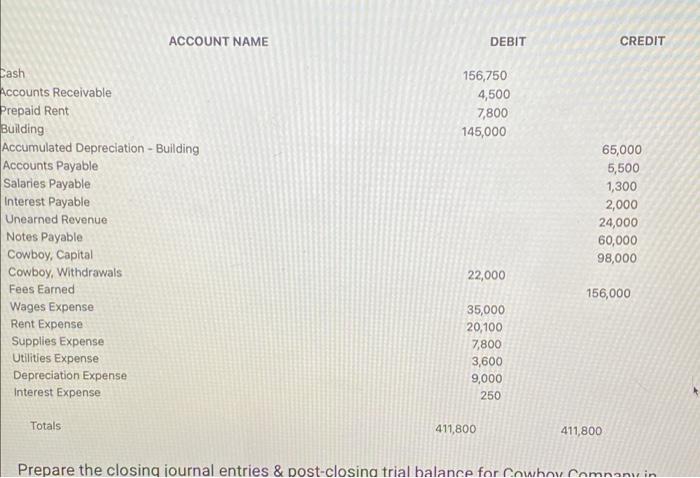

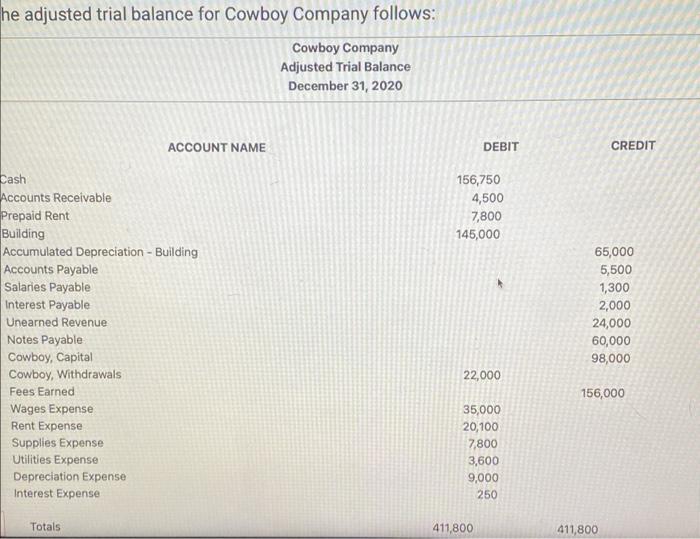

prepare the closing journal entries & post-closing trial balance

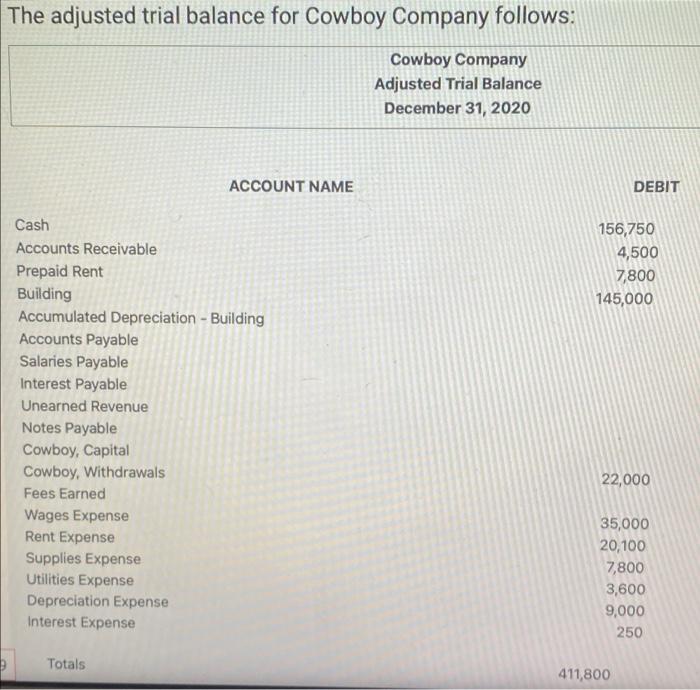

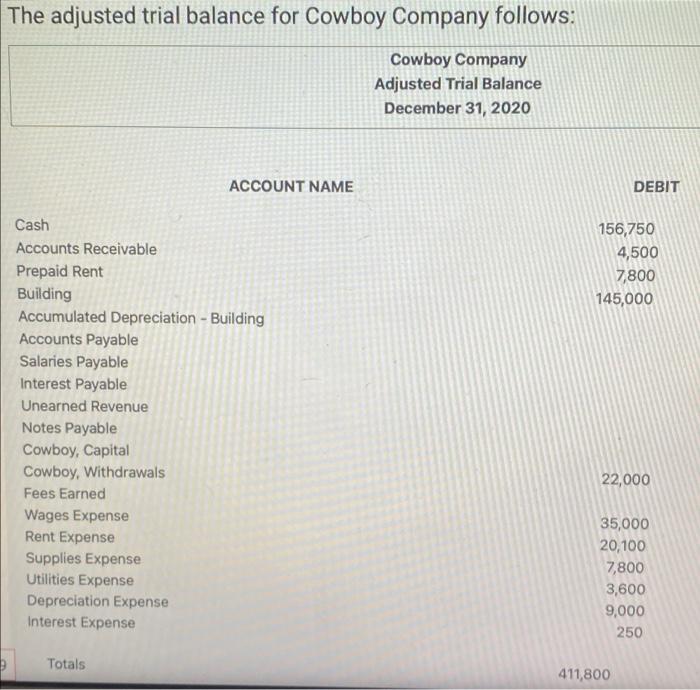

The adjusted trial balance for Cowboy Company follows: Cowboy Company Adjusted Trial Balance December 31, 2020 ACCOUNT NAME DEBIT 156,750 4,500 7,800 145,000 Cash Accounts Receivable Prepaid Rent Building Accumulated Depreciation - Building Accounts Payable Salaries Payable Interest Payable Unearned Revenue Notes Payable Cowboy, Capital Cowboy, Withdrawals Fees Earned Wages Expense Rent Expense Supplies Expense Utilities Expense Depreciation Expense Interest Expense 22,000 35,000 20,100 7,800 3,600 9,000 250 Totals 411,800 ACCOUNT NAME DEBIT CREDIT 156,750 4,500 7,800 145,000 Cash Accounts Receivable Prepaid Rent Building Accumulated Depreciation - Building Accounts Payable Salaries Payable Interest Payable Unearned Revenue Notes Payable Cowboy, Capital Cowboy, Withdrawals Fees Earned Wages Expense Rent Expense Supplies Expense Utilities Expense Depreciation Expense Interest Expense 65,000 5,500 1,300 2,000 24,000 60,000 98,000 22,000 156,000 35,000 20,100 7,800 3,600 9,000 250 Totals 411,800 411,800 Prepare the closing journal entries & Dost-closing trial balance for Cowhow Camnanvin he adjusted trial balance for Cowboy Company follows: Cowboy Company Adjusted Trial Balance December 31, 2020 ACCOUNT NAME DEBIT CREDIT 156,750 4,500 7,800 145,000 Cash Accounts Receivable Prepaid Rent Building Accumulated Depreciation - Building Accounts Payable Salaries Payable Interest Payable Unearned Revenue Notes Payable Cowboy, Capital Cowboy, Withdrawals Fees Earned Wages Expense Rent Expense Supplies Expense Utilities Expense Depreciation Expense Interest Expense 