Answered step by step

Verified Expert Solution

Question

1 Approved Answer

prepare the collecting entries help needed Sandhill Company has an inexperienced accountant. During the first month on the job, the accountant made the following errors

prepare the collecting entries help needed

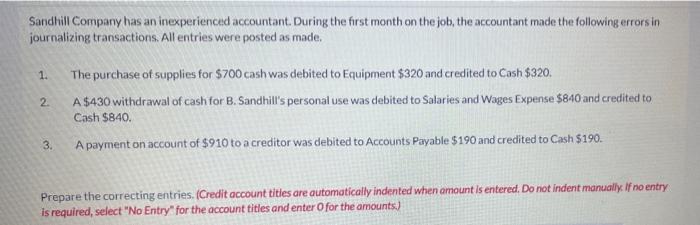

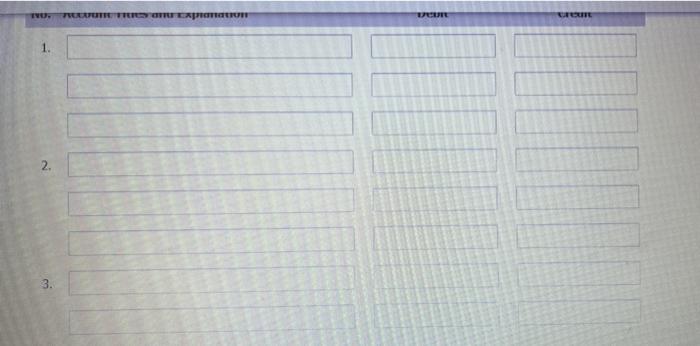

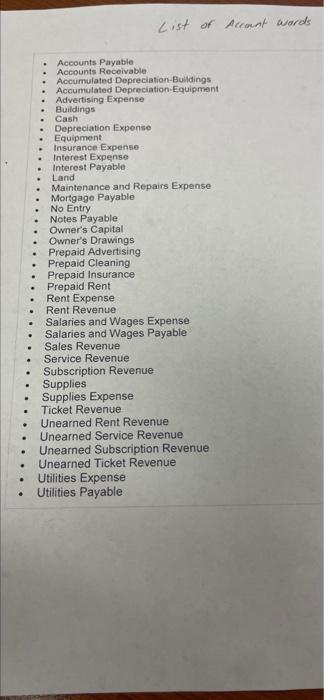

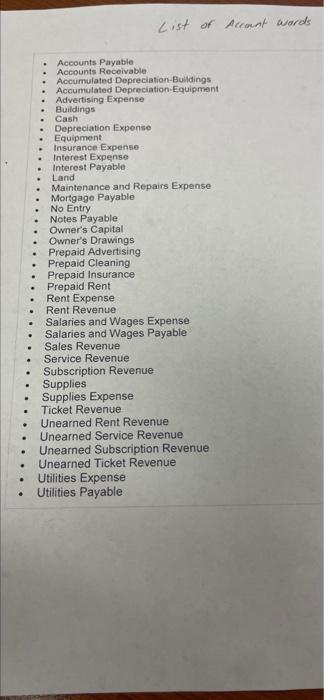

Sandhill Company has an inexperienced accountant. During the first month on the job, the accountant made the following errors in journalizing transactions. All entries were posted as made. 1. 2 The purchase of supplies for $700 cash was debited to Equipment $320 and credited to Cash $320. A $430 withdrawal of cash for B. Sandhill's personal use was debited to Salaries and Wages Expense $840 and credited to Cash $840. A payment on account of $910 to a creditor was debited to Accounts Payable $190 and credited to Cash $190. 3. Prepare the correcting entries. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) TVO, MURERETUR WELTE UTITE 2. 3. No. Account Titles and Explanation Debit Credit List of Accant words . . . . . . Accounts Payable Accounts Receivable Accumulated Depreciation Buildings Accumulated Depreciation Equipment Advertising Expense Buildings Cash Depreciation Expense Equipment Insurance Expense Interest Expense Interest Payable Land Maintenance and Repairs Expense Mortgage Payable No Entry Notes Payable Owner's Capital Owner's Drawings Prepaid Advertising Prepaid Cleaning Prepaid Insurance Prepaid Rent Rent Expense Rent Revenue Salaries and Wages Expense Salaries and Wages Payable Sales Revenue Service Revenue Subscription Revenue Supplies Supplies Expense Ticket Revenue Unearned Rent Revenue Unearned Service Revenue Unearned Subscription Revenue Unearned Ticket Revenue Utilities Expense Utilities Payable

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started