Answered step by step

Verified Expert Solution

Question

1 Approved Answer

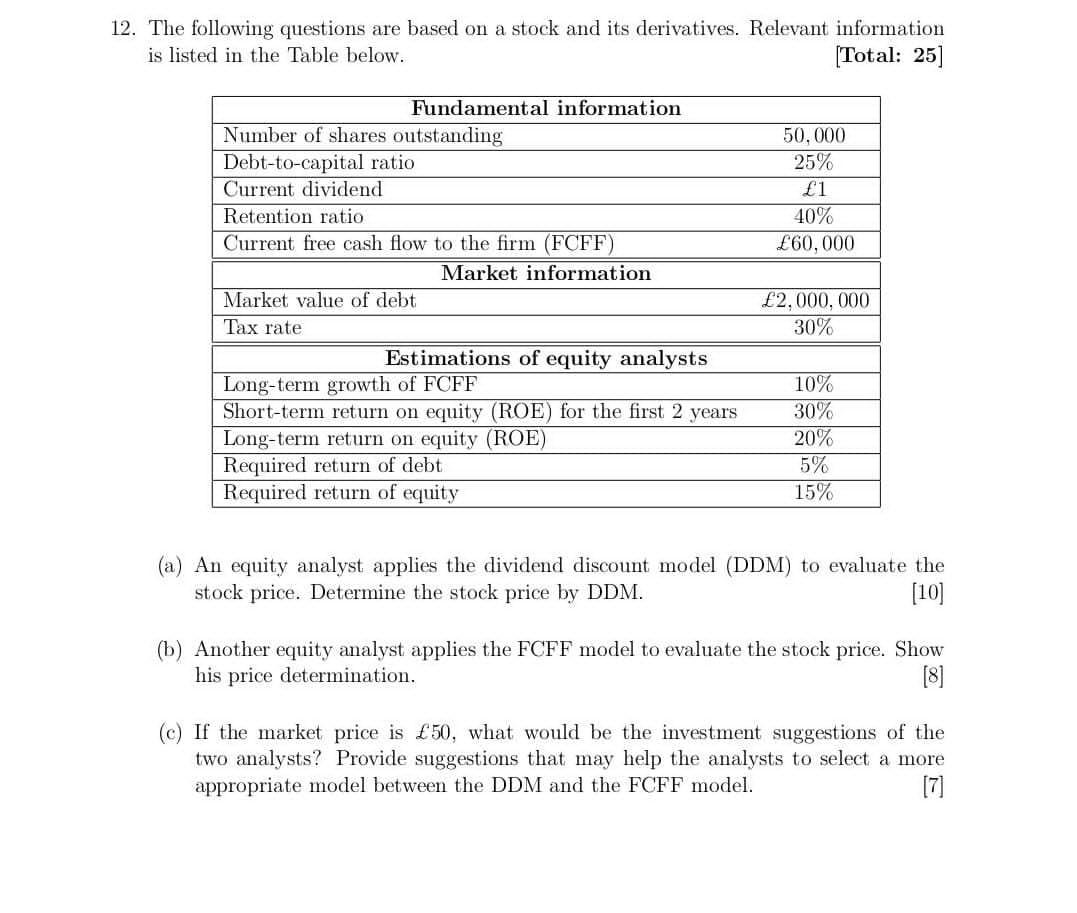

12. The following questions are based on a stock and its derivatives. Relevant information is listed in the Table below. [Total: 25] Fundamental information

12. The following questions are based on a stock and its derivatives. Relevant information is listed in the Table below. [Total: 25] Fundamental information Number of shares outstanding Debt-to-capital ratio Current dividend Retention ratio Current free cash flow to the firm (FCFF) Market information Market value of debt Tax rate Estimations of equity analysts Long-term growth of FCFF Short-term return on equity (ROE) for the first 2 years Long-term return on equity (ROE) Required return of debt Required return of equity 50,000 25% 1 40% 60,000 2,000,000 30% 10% 30% 20% 5% 15% (a) An equity analyst applies the dividend discount model (DDM) to evaluate the stock price. Determine the stock price by DDM. [10] (b) Another equity analyst applies the FCFF model to evaluate the stock price. Show his price determination. [8] (c) If the market price is 50, what would be the investment suggestions of the two analysts? Provide suggestions that may help the analysts to select a more appropriate model between the DDM and the FCFF model. [7]

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER a P Dr P 1015 P 667 b P FCFFr P 2000000015 P 13333333 c The first analyst would recommend buying the stock as it is undervalued according to th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started