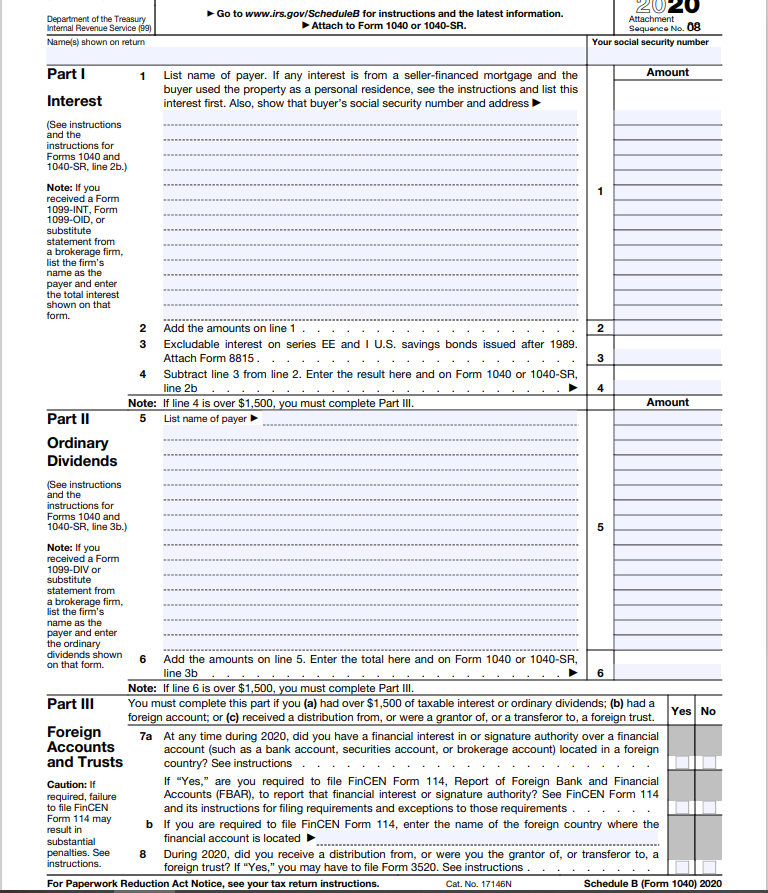

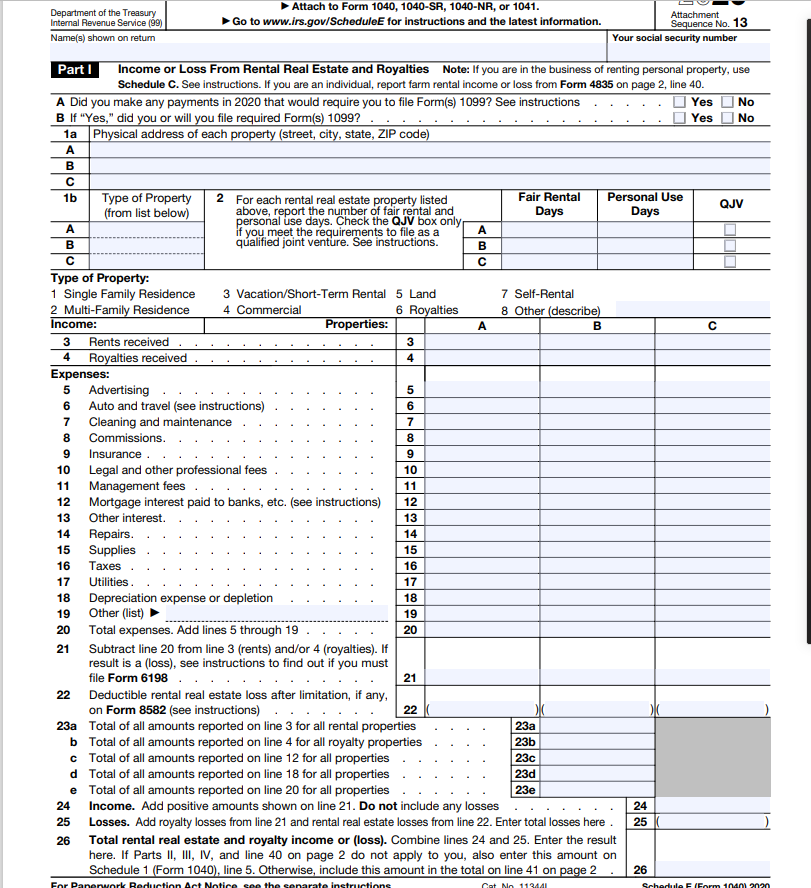

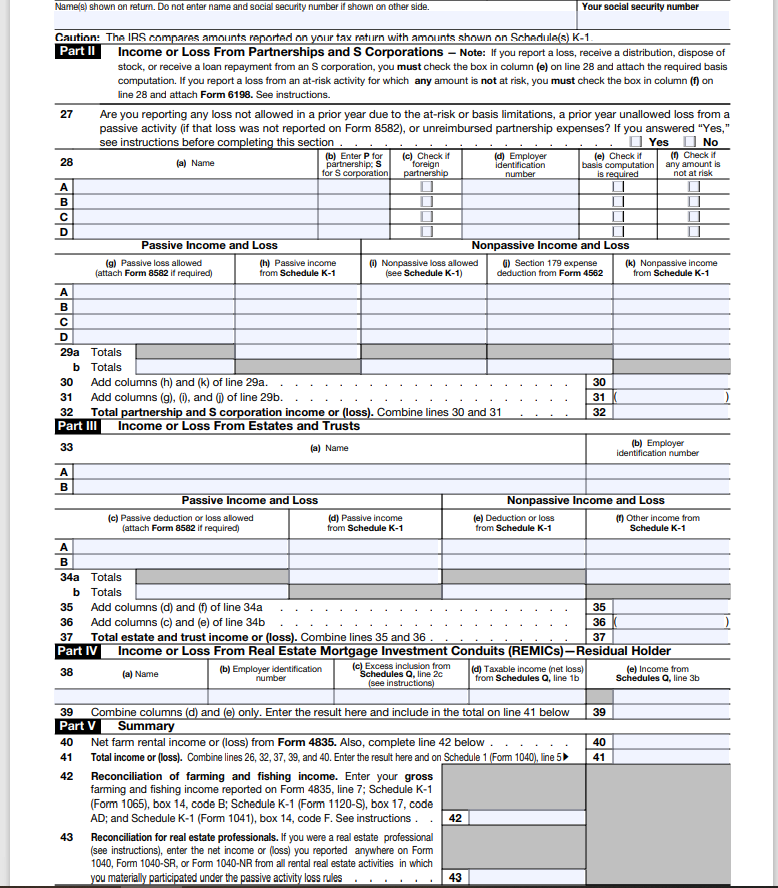

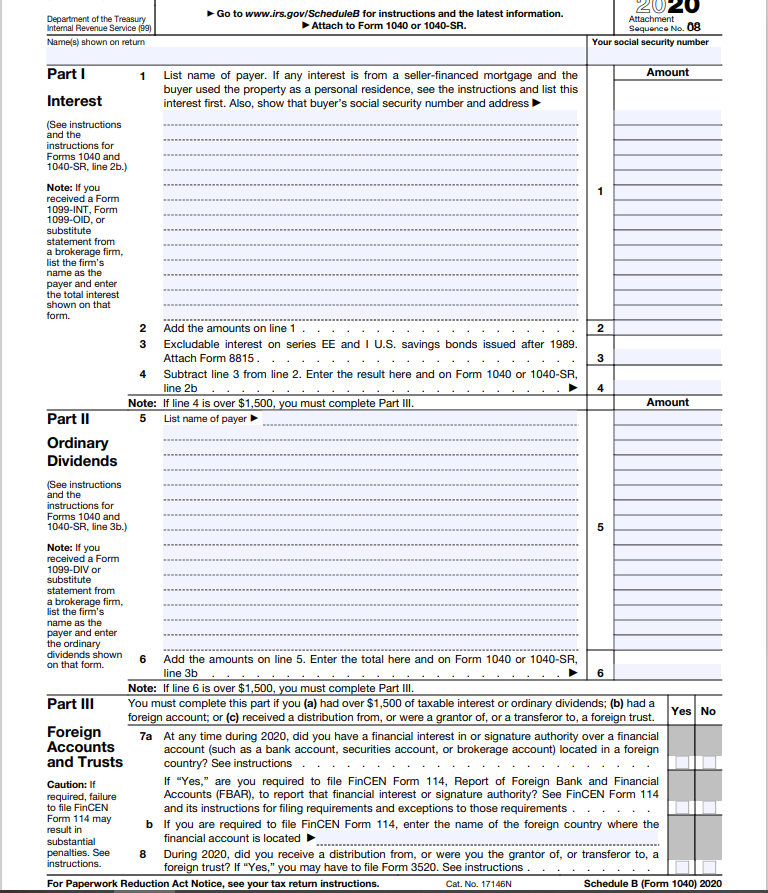

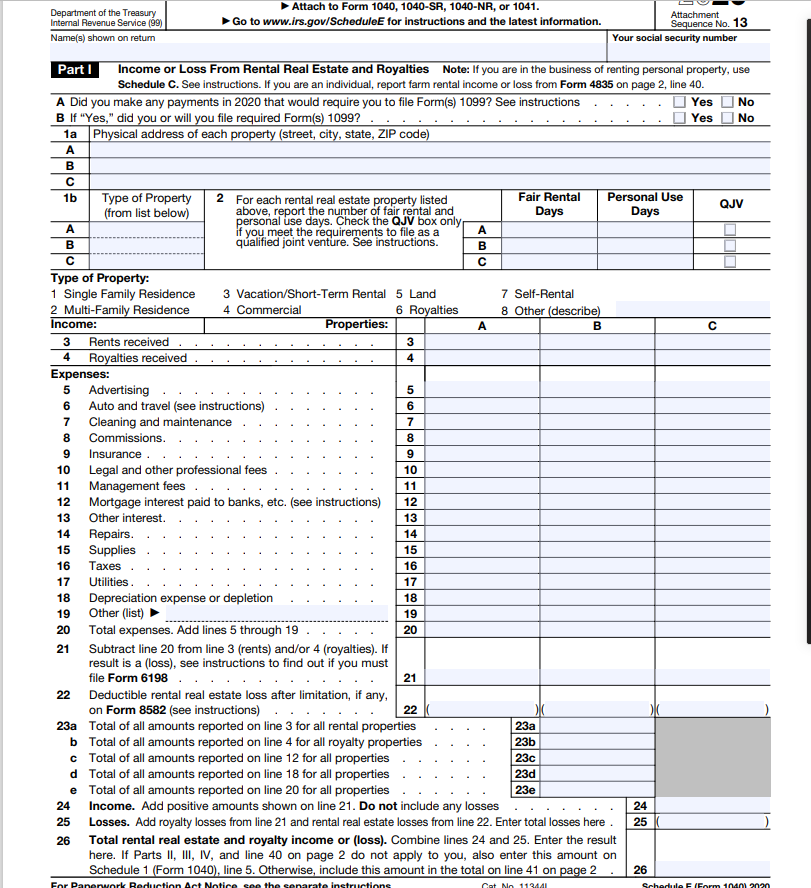

Prepare the 2020tax return from the information provided in Tax Return homework problem 58 in the back of Chapter 4. Cecil C. Seymour is a 64-year-old widower. He had income for 2020 as follows: Pension from former employer $39,850 Interest income from Alto National Bank 5,500 Interest income on City of Alto bonds 4,500 Dividends received from IBM stock held for over one year 2,000 Collections on annuity contract he purchased from Great Life Insurance 5,400 Social Security benefits 14,000 Rent income on townhouse 9,000 The cost of the annuity was $46,800, and Cecil was expected to receive a total of 260 monthly payments of $450. Cecil has received 22 payments through 2020. Cecils 40-year-old daughter, Sarah C. Seymour, borrowed $60,000 from Cecil on January 2, 2020. She used the money to start a new business. Cecil does not charge her interest because she could not afford to pay it, but he does expect to collect the principal eventually. Sarah is living with Cecil until the business becomes profitable. Except for housing, Sarah provides her own support from her business and $1,600 in dividends on stocks that she inherited from her mother. Other relevant information is presented below. Expenses on rental townhouse: Utilities $2,800 Maintenance 1,000 Depreciation 2,000 Real estate taxes 750 Insurance 700 State income taxes paid: $3,500 County personal property taxes paid: $3,100 Payments on estimated 2020 Federal income tax: $5,900 Charitable contributions of cash to Alto Baptist Church: $7,400 Federal interest rate: 6% Sales taxes paid: $912 Compute Cecils 2020 Federal income tax payable (or refund due)

Prepare the 2020tax return from the information provided in Tax Return homework problem 58 in the back of Chapter 4. Cecil C. Seymour is a 64-year-old widower. He had income for 2020 as follows: Pension from former employer $39,850 Interest income from Alto National Bank 5,500 Interest income on City of Alto bonds 4,500 Dividends received from IBM stock held for over one year 2,000 Collections on annuity contract he purchased from Great Life Insurance 5,400 Social Security benefits 14,000 Rent income on townhouse 9,000 The cost of the annuity was $46,800, and Cecil was expected