Question

Prepare schedules showing the individual components and final balances for the following: (be sure to clearly present and label all supporting computations): b- Interest Receivable

Prepare schedules showing the individual components and final balances for the following:

(be sure to clearly present and label all supporting computations):

b- Interest Receivable on 12/31/x2.

d- The balance sheet presentation of each securities portfolio on 12/31/x2.

-

Trading securities portfolio

-

Availableforsale securities portfolio

3. Heldtomaturity securities portfolio

f- Interest Revenue for the year ended 12/31/X2

h- Interest Expense for the year ended 12/31/x2

I-Depreciation Expense for the year ended 12/31/x2

j- Amortization Expense for Intangible Assets for the year ended 12/31/x2

k- Computation of impairment losses on intangible assets (if any) for the year ended 12/31/x2

I- The balances sheet presentation for each of the following accounts on 12/31/X2

1- Note Receivable "2"

2- Note Payable "A"

3- Bond Payable " A"

4- Bond Payable "B"

5- Heavy Duty Equipment

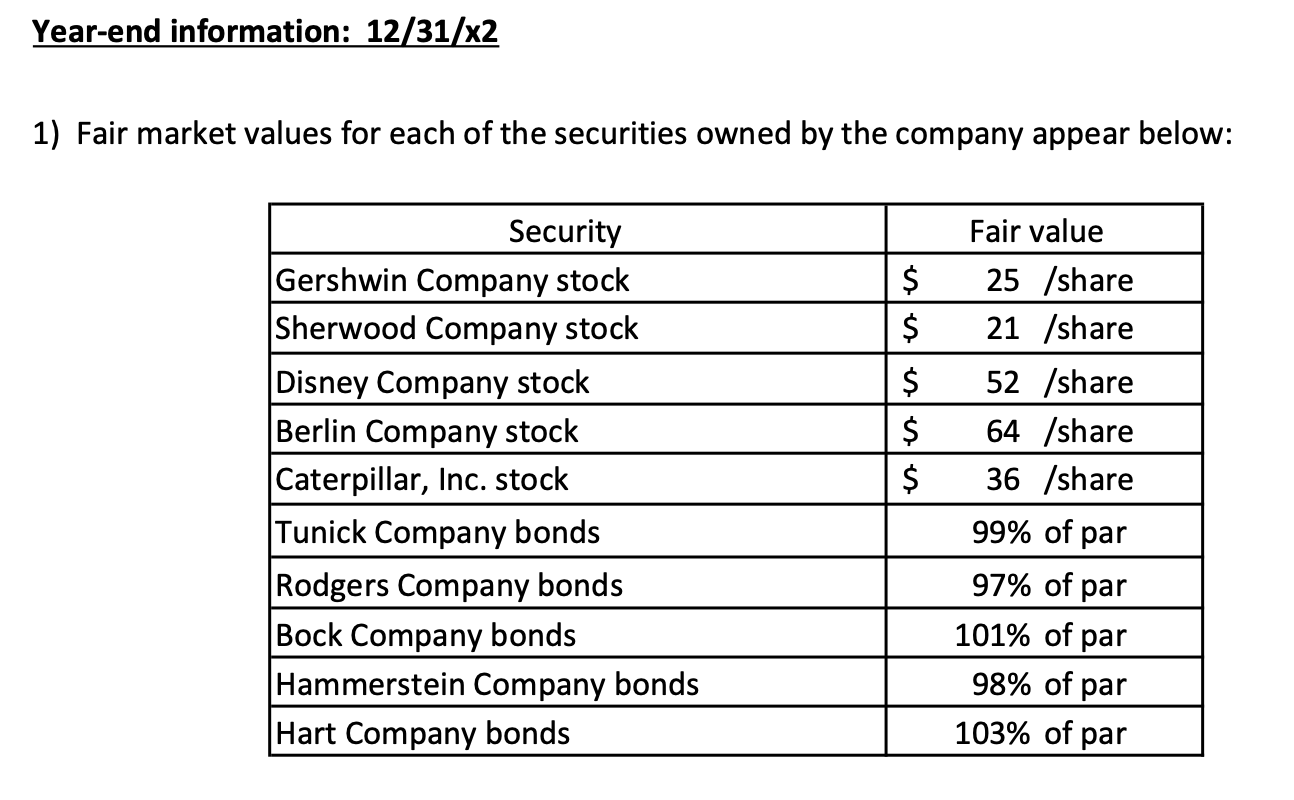

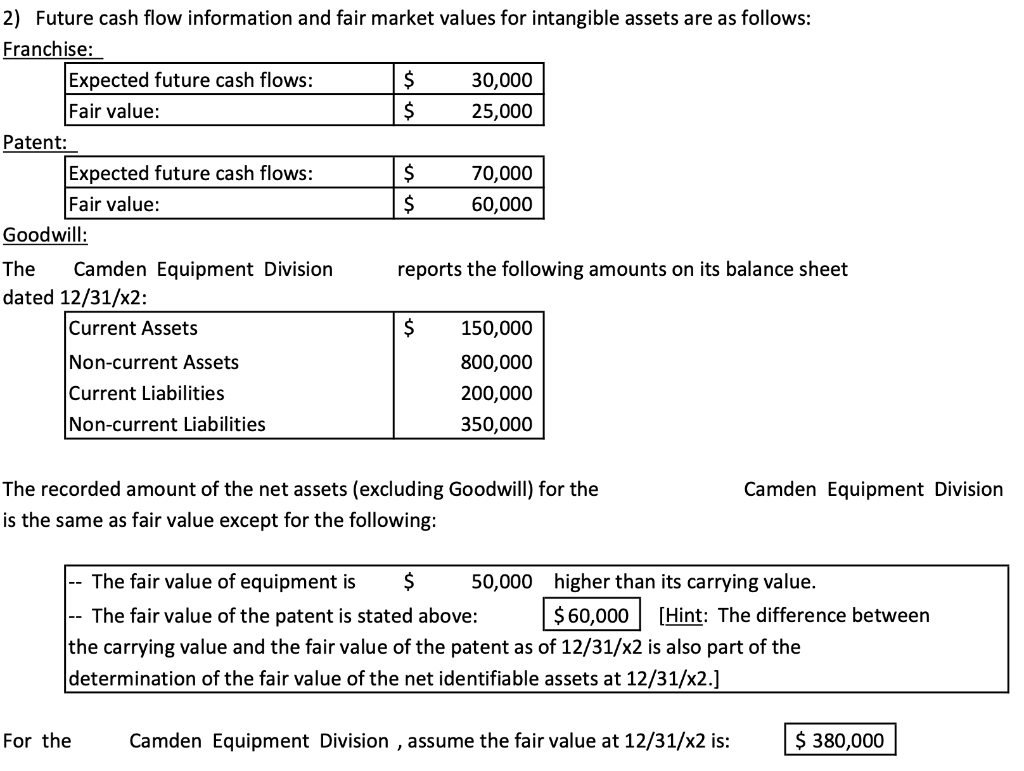

Year-end information: 12/31/x2 1) Fair market values for each of the securities owned by the company appear below: Security Gershwin Company stock Sherwood Company stock Disney Company stock Berlin Company stock Caterpillar, Inc. stock Tunick Company bonds Rodgers Company bonds Bock Company bonds Hammerstein Company bonds Hart Company bonds $ $ $ $ $ Fair value 25 /share 21 /share 52 /share 64 /share 36 /share 99% of par 97% of par 101% of par 98% of par 103% of par 2) Future cash flow information and fair market values for intangible assets are as follows: Franchise: Expected future cash flows: $ 30,000 Fair value: $ 25,000 Patent: Expected future cash flows: $ 70,000 Fair value: $ 60,000 Goodwill: The Camden Equipment Division reports the following amounts on its balance sheet dated 12/31/x2: Current Assets $ 150,000 Non-current Assets 800,000 Current Liabilities 200,000 Non-current Liabilities 