Prepare the 2018 Tax Return for Roberta Santos:

Form 1040, pages 1 and 2

Schedule 1

Schedule D

Form 8949

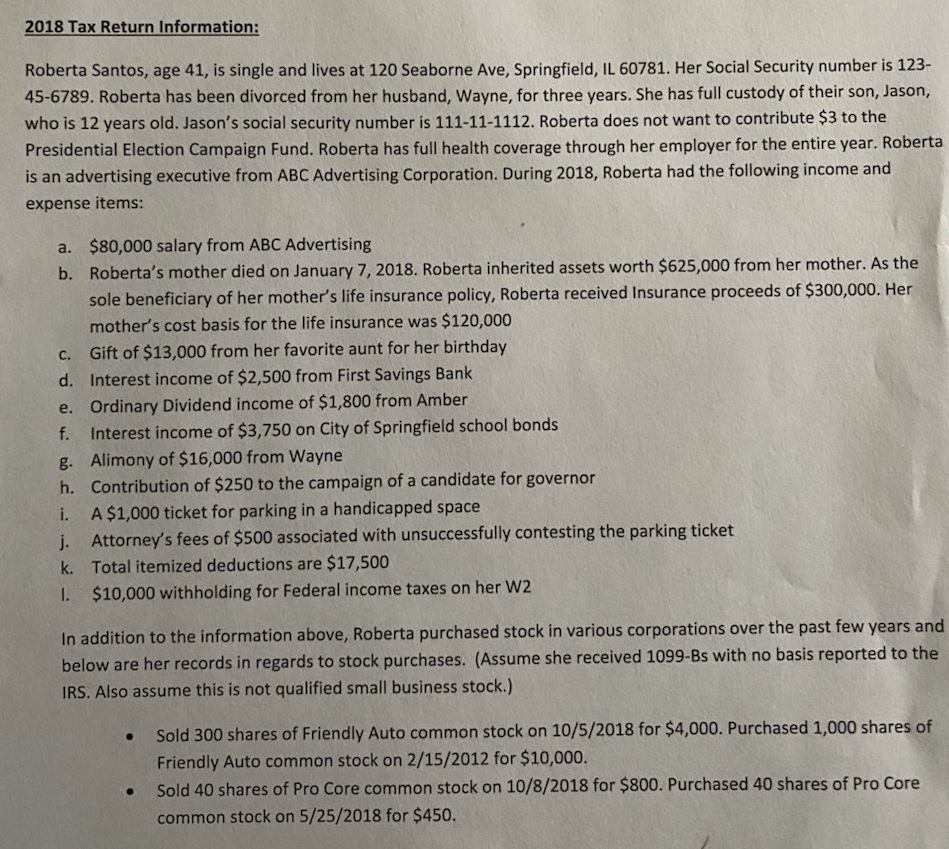

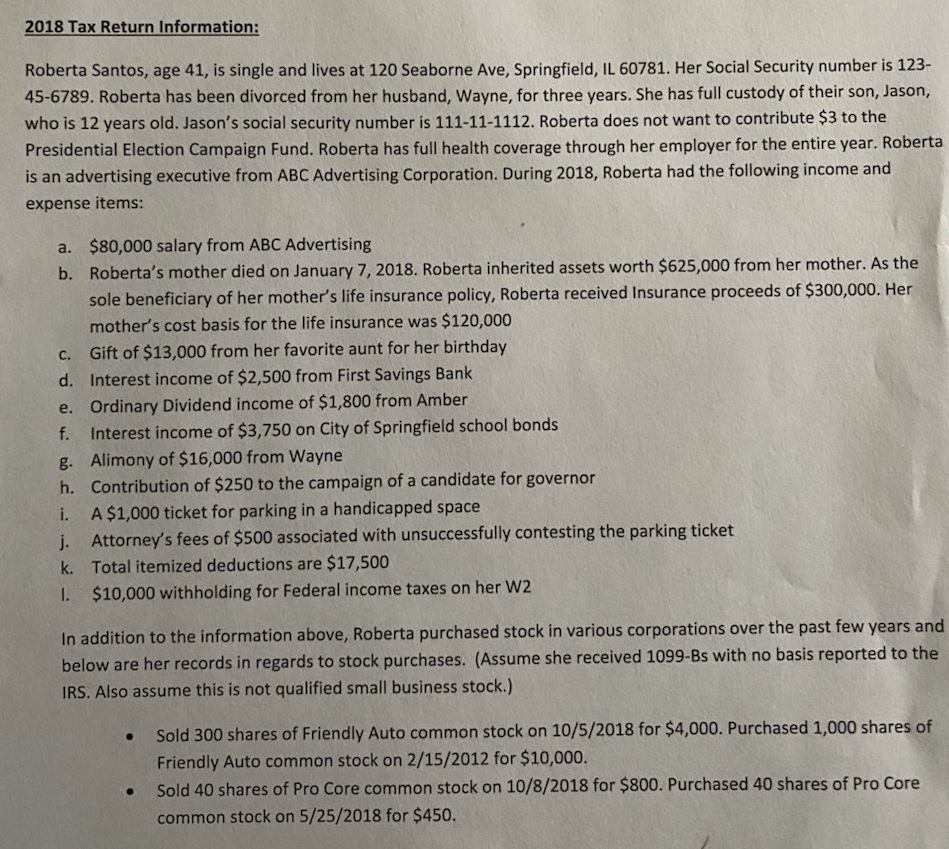

2018 Tax Return Information: Roberta Santos, age 41, is single and lives at 120 Seaborne Ave, Springfield, IL 60781. Her Social Security number is 123- 45-6789. Roberta has been divorced from her husband, Wayne, for three years. She has full custody of their son, Jason, who is 12 years old. Jason's social security number is 111-11-1112. Roberta does not want to contribute $3 to the Presidential Election Campaign Fund. Roberta has full health coverage through her employer for the entire year. Roberta is an advertising executive from ABC Advertising Corporation. During 2018, Roberta had the following income and expense items: a. $80,000 salary from ABC Advertising b. Roberta's mother died on January 7, 2018. Roberta inherited assets worth $625,000 from her mother. As the sole beneficiary of her mother's life insurance policy, Roberta received Insurance proceeds of $300,000. Her mother's cost basis for the life insurance was $120,000 c. Gift of $13,000 from her favorite aunt for her birthday d. Interest income of $2,500 from First Savings Bank e. Ordinary Dividend income of $1,800 from Amber f. Interest income of $3,750 on City of Springfield school bonds g. Alimony of $16,000 from Wayne h. Contribution of $250 to the campaign of a candidate for governor i. A $1,000 ticket for parking in a handicapped space j. Attorney's fees of $500 associated with unsuccessfully contesting the parking ticket k. Total itemized deductions are $17,500 1. $10,000 withholding for Federal income taxes on her W2 In addition to the information above, Roberta purchased stock in various corporations over the past few years and below are her records in regards to stock purchases. (Assume she received 1099-Bs with no basis reported to the IRS. Also assume this is not qualified small business stock.) Sold 300 shares of Friendly Auto common stock on 10/5/2018 for $4,000. Purchased 1,000 shares of Friendly Auto common stock on 2/15/2012 for $10,000. Sold 40 shares of Pro Core common stock on 10/8/2018 for $800. Purchased 40 shares of Pro Core common stock on 5/25/2018 for $450. 