to receive a total of 260 monthly payments of $450. Cecil has received 22 payments through 2020. Cecils 40-year-old daughter, Sarah C. Seymour, borrowed $60,000 from Cecil on January 2, 2020. She used the money to start a new business. Cecil does not charge her interest because she could not afford to pay it, but he does expect to collect the principal eventually. Sarah is living with Cecil until the business becomes profitable. Except for housing, Sarah provides her own support from her business and $1,600 in dividends on stocks that she inherited from her mother. Other relevant information is presented below. Expenses on rental townhouse: Utilities $2,800 Maintenance 1,000 Depreciation 2,000 Real estate taxes 750 Insurance 700 State income taxes paid: $3,500 County personal property taxes paid: $3,100 Payments on estimated 2020 Federal income tax: $5,900 Charitable contributions of cash to Alto Baptist Church: $7,400 Federal interest rate: 6% Sales taxes paid: $912 Compute Cecils 2020 Federal income tax payable (or refund due)

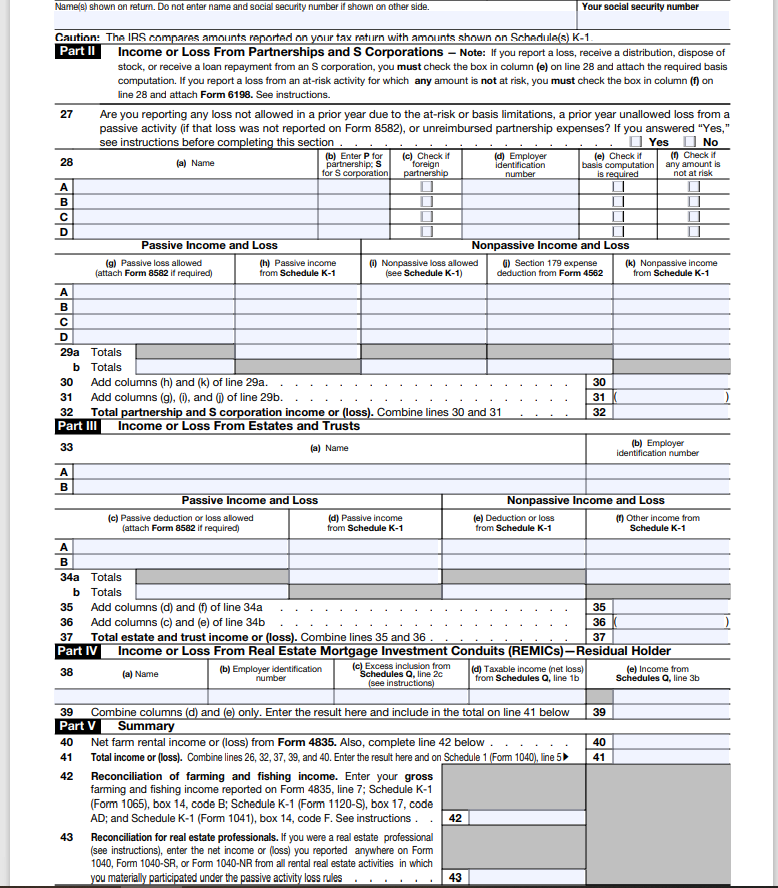

Department of the Treasury Internal Revenue Service (99) Name(s) shown on return Attach to Form 1040, 1040-SR, 1040-NR, or 1041. Go to www.irs.gov/Schedule for instructions and the latest information. Attachment Sequence No. 13 Your social security number QJV B 6 Part1 Income or Loss From Rental Real Estate and Royalties Note: If you are in the business of renting personal property, use Schedule C. See instructions. If you are an individual, report farm rental income or loss from Form 4835 on page 2, line 40. A Did you make any payments in 2020 that would require you to file Form(s) 1099? See instructions Yes No B If "Yes," did you or will you file required Form(s) 1099? . Yes No 1a Physical address of each property (street, city, state, ZIP code) B 1b Type of Property 2 For each rental real estate property listed Fair Rental Personal Use QJV (from list below) above, report the number of fair rental and Days Days A personal use days. Check the QJV box only If you meet the requirements to file as a A B qualified joint venture. See instructions. B Type of Property: 1 Single Family Residence 3 Vacation/Short-Term Rental 5 Land 7 Self-Rental 2 Multi-Family Residence 4 Commercial 6 Royalties 8 Other (describe) Income: Properties: 3 Rents received 3 4 Royalties received 4 Expenses: 5 Advertising 5 6 Auto and travel (see instructions) 6 7 Cleaning and maintenance 7 8 Commissions. 