Prepare the Balance Sheet using the report form.

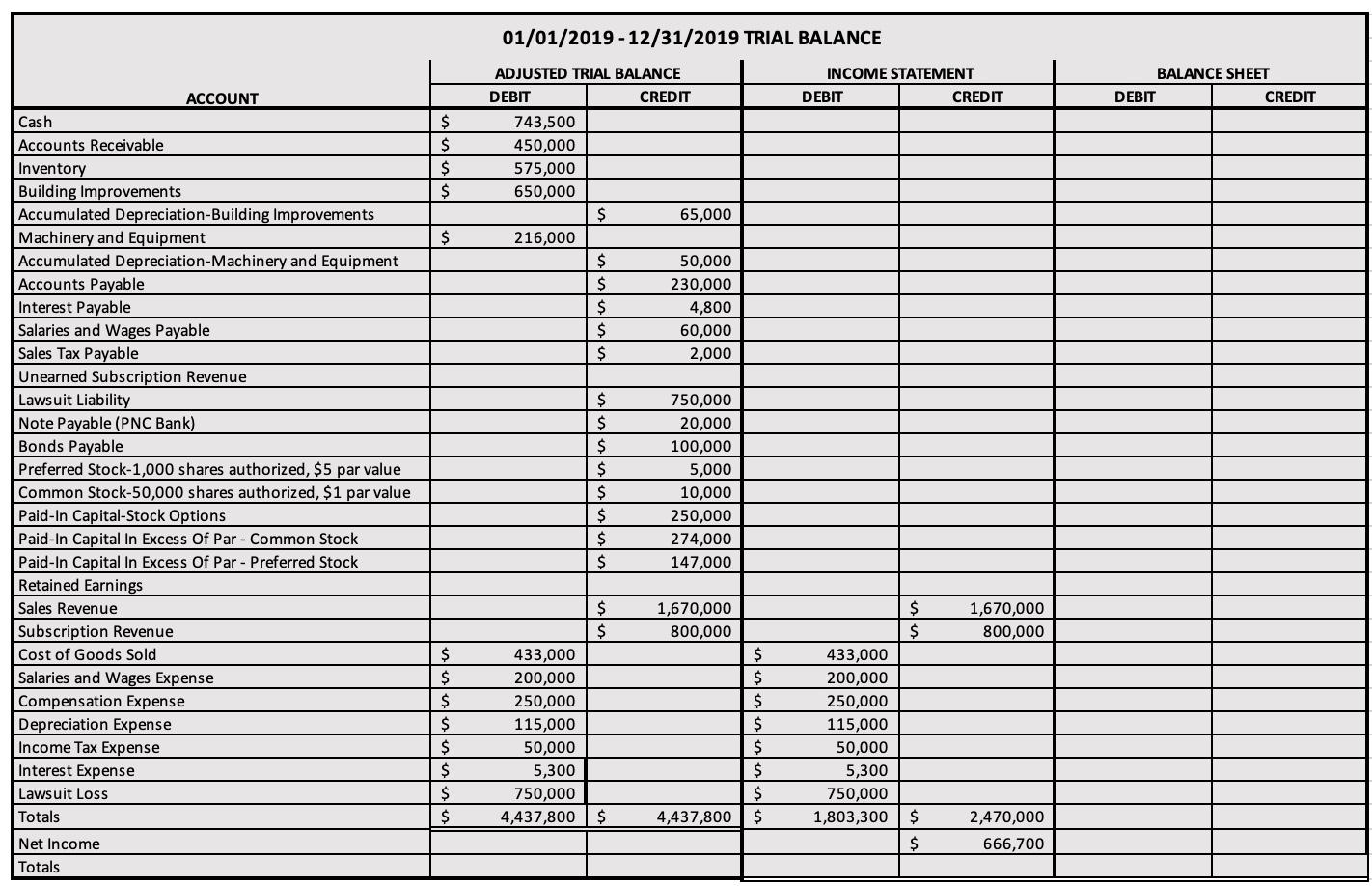

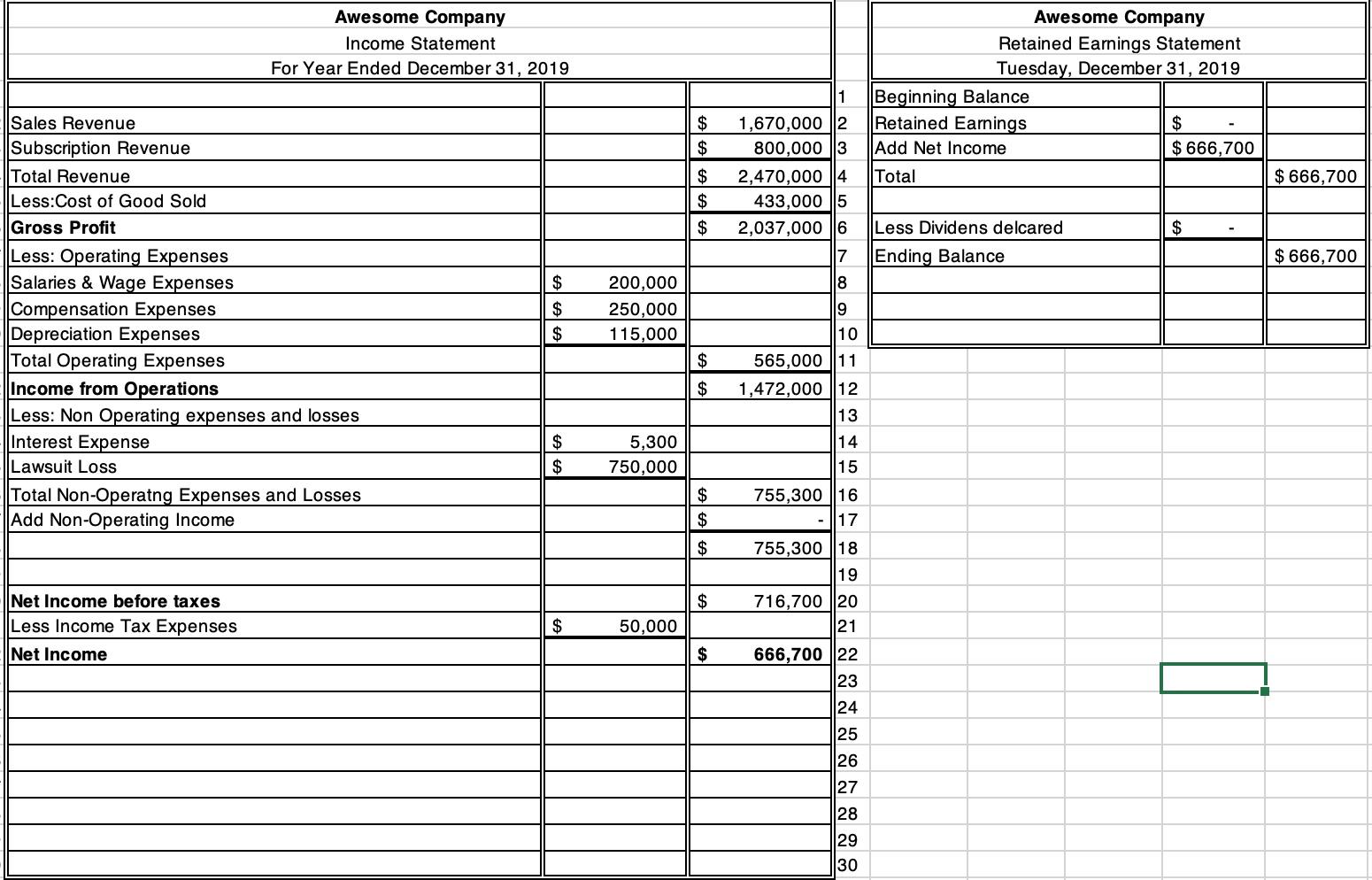

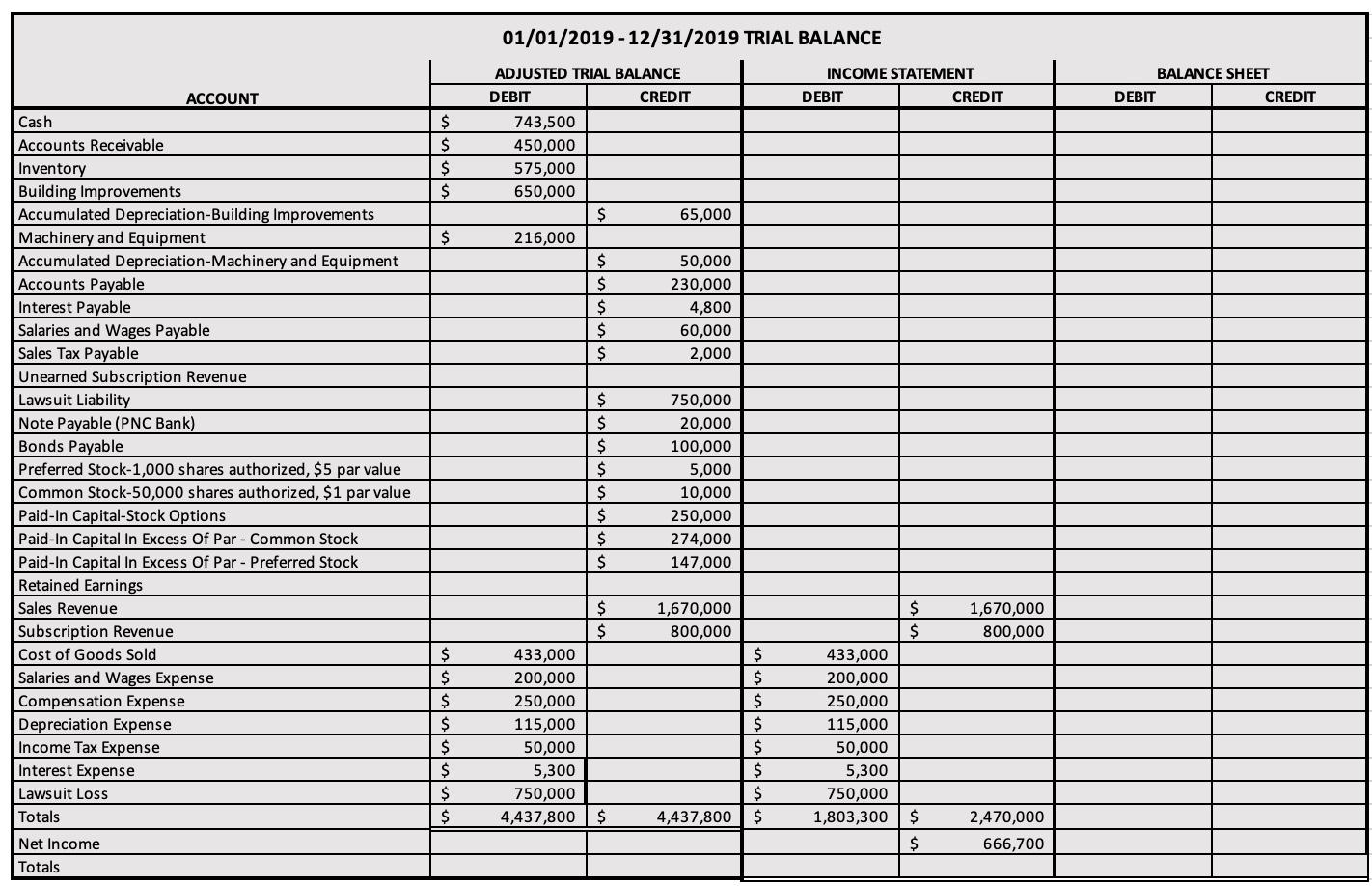

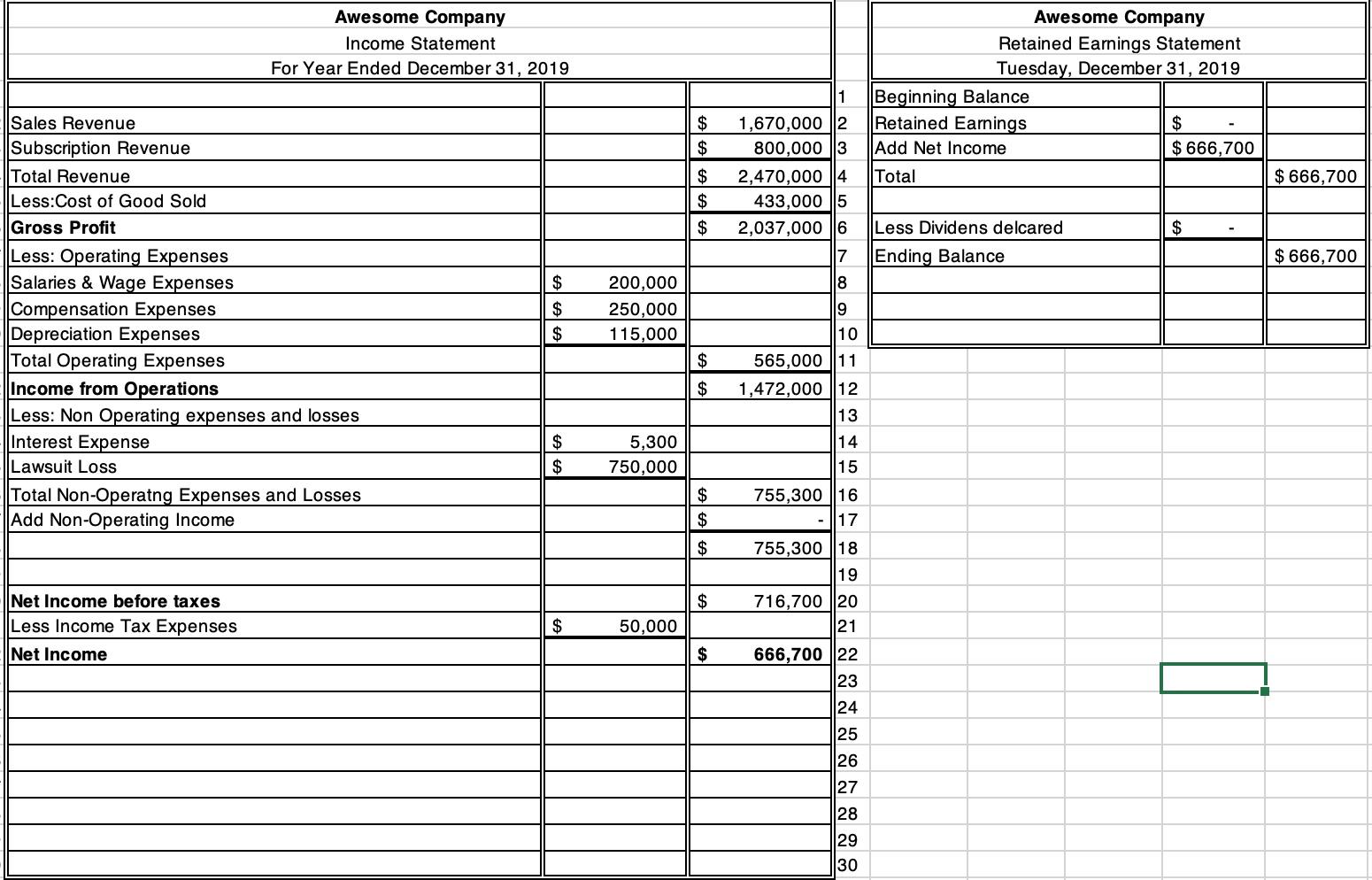

Awesome Company Balance Sheet Assets Liabilities and Stockholders' Equity 01/01/2019 - 12/31/2019 TRIAL BALANCE INCOME STATEMENT DEBIT CREDIT BALANCE SHEET DEBIT CREDIT $ $ $ $ ADJUSTED TRIAL BALANCE DEBIT CREDIT 743,500 450,000 575,000 650,000 $ 65,000 216,000 $ 50,000 $ 230,000 $ $ 4,800 $ 60,000 $ 2,000 $ ACCOUNT Cash Accounts Receivable Inventory Building Improvements Accumulated Depreciation-Building Improvements Machinery