Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare the DuPont model to identify which company has a lower return on equity. Then briefly explain exactly why the return on equity is lower.

Prepare the DuPont model to identify which company has a lower return on equity. Then briefly explain exactly why the return on equity is lower. Make sure you show all your calculations and support your answers with appropriate analytics.

Prepare the DuPont model to identify which company has a lower return on equity. Then briefly explain exactly why the return on equity is lower. Make sure you show all your calculations and support your answers with appropriate analytics.

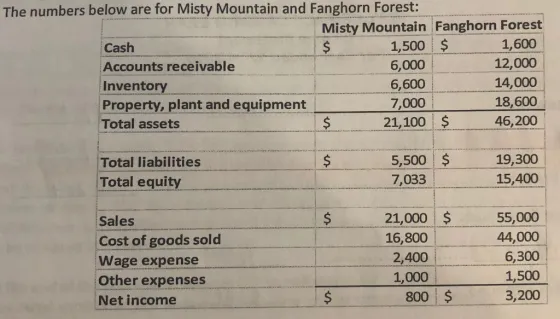

The numbers below are for Misty Mountain and Fanghorn Forest: Misty Mountain Fanghorn Forest Cash $ 1,500 $ 1,600 Accounts receivable 6,000 12,000 Inventory 6,600 14,000 Property, plant and equipment 7,000 18,600 Total assets $ 21,100 $ 46,200 Total liabilities St $ 5,500 $ 19,300 Total equity 7,033 15,400 Sales $ 21,000 $ 55,000 Cost of goods sold 16,800 44,000 Wage expense 2,400 6,300 Other expenses 1,000 1,500 Net income $ 800 $ 3,200

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Absolutely lets analyze the financial statements of Misty Mountain and Fanghorn Forest to identify which company has a lower return on equity and why DuPont Model Calculations Return on Equity ROE Mis...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started