8 9 Insurance 9 10 Legal and other professional fees 10 11 Management fees 11 12 Mortgage interest paid to banks, etc. (see instructions) 12 13 Other interest. 13 14 Repairs. 14 15 Supplies 15 16 Taxes 16 17 Utilities 17 18 Depreciation expense or depletion 18 19 Other (list) 19 20 Total expenses. Add lines 5 through 19 20 21 Subtract line 20 from line 3 (rents) and/or 4 (royalties). If result is a (loss), see instructions to find out if you must file Form 6198 21 22 Deductible rental real estate loss after limitation, if any, on Form 8582 (see instructions) 22 23a Total of all amounts reported on line 3 for all rental properties 23a b Total of all amounts reported on line 4 for all royalty properties 23b c Total of all amounts reported on line 12 for all properties 23c d Total of all amounts reported on line 18 for all properties 23d e Total of all amounts reported on line 20 for all properties 23e 24 Income. Add positive amounts shown on line 21. Do not include any losses 24 25 Losses. Add royalty losses from line 21 and rental real estate losses from line 22. Enter total losses here. 25 26 Total rental real estate and royalty income or (loss). Combine lines 24 and 25. Enter the result here. If Parts II, III, IV, and line 40 on page 2 do not apply to you, also enter this amount on Schedule 1 (Form 1040), line 5. Otherwise, include this amount in the total on line 41 on page 2 For Paperwork Reduction Act Notice see the senarate instructions 26 Schedule E Form 10401 2020 Cat No. 113AAI Name(s) shown on return. Do not enter name and social security number if shown on other side. Your social security number Caution: The IRS compares amounts reported on your tax return with amounts shown on Schedule(s) K-1. Part II Income or Loss From Partnerships and S Corporations - Note: If you report a loss, receive a distribution, dispose of stock, or receive a loan repayment from an Scorporation, you must check the box in column (e) on line 28 and attach the required basis computation. If you report a loss from an at-risk activity for which any amount is not at risk, you must check the box in column (f) on line 28 and attach Form 6198. See instructions. 