Answered step by step

Verified Expert Solution

Question

1 Approved Answer

prepare statement of changes in equity The following additional information is available: 1. At July 1, 2019 closing inventory was $42,000. 2. At the end

prepare statement of changes in equity

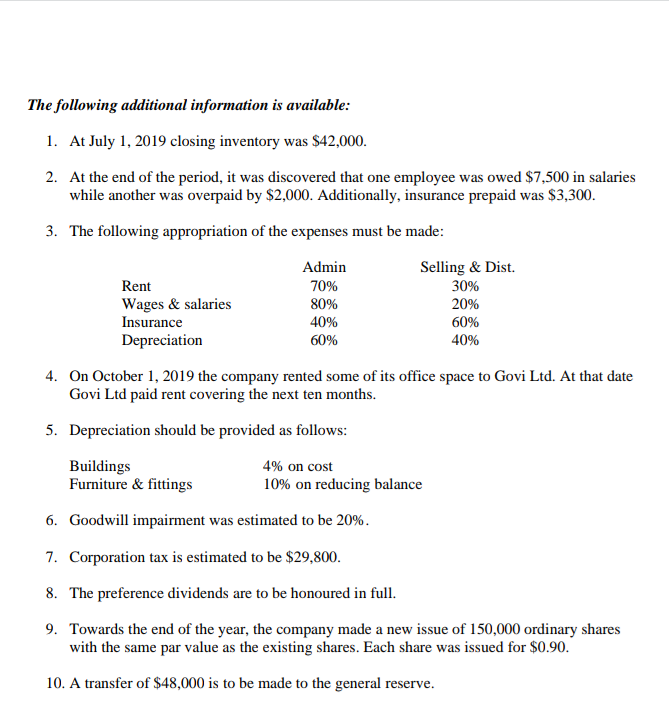

The following additional information is available: 1. At July 1, 2019 closing inventory was $42,000. 2. At the end of the period, it was discovered that one employee was owed $7,500 in salaries while another was overpaid by $2,000. Additionally, insurance prepaid was $3,300. 3. The following appropriation of the expenses must be made: Admin Selling & Dist. Rent 70% 30% Wages & salaries 80% 20% Insurance 40% 60% Depreciation 60% 40% 4. On October 1, 2019 the company rented some of its office space to Govi Ltd. At that date Govi Ltd paid rent covering the next ten months. 5. Depreciation should be provided as follows: Buildings Furniture & fittings 4% on cost 10% on reducing balance 6. Goodwill impairment was estimated to be 20%. 7. Corporation tax is estimated to be $29,800. 8. The preference dividends are to be honoured in full. 9. Towards the end of the year, the company made a new issue of 150,000 ordinary shares with the same par value as the existing shares. Each share was issued for $0.90. 10. A transfer of $48,000 is to be made to the general reserve. The following additional information is available: 1. At July 1, 2019 closing inventory was $42,000. 2. At the end of the period, it was discovered that one employee was owed $7,500 in salaries while another was overpaid by $2,000. Additionally, insurance prepaid was $3,300. 3. The following appropriation of the expenses must be made: Admin Selling & Dist. Rent 70% 30% Wages & salaries 80% 20% Insurance 40% 60% Depreciation 60% 40% 4. On October 1, 2019 the company rented some of its office space to Govi Ltd. At that date Govi Ltd paid rent covering the next ten months. 5. Depreciation should be provided as follows: Buildings Furniture & fittings 4% on cost 10% on reducing balance 6. Goodwill impairment was estimated to be 20%. 7. Corporation tax is estimated to be $29,800. 8. The preference dividends are to be honoured in full. 9. Towards the end of the year, the company made a new issue of 150,000 ordinary shares with the same par value as the existing shares. Each share was issued for $0.90. 10. A transfer of $48,000 is to be made to the general reserveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started