Answered step by step

Verified Expert Solution

Question

1 Approved Answer

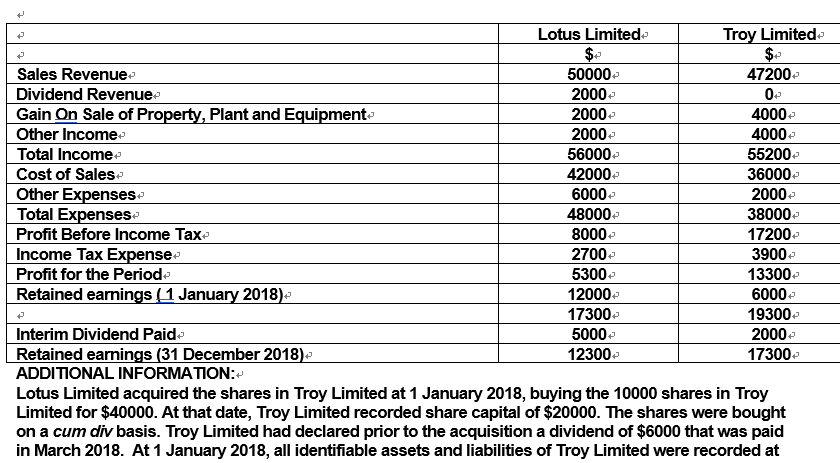

Prepare the consolidation worksheet journal entries to eliminate the effects of intragroup transactions at 31 December 2018 Lotus Limited Troy Limited $- | Sales Revenue

Prepare the consolidation worksheet journal entries to eliminate the effects of intragroup transactions at 31 December 2018