27 Are you reporting any loss not allowed in a prior year due to the at-risk or basis limitations, a prior year unallowed loss from a passive activity (if that loss was not reported on Form 8582), or unreimbursed partnership expenses? If you answered "Yes," see instructions before completing this section Yes No 28 (b) Enter P for (c) Check it (d) Employer (e) Check if (a) Name partnership: S foreign identification for Scorporation partnership (1) Check if basis computation any amount is is required not at risk number A B D Passive Income and Loss Nonpassive Income and Loss (g) Passive loss allowed (h) Passive income (i) Nonpassive loss allowed 6) Section 179 expense (k) Nonpassive income (attach Form 8582 if required) from Schedule K-1 (see Schedule K-1) deduction from Form 4562 from Schedule K-1 A B D 29a Totals b Totals 30 Add columns (h) and (k) of line 29a. 30 31 Add columns (9), (), and (of line 29b. 31 32 Total partnership and S corporation income or (loss). Combine lines 30 and 31 32 Part III Income or Loss From Estates and Trusts 33 (a) Name (b) Employer identification number A B Passive Income and Loss Nonpassive Income and Loss (c) Passive deduction or loss allowed (d) Passive income le) Deduction or loss (1) Other income from (attach Form 8582 if required) from Schedule K-1 from Schedule K-1 Schedule K-1 A B 34a Totals b Totals 35 Add columns (d) and (f) of line 34a 35 36 Add columns (c) and (e) of line 34b 36 37 Total estate and trust income or (loss). Combine lines 35 and 36 37 Part IV Income or Loss From Real Estate Mortgage Investment Conduits (REMICs) Residual Holder 38 (a) Name (b) Employer identification (c) Excess inclusion from (d) Taxable income (net loss) Schedules Q, line 2c le) Income from number (see instructions) from Schedules Q, line 1b Schedules Q, line 3b 39 40 40 41 39 Combine columns (d) and (e) only. Enter the result here and include in the total on line 41 below Part V Summary Net farm rental income or loss) from Form 4835. Also, complete line 42 below 41 Total income or loss). Combine lines 26, 32, 37, 39, and 40. Enter the result here and on Schedule 1 (For 1040), line 5) 42 Reconciliation of farming and fishing income. Enter your gross farming and fishing income reported on Form 4835, line 7; Schedule K-1 (Form 1065), box 14, code B; Schedule K-1 (Form 1120-S), box 17, code AD; and Schedule K-1 (Form 1041), box 14, code F. See instructions. Reconciliation for real estate professionals. If you were a real estate professional (see instructions), enter the net income or loss) you reported anywhere on Form 1040, Form 1040-SR, or Form 1040-NR