Answered step by step

Verified Expert Solution

Question

1 Approved Answer

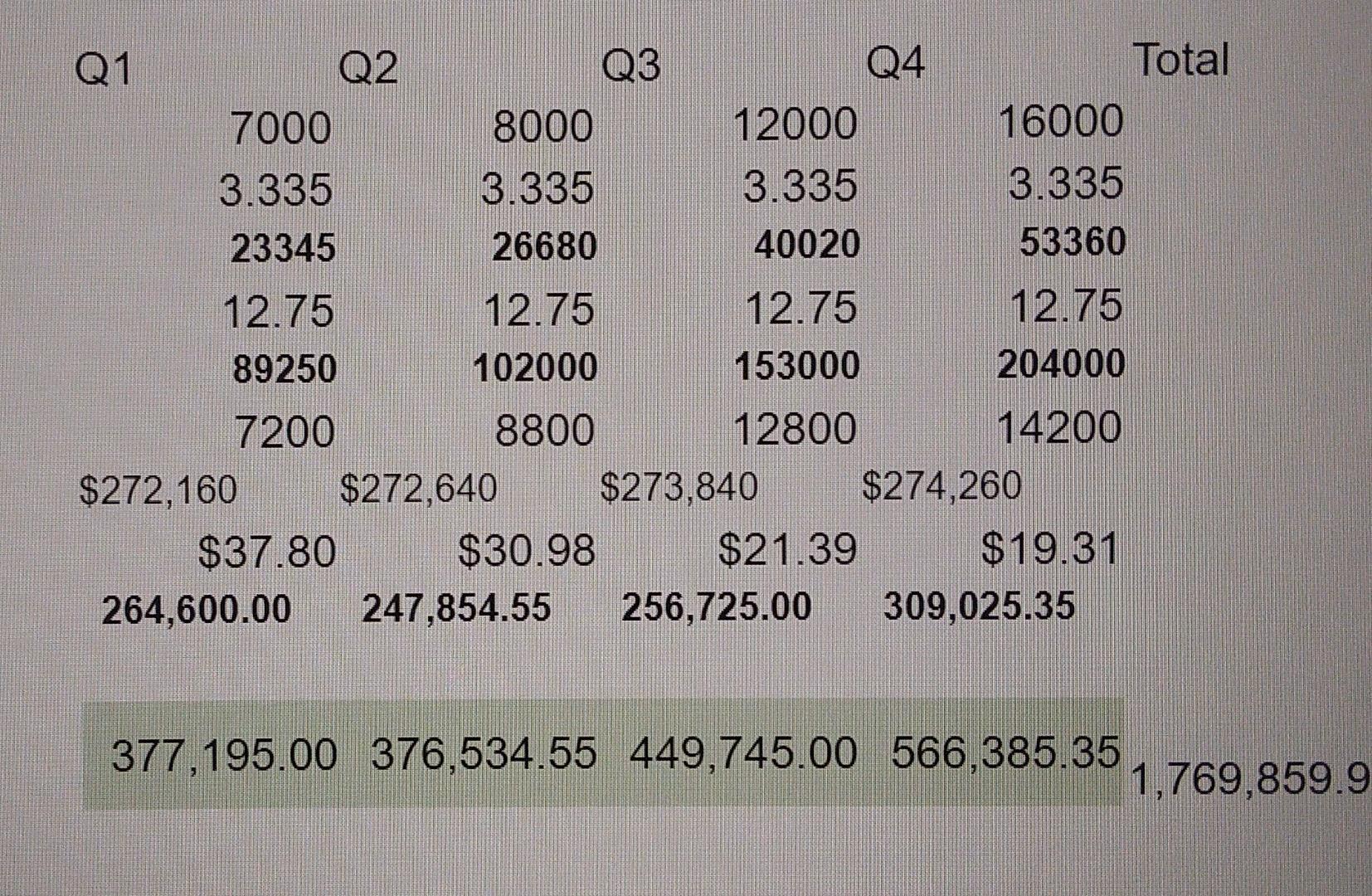

prepare the cash budget for the four quarters with the information given. can you please tell me what other information is needed? AutoSave on H

prepare the cash budget for the four quarters with the information given.

can you please tell me what other information is needed?

