Answered step by step

Verified Expert Solution

Question

1 Approved Answer

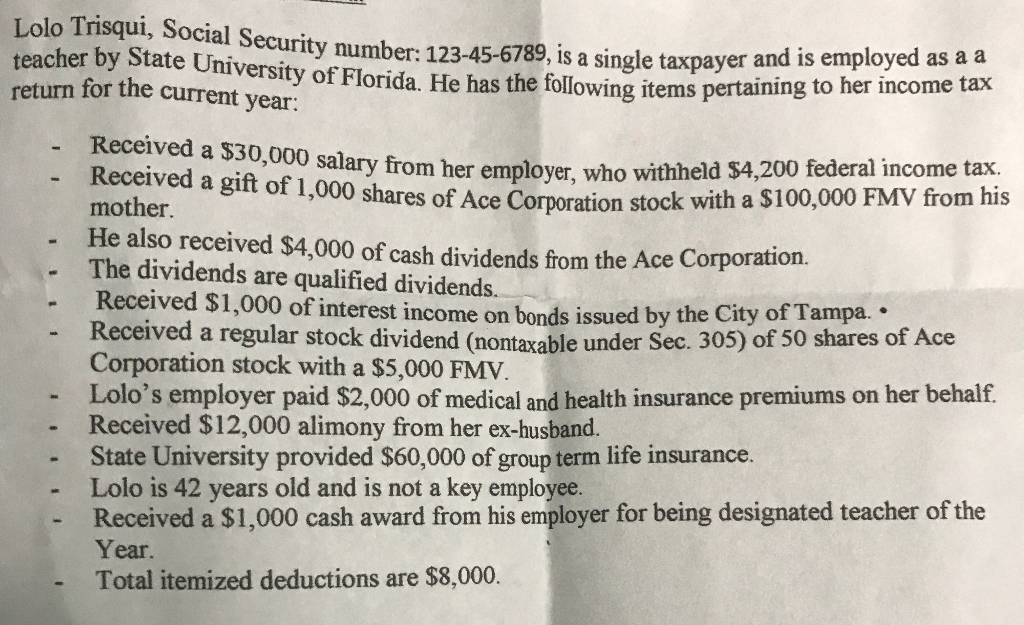

Prepare the contribution sheet on federal income. Assume that it is the 2017 form, delivered in April 2018. Use the form and annexes that you

Prepare the contribution sheet on federal income. Assume that it is the 2017 form, delivered in April 2018. Use the form and annexes that you consider necessary.

Lolo Trisqui, Social Security number: 123-45-6789, is a single taxpayer and is employed as teacher by State University of Florida. He has the following items pertaining to her return for the current year Received a s30,000 salary Received a gift or rom her employer, who withheld s4,200 federal income tax. mother He also received $4,000 of cash dividends from the Ace Corporation. The dividends are qualified dividends. Received $1,000 of interest income on bonds issued Received a regular stock dividend (nontaxable under Sec. 305) of 50 shares of Ace Corporation stock with a $5,000 FMV Lolo's employer paid $2,000 of medical and health insurance premiums on her behalf. Received $12,000 alimony from her ex-husband. State University provided S60,000 of group term life insurance. Lolo is 42 years old and is not a key employee. Received a $1,000 cash award from his employer for being designated teacher of the Year Total itemized deductions are $8,000. or 1,000 shares of Ace Corporation stock with a $100,000 FMV from his by the City of Tampa

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started