2018 Tax Return Information: Roberta Santos, age 41, is single and lives at 120 Seaborne Ave, Springfield, IL 60781. Her Social Security number is 123- 45-6789. Roberta has been divorced from her husband, Wayne, for three years. She has full custody of their son, Jason, who is 12 years old. Jason's social security number is 111-11-1112. Roberta does not want to contribute $3 to the Presidential Election Campaign Fund. Roberta has full health coverage through her employer for the entire year. Roberta is an advertising executive from ABC Advertising Corporation. During 2018, Roberta had the following income and expense items: a. $80,000 salary from ABC Advertising b. Roberta's mother died on January 7, 2018. Roberta inherited assets worth $625,000 from her mother. As the sole beneficiary of her mother's life insurance policy, Roberta received Insurance proceeds of $300,000. Her mother's cost basis for the life insurance was $120,000 c. Gift of $13,000 from her favorite aunt for her birthday d. Interest income of $2,500 from First Savings Bank e. Ordinary Dividend income of $1,800 from Amber f. Interest income of $3,750 on City of Springfield school bonds g. Alimony of $16,000 from Wayne h. Contribution of $250 to the campaign of a candidate for governor i. A $1,000 ticket for parking in a handicapped space j. Attorney's fees of $500 associated with unsuccessfully contesting the parking ticket k. Total itemized deductions are $17,500 1. $10,000 withholding for Federal income taxes on her W2 In addition to the information above, Roberta purchased stock in various corporations over the past few years and below are her records in regards to stock purchases. (Assume she received 1099-Bs with no basis reported to the IRS. Also assume this is not qualified small business stock.) Sold 300 shares of Friendly Auto common stock on 10/5/2018 for $4,000. Purchased 1,000 shares of Friendly Auto common stock on 2/15/2012 for $10,000. Sold 40 shares of Pro Core common stock on 10/8/2018 for $800. Purchased 40 shares of Pro Core common stock on 5/25/2018 for $450