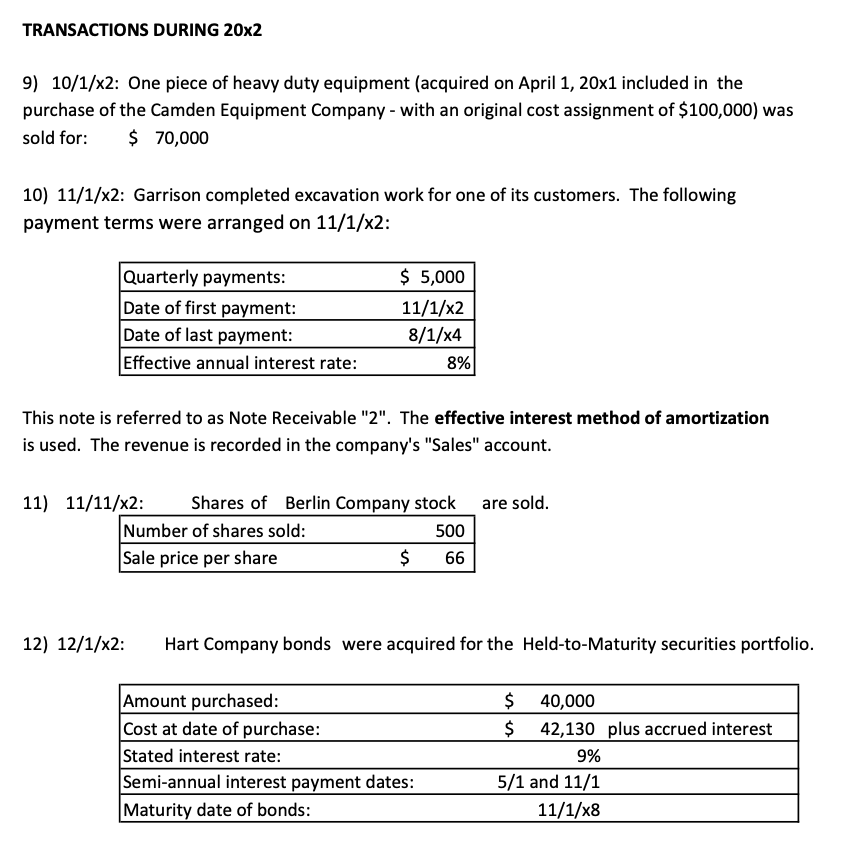

1) Fair market values for each of the securities owned by the company appear below: $ $ $ Security Gershwin Company stock Sherwood Company stock Disney Company stock Berlin Company stock Caterpillar, Inc. stock Tunick Company bonds Rodgers Company bonds Bock Company bonds Hammerstein Company bonds Hart Company bonds $ $ Fair value 25 /share 21 /share 52 /share 64 /share 36 /share 99% of par 97% of par 101% of par 98% of par 103% of par 2) Future cash flow information and fair market values for intangible assets are as follows: Franchise: Expected future cash flows: $ 30,000 Fair value: $ 25,000 Patent: Expected future cash flows: $ 70,000 Fair value: $ 60,000 Goodwill: The Camden Equipment Division reports the following amounts on its balance sheet dated 12/31/X2: Current Assets $ 150,000 Non-current Assets 800,000 Current Liabilities 200,000 Non-current Liabilities 350,000 Camden Equipment Division The recorded amount of the net assets (excluding Goodwill) for the is the same as fair value except for the following: The fair value of equipment is $ 50,000 higher than its carrying value. -- The fair value of the patent is stated above: $ 60,000 (Hint: The difference between the carrying value and the fair value of the patent as of 12/31/X2 is also part of the determination of the fair value of the net identifiable assets at 12/31/x2.] For the Camden Equipment Division , assume the fair value at 12/31/X2 is: $ 380,000 TRANSACTIONS DURING 20x2 shares. Cost: $ 32 per share. 1) 1/6/x2: Acquired: Caterpillar, Inc. stock 200 These shares were acquired for the available-for-sale securities portfolio. 2) 2/1/X2: A franchise (to be the sole distributor of the Scott's brand of top soil and fertilizer within a 50 mile radius of Garrison's place of business) was purchased for: The franchise covers a period of $ 60,000 5 years. 3) 4/1/X2: The company purchased a piece of land for $1,000,000 that contains a marble quarry. It plans to extract marble from the quarry over the next eight years. After the eight years, the company has an obligation to return the site to its original condition. The estimated cost at the end of the eight years is: $ 80,000 The appropriate interest rate in this situation is: 8% 4) 5/1/X2: Harnick Company bonds are sold at: 101.8 plus accrued interest. 5) 6/1/X2: The company issued 5-year bonds (maturing on 6/1/x7) with the following features: Principal: $ 500,000 Stated interest rate: 8% Effective interest rate at 6/1/X2: 9% Semi-annual interest payments: June 1 and December 1. These bonds are referred to as Bonds Payable "B". The effective interest method of amortization is used. 6) 7/1/X2: $90,000 of Bock Company bonds were acquired for a total amount of $ 91,300 The stated rate of interest on these bonds is: 7% Annual interest payments are made on March 1. The bonds mature on: 3/1/x5. These bonds were acquired for the available-for-sale securities portfolio. 7) 8/1/X2: $ 6,400 paid by the company for legal services related to a patent infringement case it had brought (and won) against a competitor. 8) 9/1/X2: Tunick Company bonds were acquired for the trading securities portfolio. Face amount of bonds: Cost at date of purchase: Stated interest rate: Semi-annual interest payment dates: Maturity date of bonds: $ 20,000 $ 19,600 plus accrued interest 6% 6/30 and 12/31 12/31/3 TRANSACTIONS DURING 20x2 9) 10/1/x2: One piece of heavy duty equipment (acquired on April 1, 20x1 included in the purchase of the Camden Equipment Company - with an original cost assignment of $100,000) was sold for: $ 70,000 10) 11/1/x2: Garrison completed excavation work for one of its customers. The following payment terms were arranged on 11/1/X2: Quarterly payments: Date of first payment: Date of last payment: Effective annual interest rate: $ 5,000 11/1/X2 8/1/x4 8% This note is referred to as Note Receivable "2". The effective interest method of amortization is used. The revenue is recorded in the company's "Sales" account. 