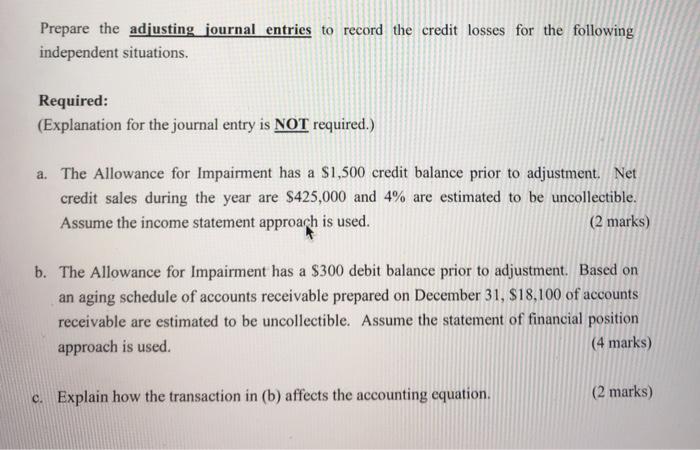

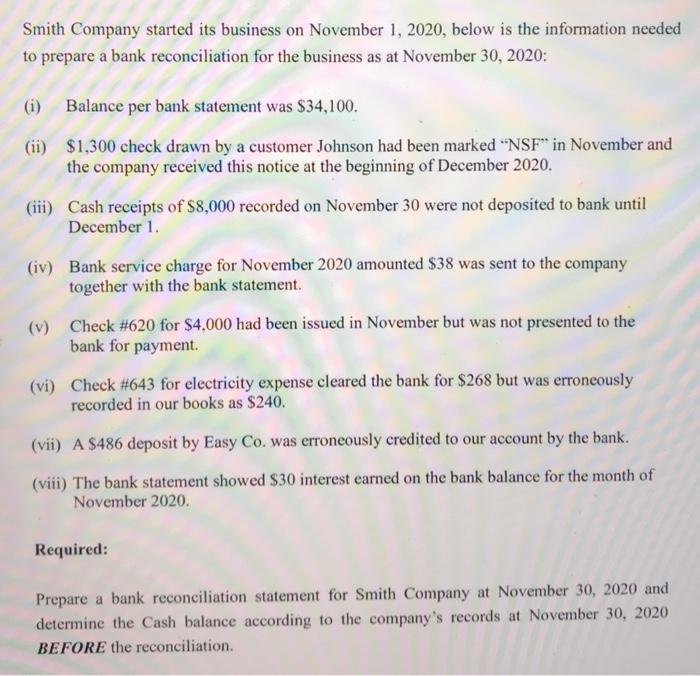

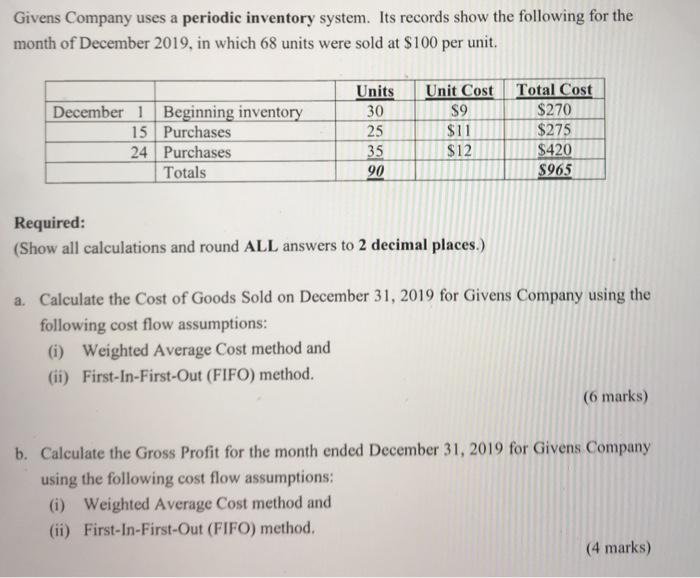

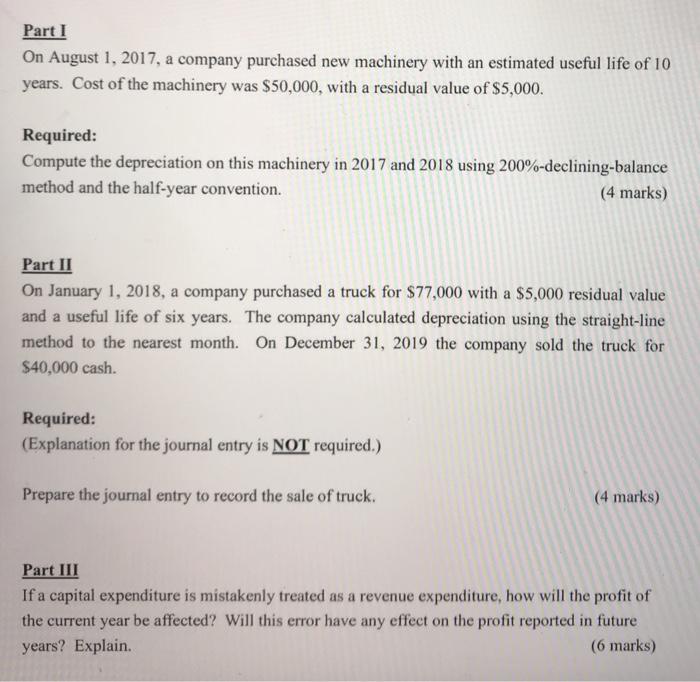

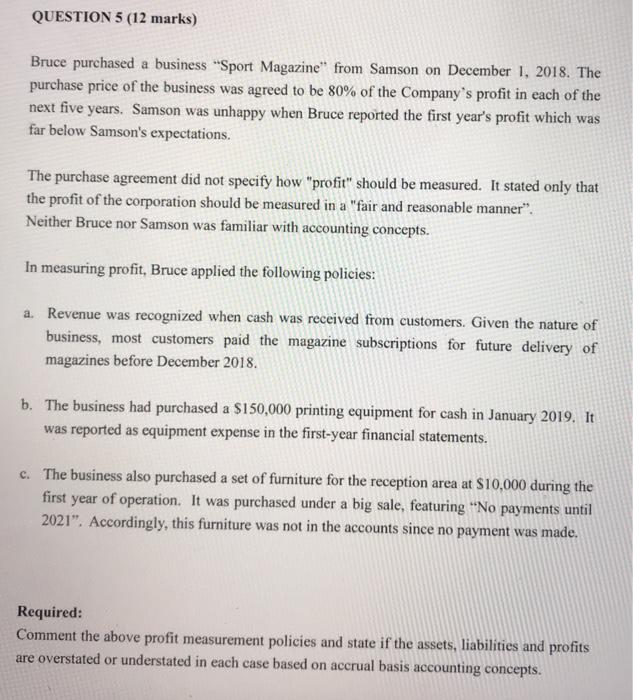

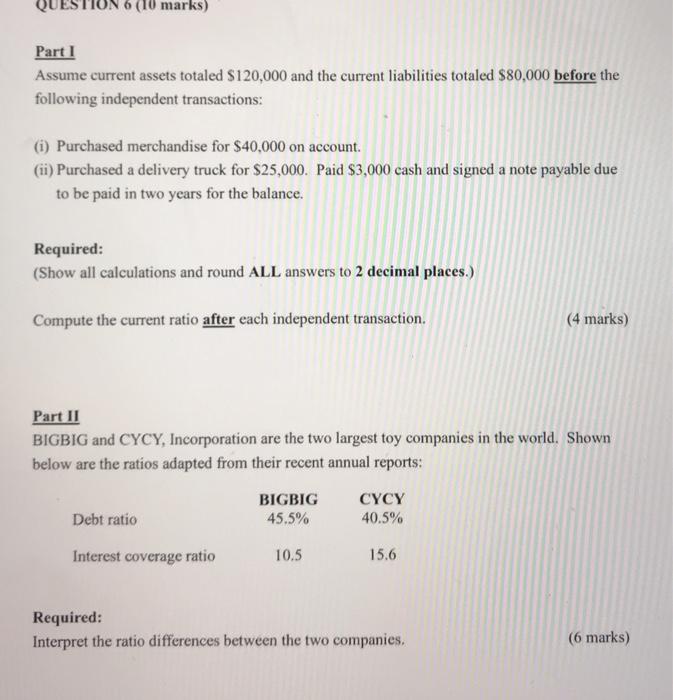

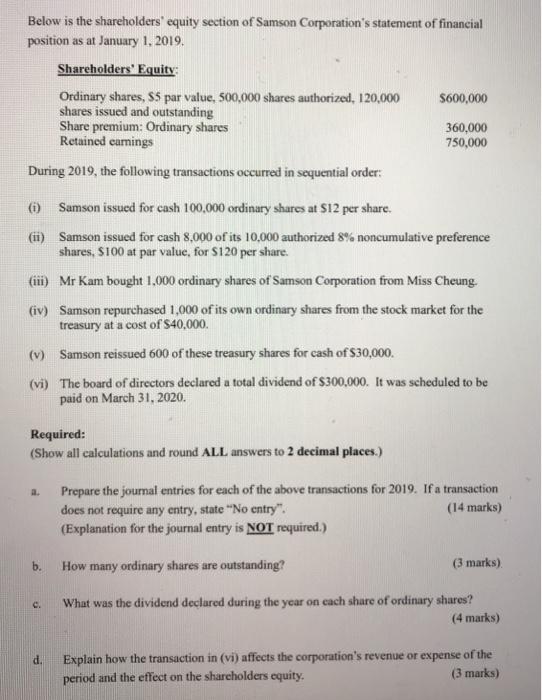

Prepare the adjusting journal entries to record the credit losses for the following independent situations Required: (Explanation for the journal entry is NOT required.) a. The Allowance for Impairment has a $1,500 credit balance prior to adjustment. Net credit sales during the year are $425,000 and 4% are estimated to be uncollectible. Assume the income statement approach is used. (2 marks) b. The Allowance for Impairment has a $300 debit balance prior to adjustment. Based on an aging schedule of accounts receivable prepared on December 31, $18,100 of accounts receivable are estimated to be uncollectible. Assume the statement of financial position approach is used. (4 marks) c. Explain how the transaction in (b) affects the accounting equation. (2 marks) Smith Company started its business on November 1, 2020, below is the information needed to prepare a bank reconciliation for the business as at November 30, 2020: (i) Balance per bank statement was $34,100. (ii) $1,300 check drawn by a customer Johnson had been marked "NSF" in November and the company received this notice at the beginning of December 2020. (iii) Cash receipts of $8,000 recorded on November 30 were not deposited to bank until December 1. (iv) Bank service charge for November 2020 amounted $38 was sent to the company together with the bank statement. (v) Check #620 for $4,000 had been issued in November but was not presented to the bank for payment. (vi) Check #643 for electricity expense cleared the bank for $268 but was erroneously recorded in our books as $240. (vii) A $486 deposit by Easy Co. was erroneously credited to our account by the