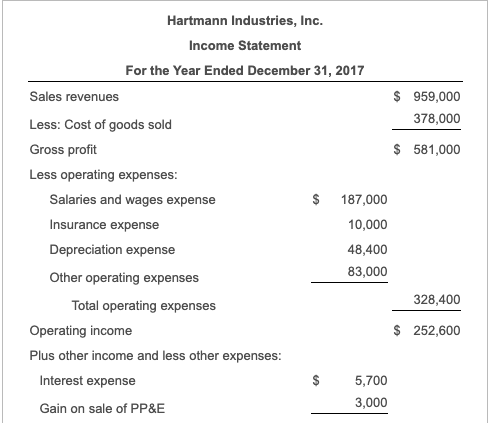

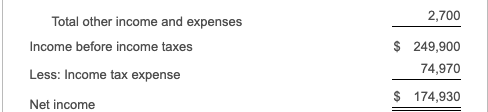

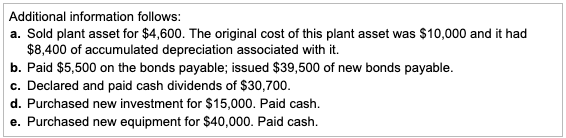

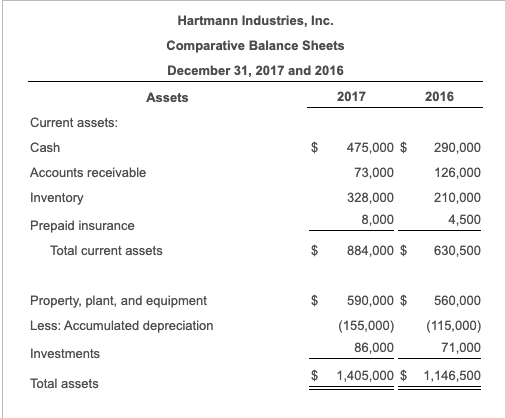

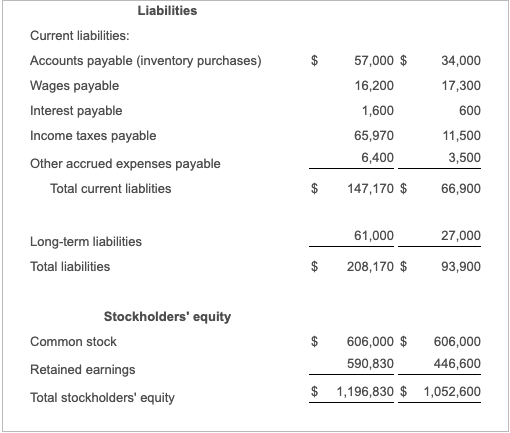

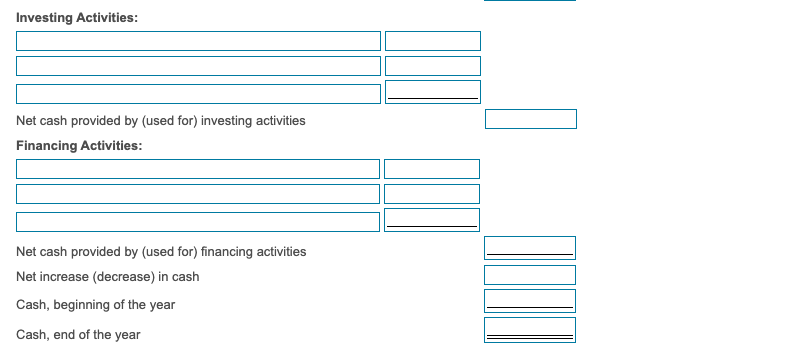

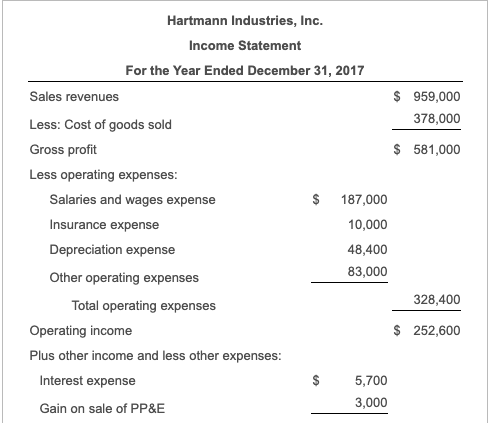

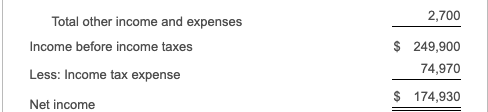

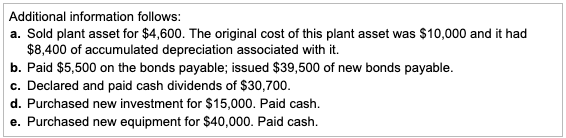

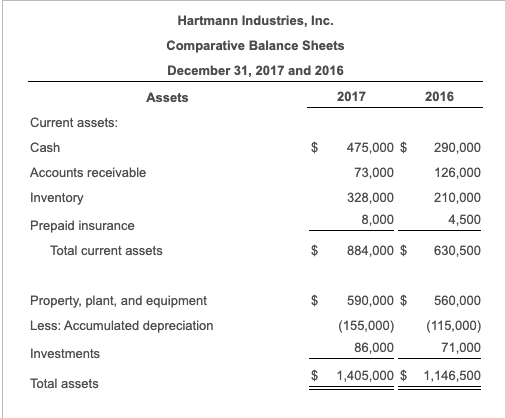

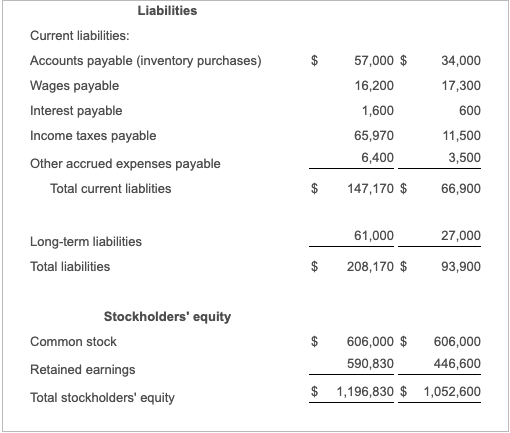

Prepare statement of cash flows using the indirect method. The income statement for 2017 and the balance sheets for 2017 and 2016 are presented for Hartmann Industries, Inc. (Click the icon to view the income statement.) (Click the icon to view the balance sheets.) (Click the icon to view additional information.) Requirement Prepare a statement of cash flows for Hartmann Industries, Inc., for the year ended December 31, 2017, using the indirect method. Hartmann Industries, Inc. Statement of Cash Flows (Indirect Method) For the Year Ended December 31, 2017 Operating Activities: Adjustments to reconcile net income to cash basis: Adjustments to reconcile net income to cash basis: Net cash provided by (used for) operating activities Investing Activities: Investing Activities: Net cash provided by used for) investing activities Financing Activities: Net cash provided by (used for) financing activities Net increase (decrease) in cash Cash, beginning of the year Cash, end of the year MIUI Hartmann Industries, Inc. Income Statement For the Year Ended December 31, 2017 Sales revenues $ 959,000 Less: Cost of goods sold 378,000 Gross profit $ 581,000 Less operating expenses: Salaries and wages expense $ 187,000 Insurance expense 10,000 