Prepare the couples federal income tax return, Form 1040 for the year ended December 31, 2021, plus any additional schedules necessary. Forms are available at the IRS website Links to an external site.under Forms & Instructions. Please utilize the facts and the information included in the Miller family tax documents to complete this assignment. We will be using the 2021 federal income tax forms, rates, and laws. For any information not provided, please use reasonable assumptions.

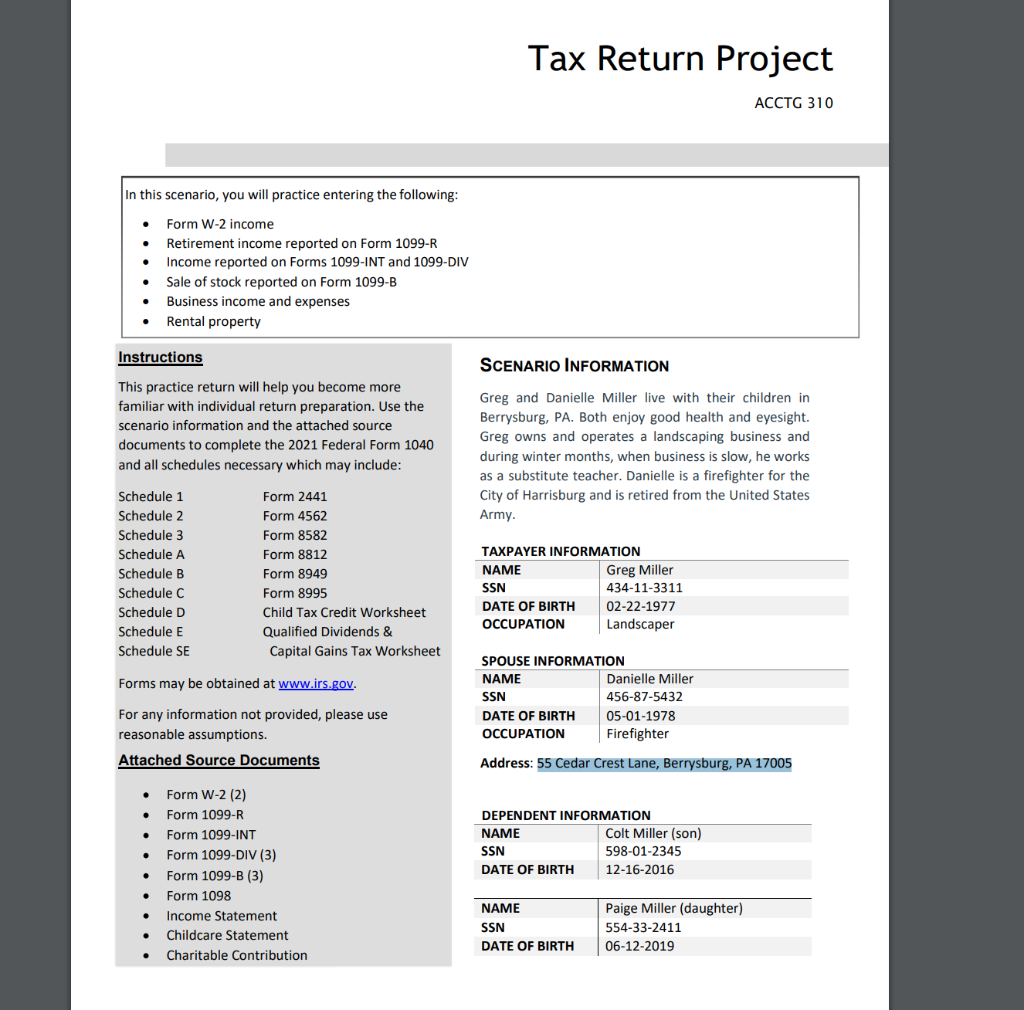

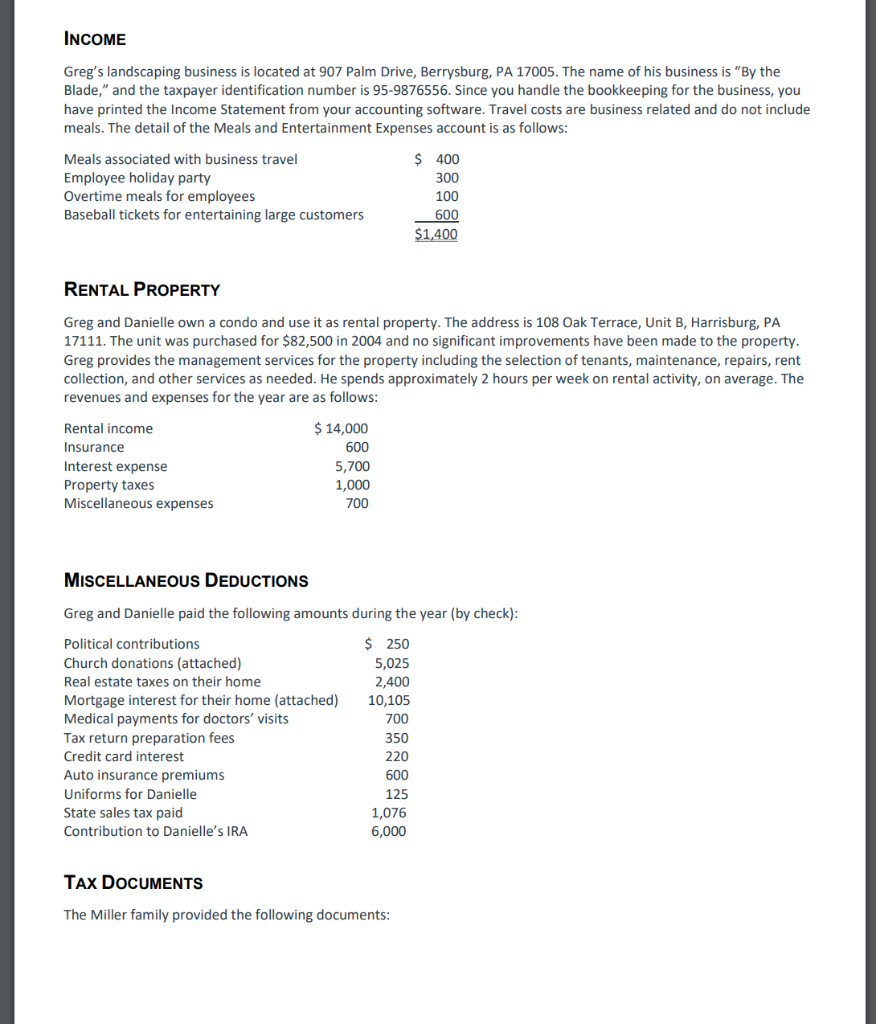

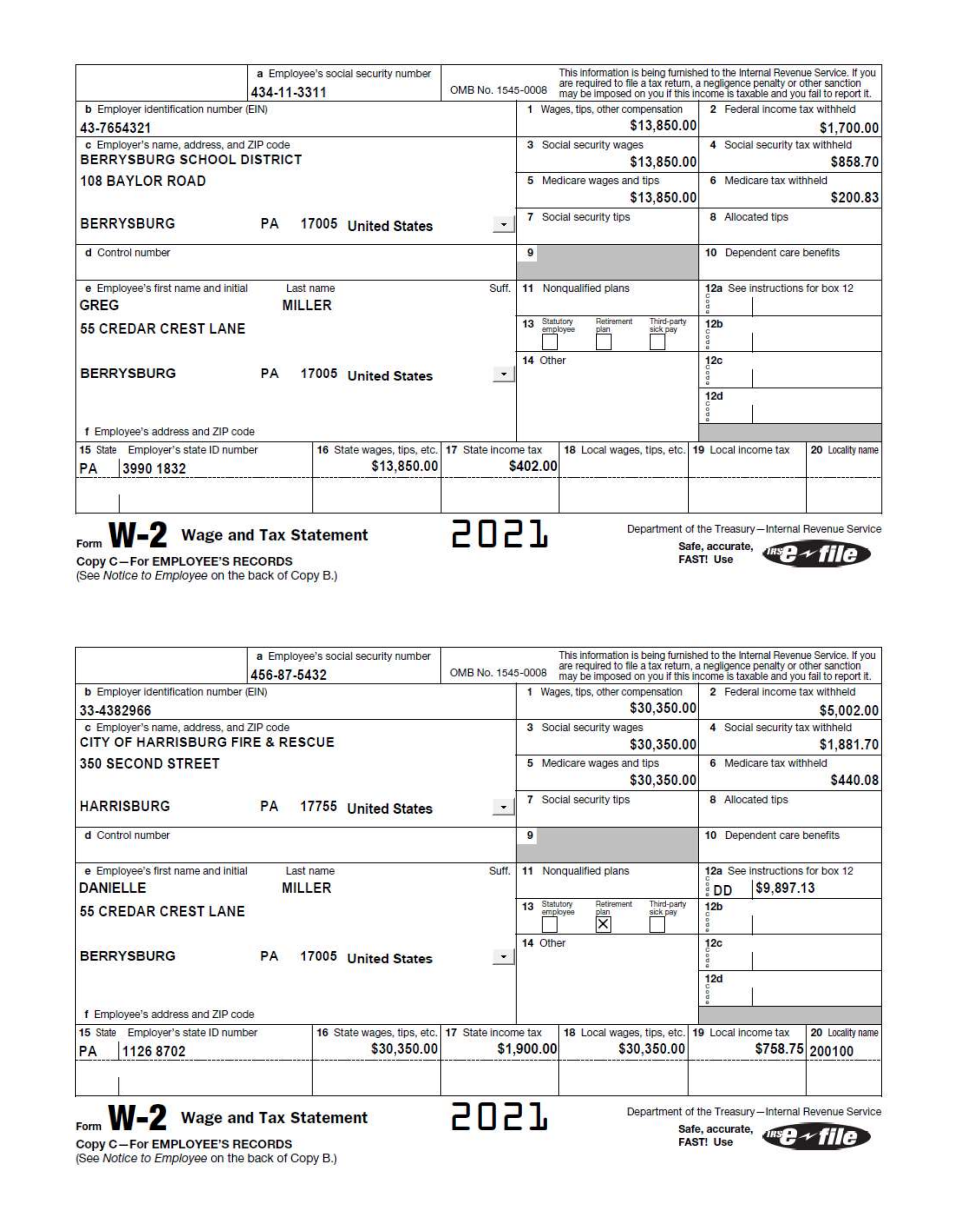

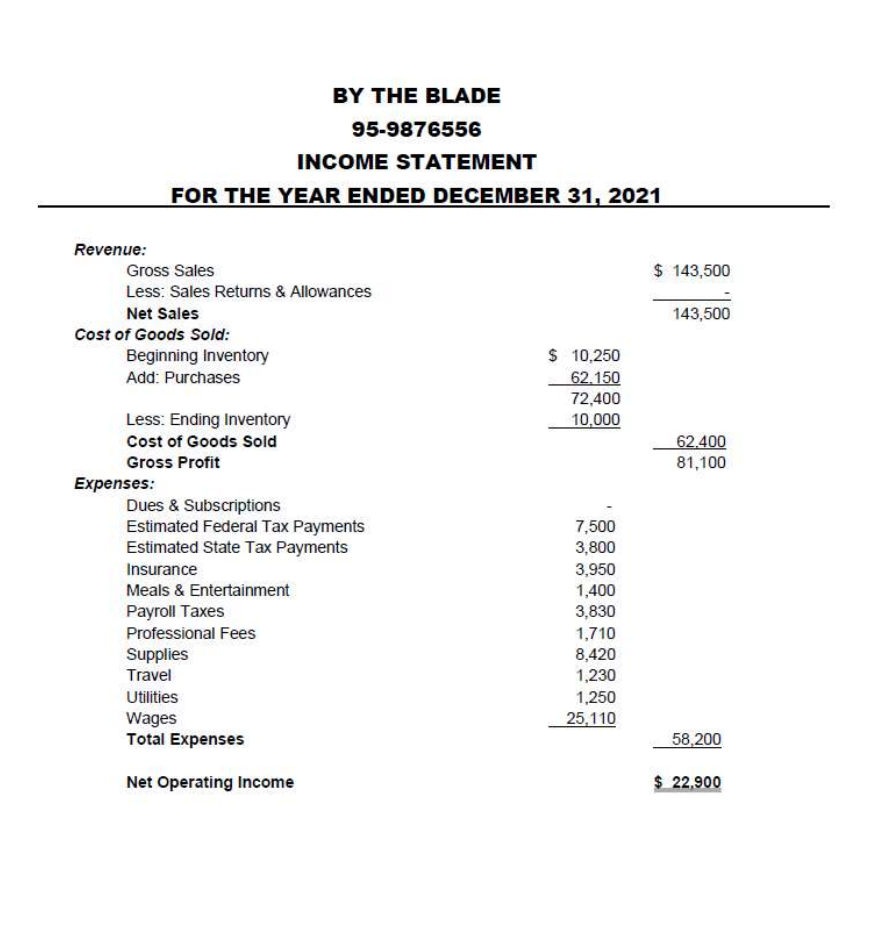

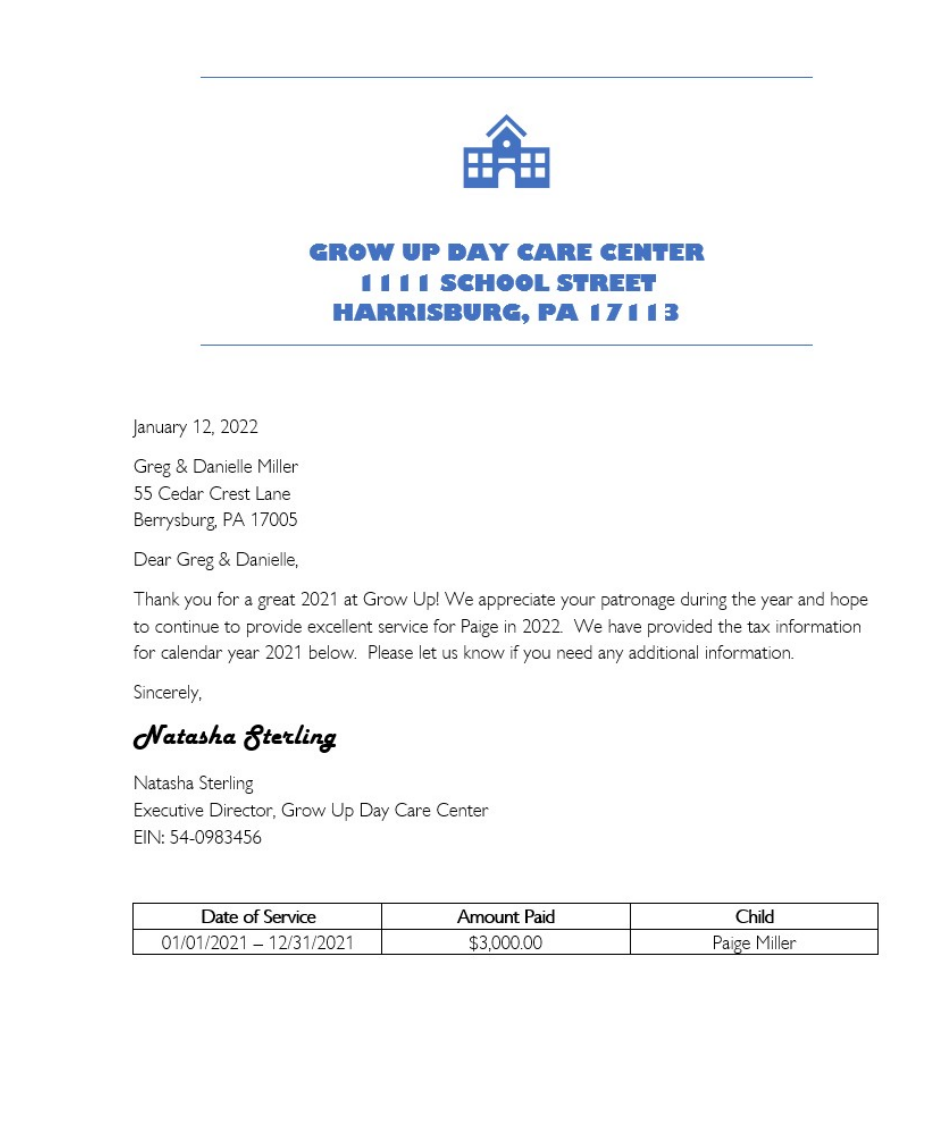

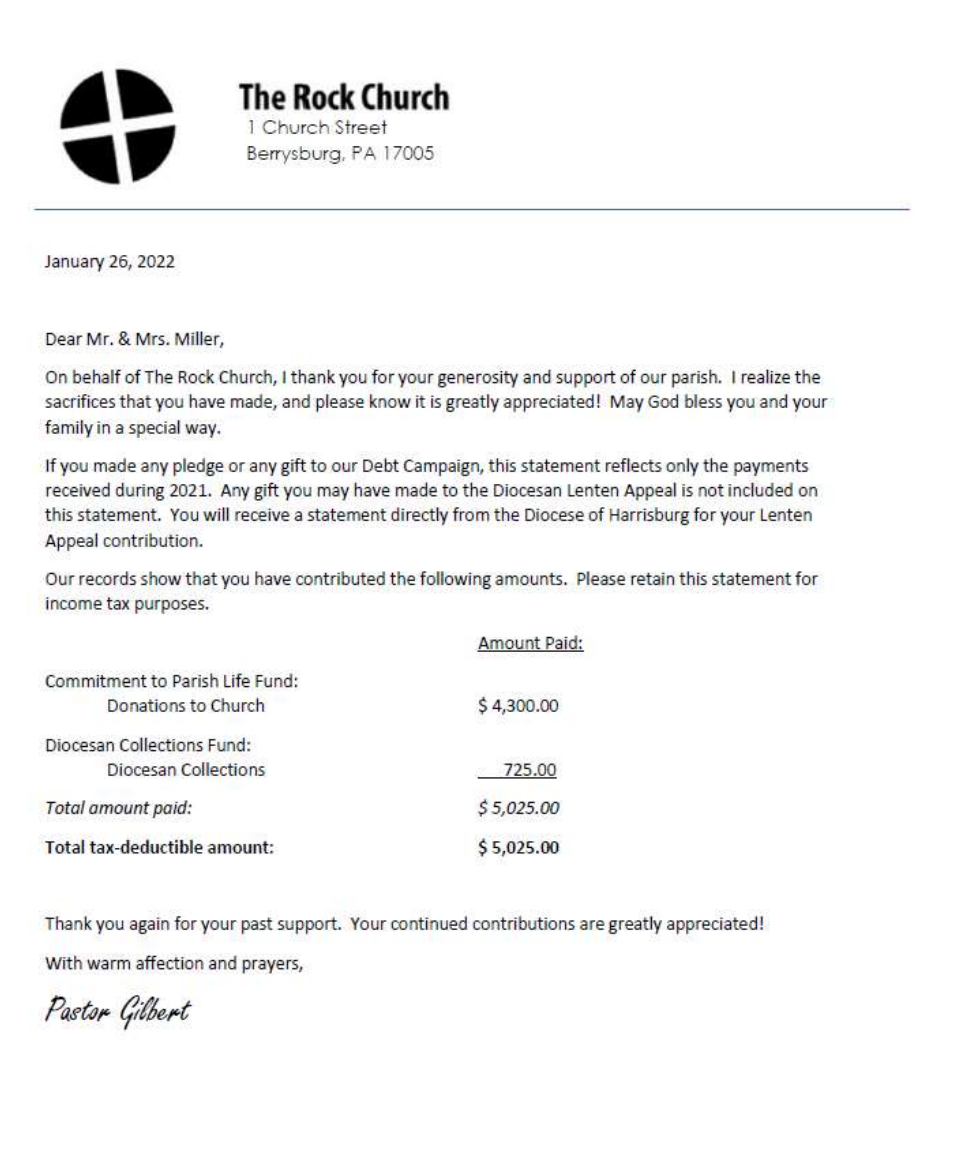

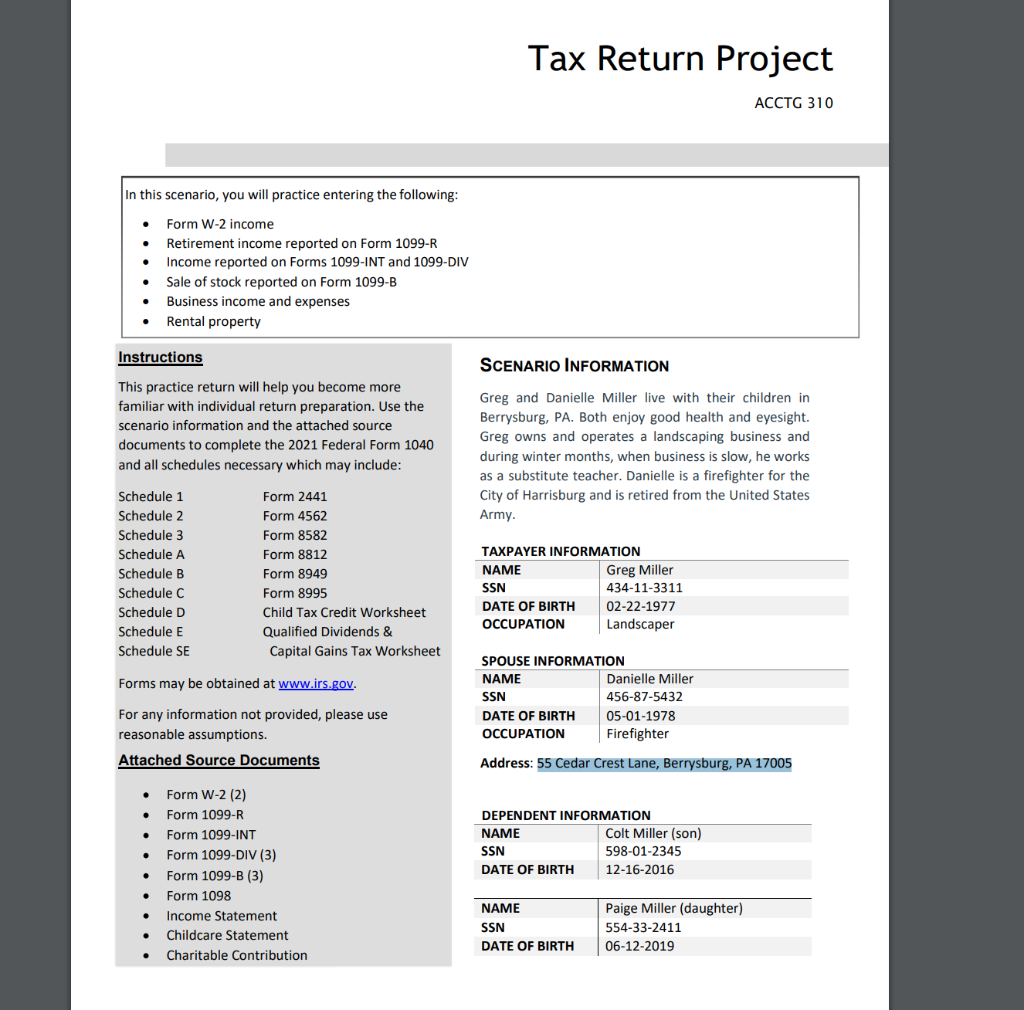

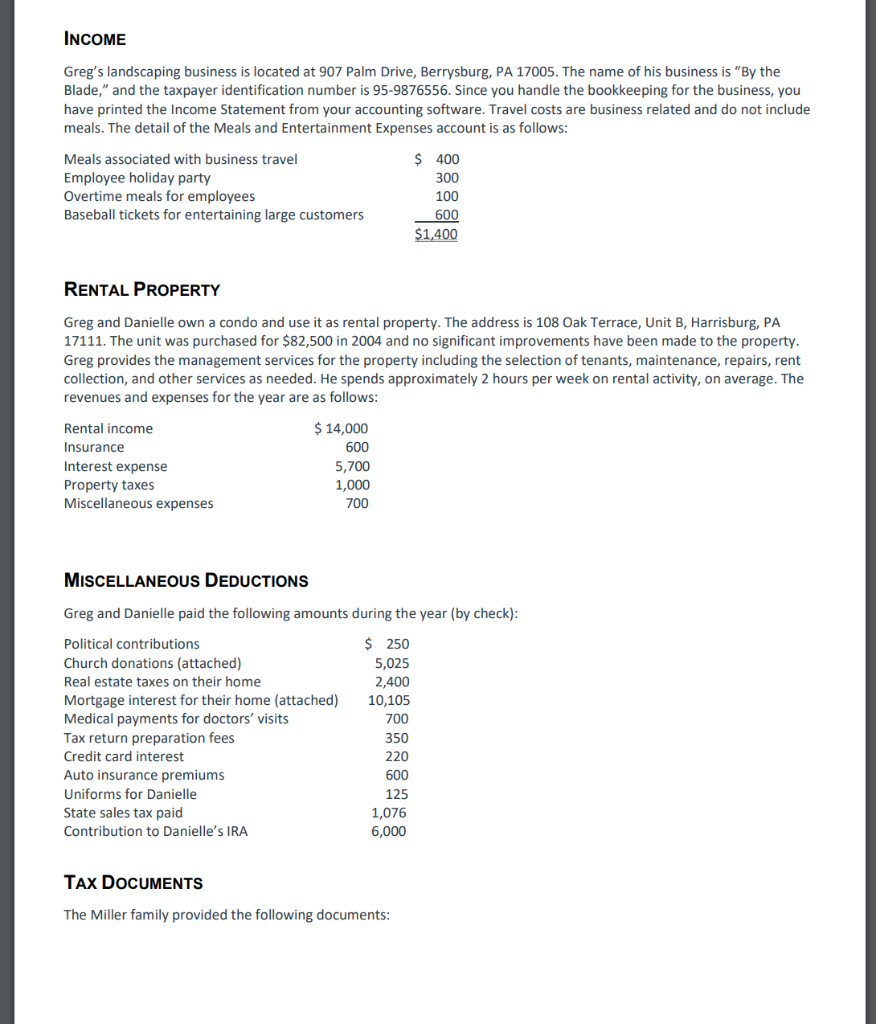

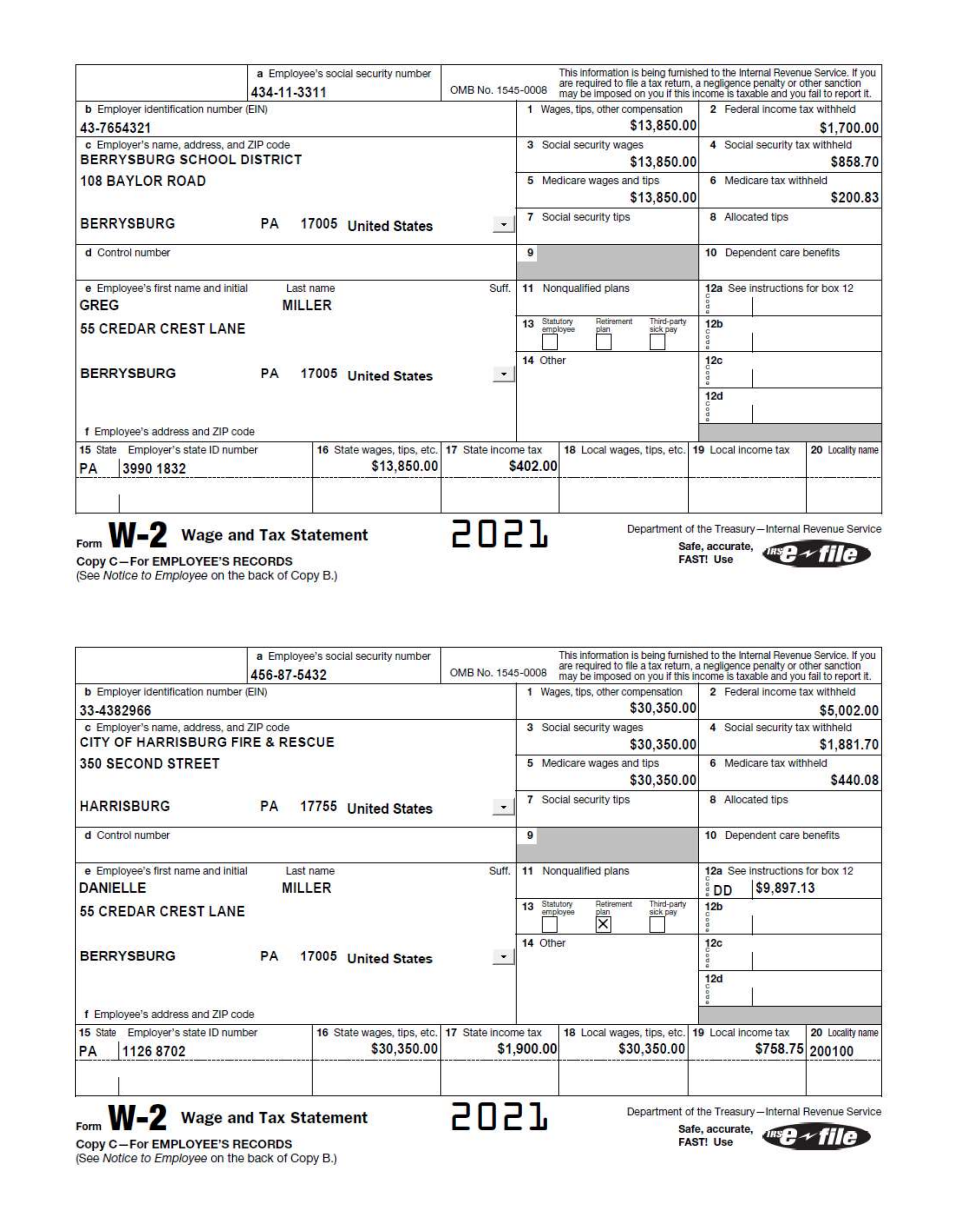

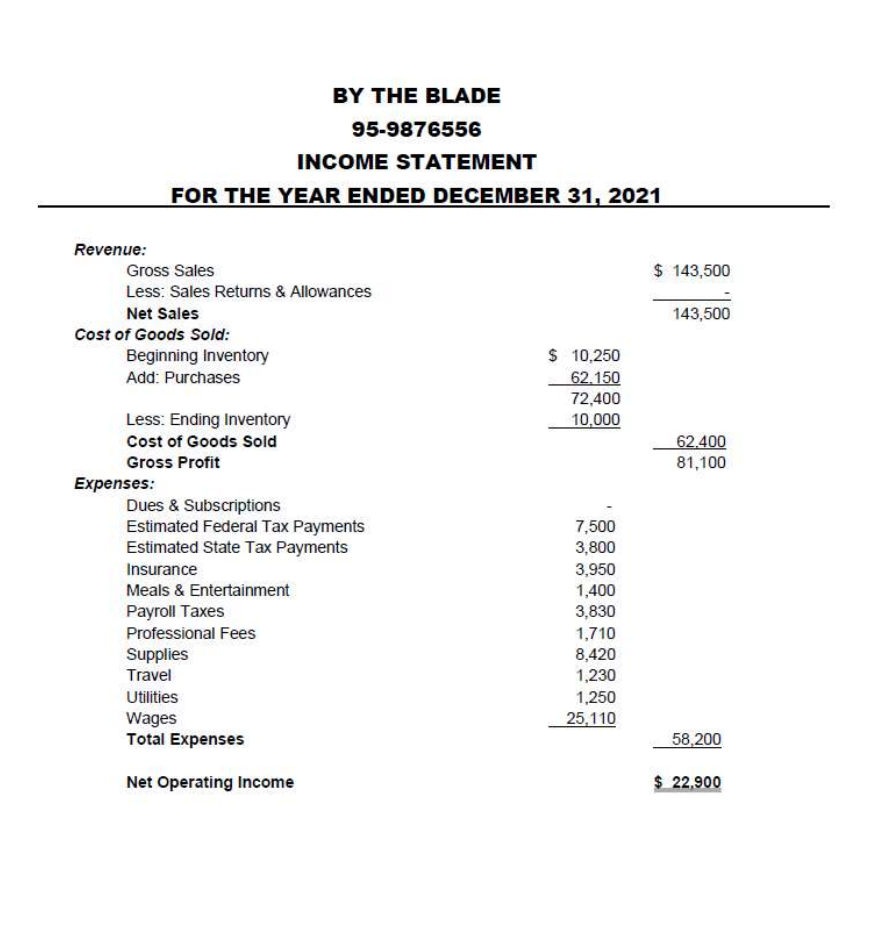

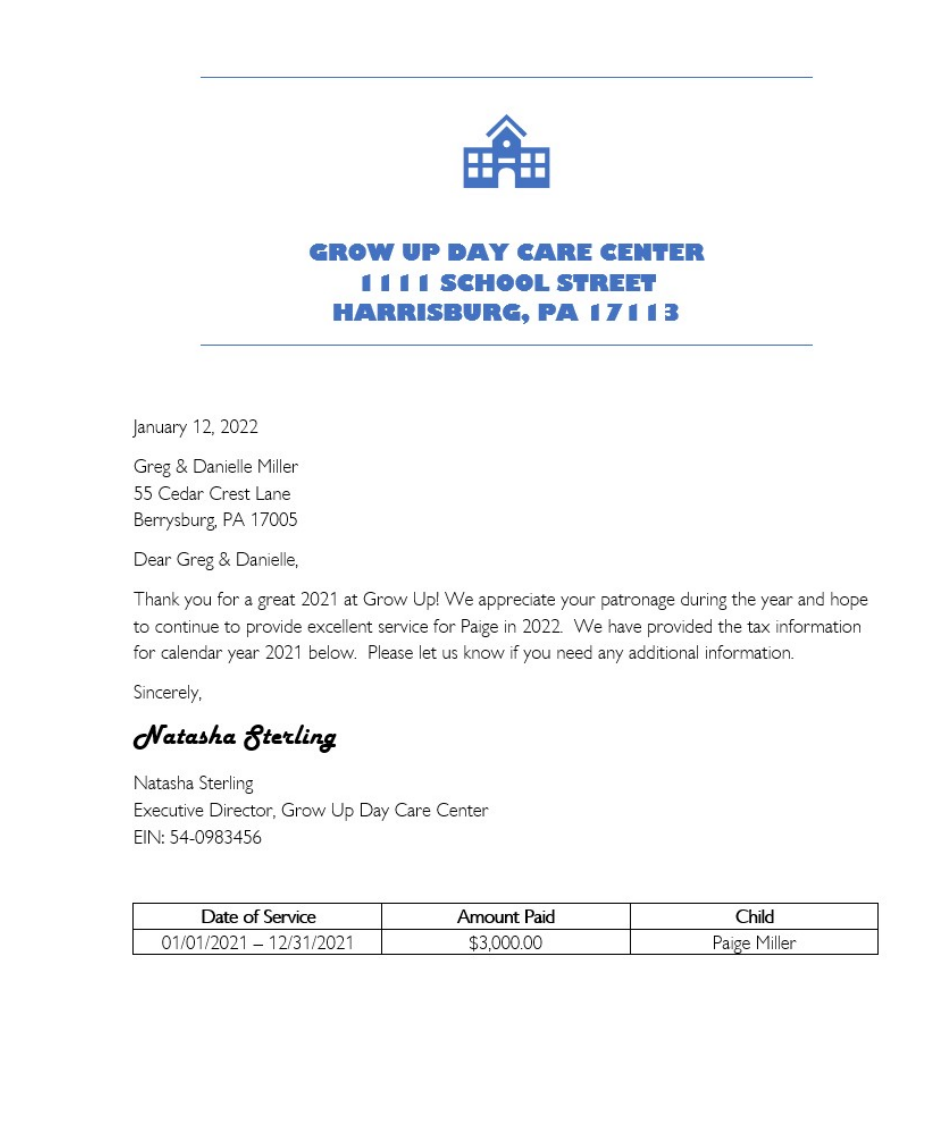

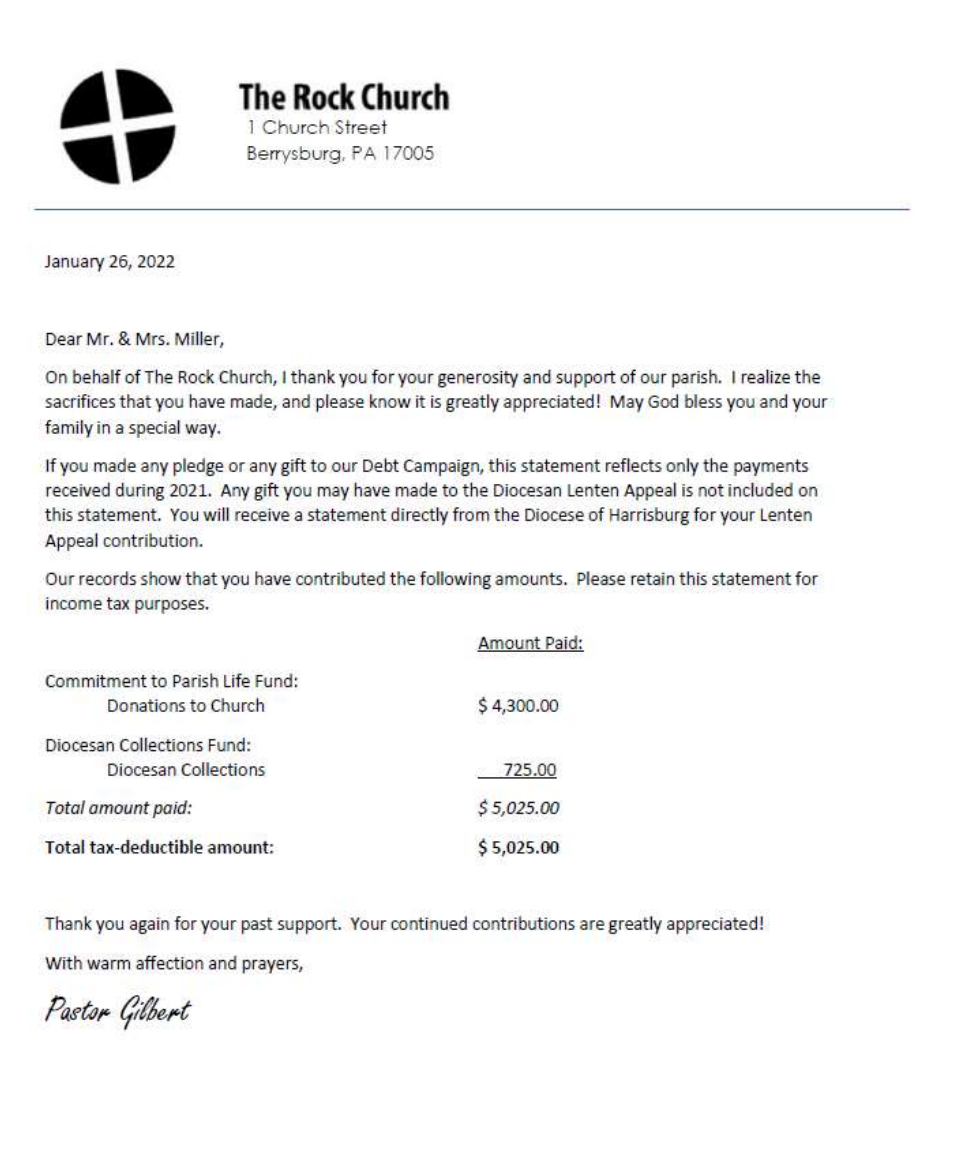

Tax Return Project ACCTG310 In this scenario, you will practice entering the following: - Form W-2 income - Retirement income reported on Form 1099-R - Income reported on Forms 1099-INT and 1099-DIV - Sale of stock reported on Form 1099-B - Business income and expenses - Rental property Instructions SCENARIO INFORMATION This practice return will help you become more familiar with individual return preparation. Use the Greg and Danielle Miller live with their children in scenario information and the attached source Berrysburg, PA. Both enjoy good health and eyesight. documents to complete the 2021 Federal Form 1040 Greg owns and operates a landscaping business and and all schedules necessary which may include: during winter months, when business is slow, he works as a substitute teacher. Danielle is a firefighter for the City of Harrisburg and is retired from the United States Army. Forms may be obtained at www.irs.gov. For any information not provided, please use reasonable assumptions. Attached Source Documents Address: 55 Cedar Crest Lane, Berrysburg, PA 17005 - Form W-2 (2) - Form 1099-R - Form 1099-INT - Form 1099-DIV (3) - Form 1099-B (3) - Form 1098 - Income Statement - Childcare Statement - Charitable Contribution INCOME Greg's landscaping business is located at 907 Palm Drive, Berrysburg, PA 17005. The name of his business is "By the Blade," and the taxpayer identification number is 95-9876556. Since you handle the bookkeeping for the business, you have printed the Income Statement from your accounting software. Travel costs are business related and do not include meals. The detail of the Meals and Entertainment Expenses account is as follows: RENTAL PROPERTY Greg and Danielle own a condo and use it as rental property. The address is 108 Oak Terrace, Unit B, Harrisburg, PA 17111. The unit was purchased for $82,500 in 2004 and no significant improvements have been made to the property. Greg provides the management services for the property including the selection of tenants, maintenance, repairs, rent collection, and other services as needed. He spends approximately 2 hours per week on rental activity, on average. The revenues and expenses for the year are as follows: MISCELLANEOUS DEDUCTIONS Greg and Danielle paid the following amounts during the year (by check): TAX DOCUMENTS The Miller family provided the following documents: Form M=2 Wage and Tax Statement Copy C-For EMPLOYEE'S RECORDS (See Notice to Employee on the back of Copy B.) BY THE BLADE 95-9876556 INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 2021 Revenue: Cost of Goods Sold: Cost of Goods Sold Gross Profit 81,10062,400 Expenses: Dues \& Subscriptions Estimated Federal Tax Payments Estimated State Tax Payments Insurance Meals \& Entertainment Payroll Taxes Professional Fees Supplies Travel Utilities Wages Total Expenses 58,200 Net Operating Income $22,900 January 12, 2022 Greg \& Danielle Miller 55 Cedar Crest Lane Berrysburg, PA 17005 Dear Greg \& Danielle, Thank you for a great 2021 at Grow Up! We appreciate your patronage during the year and hope to continue to provide excellent service for Paige in 2022 . We have provided the tax information for calendar year 2021 below. Please let us know if you need any additional information. Sincerely, Natasha oterling Natasha Sterling Executive Director, Grow Up Day Care Center EIN: 54-0983456 The Rock Church 1 Church Street Berrysburg, PA 17005 January 26,2022 Dear Mr. \& Mrs. Miller, On behalf of The Rock Church, I thank you for your generosity and support of our parish. I realize the sacrifices that you have made, and please know it is greatly appreciated! May God bless you and your family in a special way. If you made any pledge or any gift to our Debt Campaign, this statement reflects only the payments received during 2021. Any gift you may have made to the Diocesan Lenten Appeal is not included on this statement. You will receive a statement directly from the Diocese of Harrisburg for your Lenten Appeal contribution. Our records show that you have contributed the following amounts. Please retain this statement for income tax purposes. Thank you again for your past support. Your continued contributions are greatly appreciated! With warm affection and prayers, Tax Return Project ACCTG310 In this scenario, you will practice entering the following: - Form W-2 income - Retirement income reported on Form 1099-R - Income reported on Forms 1099-INT and 1099-DIV - Sale of stock reported on Form 1099-B - Business income and expenses - Rental property Instructions SCENARIO INFORMATION This practice return will help you become more familiar with individual return preparation. Use the Greg and Danielle Miller live with their children in scenario information and the attached source Berrysburg, PA. Both enjoy good health and eyesight. documents to complete the 2021 Federal Form 1040 Greg owns and operates a landscaping business and and all schedules