prepare statement of financial position for ABC Company in good format and according to the requirements of IAS 1

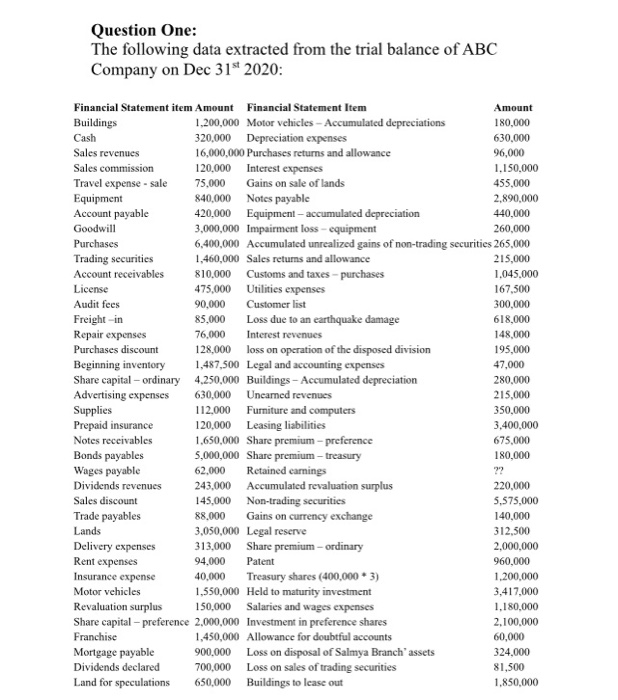

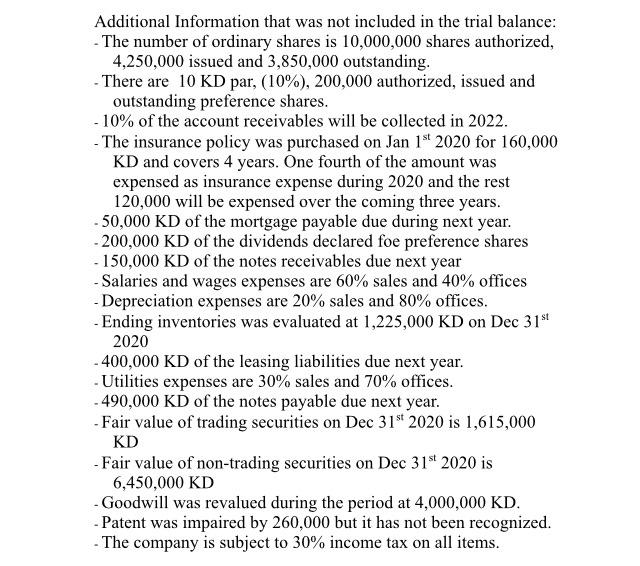

Question One: The following data extracted from the trial balance of ABC Company on Dec 31st 2020: Financial Statement item Amount Financial Statement Item Amount Buildings 1,200,000 Motor vehicles - Accumulated depreciations 180,000 Cash 320,000 Depreciation expenses 630,000 Sales revenues 16,000,000 Purchases returns and allowance 96,000 Sales commission 120,000 Interest expenses 1,150,000 Travel expense - sale 75.000 Gains on sale of lands 455,000 Equipment 840,000 Notes payable 2,890,000 Account payable 420,000 Equipment - accumulated depreciation 440,000 Goodwill 3,000,000 Impairment loss - equipment 260,000 Purchases 6,400,000 Accumulated unrealized gains of non-trading securities 265,000 Trading securities 1,460,000 Sales returns and allowance 215,000 Account receivables 810,000 Customs and taxes - purchases 1.045,000 License 475,000 Utilities expenses 167,500 Audit fees 90,000 Customer list 300,000 Freight-in 85,000 Loss due to an earthquake damage 618,000 Repair expenses 76,000 Interest revenues 148.000 Purchases discount 128,000 loss on operation of the disposed division 195,000 Beginning inventory 1,487,500 Legal and accounting expenses 47,000 Share capital - ordinary 4,250,000 Buildings - Accumulated depreciation 280,000 Advertising expenses 630,000 Uncamned revenues 215,000 Supplies 112.000 Furniture and computers 350,000 Prepaid insurance 120,000 Leasing liabilities 3,400,000 Notes receivables 1,650,000 Share premium-preference 675,000 Bonds payables 5,000,000 Share premium - treasury 180,000 Wages payable 62.000 Retained earnings ?? Dividends revenues 243,000 Accumulated revaluation surplus 220,000 Sales discount 145,000 Non-trading securities 5,575,000 Trade payables 88.000 Gains on currency exchange 140,000 Lands 3,050,000 Legal reserve 312,500 Delivery expenses 313,000 Share premium - ordinary 2,000,000 Rent expenses 94.000 Patent 960,000 Insurance expense 40,000 Treasury shares (400,000 * 3) 1.200,000 Motor vehicles 1,550,000 Held to maturity investment 3,417,000 Revaluation surplus 150,000 Salaries and wages expenses 1.180,000 Share capital - preference 2,000,000 Investment in preference shares 2,100,000 Franchise 1,450,000 Allowance for doubtful accounts 60,000 Mortgage payable 900.000 Loss on disposal of Salmya Branch' assets 324,000 Dividends declared 700,000 Loss on sales of trading securities 81,500 Land for speculations 650,000 Buildings to Icase out 1,850,000 Additional Information that was not included in the trial balance: - The number of ordinary shares is 10,000,000 shares authorized, 4,250,000 issued and 3,850,000 outstanding. - There are 10 KD par, (10%), 200,000 authorized, issued and outstanding preference shares. - 10% of the account receivables will be collected in 2022. - The insurance policy was purchased on Jan 1st 2020 for 160,000 KD and covers 4 years. One fourth of the amount was expensed as insurance expense during 2020 and the rest 120,000 will be expensed over the coming three years. - 50,000 KD of the mortgage payable due during next year. - 200,000 KD of the dividends declared foe preference shares - 150,000 KD of the notes receivables due next year - Salaries and wages expenses are 60% sales and 40% offices - Depreciation expenses are 20% sales and 80% offices. - Ending inventories was evaluated at 1,225,000 KD on Dec 31st 2020 -400,000 KD of the leasing liabilities due next year. - Utilities expenses are 30% sales and 70% offices. -490,000 KD of the notes payable due next year. - Fair value of trading securities on Dec 31st 2020 is 1,615,000 KD - Fair value of non-trading securities on Dec 31st 2020 is 6,450,000 KD - Goodwill was revalued during the period at 4,000,000 KD. - Patent was impaired