and Equipment Accumulated Depreciation Machinery and Equipment Accounts Payable Interest Payable Salaries and Wages Payable Sales Tax Payable Unearned Subscription Revenue Lawsuit Liability Note Payable (PNC Bank) Bonds Payable Preferred Stock-1,000 shares authorized, $5 par value Common Stock-50,000 shares authorized, $1 par value Paid-In Capital-Stock Options Paid-In Capital In Excess Of Par - Common Stock Paid-In Capital In Excess Of Par - Preferred Stock Retained Earnings Sales Revenue Subscription Revenue Cost of Goods Sold Salaries and Wages Expense Compensation Expense Depreciation Expense Income Tax Expense Interest Expense Lawsuit Loss Totals Net Income Totals $ $ $ $ $ $ $ $ 750,000 20,000 100,000 5,000 10,000 250,000 274,000 147,000 1,670,000 800,000 $ $ $ $ $ $ $ $ $ $ 433,000 200,000 250,000 115,000 50,000 5,300 750,000 4,437,800 $ 1,670,000 800,000 $ $ $ $ $ $ $ 4,437,800 $ $ $ 433,000 200,000 250,000 115,000 50,000 5,300 750,000 1,803,300 $ $ 2,470,000 666,700 Awesome Company Income Statement For Year Ended December 31, 2019 1 Awesome Company Retained Earnings Statement Tuesday, December 31, 2019 Beginning Balance Retained Earnings $ Add Net Income $ 666,700 Total $ $ $ $ 666,700 $ 1,670,000 2 800,000 3 2,470,000 4 433,000 15 2,037,000 6 17 18 $ $ Less Dividens delcared Ending Balance $ 666,700 $ Sales Revenue Subscription Revenue Total Revenue Less:Cost of Good Sold Gross Profit Less: Operating Expenses Salaries & Wage Expenses Compensation Expenses Depreciation Expenses Total Operating Expenses Income from Operations Less: Non Operating expenses and losses Interest Expense Lawsuit Loss Total Non-Operatng Expenses and Losses Add Non-Operating Income $ $ 200,000 250,000 115,000 $ 19 10 565,000 11 1,472,000 12 13 $ $ $ 5,300 750,000 14 15 $ $ $ $ Net Income before taxes Less Income Tax Expenses Net Income $ 50,000 $ 755,300 || 16 17 755,300 ||18 19 716,700 20 21 666,700 22 23 24 25 26 27 28 29 30