Answered step by step

Verified Expert Solution

Question

1 Approved Answer

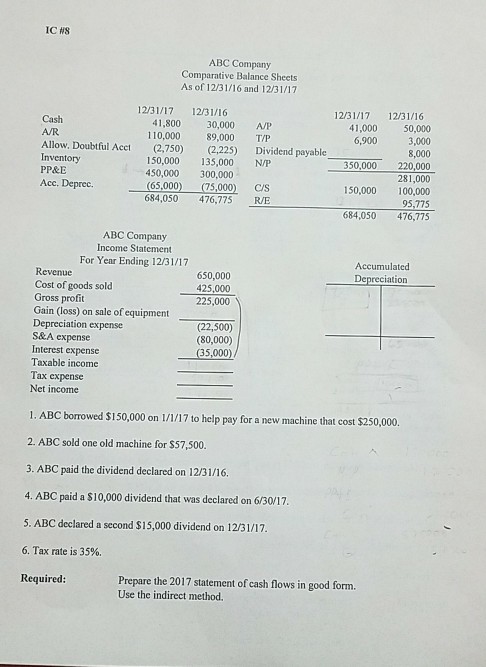

Prepare the 2017 statement of cash flows in good form using the indirect method ABC Company Comparative Balance Sheets As of 12/31/16 and 12/31/17 12/31/17

Prepare the 2017 statement of cash flows in good form using the indirect method

ABC Company Comparative Balance Sheets As of 12/31/16 and 12/31/17 12/31/17 12/31/16 12/31/17 12/31/16 Cash A/R Allow. Doubtful Acct Inventory PP&E Acc. Deprec 41,800 30,000 AP 110,000 89,000 T/P 41,000 50,000 3,000 8,000 350,000220,000 281,000 150,000 100,000 95,775 684,050 476,775 6,900 Dividend payable (2,750) 150,000 135,000 N/P 450,000 300,000 (65,000) (75,000) C/S 684,050 476,775 R/E (2,225) ABC Company Income Statement For Year Ending 12/31/17 Accumulated Revenue Cost of goods sold Gross profit Gain (loss) on sale of equipment Depreciation expense S&A expense Interest expense Taxable income Tax expense Net income 650,000 425,000 225,000 (22,500) (80,000) 35,000) 1. ??? borrowed $150,000 on l/1/17 to help pay for a new machine that cost $250,000. 2. ABC sold one old machine for $57,500 3. ABC paid the dividend declared on 12/31/16. 4. ABC paid a S10,000 dividend that was declared on 6/30/17. 5. ABC declared a second $15,000 dividend on 12/31/17. 6, Tax rate is 35%. Required Prepare the 2017 statement of cash flows in good form. Use the indirect methodStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started