Answered step by step

Verified Expert Solution

Question

1 Approved Answer

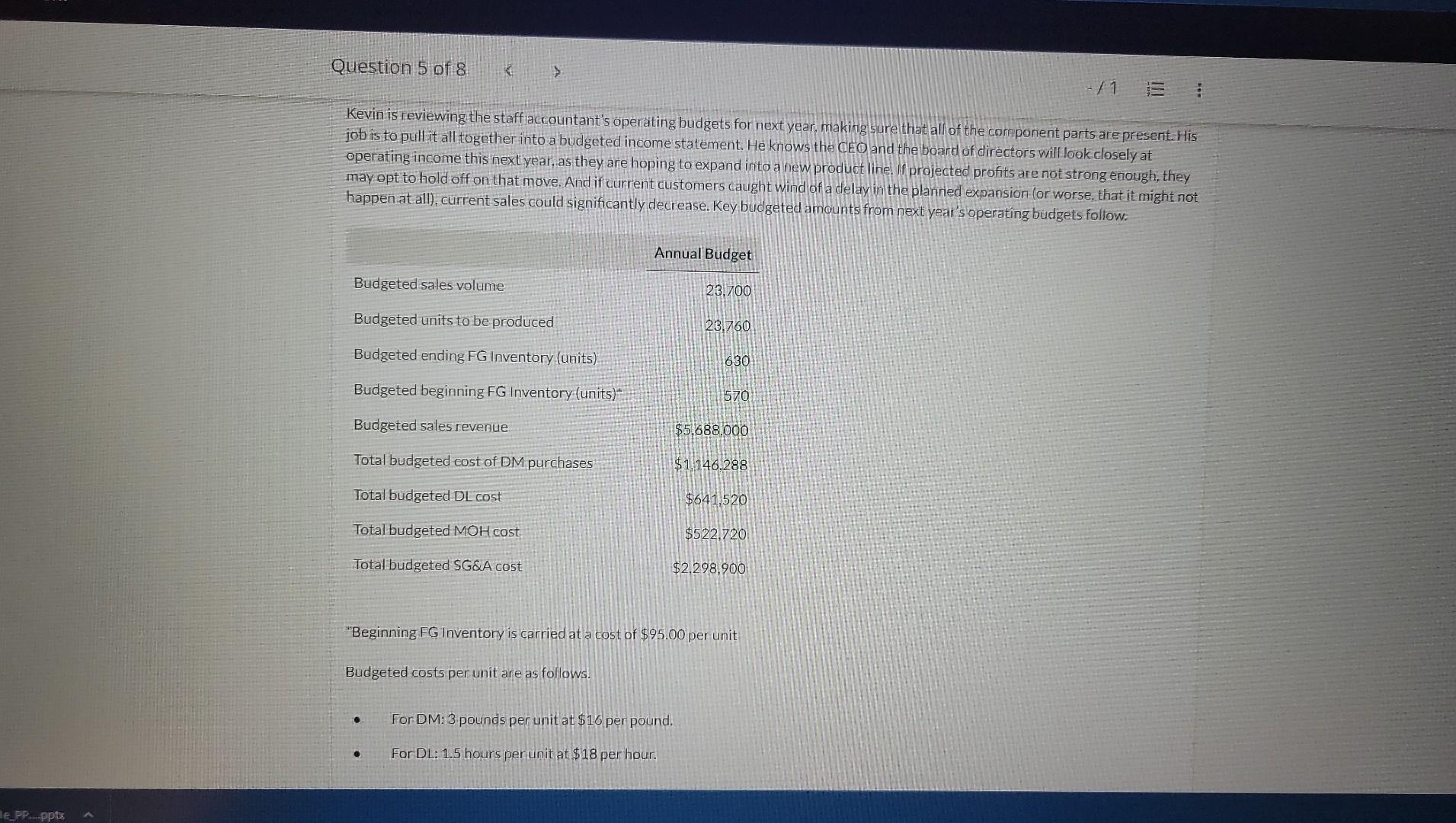

prepare the COGS budget for Kevin's company for next year assuming the company uses the FIFO method for inventory valuation. Kevin is reviewing the staff

prepare the COGS budget for Kevin's company for next year assuming the company uses the FIFO method for inventory valuation.

Kevin is reviewing the staff accountant's operating budgets for next year, making sure that all of the component parts are present. His job is to pull it all together into a budgeted income statement. He knows the CEO and the board of directors will loak closely at operating income this next year, as they are hoping to expand into a new product line. If projected profits are not strong enough, they may opt to hold off on that move. And if current customers caught wind of a delay in the planned expansion (or worse, that it might not happen at all), current sales could significantly decrease. Key budgeted amounts from next year's operating budgets follow: "Beginning FG Inventory is carried at a cost of $95.00 per unit Budgeted costs per unit are as follows. - For DM: 3 pounds per unit at $16 per pound. - For DL: 1.5 hours per unit at $18 per hourStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started