bank. (viii) The bank statement showed $30 interest earned on the bank balance for the month of November 2020 Required: Prepare a bank reconciliation statement for Smith Company at November 30, 2020 and determine the Cash balance according to the company's records at November 30, 2020 BEFORE the reconciliation Givens Company uses a periodic inventory system. Its records show the following for the month of December 2019, in which 68 units were sold at $100 per unit. December 1 Beginning inventory 15 Purchases 24 Purchases Totals Units 30 25 35 90 Unit Cost S9 $11 $12 Total Cost $270 $275 $420 $965 Required: (Show all calculations and round ALL answers to 2 decimal places.) a. Calculate the cost of Goods Sold on December 31, 2019 for Givens Company using the following cost flow assumptions: (i) Weighted Average Cost method and (ii) First-In-First-Out (FIFO) method. (6 marks) b. Calculate the Gross Profit for the month ended December 31, 2019 for Givens Company using the following cost flow assumptions: (i) Weighted Average Cost method and (ii) First-In-First-Out (FIFO) method. (4 marks) Part I On August 1, 2017, a company purchased new machinery with an estimated useful life of 10 years. Cost of the machinery was $50,000, with a residual value of $5,000. Required: Compute the depreciation on this machinery in 2017 and 2018 using 200%-declining-balance method and the half-year convention. (4 marks) Part II On January 1, 2018, a company purchased a truck for $77,000 with a $5,000 residual value and a useful life of six years. The company calculated depreciation using the straight-line method to the nearest month. On December 31, 2019 the company sold the truck for $40,000 cash. Required: (Explanation for the journal entry is NOT required.) Prepare the journal entry to record the sale of truck. (4 marks) Part III If a capital expenditure is mistakenly treated as a revenue expenditure, how will the profit of the