Answered step by step

Verified Expert Solution

Question

1 Approved Answer

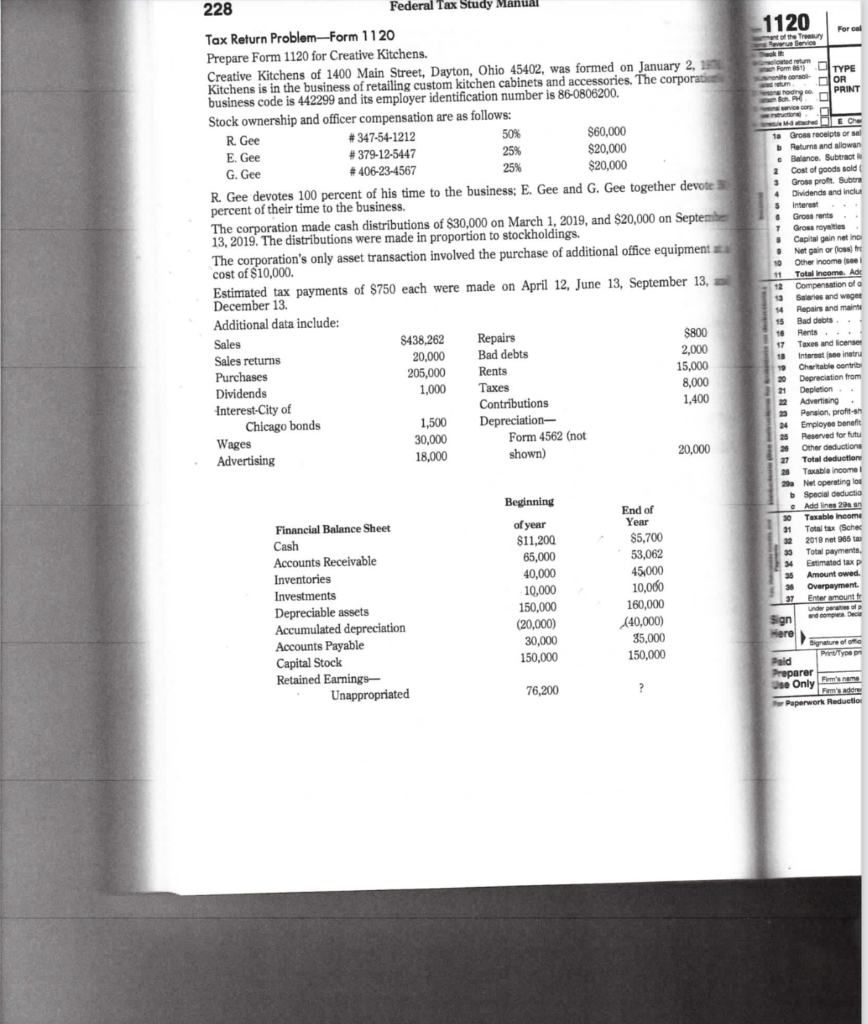

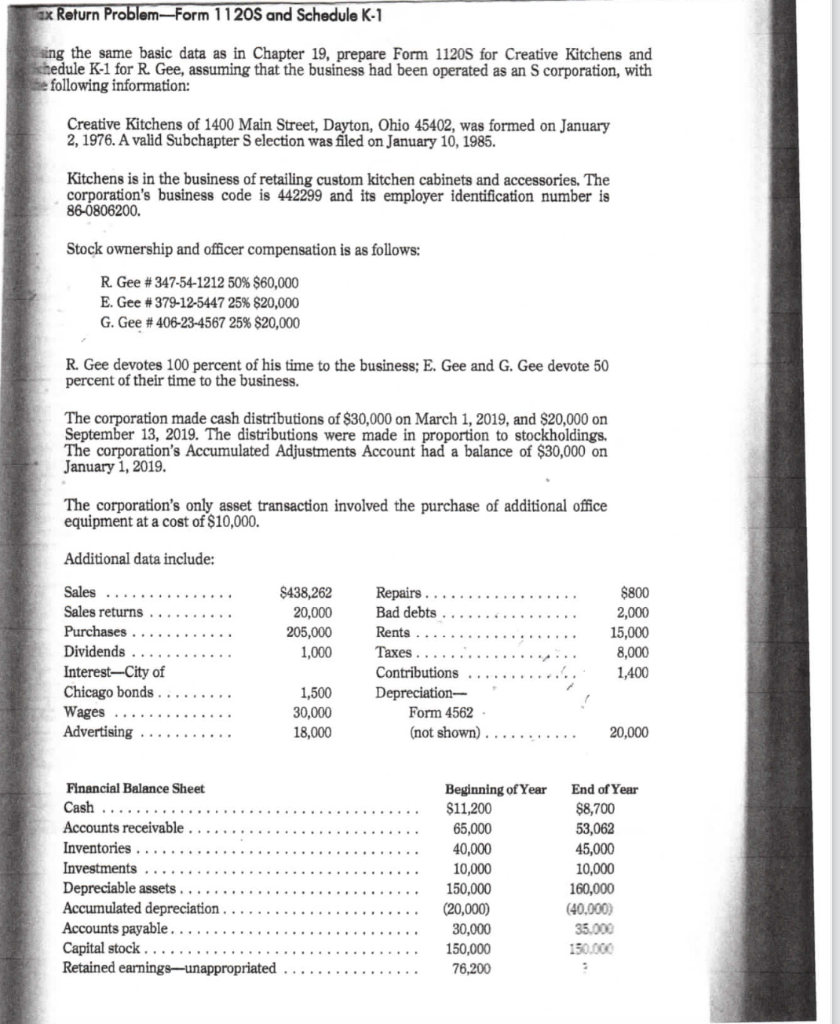

Prepare the 1120S. Include the Schedule B, K, K-1. Problem is on second page 228 Federal Tax Study Manual 1120 Forcol wervice odrum TYPE OR