necessary which may include: during winter months, when business is slow, he works as a substitute teacher. Danielle is a firefighter for the City of Harrisburg and is retired from the United States Army. Forms may be obtained at www.irs.gov. For any information not provided, please use reasonable assumptions. Attached Source Documents Address: 55 Cedar Crest Lane, Berrysburg, PA 17005 - Form W-2 (2) - Form 1099-R - Form 1099-INT - Form 1099-DIV (3) - Form 1099-B (3) - Form 1098 - Income Statement - Childcare Statement - Charitable Contribution INCOME Greg's landscaping business is located at 907 Palm Drive, Berrysburg, PA 17005. The name of his business is "By the Blade," and the taxpayer identification number is 95-9876556. Since you handle the bookkeeping for the business, you have printed the Income Statement from your accounting software. Travel costs are business related and do not include meals. The detail of the Meals and Entertainment Expenses account is as follows: RENTAL PROPERTY Greg and Danielle own a condo and use it as rental property. The address is 108 Oak Terrace, Unit B, Harrisburg, PA 17111. The unit was purchased for $82,500 in 2004 and no significant improvements have been made to the property. Greg provides the management services for the property including the selection of tenants, maintenance, repairs, rent collection, and other services as needed. He spends approximately 2 hours per week on rental activity, on average. The revenues and expenses for the year are as follows: MISCELLANEOUS DEDUCTIONS Greg and Danielle paid the following amounts during the year (by check): TAX DOCUMENTS The Miller family provided the following documents: Form M=2 Wage and Tax Statement Copy C-For EMPLOYEE'S RECORDS (See Notice to Employee on the back of Copy B.) BY THE BLADE 95-9876556 INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 2021 Revenue: Cost of Goods Sold: Cost of Goods Sold Gross Profit 81,10062,400 Expenses: Dues \& Subscriptions Estimated Federal Tax Payments Estimated State Tax Payments Insurance Meals \& Entertainment Payroll Taxes Professional Fees Supplies Travel Utilities Wages Total Expenses 58,200 Net Operating Income $22,900 January 12, 2022 Greg \& Danielle Miller 55 Cedar Crest Lane Berrysburg, PA 17005 Dear Greg \& Danielle, Thank you for a great 2021 at Grow Up! We appreciate your patronage during the year and hope to continue to provide excellent service for Paige in 2022 . We have provided the tax information for calendar year 2021 below. Please let us know if you need any additional information. Sincerely, Natasha oterling Natasha Sterling Executive Director, Grow Up Day Care Center EIN: 54-0983456 The Rock Church 1 Church Street Berrysburg, PA 17005 January 26,2022 Dear Mr. \& Mrs. Miller, On behalf of The Rock Church, I thank you for your generosity and support of our parish. I realize the sacrifices that you have made, and please know it is greatly appreciated! May God bless you and your family in a special way. If you made any pledge or any gift to our Debt Campaign, this statement reflects only the payments received during 2021. Any gift you may have made to the Diocesan Lenten Appeal is not included on this statement. You will receive a statement directly from the Diocese of Harrisburg for your Lenten Appeal contribution. Our records show that you have contributed the following amounts. Please retain this statement for income tax purposes. Thank you again for your past support. Your continued contributions are greatly appreciated! With warm affection and prayers