65,000 5,500 1,300 2,000 24,000 60,000 98,000 22,000 156,000 35,000 20,100 7,800 3,600 9,000 250 Totals 411,800 411,800 The adjusted trial balance for Cowboy Company follows: Cowboy Company Adjusted Trial Balance December 31, 2020 ACCOUNT NAME DEBIT 156,750 4,500 7,800 145,000 Cash Accounts Receivable Prepaid Rent Building Accumulated Depreciation - Building Accounts Payable Salaries Payable Interest Payable Unearned Revenue Notes Payable Cowboy, Capital Cowboy, Withdrawals Fees Earned Wages Expense Rent Expense Supplies Expense Utilities Expense Depreciation Expense Interest Expense 22,000 35,000 20,100 7,800 3,600 9,000 250 Totals 411,800 ACCOUNT NAME DEBIT CREDIT 156,750 4,500 7,800 145,000 Cash Accounts Receivable Prepaid Rent Building Accumulated Depreciation - Building Accounts Payable Salaries Payable Interest Payable Unearned Revenue Notes Payable Cowboy, Capital Cowboy, Withdrawals Fees Earned Wages Expense Rent Expense Supplies Expense Utilities Expense Depreciation Expense Interest Expense 65,000 5,500 1,300 2,000 24,000 60,000 98,000 22,000 156,000 35,000 20,100 7,800 3,600 9,000 250 Totals 411,800 411,800 Prepare the closing journal entries & Dost-closing trial balance for Cowhow Camnanvin he adjusted trial balance for Cowboy Company follows: Cowboy Company Adjusted Trial Balance December 31, 2020 ACCOUNT NAME DEBIT CREDIT 156,750 4,500 7,800 145,000 Cash Accounts Receivable Prepaid Rent Building Accumulated Depreciation - Building Accounts Payable Salaries Payable Interest Payable Unearned Revenue Notes Payable Cowboy, Capital Cowboy, Withdrawals Fees Earned Wages Expense Rent Expense Supplies Expense Utilities Expense Depreciation Expense Interest Expense 65,000 5,500 1,300 2,000 24,000 60,000 98,000 22,000 156,000 35,000 20,100 7,800 3,600 9,000 250 Totals 411,800 411,800