current year be affected? Will this error have any effect on the profit reported in future years? Explain. (6 marks) QUESTION 5 (12 marks) Bruce purchased a business Sport Magazine" from Samson on December 1, 2018. The purchase price of the business was agreed to be 80% of the Company's profit in each of the next five years. Samson was unhappy when Bruce reported the first year's profit which was far below Samson's expectations. The purchase agreement did not specify how "profit" should be measured. It stated only that the profit of the corporation should be measured in a "fair and reasonable manner". Neither Bruce nor Samson was familiar with accounting concepts. In measuring profit, Bruce applied the following policies: a. Revenue was recognized when cash was received from customers. Given the nature of business, most customers paid the magazine subscriptions for future delivery of magazines before December 2018, b. The business had purchased a $150,000 printing equipment for cash in January 2019. It was reported as equipment expense in the first-year financial statements. c. The business also purchased a set of furniture for the reception area at $10,000 during the first year of operation. It was purchased under a big sale, featuring "No payments until 2021". Accordingly, this furniture was not in the accounts since no payment was made. Required: Comment the above profit measurement policies and state the assets, liabilities and profits are overstated or understated in each case based on accrual basis accounting concepts. QUESTION 6 (10 marks) Part 1 Assume current assets totaled $120,000 and the current liabilities totaled $80,000 before the following independent transactions: (1) Purchased merchandise for $40,000 on account. (ii) Purchased a delivery truck for $25,000. Paid $3,000 cash and signed a note payable due to be paid in two years for the balance. Required: (Show all calculations and round ALL