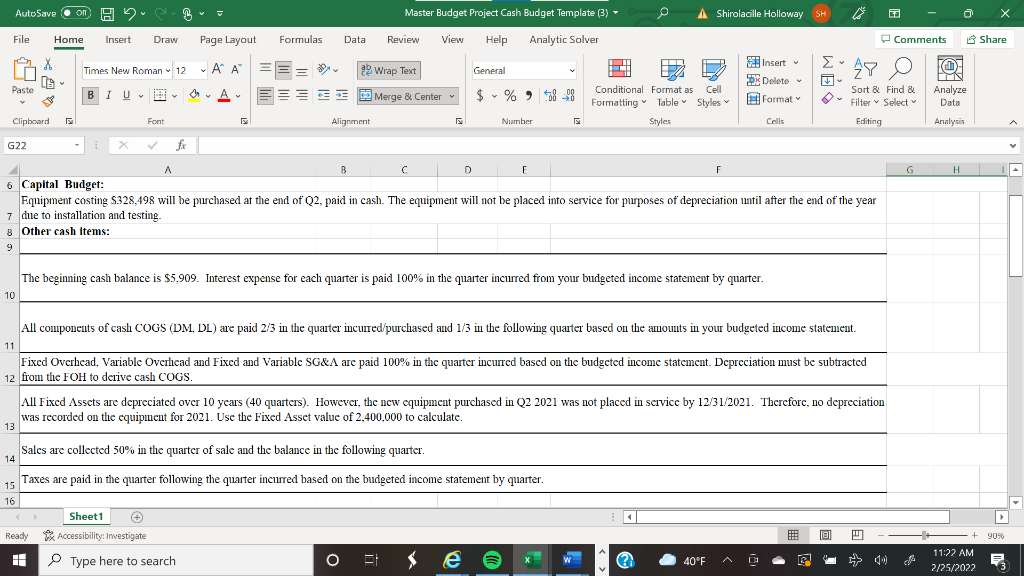

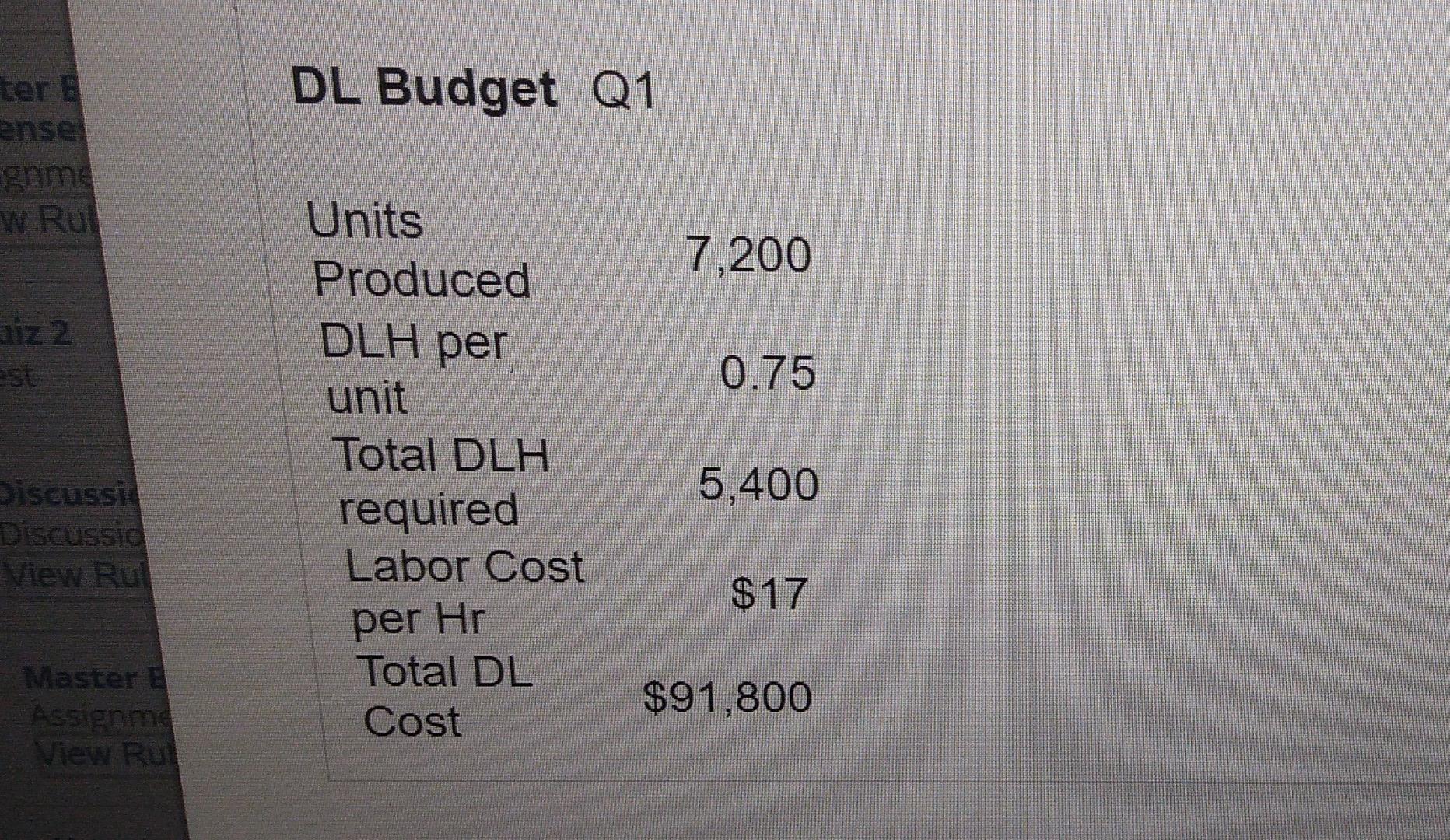

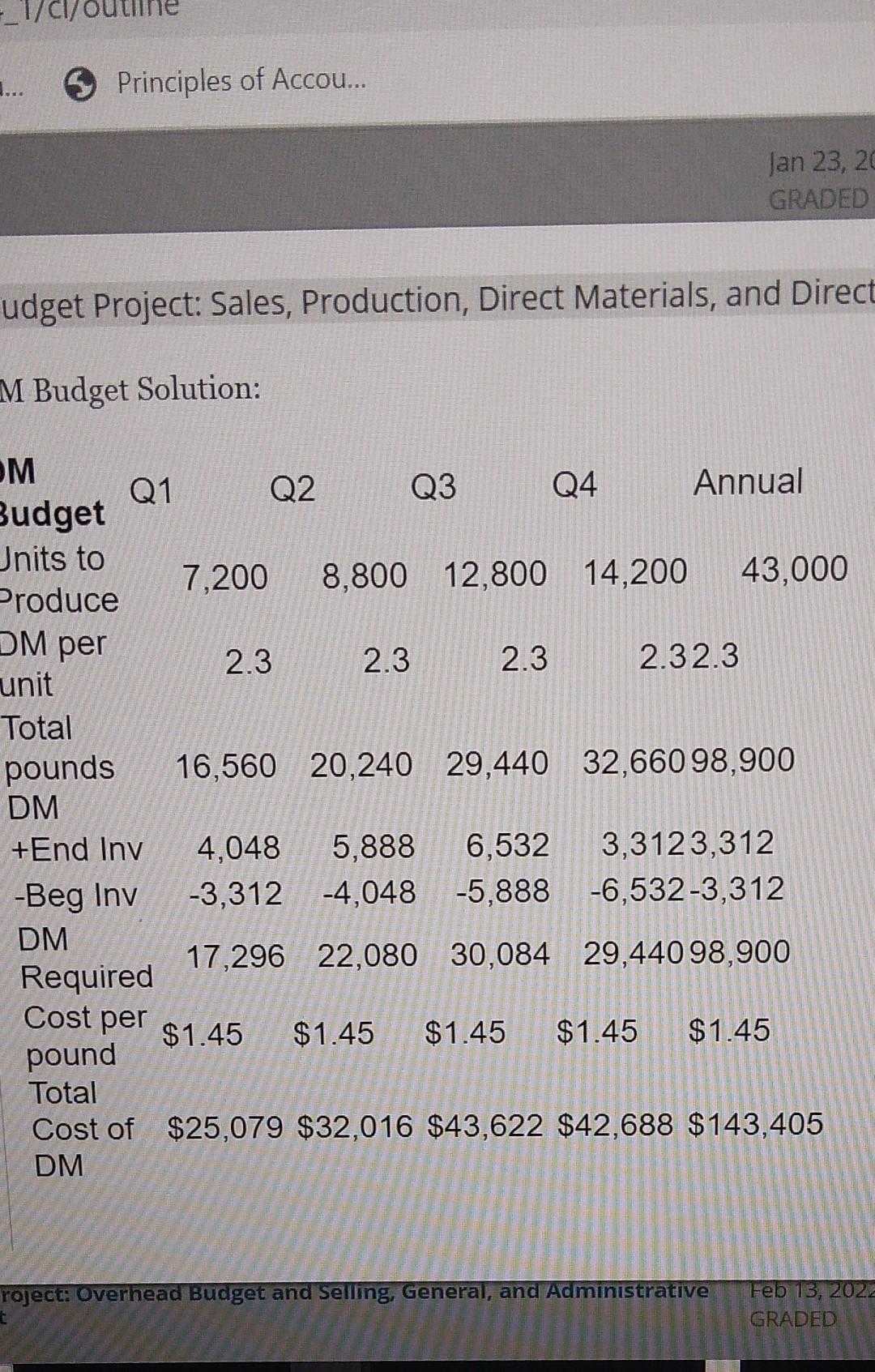

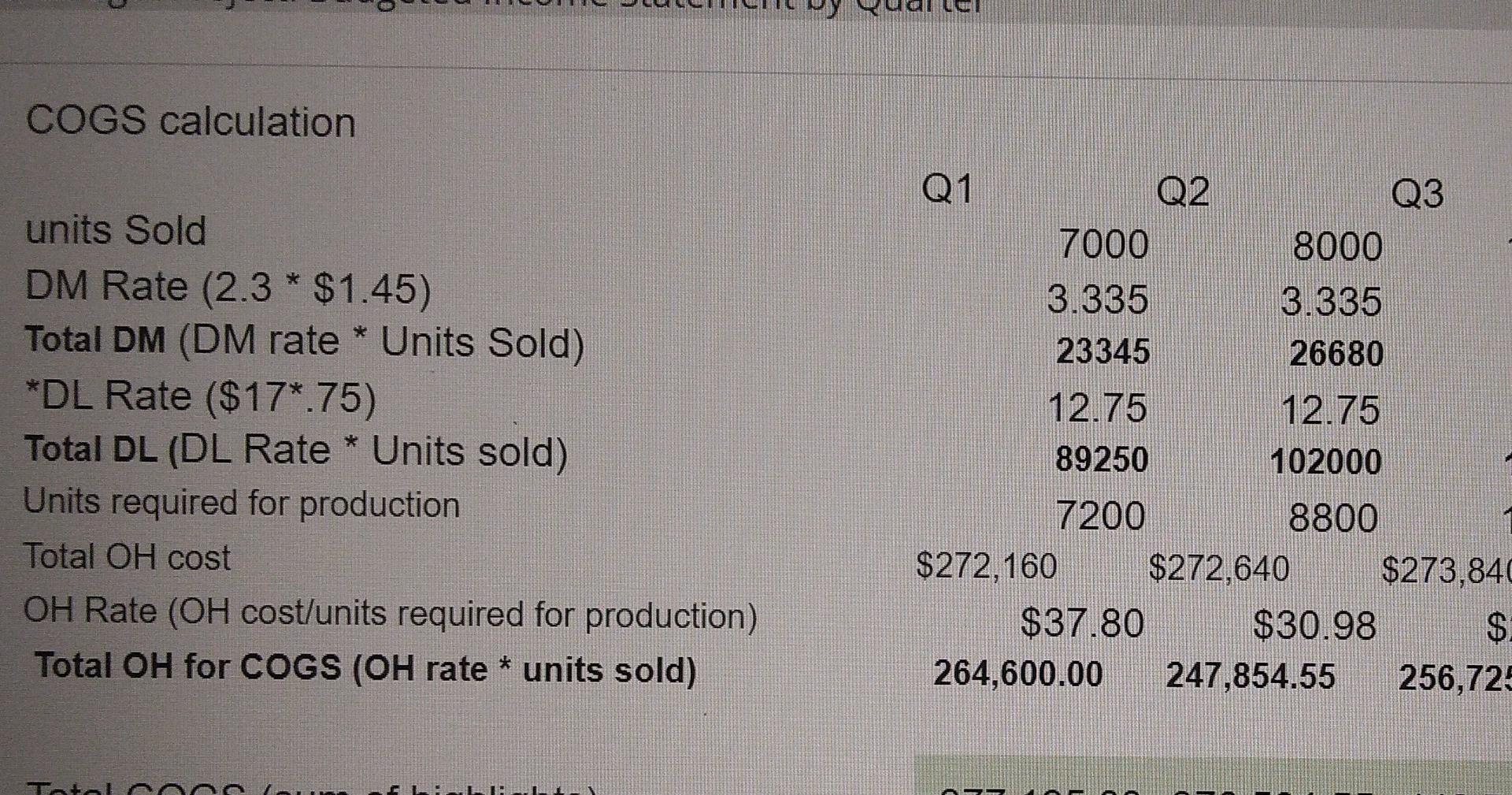

AutoSave on H 2 Master Budget Project Cash Budget Template (3) Shirolacille Holloway SH File Home Insert Draw Page Layout Formulas Data Review View Help Analytic Solver Comments Share . X 09 General Times New Roman 12 AA == Wrap Text BIU. CA AL Es Merge & Center Insert 3X Delete Format 28 O Paste $ % 48 Conditional Format as Cell Formatting Table Styles Styles Sort & Find & Filter Select Editing Analyze Data Clipboard Font Alignment Number Cells Analysis G22 fa A B B D F G H H I- E 6 Capital Budget: Equipment costing S328,498 will be purchased at the end of Q2, paid in cash. The equipment will not be placed into service for purposes of depreciation until after the end of the year 7 due to installation and testing 8 Other cash items: 9 The beginning cash balance is $5,909. Interest expense for each quarter is paid 100% in the quarter incurred from your budgeted income statement by quarter. 10 All components of cash COGS (DM, DL) are paid 2/3 in the quarter incurred/purchased and 1/3 in the following quarter based on the amounts in your budgeted income statement. 