Prepare the 1120S. Include the Schedule B, K, K-1. Problem is on second page

228 Federal Tax Study Manual 1120 Forcol wervice odrum TYPE OR os PRINT Vio Tax Return Problem-Form 1120 Prepare Form 1120 for Creative Kitchens. Creative Kitchens of 1400 Main Street, Dayton, Ohio 45402, was formed on January 2, 1570 Kitchens is in the business of retailing custom kitchen cabinets and accessories. The corporati business code is 442299 and its employer identification number is 86-0806200. Stock ownership and officer compensation are as follows: R. Gee # 347-54-1212 50% $60,000 E. Gee #379-12-5447 25% $20,000 G. Gee #406-23-4567 25% $20,000 R. Gee devotes 100 percent of his time to the business; E. Gee and G. Gee together devote percent of their time to the business, The corporation made cash distributions of $30,000 on March 1, 2019, and $20,000 on September 13, 2019. The distributions were made in proportion to stockholdings. The corporation's only asset transaction involved the purchase of additional office equipment cost of $10,000. Estimated tax payments of $750 each were made on April 12, June 13, September 13, December 13. Additional data include: Sales $438,262 Repairs $800 Sales returns 20.000 Bad debts 2,000 Purchases 205,000 Rents 15,000 Dividends 1,000 Taxes 8,000 Interest-City of Contributions 1,400 Chicago bonds 1,500 Depreciation- Wages 30,000 Form 4562 (not Advertising shown) 20,000 ta Gross receipts or sal Returns and allowen e Balance Subtract 2 Cost of goods sold 3 Gross profit. Subtra 4 Dividends and inclus 5 Interest . Grossrents 7 Gross royalties . Capital gain netino . Net gain or loss tre 10 Other income se 11 Total income. Ade 12 Compensation of Salaries and wager 14 Repairs and mainte 15 Bad debts.. 16 Rents ... 17 Taxes and license Interest instru Chartable contrib 20 Depreciation from 21 Depletion. 22 Advertising 23 Pension, profit-sh 24 Employee benefit Reserved for futu Other deductions 27 Total deduction 20 Taxable income 20 Net operating for b Special deductia e Add lines 29 an 30 Taxable income 31 Totaltex Sche 32 2010 net 965 39 Total payments 34 Estimated tax 35 Amount owed. 36 Overpayment 37 Enter amount Under Sign Here gnature offe Print/typer Pald Preparer Firmame 18,000 Financial Balance Sheet Cash Accounts Receivable Inventories Investments Depreciable assets Accumulated depreciation Accounts Payable Capital Stock Retained Earnings- Unappropriated Beginning of year $11,200 65,000 40,000 10,000 150,000 (20,000) 30,000 150,000 End of Year $5,700 53,062 45,000 10,000 160,000 (40,000) 35,000 150,000 76,200 ? Use Only 's addre Paperwork Reduction ex Return Problem-Form 1120S and Schedule K-1 Esing the same basic data as in Chapter 19, prepare Form 1120S for Creative Kitchens and schedule K-1 for R. Gee, assuming that the business had been operated as an Scorporation, with following information: Creative Kitchens of 1400 Main Street, Dayton, Ohio 45402, was formed on January 2, 1976. A valid Subchapter Selection was filed on January 10, 1985. Kitchens is in the business of retailing custom kitchen cabinets and accessories. The corporation's business code is 442299 and its employer identification number is 86-0806200. Stock ownership and officer compensation is as follows: R. Gee # 347-54-1212 50% $60,000 E. Gee #379-12-5447 25% $20,000 G. Gee #406-23-4567 25% $20,000 R. Gee devotes 100 percent of his time to the business; E. Gee and G. Gee devote 50 percent of their time to the business. The corporation made cash distributions of $30,000 on March 1, 2019, and $20,000 on September 13, 2019. The distributions were made in proportion to stockholdings. The corporation's Accumulated Adjustments Account had a balance of $30,000 on January 1, 2019. The corporation's only asset transaction involved the purchase of additional office equipment at a cost of $10,000. Additional data include: $438,262 20,000 205,000 1,000 Sales Sales returns Purchases Dividends Interest-City of Chicago bonds Wages Advertising Repairs Bad debts Rents Taxes Contributions Depreciation- Form 4562 (not shown) $800 2,000 15,000 8,000 1,400 1,500 30,000 18,000 20,000 Financial Balance Sheet Cash Accounts receivable Inventories Investments Depreciable assets Accumulated depreciation Accounts payable. Capital stock... Retained earnings-unappropriated Beginning of Year $11,200 65,000 40,000 10,000 150,000 (20,000) 30,000 150,000 76,200 End of Year $8,700 53,062 45,000 10,000 160,000 (40.000) 35.000 