Answered step by step

Verified Expert Solution

Question

1 Approved Answer

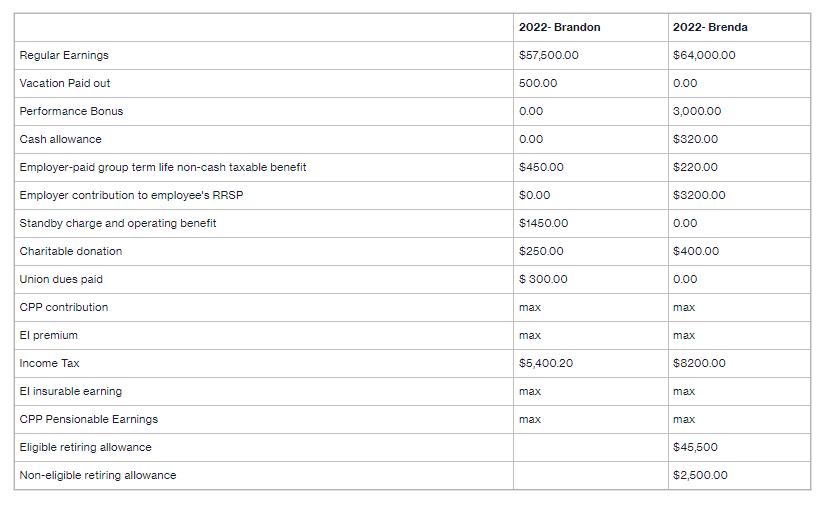

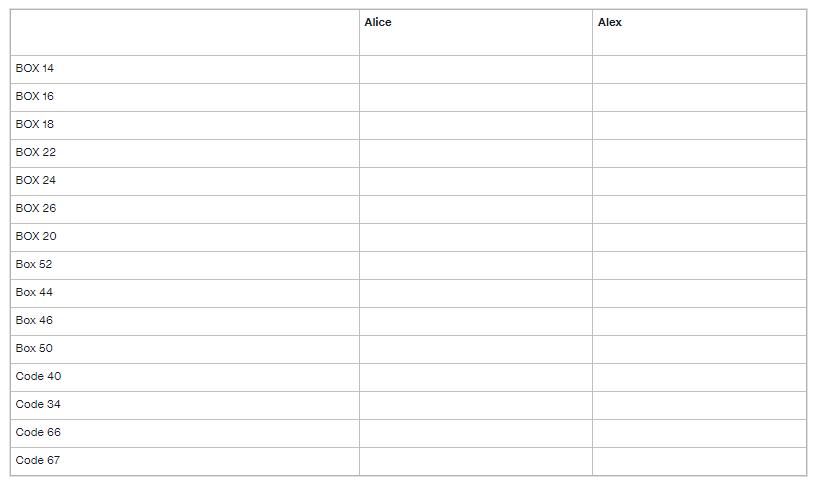

Prepare the 2022 T4 for the following: 2. Prepare the Record of Employment for two Employees Regular Earnings Overtime paid out Employer-paid group term life

- Prepare the 2022 T4 for the following:

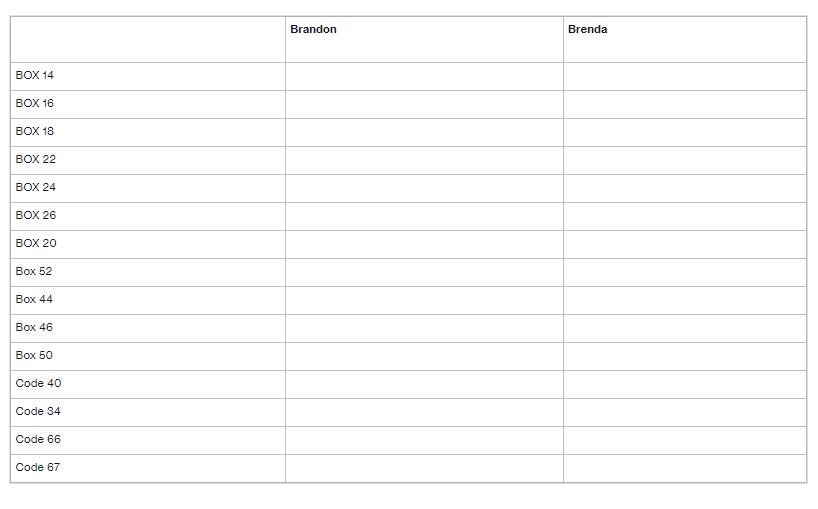

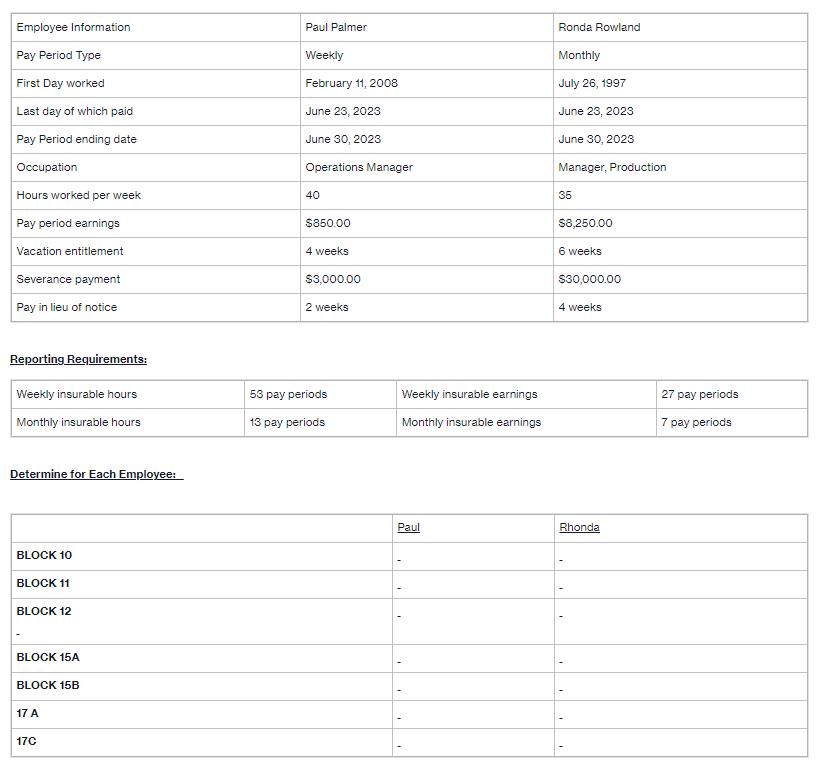

2. Prepare the Record of Employment for two Employees

Regular Earnings Overtime paid out Employer-paid group term life non-cash taxable benefit Cash allowance Standby charge and operating benefit Union dues paid Charitable donation CPP contribution El premium Income Tax El insurable earning CPP Pensionable Earnings RPP contributions employee paid # 2345678 RPP contributions employer paid #2345678 2022- Alice $75,000.00 $1000.00 $450.00 $530.00 0.00 $350.00 0.00 max max $6,685.20 max max $ 800.00 $ 800.00 2022- Alex $84,000.00 $320.00 $400.00 $420.00 0.00 $520.00 max max $7200.00 max max $1550.00 $1550.00

Step by Step Solution

★★★★★

3.54 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Paul Palmer and Ronda Rowland are two employees Ill assist you in filling up the necessary fields in ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started