by 260,000 but it has not been recognized. - The company is subject to 30% income tax on all items. Question One: The following data extracted from the trial balance of ABC Company on Dec 31st 2020: Financial Statement item Amount Financial Statement Item Amount Buildings 1,200,000 Motor vehicles - Accumulated depreciations 180,000 Cash 320,000 Depreciation expenses 630,000 Sales revenues 16,000,000 Purchases returns and allowance 96,000 Sales commission 120,000 Interest expenses 1,150,000 Travel expense - sale 75.000 Gains on sale of lands 455,000 Equipment 840,000 Notes payable 2,890,000 Account payable 420,000 Equipment - accumulated depreciation 440,000 Goodwill 3,000,000 Impairment loss - equipment 260,000 Purchases 6,400,000 Accumulated unrealized gains of non-trading securities 265,000 Trading securities 1,460,000 Sales returns and allowance 215,000 Account receivables 810,000 Customs and taxes - purchases 1.045,000 License 475,000 Utilities expenses 167,500 Audit fees 90,000 Customer list 300,000 Freight-in 85,000 Loss due to an earthquake damage 618,000 Repair expenses 76,000 Interest revenues 148.000 Purchases discount 128,000 loss on operation of the disposed division 195,000 Beginning inventory 1,487,500 Legal and accounting expenses 47,000 Share capital - ordinary 4,250,000 Buildings - Accumulated depreciation 280,000 Advertising expenses 630,000 Uncamned revenues 215,000 Supplies 112.000 Furniture and computers 350,000 Prepaid insurance 120,000 Leasing liabilities 3,400,000 Notes receivables 1,650,000 Share premium-preference 675,000 Bonds payables 5,000,000 Share premium - treasury 180,000 Wages payable 62.000 Retained earnings ?? Dividends revenues 243,000 Accumulated revaluation surplus 220,000 Sales discount 145,000 Non-trading securities 5,575,000 Trade payables 88.000 Gains on currency exchange 140,000 Lands 3,050,000 Legal reserve 312,500 Delivery expenses 313,000 Share premium - ordinary 2,000,000 Rent expenses 94.000 Patent 960,000 Insurance expense 40,000 Treasury shares (400,000 * 3) 1.200,000 Motor vehicles 1,550,000 Held to maturity investment 3,417,000 Revaluation surplus 150,000 Salaries and wages expenses 1.180,000 Share capital - preference 2,000,000 Investment in preference shares 2,100,000 Franchise 1,450,000 Allowance for doubtful accounts 60,000 Mortgage payable 900.000 Loss on disposal of Salmya Branch' assets 324,000 Dividends declared 700,000 Loss on sales of trading securities 81,500 Land for speculations 650,000 Buildings to Icase out 1,850,000 Additional Information that was not included in the trial balance: - The number of ordinary shares is 10,000,000 shares authorized, 4,250,000 issued and 3,850,000 outstanding. - There are 10 KD par, (10%), 200,000 authorized, issued and outstanding preference shares. - 10% of the account receivables will be collected in 2022. - The insurance policy was purchased on Jan 1st 2020 for 160,000 KD and covers 4 years. One fourth of the amount was expensed as insurance expense during 2020 and the rest 120,000 will be expensed over the coming three years. - 50,000 KD of the mortgage payable due during next year. - 200,000 KD of the dividends declared foe preference shares - 150,000 KD of the notes receivables due next year - Salaries and wages expenses are 60% sales and 40% offices - Depreciation expenses are 20% sales and 80% offices. - Ending inventories was evaluated at 1,225,000 KD on Dec 31st 2020 -400,000 KD of the leasing liabilities due next year. - Utilities expenses are 30% sales and 70% offices. -490,000 KD of the notes payable due next year. - Fair value of trading securities on Dec 31st 2020 is 1,615,000 KD - Fair value of non-trading securities on Dec 31st 2020 is 6,450,000 KD - Goodwill was revalued during the period at 4,000,000 KD. - Patent was impaired by 260,000 but it has not been recognized. - The company is subject to 30% income tax on all items