11 Fixed Overhead, Variable Overhead and Fixed and Variable SG&A are paid 100% in the quarter incurred based on the budgeted income statement. Depreciation must be subtracted 12 from the FOH to derive cash COGS. All Fixed Assets are depreciated over 10 years (40 quarters). However, the new equipment purchased in Q2 2021 was not placed in service by 12/31/2021. Therefore, no depreciation was recorded on the equipment for 2021. Use the Fixed Asset value of 2,400,000 to calculate. 13 Sales are collected 50% in the quarter of sale and the balance in the following quarter. 14 1 15 Taxes are paid in the quarter following the quarter incurred based on the budgeted income statement by quarter. 16 Sheet1 # Ready Accessibility: Investigate HE Type here to search O o ja + 90% x (? 40F D 11:22 AM 2/25/2022 DL Budget Q1 ter ense game W Rul Units Produced 7,200 DLH per est 0.75 unit Total DLH required Labor Cost Discussid Discussid View Rul 5,400 $17 per Hr Master Assignme View Rul Total DL Cost $91,800 > Principles of Accou... Jan 23, 20 GRADED udget Project: Sales, Production, Direct Materials, and Direct M Budget Solution: OM Q1 Q2 Q3 Q4 Annual Budget Units to 7.200 8,800 12,800 14,200 43,000 Produce DM per 2.3 2.3 2.3 2.32.3 16,560 20,240 29,440 32,660 98,900 unit Total pounds DM +End Iny -Beg Inv DM Required 4,048 5,888 6,532 -3,312 -4,048 -5,888 3,3123,312 -6,532-3,312 17,296 22,080 30,084 29,440 98,900 Cost per $1.45 $1.45 $1.45 $1.45 $1.45 pound Total Cost of $25,079 $32,016 $43,622 $42,688 $143,405 DM roject: Overhead Budget and selling, General, and Administrative Feb 13, 