Depreciation expense 48,400 83,000 Other operating expenses 328,400 Total operating expenses Operating income $ 252,600 Plus other income and less other expenses: Interest expense 5,700 3,000 Gain on sale of PP&E $ 2,700 Total other income and expenses Income before income taxes $ 249,900 74,970 Less: Income tax expense $ 174,930 Net income Additional information follows: a. Sold plant asset for $4,600. The original cost of this plant asset was $10,000 and it had $8,400 of accumulated depreciation associated with it. b. Paid $5,500 on the bonds payable; issued $39,500 of new bonds payable. c. Declared and paid cash dividends of $30,700. d. Purchased new investment for $15,000. Paid cash. e. Purchased new equipment for $40,000. Paid cash. 2016 Hartmann Industries, Inc. Comparative Balance Sheets December 31, 2017 and 2016 Assets 2017 Current assets: Cash 475,000 $ Accounts receivable 73,000 Inventory 328,000 Prepaid insurance 8,000 Total current assets 884,000 $ 290,000 126,000 210,000 4,500 630,500 Property, plant, and equipment Less: Accumulated depreciation Investments 590,000 $ (155,000) 86,000 560,000 (115,000) 71,000 $ 1,405,000 $ 1,146,500 Total assets 34,000 17,300 Liabilities Current liabilities: Accounts payable inventory purchases) Wages payable Interest payable Income taxes payable Other accrued expenses payable Total current liablities 57,000 $ 16,200 1,600 65,970 6,400 600 11,500 3,500 147,170 $ 66,900 61,000 27,000 Long-term liabilities Total liabilities 208,170 $ 93,900 $ Stockholders' equity Common stock Retained earnings Total stockholders' equity 606,000 $ 590,830 606,000 446,600 $ 1,196,830 $ 1,052,600 Total liabilities and equity $ 1,405,000 $ 1,146,500