Answered step by step

Verified Expert Solution

Question

1 Approved Answer

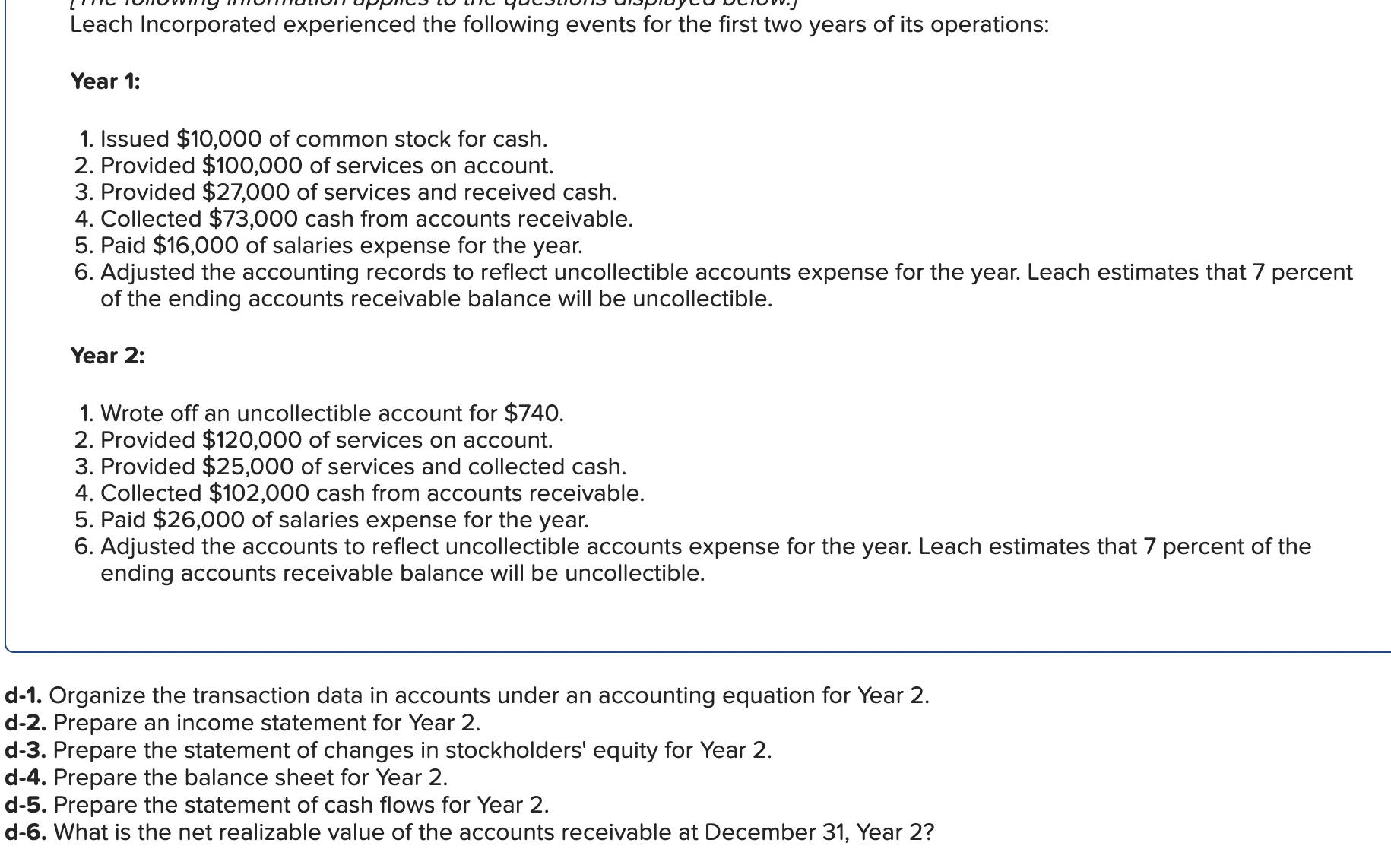

Prepare the balance sheet for Year 2 . begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} hline multicolumn{11}{|c|}{ LEACH INCORPORATED } hline multicolumn{11}{|c|}{ Accounting Equation for Year 2} hline multirow[b]{2}{*}{