from all rental real estate activities in which you materially participated under the passive activity loss rules 42 43 43 Department of the Treasury Internal Revenue Service (99) Name(s) shown on return Attach to Form 1040, 1040-SR, 1040-NR, or 1041. Go to www.irs.gov/Schedule for instructions and the latest information. Attachment Sequence No. 13 Your social security number QJV B 6 Part1 Income or Loss From Rental Real Estate and Royalties Note: If you are in the business of renting personal property, use Schedule C. See instructions. If you are an individual, report farm rental income or loss from Form 4835 on page 2, line 40. A Did you make any payments in 2020 that would require you to file Form(s) 1099? See instructions Yes No B If "Yes," did you or will you file required Form(s) 1099? . Yes No 1a Physical address of each property (street, city, state, ZIP code) B 1b Type of Property 2 For each rental real estate property listed Fair Rental Personal Use QJV (from list below) above, report the number of fair rental and Days Days A personal use days. Check the QJV box only If you meet the requirements to file as a A B qualified joint venture. See instructions. B Type of Property: 1 Single Family Residence 3 Vacation/Short-Term Rental 5 Land 7 Self-Rental 2 Multi-Family Residence 4 Commercial 6 Royalties 8 Other (describe) Income: Properties: 3 Rents received 3 4 Royalties received 4 Expenses: 5 Advertising 5 6 Auto and travel (see instructions) 6 7 Cleaning and maintenance 7 8 Commissions. 8 9 Insurance 9 10 Legal and other professional fees 10 11 Management fees 11 12 Mortgage interest paid to banks, etc. (see instructions) 12 13 Other interest. 13 14 Repairs. 14 15 Supplies 15 16 Taxes 16 17 Utilities 17 18 Depreciation expense or depletion 18 19 Other (list) 19 20 Total expenses. Add lines 5 through 19 20 21 Subtract line 20 from line 3 (rents) and/or 4 (royalties). If result is a (loss), see instructions to find out if you must file Form 6198 21 22 Deductible rental real estate loss after limitation, if any, on Form 8582 (see instructions) 22 23a Total of all amounts reported on line 3 for all rental properties 23a b Total of all amounts reported on line 4 for all royalty properties 23b c Total of all amounts reported on line 12 for all properties 23c d Total of all amounts reported on line 18 for all properties 23d e Total of all amounts reported on line 20 for all properties 