350,000 Camden Equipment Division The recorded amount of the net assets (excluding Goodwill) for the is the same as fair value except for the following: The fair value of equipment is $ 50,000 higher than its carrying value. The fair value of the patent is stated above: $ 60,000 (Hint: The difference between the carrying value and the fair value of the patent as of 12/31/X2 is also part of the determination of the fair value of the net identifiable assets at 12/31/x2.] For the Camden Equipment Division , assume the fair value at 12/31/X2 is: $ 380,000 Year-end information: 12/31/x2 1) Fair market values for each of the securities owned by the company appear below: Security Gershwin Company stock Sherwood Company stock Disney Company stock Berlin Company stock Caterpillar, Inc. stock Tunick Company bonds Rodgers Company bonds Bock Company bonds Hammerstein Company bonds Hart Company bonds $ $ $ $ $ Fair value 25 /share 21 /share 52 /share 64 /share 36 /share 99% of par 97% of par 101% of par 98% of par 103% of par 2) Future cash flow information and fair market values for intangible assets are as follows: Franchise: Expected future cash flows: $ 30,000 Fair value: $ 25,000 Patent: Expected future cash flows: $ 70,000 Fair value: $ 60,000 Goodwill: The Camden Equipment Division reports the following amounts on its balance sheet dated 12/31/x2: Current Assets $ 150,000 Non-current Assets 800,000 Current Liabilities 200,000 Non-current Liabilities 350,000 Camden Equipment Division The recorded amount of the net assets (excluding Goodwill) for the is the same as fair value except for the following: The fair value of equipment is $ 50,000 higher than its carrying value. The fair value of the patent is stated above: $ 60,000 (Hint: The difference between the carrying value and the fair value of the patent as of 12/31/X2 is also part of the determination of the fair value of the net identifiable assets at 12/31/x2.] For the Camden Equipment Division , assume the fair value at 12/31/X2 is: $ 380,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started