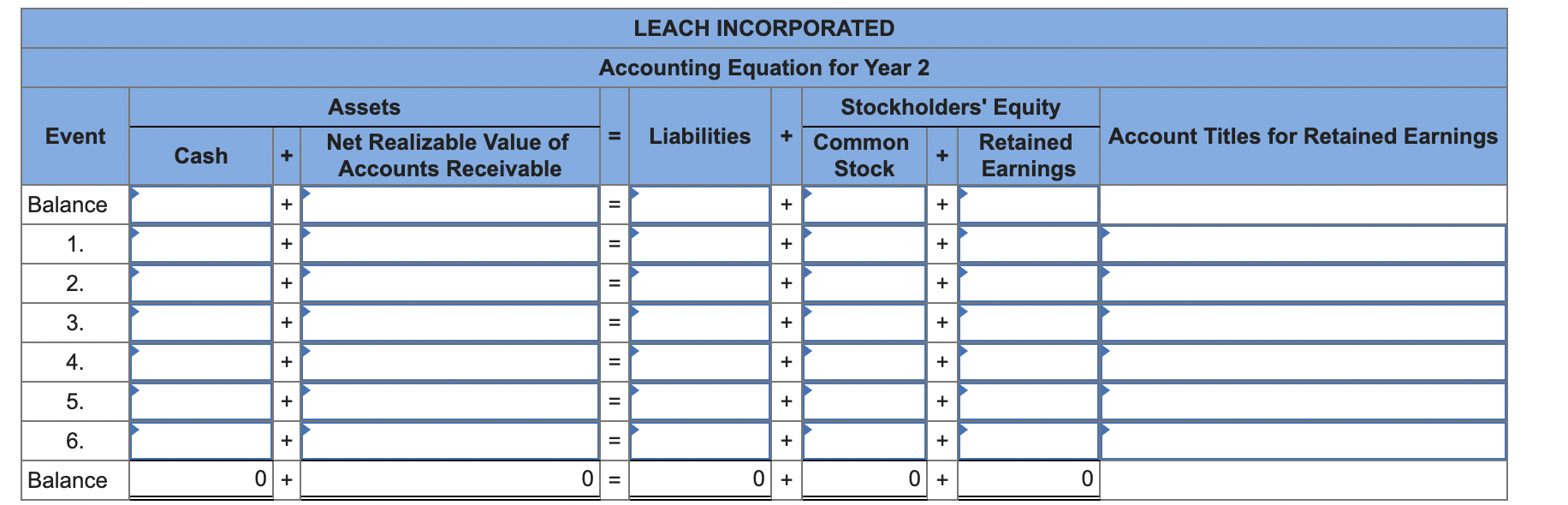

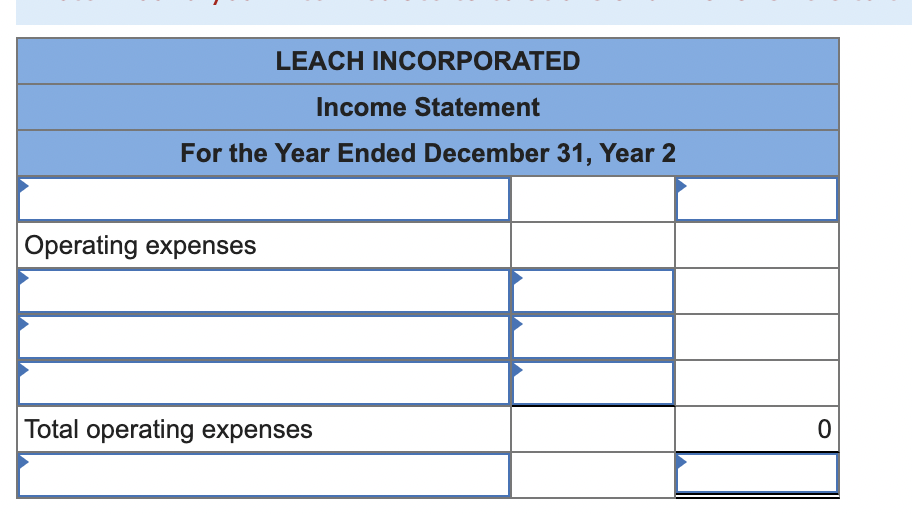

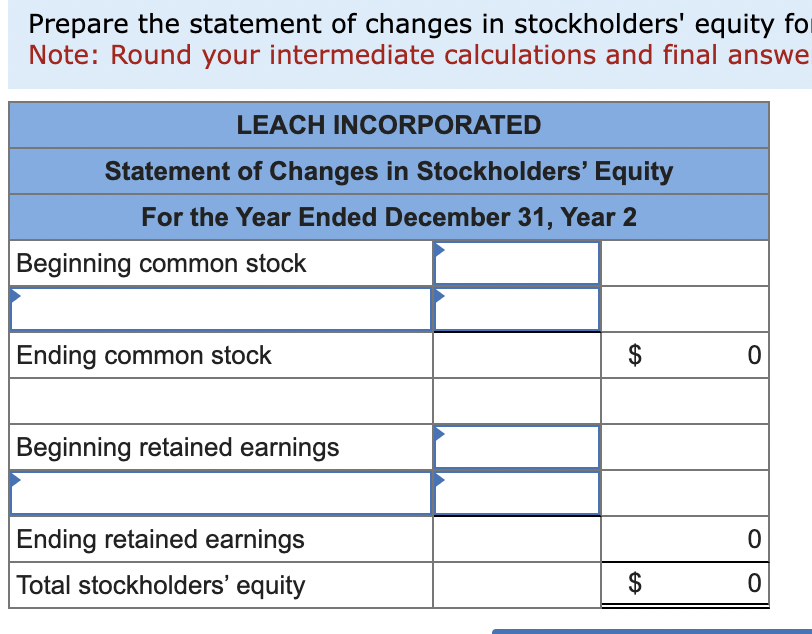

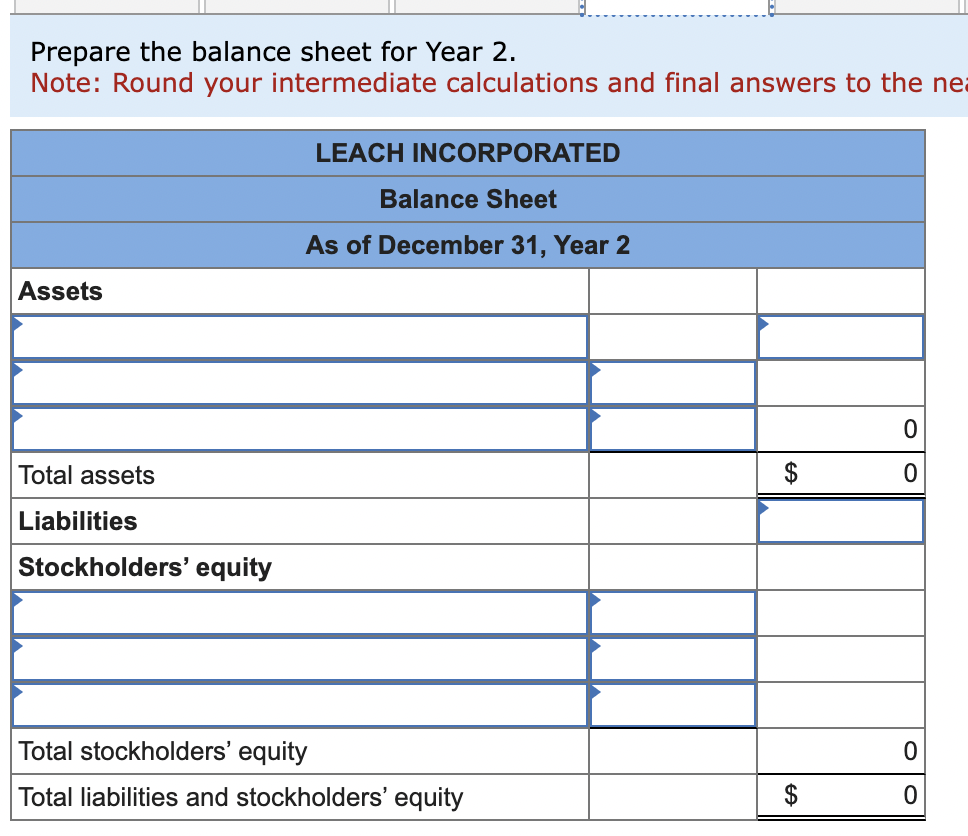

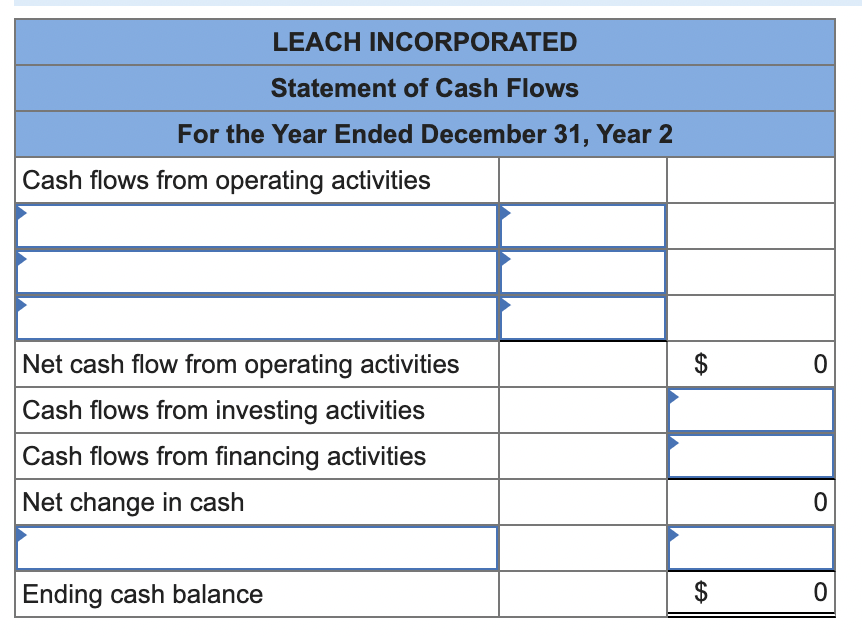

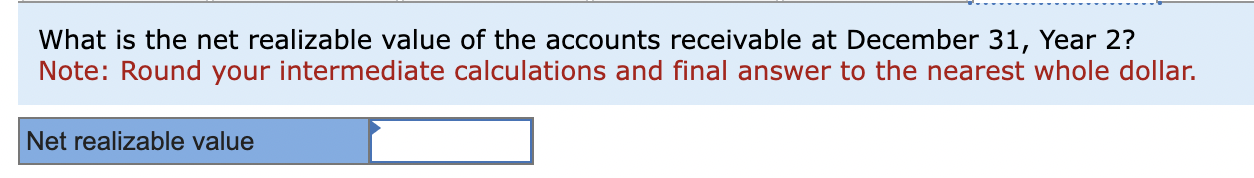

Prepare the balance sheet for Year 2 . \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{11}{|c|}{ LEACH INCORPORATED } \\ \hline \multicolumn{11}{|c|}{ Accounting Equation for Year 2} \\ \hline \multirow[b]{2}{*}{ Event } & \multicolumn{3}{|r|}{ Assets } & \multirow[b]{2}{*}{=} & \multirow[b]{2}{*}{ Liabilities } & \multirow[b]{2}{*}{+} & \multicolumn{3}{|c|}{ Stockholders' Equity } & \multirow[b]{2}{*}{ Account Titles for Retained Earnings } \\ \hline & Cash & + & \begin{tabular}{c} Net Realizable Value of \\ Accounts Receivable \end{tabular} & & & & \begin{tabular}{l} Common \\ Stock \end{tabular} & + & \begin{tabular}{l} Retained \\ Earnings \end{tabular} & \\ \hline Balance & & + & & = & & + & & + & & \\ \hline 1. & & + & & = & & + & & + & & \\ \hline 2. & & + & & = & & + & & + & & \\ \hline 3. & & + & & = & & + & & + & & \\ \hline 4. & & + & & = & & + & & + & & \\ \hline 