Prepare the consolidation journal / worksheet entries for Ghostbusters Ltd for 30/6/2020.

Update and complete the consolidation worksheet for 30/6/2020. Use the following worksheet please

| Financial Statements | Ghost Ltd | Bat Ltd | Adjustments | Group |

| | Dr | Cr | | |

| Sales revenue | 220 000 | 182 000 | | | | | |

| Other income | 62 000 | 20 000 | | | | | |

| | 282 000 | 202 000 | | | | | |

| Cost of sales | 162 000 | 128 000 | | | | | |

| Other expenses | 53 000 | 41 000 | | | | | |

| | 215 000 | 169 000 | | | | | |

| Trading profit | 67 000 | 33 000 | | | | | |

| Gains/losses on sale of non-current assets | 22 000 | 25 000 | | | | | |

| Profit before tax | 89 000 | 58 000 | | | | | |

| Tax expense | 20 000 | 18 000 | | | | | |

| Profit | 69 000 | 40 000 | | | | | |

| Retained earnings (1/7/19) | 30 000 | 45 000 | | | | | |

| Transfer from BCV reserve | 0 | 0 | | | | | |

| | 99 000 | 85 000 | | | | | |

| Dividend paid | 12 000 | 10 000 | | | | | |

| Dividend declared | 6 000 | 4 000 | | | | | |

| | 18 000 | 14 000 | | | | | |

| Retained earnings (30/6/20) | 81 000 | 71 000 | | | | | |

| Share capital | 312 000 | 200 000 | | | | | |

| General reserve | 20 000 | 25 000 | | | | | |

| BCVR | - | - | | | | | |

| Total Equity | 413 000 | 296 000 | | | | | |

| Deferred tax liabilities | - | - | | | | | |

| Dividend payable | 6 000 | 4 000 | | | | | |

| Current tax liability | 8 000 | 2 500 | | | | | |

| Loan from Ghost Ltd | - | 12 000 | | | | | |

| Provisions | 78 000 | 169 500 | | | | | |

| Total Liabilities | 92 000 | 188 000 | | | | | |

| Total Liabilities + Equity | 505 000 | 484 000 | | | | | |

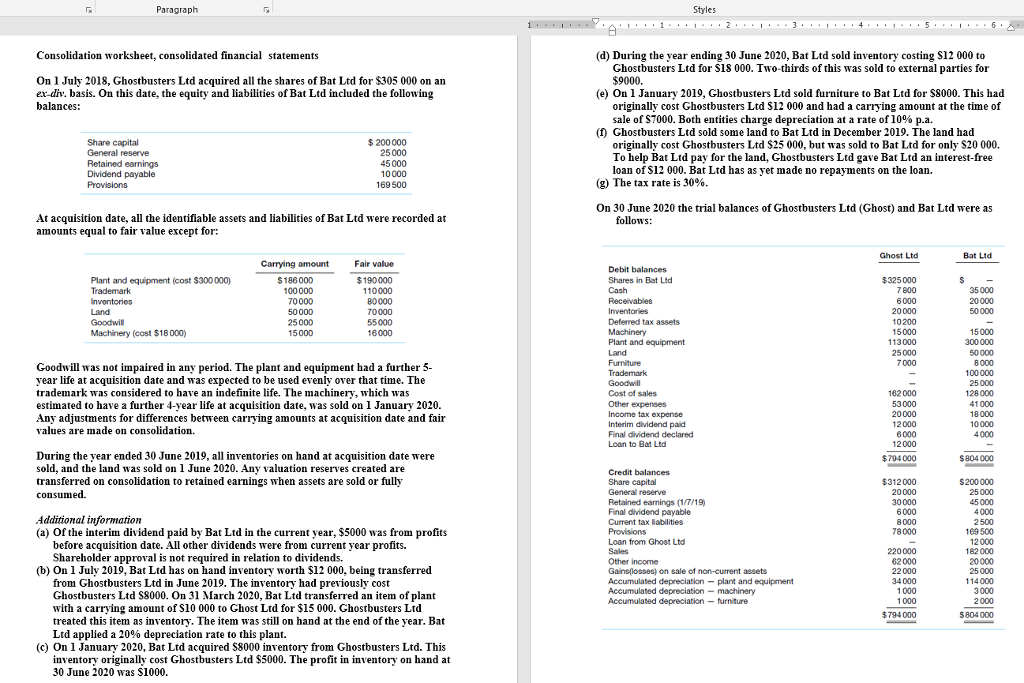

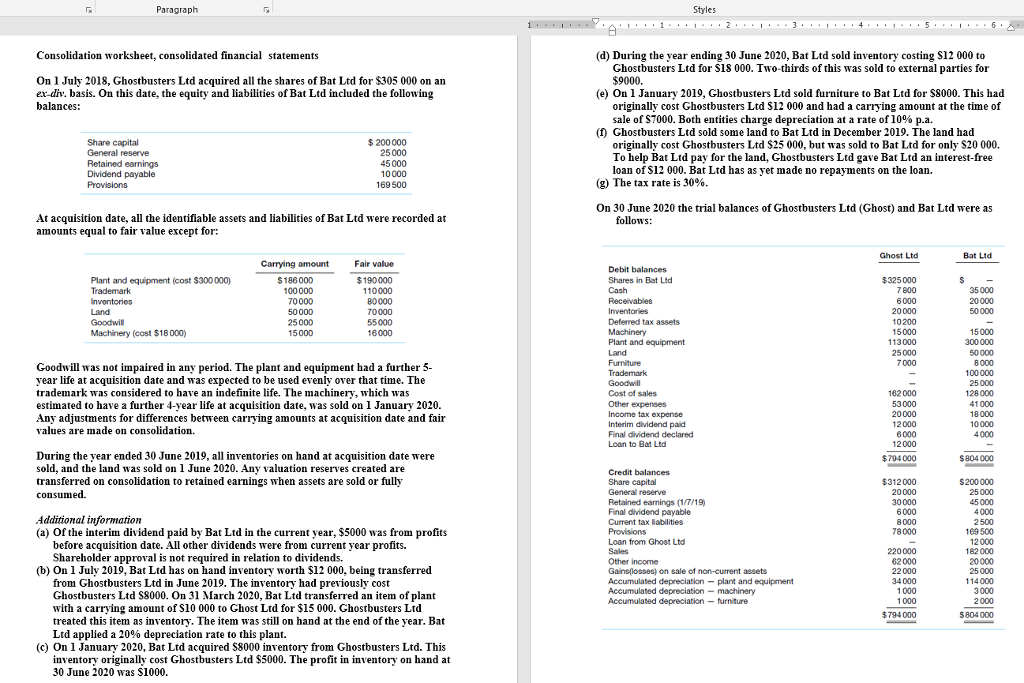

Styles Consolidation worksheet, consolidated financial statements (d) During the year ending 30 June 2020, Bat Ltd sold inventory costing S12 000 to Ghostbusters Ltd for S18 000. Two-thirds of this was sold to external parties for On July 2018, Ghostbusters Ltd acquired all the shares of Bat Ltd for $305 000 on an ex-div. basis. On this date, the equity and liabilities of Bat Ltd included the following balances: (e) On 1 January 2019, Ghostbusters Ltd sold furniture to Bat Ltd for S8000. This had originally cost Ghostbusters Ltd S12 000 and had a carrying amount at the time of sale of S7000. Both entities charge depreciation at a rate of 10% pa. (f) Ghostbusters Ltd sold some land to Bat Ltd in December 2019. The land had Share capital $200000 25000 45000 originally cost Ghostbusters Ltd $25 000, but was sold to Bat Ltd for only S20 000. To help Bat Ltd pay for the land, Ghostbusters Ltd gave Bat Ltd an interest-free loan of S12 000. Bat Ltd has as