Prepare the Federal income tax return of 2021 for the Smiths.

You will include Form 1040, Schedule 1, Schedule C-only page

1. and Schedule A, Schedule SE-only page 1

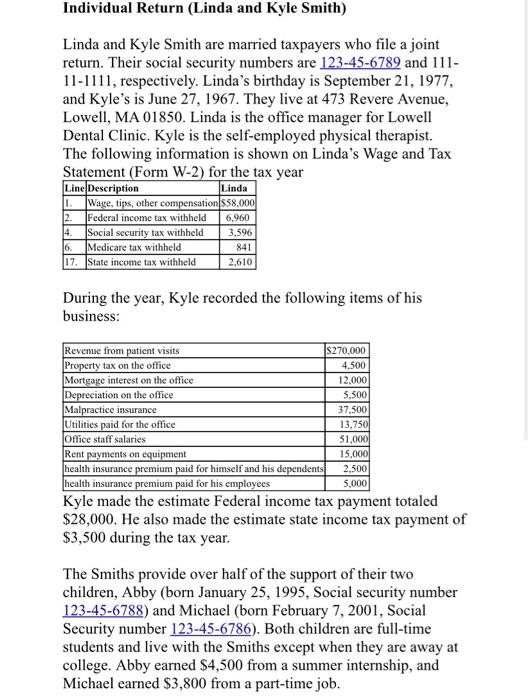

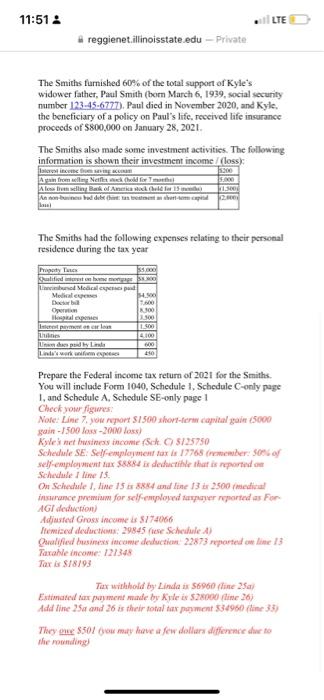

Individual Return (Linda and Kyle Smith) Linda and Kyle Smith are married taxpayers who file a joint return. Their social security numbers are 123-45-6789 and 11111-1111, respectively. Linda's birthday is September 21, 1977, and Kyle's is June 27,1967 . They live at 473 Revere Avenue, Lowell, MA 01850. Linda is the office manager for Lowell Dental Clinic. Kyle is the self-employed physical therapist. The following information is shown on Linda's Wage and Tax Statement (Form W-2) for the tax year During the year, Kyle recorded the following items of his business: Kyle made the estimate Federal income tax payment totaled $28,000. He also made the estimate state income tax payment of $3,500 during the tax year. The Smiths provide over half of the support of their two children, Abby (born January 25, 1995, Social security number 123-45-6788) and Michael (born February 7, 2001, Social Security number 123-45-6786). Both children are full-time students and live with the Smiths except when they are away at college. Abby earned $4,500 from a summer internship, and Michael earned $3,800 from a part-time job. The Smiths furnished 60\% of the tolal support of Kyle's widower father, Paul Smith (borm March 6 , 1939, social security number 12345.6777. Paul died in November 2020, and Kylc. the beneficiary of a policy on Paul's life. received lafe insarance procecds of $800,000 on January 28,2021. The Smiths also made some investment activities. The following The Samiths had the following expenses relating to their personal residence during the tax year Prepare the Federal income tax return of 2021 for the S miths. You will include Form I040, Schedule 1, Schedule C-only page I, and Schedule A. Schedule SE-only page 1 Checki your figires: gain - I500 baxs-2000 fossl Schedule SE: Self-employment fax in 17765 (mmender: S60 5 of self-employment hax \$8.884 is dendacrithte thar is noported on Sichedated line 15 . inxurance peimiam for self entployed fanpuyer nymorted as For. AGJ dethicrion] Adjasfed Gross income is \$374066 ficmised defuctioms. 29845 fose Schedule A) Orafified busimers ittrame dechuction. 22873 mparted an bime 13 Taxahe income: 121344 Tax is $/8/93 Ti2r wrishold by Linda is $6960 prome 25 at Add tine 25 and 26 is their fotal tax phyment \$3496d (ilime 33 ) They gue 350I bou mary have a few dollara differcece due to the mownding)