5. & & + & & = & & + & & + & & \\ \hline 6. & & + & & = & & + & & + & & \\ \hline Balance & 0 & + & 0 & = & 0 & + & 0 & + & 0 & \\ \hline \end{tabular} Prepare the statement of changes in stockholders' equity fo Note. Round vour intermediate calculatinnc and final ancive \begin{tabular}{|l|l|l|} \hline \multicolumn{2}{|c|}{ SEACH INCORPORATED } \\ \hline \multicolumn{2}{|c|}{ For the Year Ended December 31, Year 2} \\ \hline Cash flows from operating activities & & \\ \hline & & \\ \hline & & \\ \hline Net cash flow from operating activities & & \\ \hline Cash flows from investing activities & & \\ \hline Cash flows from financing activities & & \\ \hline Net change in cash & & \\ \hline & & \\ \hline Ending cash balance & & $ \\ \hline \end{tabular} Leach Incorporated experienced the following events for the first two years of its operations: Year 1: 1. Issued $10,000 of common stock for cash. 2. Provided $100,000 of services on account. 3. Provided $27,000 of services and received cash. 4. Collected $73,000 cash from accounts receivable. 5. Paid $16,000 of salaries expense for the year. 6. Adjusted the accounting records to reflect uncollectible accounts expense for the year. Leach estimates that 7 percent of the ending accounts receivable balance will be uncollectible. Year 2: 1. Wrote off an uncollectible account for $740. 2. Provided $120,000 of services on account. 3. Provided $25,000 of services and collected cash. 4. Collected $102,000 cash from accounts receivable. 5. Paid $26,000 of salaries expense for the year. 6. Adjusted the accounts to reflect uncollectible accounts expense for the year. Leach estimates that 7 percent of the ending accounts receivable balance will be uncollectible. d-1. Organize the transaction data in accounts under an accounting equation for Year 2. d-2. Prepare an income statement for Year 2. d-3. Prepare the statement of changes in stockholders' equity for Year 2. d-4. Prepare the balance sheet for Year 2. d-5. Prepare the statement of cash flows for Year 2. d-6. What is the net realizable value of the accounts receivable at December 31, Year 2 ? What is the net realizable value of the accounts receivable at December 31, Year 2 ? Note: Round your intermediate calculations and final answer to the nearest whole dollar