2022 GRADED + COGS calculation Q2 7000 Q3 8000 3.335 23345 3.335 26680 units Sold DM Rate (2.3 * $1.45) Total DM (DM rate * Units Sold) *DL Rate ($17*.75) Total DL (DL Rate * Units sold) Units required for production Total OH cost OH Rate (OH cost/units required for production) Total OH for COGS (OH rate * units sold) 12.75 89250 12.75 102000 * 7200 8800 $272.160 $272,640 $273,84 $37.80 $30.98 $ 264,600.00 247,854.55 256,72 * Totolon Q1 03 Q2 7000 Total 16000 8000 Q4 12000 3.335 40020 3.335 23345 3.335 26680 3.335 53360 12.75 12.75 89250 12.75 102000 12.75 153000 204000 7200 8800 12800 14200 $272,160 $272,640 $273.840 $274,260 $37.80 $30.98 $21.39 $19.31 264,600.00 247.854.55 256,725.00 309,025.35 377,195.00 376,534.55 449,745.00 566,385.35 1,769,859.9 AutoSave on H 2 Master Budget Project Cash Budget Template (3) Shirolacille Holloway SH File Home Insert Draw Page Layout Formulas Data Review View Help Analytic Solver Comments Share . X 09 General Times New Roman 12 AA == Wrap Text BIU. CA AL Es Merge & Center Insert 3X Delete Format 28 O Paste $ % 48 Conditional Format as Cell Formatting Table Styles Styles Sort & Find & Filter Select Editing Analyze Data Clipboard Font Alignment Number Cells Analysis G22 fa A B B D F G H H I- E 6 Capital Budget: Equipment costing S328,498 will be purchased at the end of Q2, paid in cash. The equipment will not be placed into service for purposes of depreciation