23e 24 Income. Add positive amounts shown on line 21. Do not include any losses 24 25 Losses. Add royalty losses from line 21 and rental real estate losses from line 22. Enter total losses here. 25 26 Total rental real estate and royalty income or (loss). Combine lines 24 and 25. Enter the result here. If Parts II, III, IV, and line 40 on page 2 do not apply to you, also enter this amount on Schedule 1 (Form 1040), line 5. Otherwise, include this amount in the total on line 41 on page 2 For Paperwork Reduction Act Notice see the senarate instructions 26 Schedule E Form 10401 2020 Cat No. 113AAI Name(s) shown on return. Do not enter name and social security number if shown on other side. Your social security number Caution: The IRS compares amounts reported on your tax return with amounts shown on Schedule(s) K-1. Part II Income or Loss From Partnerships and S Corporations - Note: If you report a loss, receive a distribution, dispose of stock, or receive a loan repayment from an Scorporation, you must check the box in column (e) on line 28 and attach the required basis computation. If you report a loss from an at-risk activity for which any amount is not at risk, you must check the box in column (f) on line 28 and attach Form 6198. See instructions. 27 Are you reporting any loss not allowed in a prior year due to the at-risk or basis limitations, a prior year unallowed loss from a passive activity (if that loss was not reported on Form 8582), or unreimbursed partnership expenses? If you answered "Yes," see instructions before completing this section Yes No 28 (b) Enter P for (c) Check it (d) Employer (e) Check if (a) Name partnership: S foreign identification for Scorporation partnership (1) Check if basis computation any amount is is required not at risk number A B D Passive Income and Loss Nonpassive Income and Loss (g) Passive loss allowed (h) Passive income (i) Nonpassive loss allowed 6) Section 179 expense (k) Nonpassive income (attach Form 8582 if required) from Schedule K-1 (see Schedule K-1) deduction from Form 4562 from Schedule K-1 A B D 29a Totals b Totals 30 Add columns (h) and (k) of line 29a. 30 31 Add columns (9), (), and (of line 29b. 31 32 Total partnership and S corporation income or (loss). Combine lines 30 and 31 32 Part III Income or Loss From Estates and Trusts 33 (a) Name (b) Employer identification number A B Passive Income and Loss Nonpassive Income and