Prepare the balance sheet for Year 2 . \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{11}{|c|}{ LEACH INCORPORATED } \\ \hline \multicolumn{11}{|c|}{ Accounting Equation for Year 2} \\ \hline \multirow[b]{2}{*}{ Event } & \multicolumn{3}{|r|}{ Assets } & \multirow[b]{2}{*}{=} & \multirow[b]{2}{*}{ Liabilities } & \multirow[b]{2}{*}{+} & \multicolumn{3}{|c|}{ Stockholders' Equity } & \multirow[b]{2}{*}{ Account Titles for Retained Earnings } \\ \hline & Cash & + & \begin{tabular}{c} Net Realizable Value of \\ Accounts Receivable \end{tabular} & & & & \begin{tabular}{l} Common \\ Stock \end{tabular} & + & \begin{tabular}{l} Retained \\ Earnings \end{tabular} & \\ \hline Balance & & + & & = & & + & & + & & \\ \hline 1. & & + & & = & & + & & + & & \\ \hline 2. & & + & & = & & + & & + & & \\ \hline 3. & & + & & = & & + & & + & & \\ \hline 4. & & + & & = & & + & & + & & \\ \hline 5. & & + & & = & & + & & + & & \\ \hline 6. & & + & & = & & + & & + & & \\ \hline Balance & 0 & + & 0 & = & 0 & + & 0 & + & 0 & \\ \hline \end{tabular} Prepare the statement of changes in stockholders' equity fo Note. Round vour intermediate calculatinnc and final ancive \begin{tabular}{|l|l|l|} \hline \multicolumn{2}{|c|}{ SEACH INCORPORATED } \\ \hline \multicolumn{2}{|c|}{ For the Year Ended December 31, Year 2} \\ \hline Cash flows from operating activities & & \\ \hline & & \\ \hline & & \\ \hline Net cash flow from operating activities & & \\ \hline Cash flows from investing activities & & \\ \hline Cash flows from financing activities & & \\ \hline Net change in cash & & \\ \hline & & \\ \hline Ending cash balance & & $ \\ \hline \end{tabular} Leach Incorporated experienced the following events for the first two years of its operations: Year 1: 1. Issued $10,000 of common stock for cash. 2. Provided $100,000 of services on account. 3. Provided $27,000 of services and received cash. 4. Collected $73,000 cash from accounts receivable. 5. Paid $16,000 of salaries expense for the year. 6. Adjusted the accounting records to reflect uncollectible accounts expense for the year. Leach estimates that 7 percent of the ending accounts receivable balance will be uncollectible. Year 2: 1. Wrote off an uncollectible account for $740. 2. Provided $120,000 of services on account. 3. Provided $25,000 of services and collected cash. 4. Collected $102,000 cash from accounts receivable. 5. Paid $26,000 of salaries expense for the year. 6. Adjusted the accounts to reflect uncollectible accounts expense for the year. Leach estimates that 7 percent of the ending accounts receivable balance will be uncollectible. d-1. Organize the transaction data in accounts under an accounting equation for Year 2. d-2. Prepare an income statement for Year 2. d-3. Prepare the statement of changes in stockholders' equity for Year 2. d-4. Prepare the balance sheet for Year 2. d-5. Prepare the statement of cash flows for Year 2. d-6. What is the net realizable value of the accounts receivable at December 31, Year 2 ? What is the net realizable value of the accounts receivable at December 31, Year 2 ? Note: Round your intermediate calculations and final answer to the nearest whole dollar Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started