150.000 2 228 Federal Tax Study Manual 1120 Forcol wervice odrum TYPE OR os PRINT Vio Tax Return Problem-Form 1120 Prepare Form 1120 for Creative Kitchens. Creative Kitchens of 1400 Main Street, Dayton, Ohio 45402, was formed on January 2, 1570 Kitchens is in the business of retailing custom kitchen cabinets and accessories. The corporati business code is 442299 and its employer identification number is 86-0806200. Stock ownership and officer compensation are as follows: R. Gee # 347-54-1212 50% $60,000 E. Gee #379-12-5447 25% $20,000 G. Gee #406-23-4567 25% $20,000 R. Gee devotes 100 percent of his time to the business; E. Gee and G. Gee together devote percent of their time to the business, The corporation made cash distributions of $30,000 on March 1, 2019, and $20,000 on September 13, 2019. The distributions were made in proportion to stockholdings. The corporation's only asset transaction involved the purchase of additional office equipment cost of $10,000. Estimated tax payments of $750 each were made on April 12, June 13, September 13, December 13. Additional data include: Sales $438,262 Repairs $800 Sales returns 20.000 Bad debts 2,000 Purchases 205,000 Rents 15,000 Dividends 1,000 Taxes 8,000 Interest-City of Contributions 1,400 Chicago bonds 1,500 Depreciation- Wages 30,000 Form 4562 (not Advertising shown) 20,000 ta Gross receipts or sal Returns and allowen e Balance Subtract 2 Cost of goods sold 3 Gross profit. Subtra 4 Dividends and inclus 5 Interest . Grossrents 7 Gross royalties . Capital gain netino . Net gain or loss tre 10 Other income se 11 Total income. Ade 12 Compensation of Salaries and wager 14 Repairs and mainte 15 Bad debts.. 16 Rents ... 17 Taxes and license Interest instru Chartable contrib 20 Depreciation from 21 Depletion. 22 Advertising 23 Pension, profit-sh 24 Employee benefit Reserved for futu Other deductions 27 Total deduction 20 Taxable income 20 Net operating for b Special deductia e Add lines 29 an 30 Taxable income 31 Totaltex Sche 32 2010 net 965 39 Total payments 34 Estimated tax 35 Amount owed. 36 Overpayment 37 Enter amount Under Sign Here gnature offe Print/typer Pald Preparer Firmame 18,000 Financial Balance Sheet Cash Accounts Receivable Inventories Investments Depreciable assets Accumulated depreciation Accounts Payable Capital Stock Retained Earnings- Unappropriated Beginning of year $11,200 65,000 40,000 10,000 150,000 (20,000) 30,000 150,000 End of Year $5,700 53,062 45,000 10,000 160,000 (40,000) 35,000 150,000 76,200 ? Use Only 's addre Paperwork Reduction ex Return Problem-Form 1120S and Schedule K-1 Esing the same basic data as in Chapter 19, prepare Form 1120S for Creative Kitchens and schedule K-1 for R. Gee, assuming that the business had been operated as an Scorporation, with following information: Creative Kitchens of 1400 Main Street, Dayton, Ohio 45402, was formed on January 2, 1976. A valid Subchapter Selection was filed on January 10, 1985. Kitchens is in the business of retailing custom kitchen cabinets and accessories. The corporation's business code is 442299 and its employer identification number is 86-0806200. Stock ownership and officer compensation is as follows: R. Gee # 347-54-1212 50% $60,000 E. Gee #379-12-5447 25% $20,000 G. Gee #406-23-4567 25% $20,000 R. Gee devotes 100 percent of his time to the business; E. Gee and G. Gee devote 50 percent of their time to the business. The corporation made cash distributions of $30,000 on March 1, 2019, and $20,000 on September 13, 2019. The distributions were made in proportion to stockholdings. The corporation's Accumulated Adjustments Account had a balance of $30,000 on January 1, 2019. The corporation's only asset transaction involved the purchase of additional office equipment at a cost of $10,000. Additional data include: $438,262 20,000 205,000 1,000 Sales Sales returns Purchases Dividends Interest-City of Chicago bonds Wages Advertising Repairs Bad debts Rents Taxes Contributions Depreciation- Form 4562 (not shown) $800 2,000 15,000 8,000 1,400 1,500 30,000 18,000 20,000 Financial Balance Sheet Cash Accounts receivable Inventories Investments Depreciable assets Accumulated depreciation Accounts payable. Capital stock... Retained earnings-unappropriated Beginning of Year $11,200 65,000 40,000 10,000 150,000 (20,000) 30,000 150,000 76,200 End of Year $8,700 53,062 45,000 10,000 160,000 (40.000) 35.000 150.000 2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started