Answered step by step

Verified Expert Solution

Question

1 Approved Answer

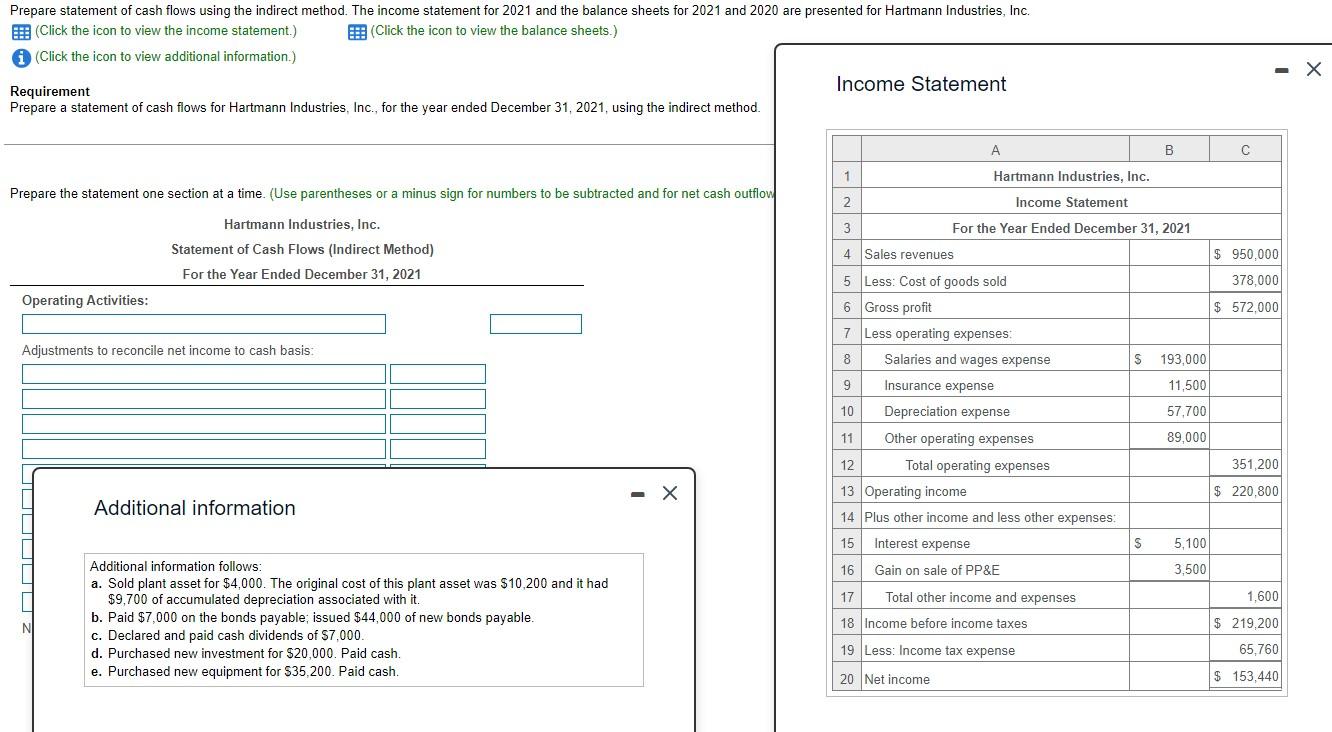

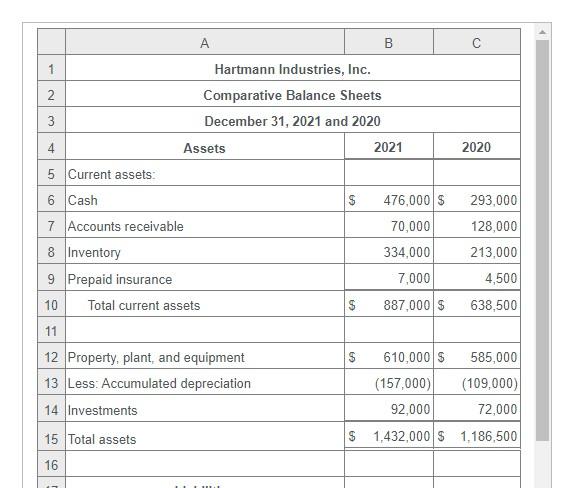

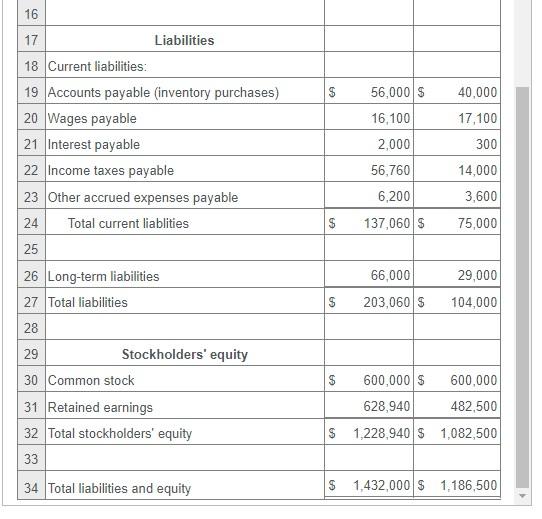

Prepare statement of cash flows using the indirect method. The income statement for 2021 and the balance sheets for 2021 and 2020 are presented

Prepare statement of cash flows using the indirect method. The income statement for 2021 and the balance sheets for 2021 and 2020 are presented for Hartmann Industries, Inc. (Click the icon to view the income statement.) (Click the icon to view the balance sheets.) (Click the icon to view additional information.) Requirement Income Statement Prepare a statement of cash flows for Hartmann Industries, Inc., for the year ended December 31, 2021, using the indirect method. Prepare the statement one section at a time. (Use parentheses or a minus sign for numbers to be subtracted and for net cash outflow Hartmann Industries, Inc. Statement of Cash Flows (Indirect Method) For the Year Ended December 31, 2021 Operating Activities: Adjustments to reconcile net income to cash basis: Additional information Additional information follows: a. Sold plant asset for $4,000. The original cost of this plant asset was $10,200 and it had $9,700 of accumulated depreciation associated with it. b. Paid $7,000 on the bonds payable; issued $44,000 of new bonds payable. c. Declared and paid cash dividends of $7,000. d. Purchased new investment for $20,000. Paid cash. e. Purchased new equipment for $35,200. Paid cash. A B C 1 Hartmann Industries, Inc. 2 Income Statement 3 For the Year Ended December 31, 2021 4 Sales revenues $ 950,000 5 Less: Cost of goods sold 378,000 6 Gross profit $ 572,000 7 Less operating expenses: 8 Salaries and wages expense $ 193,000 9 Insurance expense 11,500 10 Depreciation expense 57,700 11 Other operating expenses 89,000 12 Total operating expenses 351,200 - X 13 Operating income $ 220,800 14 Plus other income and less other expenses: 15 Interest expense 16 Gain on sale of PP&E 17 Total other income and expenses 18 Income before income taxes 19 Less: Income tax expense 20 Net income S 5,100 3,500 1,600 $ 219,200 65,760 $ 153,440 - X

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started