Loss (c) Passive deduction or loss allowed (d) Passive income le) Deduction or loss (1) Other income from (attach Form 8582 if required) from Schedule K-1 from Schedule K-1 Schedule K-1 A B 34a Totals b Totals 35 Add columns (d) and (f) of line 34a 35 36 Add columns (c) and (e) of line 34b 36 37 Total estate and trust income or (loss). Combine lines 35 and 36 37 Part IV Income or Loss From Real Estate Mortgage Investment Conduits (REMICs) Residual Holder 38 (a) Name (b) Employer identification (c) Excess inclusion from (d) Taxable income (net loss) Schedules Q, line 2c le) Income from number (see instructions) from Schedules Q, line 1b Schedules Q, line 3b 39 40 40 41 39 Combine columns (d) and (e) only. Enter the result here and include in the total on line 41 below Part V Summary Net farm rental income or loss) from Form 4835. Also, complete line 42 below 41 Total income or loss). Combine lines 26, 32, 37, 39, and 40. Enter the result here and on Schedule 1 (For 1040), line 5) 42 Reconciliation of farming and fishing income. Enter your gross farming and fishing income reported on Form 4835, line 7; Schedule K-1 (Form 1065), box 14, code B; Schedule K-1 (Form 1120-S), box 17, code AD; and Schedule K-1 (Form 1041), box 14, code F. See instructions. Reconciliation for real estate professionals. If you were a real estate professional (see instructions), enter the net income or loss) you reported anywhere on Form 1040, Form 1040-SR, or Form 1040-NR from all rental real estate activities in which you materially participated under the passive activity loss rules 42 43 43

Prepare the 2020tax return from the information provided in Tax Return homework problem 58 in the back of Chapter 4. Cecil C. Seymour is a 64-year-old widower. He had income for 2020 as follows: Pension from former employer $39,850 Interest income from Alto National Bank 5,500 Interest income on City of Alto bonds 4,500 Dividends received from IBM stock held for over one year 2,000 Collections on annuity contract he purchased from Great Life Insurance 5,400 Social Security benefits 14,000 Rent income on townhouse 9,000 The cost of the annuity was $46,800, and Cecil was expected to receive a total of 260 monthly payments of $450. Cecil has received 22 payments through 2020. Cecils 40-year-old daughter, Sarah C. Seymour, borrowed $60,000 from Cecil on January 2, 2020. She used the money to start a new business. Cecil does