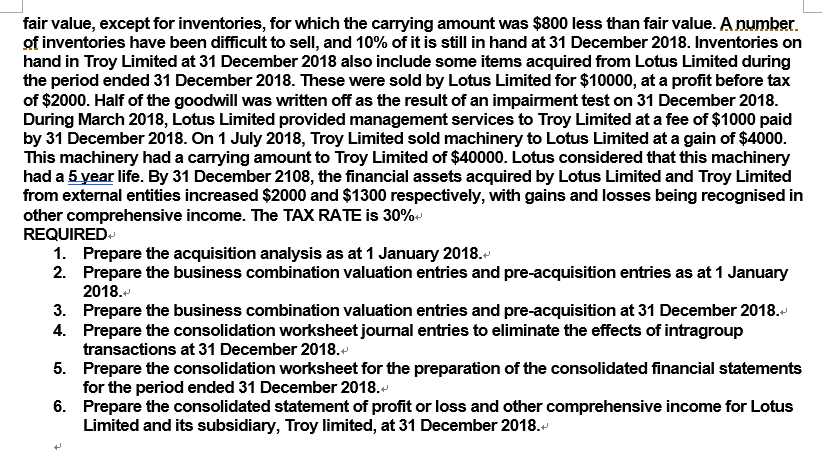

Lotus Limited Troy Limited $- | Sales Revenue 50000- 47200- Dividend Revenue- 2000- 0- | Gain On Sale of Property, Plant and Equipment 2000- 4000- Other Income- 2000- 4000- Total Income- 56000 55200- Cost of Sales- 42000- 36000- Other Expenses 6000- 2000- Total Expenses 48000 38000- Profit Before Income Tax 8000- 17200- Income Tax Expense- 2700- 3900- Profit for the Periode 5300 13300- Retained earnings (1 January 2018) 12000- 6000 17300- 19300- Interim Dividend Paide 5000- 2000- Retained earnings (31 December 2018) - 12300- 17300- ADDITIONAL INFORMATION: Lotus Limited acquired the shares in Troy Limited at 1 January 2018, buying the 10000 shares in Troy Limited for $40000. At that date, Troy Limited recorded share capital of $20000. The shares were bought on a cum div basis. Troy Limited had declared prior to the acquisition a dividend of $6000 that was paid in March 2018. At 1 January 2018, all identifiable assets and liabilities of Troy Limited were recorded at fair value, except for inventories, for which the carrying amount was $800 less than fair value. A number. of inventories have been difficult to sell, and 10% of it is still in hand at 31 December 2018. Inventories on hand in Troy Limited at 31 December 2018 also include some items acquired from Lotus Limited during the period ended 31 December 2018. These were sold by Lotus Limited for $10000, at a profit before tax of $2000. Half of the goodwill was written off as the result of an impairment test on 31 December 2018. During March 2018, Lotus Limited provided management services to Troy Limited at a fee of $1000 paid by 31 December 2018. On 1 July 2018, Troy Limited sold machinery to Lotus Limited at a gain of $4000. This machinery had a carrying amount to Troy Limited of $40000. Lotus considered that this machinery had a 5 year life. By 31 December 2108, the financial assets acquired by Lotus Limited and Troy Limited from external entities increased $2000 and $1300 respectively, with gains and losses being recognised in other comprehensive income. The TAX RATE is 30% REQUIRED 1. Prepare the acquisition analysis as at 1 January 2018. 2. Prepare the business combination valuation entries and pre-acquisition entries as at 1 January 2018. 3. Prepare the business combination valuation entries and pre-acquisition at 31 December 2018. 4. Prepare the consolidation worksheet journal entries to eliminate the effects of intragroup transactions at 31 December 2018. 5. Prepare the consolidation worksheet for the preparation of the consolidated financial statements for the period ended 31 December 2018. Prepare the consolidated statement of profit or loss and other comprehensive income for Lotus Limited and its subsidiary, Troy limited, at 31 December 2018. Lotus Limited Troy Limited $- | Sales Revenue 50000- 47200- Dividend Revenue- 2000- 0- | Gain On Sale of Property, Plant and Equipment 2000- 4000- Other Income- 2000- 4000- Total Income- 56000 55200- Cost of Sales- 42000- 36000- Other Expenses 6000- 2000- Total Expenses 48000 38000- Profit Before Income Tax 8000- 17200- Income Tax Expense- 2700- 3900- Profit for the Periode 5300 13300- Retained earnings (1 January 2018) 12000- 6000 17300- 19300- Interim Dividend Paide 5000- 2000- Retained earnings (31 December 2018) - 12300- 17300- ADDITIONAL INFORMATION: Lotus Limited acquired the shares in Troy Limited at 1 January 2018, buying the 10000 shares in Troy Limited for $40000. At that date, Troy Limited recorded share capital of $20000. The shares were bought on a cum div basis. Troy Limited had declared prior to the acquisition a dividend of $6000 that was paid in March 2018. At 1 January 2018, all identifiable assets and liabilities of Troy Limited were recorded at fair value, except for inventories, for which the carrying amount was $800 less than fair value. A number. of inventories have been difficult to sell, and 10% of it is still in hand at 31 December 2018. Inventories on hand in Troy Limited at 31 December 2018 also include some items acquired from Lotus Limited during the period ended 31 December 2018. These were sold by Lotus Limited for $10000, at a profit before tax of $2000. Half of the goodwill was written off as the result of an impairment test on 31 December 2018. During March 2018, Lotus Limited provided management services to Troy Limited at a fee of $1000 paid by 31 December 2018. On 1 July 2018, Troy Limited sold machinery to Lotus Limited at a gain of $4000. This machinery had a carrying amount to Troy Limited of $40000. Lotus considered that this machinery had a 5 year life. By 31 December 2108, the financial assets acquired by Lotus Limited and Troy Limited from external entities increased $2000 and $1300 respectively, with gains and losses being recognised in other comprehensive income. The TAX RATE is 30% REQUIRED 1. Prepare the acquisition analysis as at 1 January 2018. 2. Prepare the business combination valuation entries and pre-acquisition entries as at 1 January 2018. 3. Prepare the business combination valuation entries and pre-acquisition at 31 December 2018. 4. Prepare the consolidation worksheet journal entries to eliminate the effects of intragroup transactions at 31 December 2018. 5. Prepare the consolidation worksheet for the preparation of the consolidated financial statements for the period ended 31 December 2018. Prepare the consolidated statement of profit or loss and other comprehensive income for Lotus Limited and its subsidiary, Troy limited, at 31 December 2018

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started