until after the end of the year 7 due to installation and testing 8 Other cash items: 9 The beginning cash balance is $5,909. Interest expense for each quarter is paid 100% in the quarter incurred from your budgeted income statement by quarter. 10 All components of cash COGS (DM, DL) are paid 2/3 in the quarter incurred/purchased and 1/3 in the following quarter based on the amounts in your budgeted income statement. 11 Fixed Overhead, Variable Overhead and Fixed and Variable SG&A are paid 100% in the quarter incurred based on the budgeted income statement. Depreciation must be subtracted 12 from the FOH to derive cash COGS. All Fixed Assets are depreciated over 10 years (40 quarters). However, the new equipment purchased in Q2 2021 was not placed in service by 12/31/2021. Therefore, no depreciation was recorded on the equipment for 2021. Use the Fixed Asset value of 2,400,000 to calculate. 13 Sales are collected 50% in the quarter of sale and the balance in the following quarter. 14 1 15 Taxes are paid in the quarter following the quarter incurred based on the budgeted income statement by quarter. 16 Sheet1 # Ready Accessibility: Investigate HE Type here to search O o ja + 90% x (? 40F D 11:22 AM 2/25/2022 DL Budget Q1 ter ense game W Rul Units Produced 7,200 DLH per est 0.75 unit Total DLH required Labor Cost Discussid Discussid View Rul 5,400 $17 per Hr Master Assignme View Rul Total DL Cost $91,800 > Principles of Accou... Jan 23, 20 GRADED udget Project: Sales, Production, Direct Materials, and Direct M Budget Solution: OM Q1 Q2 Q3 Q4 Annual Budget Units to 7.200 8,800 12,800 14,200 43,000 Produce DM per 2.3 2.3 2.3 2.32.3 16,560 20,240 29,440 32,660 98,900 unit Total pounds DM +End Iny -Beg Inv DM Required 4,048 5,888 6,532 -3,312 -4,048 -5,888 3,3123,312 -6,532-3,312 17,296 22,080 30,084 29,440 98,900 Cost per $1.45 $1.45 $1.45 $1.45 $1.45 pound Total Cost of $25,079 $32,016 $43,622 $42,688 $143,405 DM roject: Overhead Budget and selling, General, and Administrative Feb 13, 2022 GRADED + COGS calculation Q2 7000 Q3 8000 3.335 23345 3.335 26680 units Sold DM Rate (2.3 * $1.45) Total DM (DM rate * Units Sold) *DL Rate ($17*.75) Total DL (DL Rate * Units sold) Units required for production Total OH cost OH Rate (OH cost/units required for production) Total OH for COGS (OH rate * units sold) 12.75 89250 12.75 102000 * 7200 8800 $272.160 $272,640 $273,84 $37.80 $30.98 $ 264,600.00 247,854.55 256,72 * Totolon Q1 03 Q2 7000 Total 16000 8000 Q4 12000 3.335 40020 3.335 23345 3.335 26680 3.335 53360 12.75 12.75 89250 12.75 102000 12.75 153000 204000 7200 8800 12800 14200 $272,160 $272,640 $273.840 $274,260 $37.80 $30.98 $21.39 $19.31 264,600.00 247.854.55 256,725.00 309,025.35 377,195.00 376,534.55 449,745.00 566,385.35 1,769,859.9Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started