not charge her interest because she could not afford to pay it, but he does expect to collect the principal eventually. Sarah is living with Cecil until the business becomes profitable. Except for housing, Sarah provides her own support from her business and $1,600 in dividends on stocks that she inherited from her mother. Other relevant information is presented below. Expenses on rental townhouse: Utilities $2,800 Maintenance 1,000 Depreciation 2,000 Real estate taxes 750 Insurance 700 State income taxes paid: $3,500 County personal property taxes paid: $3,100 Payments on estimated 2020 Federal income tax: $5,900 Charitable contributions of cash to Alto Baptist Church: $7,400 Federal interest rate: 6% Sales taxes paid: $912 Compute Cecils 2020 Federal income tax payable (or refund due)

Prepare the 2020tax return from the information provided in Tax Return homework problem 58 in the back of Chapter 4. Cecil C. Seymour is a 64-year-old widower. He had income for 2020 as follows: Pension from former employer $39,850 Interest income from Alto National Bank 5,500 Interest income on City of Alto bonds 4,500 Dividends received from IBM stock held for over one year 2,000 Collections on annuity contract he purchased from Great Life Insurance 5,400 Social Security benefits 14,000 Rent income on townhouse 9,000 The cost of the annuity was $46,800, and Cecil was expected to receive a total of 260 monthly payments of $450. Cecil has received 22 payments through 2020. Cecils 40-year-old daughter, Sarah C. Seymour, borrowed $60,000 from Cecil on January 2, 2020. She used the money to start a new business. Cecil does not charge her interest because she could not afford to pay it, but he does expect to collect the principal eventually. Sarah is living with Cecil until the business becomes profitable. Except for housing, Sarah provides her own support from her business and $1,600 in dividends on stocks that she inherited from her mother. Other relevant information is presented below. Expenses on rental townhouse: Utilities $2,800 Maintenance 1,000 Depreciation 2,000 Real estate taxes 750 Insurance 700 State income taxes paid: $3,500 County personal property taxes paid: $3,100 Payments on estimated 2020 Federal income tax: $5,900 Charitable contributions of cash to Alto Baptist Church: $7,400 Federal interest rate: 6% Sales taxes paid: $912 Compute Cecils 2020 Federal income tax payable (or refund due)