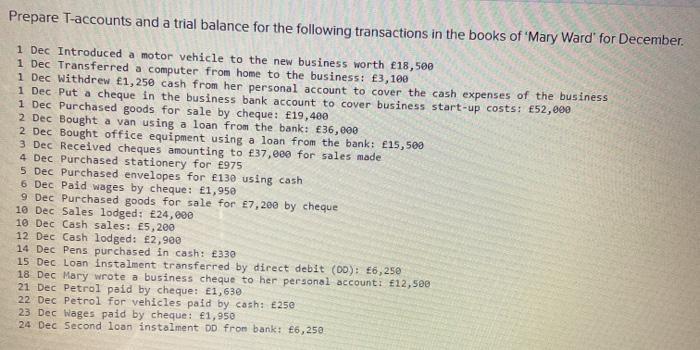

Prepare T-accounts and a trial balance for the following transactions in the books of 'Mary Ward' for December. 1 Dec Introduced a motor vehicle

Prepare T-accounts and a trial balance for the following transactions in the books of 'Mary Ward' for December. 1 Dec Introduced a motor vehicle to the new business worth 18,500 1 Dec Transferred a computer from home to the business: 3,100 1 Dec Withdrew 1,250 cash from her personal account to cover the cash expenses of the business 1 Dec Put a cheque in the business bank account to cover business start-up costs: 52,000 1 Dec Purchased goods for sale by cheque: 19,400 2 Dec Bought a van using a loan from the bank: 36,000 2 Dec Bought office equipment using a loan from the bank: 15,500 3 Dec Received cheques amounting to 37,000 for sales made 4 Dec Purchased stationery for 975 5 Dec Purchased envelopes for 130 using cash 6 Dec Paid wages by cheque: 1,950 9 Dec Purchased goods for sale for 7,200 by cheque 10 Dec Sales lodged: 24,000 10 Dec Cash sales: 5,200 12 Dec Cash lodged: 2,900 14 Dec Pens purchased in cash: 330 15 Dec Loan instalment transferred by direct debit (00): 6,250 18 Dec Mary wrote a business cheque to her personal account: 12,500 21 Dec Petrol paid by cheque: 1,630. 22 Dec Petrol for vehicles paid by cash: 250 23 Dec Wages paid by cheque: 1,950 24 Dec Second loan instalment DD from bank: 6,250

Step by Step Solution

3.37 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Motor Vehicle All 18500 Cash AlL 1250 5200 To Capital To capita...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started