answers to 2 decimal places.) Compute the current ratio after each independent transaction. (4 marks) Part II BIGBIG and CYCY, Incorporation are the two largest toy companies in the world. Shown below are the ratios adapted from their recent annual reports: BIGBIG 45.5% CYCY 40.5% Debt ratio Interest coverage ratio 10.5 15.6 Required: Interpret the ratio differences between the two companies. (6 marks) Below is the shareholders' equity section of Samson Corporation's statement of financial position as at January 1, 2019. Shareholders' Equity Ordinary shares, SS par value, 500,000 shares authorized, 120,000 $600,000 shares issued and outstanding Share premium: Ordinary shares 360,000 Retained cumings 750,000 During 2019, the following transactions occurred in sequential order: () Samson issued for cash 100,000 ordinary shares at $12 per share. (11) Samson issued for cash 8,000 of its 10,000 authorized 8% noncumulative preference shares, $100 at par value, for S120 per share. (iii) Mr Kam bought 1.000 ordinary shares of Samson Corporation from Miss Cheung. (iv) Samson repurchased 1,000 of its own ordinary shares from the stock market for the treasury at a cost of $40,000. (v) Samson reissued 600 of these treasury shares for cash of $30,000. (vi) The board of directors declared a total dividend of $300,000. It was scheduled to be paid on March 31, 2020. Required: (Show all calculations and round ALL answers to 2 decimal places.) Prepare the journal entries for each of the above transactions for 2019. If a transaction does not require any entry, state "No entry". (14 marks) (Explanation for the journal entry is NOT required.) b. How many ordinary shares are outstanding? (3 marks) c. What was the dividend declared during the year on each share of ordinary shares? (4 marks) d. Explain how the transaction in (vi) affects the corporation's revenue or expense of the period and the effect on the shareholders equity