yet made no repayments on the loan. Retained earnings Dividend payable 169 500 (g) The tax rate is 30%. On 30 June 2020 the trial balances of Ghostbusters Ltd (Ghost) and Bat Ltd were as At acquisition date, all the identifiable assets and liabilities of Bat Ltd were recorded at amounts equal to fair value except for: S: Ghost Ltd Bat Ltd amount Debit balances Shares in Bat Ltd Cash Plant and equipment (cost $300000) $325000 $186000 100000 70000 50000 $190000 110000 80000 35000 20000 50000 20000 Goodwil Machinery (cost $18000) 55000 Deferred tax assets 15000 Plant and equipment Land Furniture 113000 25000 7000 300 000 50000 Goodwill was not impaired in any period. The plant and equipment had a further 5- year life at acquisition date and was expected to be used evenly over that time. The trademark was considered to have an indefinite life. The machinery, which was estimated to have a further 4-year life at acquisition date, was sold on 1 January 2020 Any adjustments for differences between carrying amounts at acquisition date and fair values are made on consolidation. Goodwill Cost of sales 100000 25 000 128000 162000 53000 20000 Income tax expense Interim dividend paid Final dividend declared Loan to Bat Ltd 18000 10000 During the year ended 30 June 2019, a inventories on hand at acquisition date were sold, and the land was sold on 1 June 2020. Any valuation reserves created are transferred on consolidation to retained earnings when assets are sold or fully $794000 $312000 30000 804 000 Credit balances Share capital $200000 25 000 45000 Retained earnings (1/7/19) Final dividend payable Current tax liabilities Additional informatioin (a) Of the interim dividend paid by Bat Ltd in the current year, $5000 was from profits 69500 Loan from Ghost Ltd before acquisition date. All other dividends were from current year profits. Shareholder approval is not required in relation to dividends. 220000 Other income Gainslosses) on sale of non-current aseets Accumulated depreciation- plant and equipment 20000 25000 114000 (b) On 1 July 2019, Bat Ltd has on hand inventory worth $12 000, being transferreed 22000 34000 from Ghostbusters Ltd in June 2019. The inventory had previously cost Ghostbusters Ltd $8000. On 31 March 2020, Bat Ltd transferred an item of plant with a carrying amount of S10 000 to Ghost Ltd for $15 000. Ghostbusters Ltd treated this item as inventory. The item was still on hand at the end of the year. Bat Ltd applied a 20% depreciation rate to this plan. $794000 $804000 (c) On 1 January 2020, Bat Ltd acquired S8000 inventory from Ghostbusters Ltd. This inventory originally cost Ghostbusters Ltd $5000. The profit in inventory on hand at 30 June 2020 was $1000