11) 11/11/x2: Shares of Berlin Company stock are sold. Number of shares sold: 500 Sale price per share $ 66 12) 12/1/X2: Hart Company bonds were acquired for the Held-to-Maturity securities portfolio. Amount purchased: Cost at date of purchase: Stated interest rate: Semi-annual interest payment dates: Maturity date of bonds: $ 40,000 $ 42,130 plus accrued interest 9% 5/1 and 11/1 11/1/x8 1) Fair market values for each of the securities owned by the company appear below: $ $ $ Security Gershwin Company stock Sherwood Company stock Disney Company stock Berlin Company stock Caterpillar, Inc. stock Tunick Company bonds Rodgers Company bonds Bock Company bonds Hammerstein Company bonds Hart Company bonds $ $ Fair value 25 /share 21 /share 52 /share 64 /share 36 /share 99% of par 97% of par 101% of par 98% of par 103% of par 2) Future cash flow information and fair market values for intangible assets are as follows: Franchise: Expected future cash flows: $ 30,000 Fair value: $ 25,000 Patent: Expected future cash flows: $ 70,000 Fair value: $ 60,000 Goodwill: The Camden Equipment Division reports the following amounts on its balance sheet dated 12/31/X2: Current Assets $ 150,000 Non-current Assets 800,000 Current Liabilities 200,000 Non-current Liabilities 350,000 Camden Equipment Division The recorded amount of the net assets (excluding Goodwill) for the is the same as fair value except for the following: The fair value of equipment is $ 50,000 higher than its carrying value. -- The fair value of the patent is stated above: $ 60,000 (Hint: The difference between the carrying value and the fair value of the patent as of 12/31/X2 is also part of the determination of the fair value of the net identifiable assets at 12/31/x2.] For the Camden Equipment Division , assume the fair value at 12/31/X2 is: $ 380,000 TRANSACTIONS DURING 20x2 shares. Cost: $ 32 per share. 1) 1/6/x2: Acquired: Caterpillar, Inc. stock 200 These shares were acquired for the available-for-sale securities portfolio. 2) 2/1/X2: A franchise (to be the sole distributor of the Scott's brand of top soil and fertilizer within a 50 mile radius of Garrison's place of business) was purchased for: The franchise covers a period of $ 60,000 5 years. 3) 4/1/X2: The company purchased a piece of land for $1,000,000 that contains a marble quarry. It plans to extract marble from the quarry over the next eight years. After the eight years, the company has an obligation to return the site to its original condition. The estimated cost at the end of the eight years is: $ 80,000 The appropriate interest rate in this situation is: 8% 4) 5/1/X2: Harnick Company bonds are sold at: 101.8 plus accrued interest. 5) 6/1/X2: The company issued 5-year bonds (maturing on 6/1/x7) with the following features: Principal: $ 500,000 Stated interest rate: 8% Effective interest rate at 6/1/X2: 9% Semi-annual interest payments: June 1 and December 1. These bonds are referred to as Bonds Payable "B". The effective interest method of amortization is used. 6) 7/1/X2: $90,000 of Bock Company bonds were acquired for a total amount of $ 91,300 The stated rate of interest on these bonds is: 7% Annual interest payments are made on March 1. The bonds mature on: 3/1/x5. These bonds were acquired for the available-for-sale securities portfolio. 7) 8/1/X2: $ 6,400 paid by the company for legal services related to a patent infringement case it had brought (and won) against a competitor. 8) 9/1/X2: Tunick Company bonds were acquired for the trading securities portfolio. Face amount of bonds: Cost at date of purchase: Stated interest rate: Semi-annual interest payment dates: Maturity date of bonds: $ 20,000 $ 19,600 plus accrued interest 6% 6/30 and 12/31 12/31/3 TRANSACTIONS DURING 20x2 9) 10/1/x2: One piece of heavy duty equipment (acquired on April 1, 20x1 included in the purchase of the Camden Equipment Company - with an original cost assignment of $100,000) was sold for: $ 70,000 10) 11/1/x2: Garrison completed excavation work for one of its customers. The following payment terms were arranged on 11/1/X2: Quarterly payments: Date of first payment: Date of last payment: Effective annual interest rate: $ 5,000 11/1/X2 8/1/x4 8% This note is referred to as Note Receivable "2". The effective interest method of amortization is used. The revenue is recorded in the company's "Sales" account. 11) 11/11/x2: Shares of Berlin Company stock are sold. Number of shares sold: 500 Sale price per share $ 66 12) 12/1/X2: Hart Company bonds were acquired for the Held-to-Maturity securities portfolio. Amount purchased: Cost at date of purchase: Stated interest rate: Semi-annual interest payment dates: Maturity date of bonds: $ 40,000 $ 42,130 plus accrued interest 9% 5/1 and 11/1 11/1/x8