Answered step by step

Verified Expert Solution

Question

1 Approved Answer

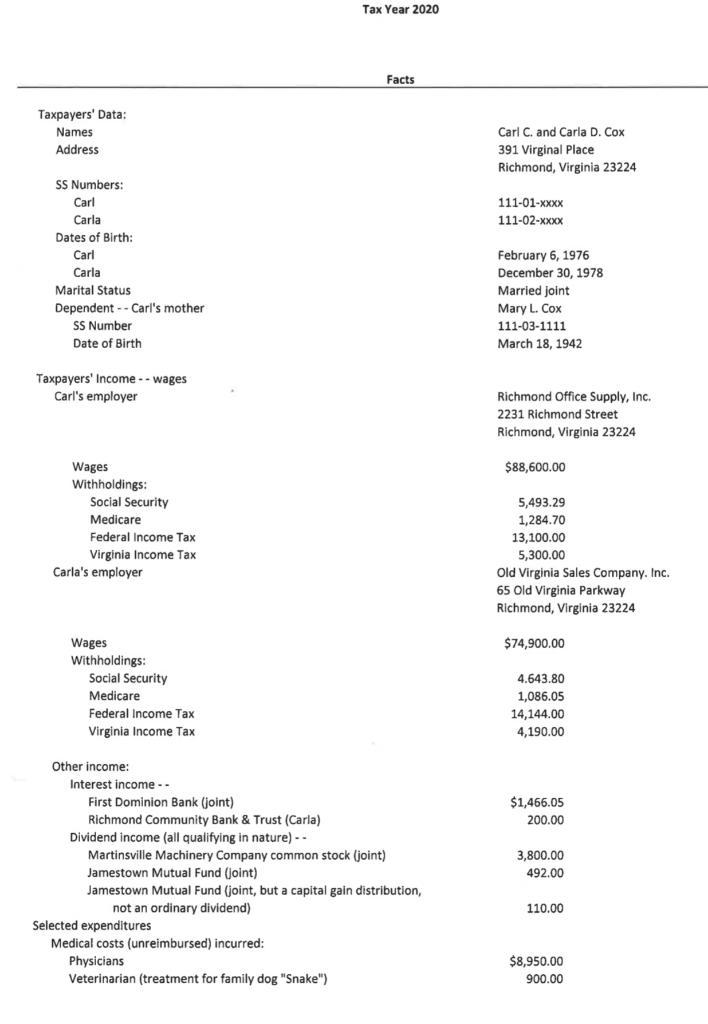

Prepare the federal income tax return using the information below with form 1040 and any other required IRS forms. Taxpayers' Data: Names Address SS Numbers:

Prepare the federal income tax return using the information below with form 1040 and any other required IRS forms.

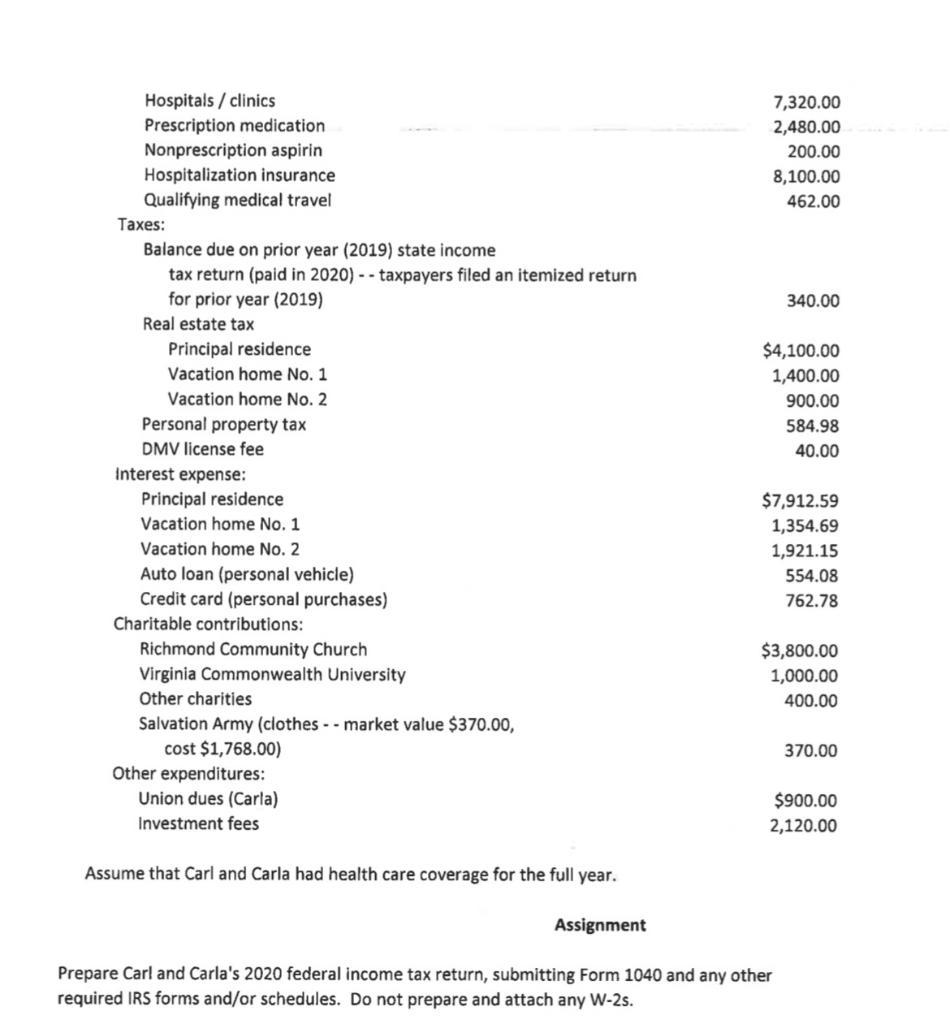

Taxpayers' Data: Names Address SS Numbers: Carl Carla Dates of Birth: Carl Carla Marital Status Dependent Carl's mother SS Number Date of Birth Taxpayers' Income -- wages Carl's employer Wages Withholdings: Social Security Medicare Federal Income Tax Virginia Income Tax Carla's employer Wages Withholdings: Social Security Medicare Federal Income Tax Virginia Income Tax Other income: Interest income -- First Dominion Bank (joint) Richmond Community Bank & Trust (Carla) Dividend income (all qualifying in nature) -- Martinsville Machinery Company common stock (joint) not an ordinary dividend) Tax Year 2020 Jamestown Mutual Fund (joint) Jamestown Mutual Fund (joint, but a capital gain distribution, Selected expenditures Medical costs (unreimbursed) incurred: Physicians Veterinarian (treatment for family dog "Snake") Facts Carl C. and Carla D. Cox 391 Virginal Place Richmond, Virginia 23224 111-01-xxxx 111-02-xxxx February 6, 1976 December 30, 1978 Married joint Mary L. Cox 111-03-1111 March 18, 1942 Richmond Office Supply, Inc. 2231 Richmond Street Richmond, Virginia 23224 $88,600.00 5,493.29 1,284.70 13,100.00 5,300.00 Old Virginia Sales Company. Inc. 65 Old Virginia Parkway Richmond, Virginia 23224 $74,900.00 4.643.80 1,086.05 14,144.00 4,190.00 $1,466.05 200.00 3,800.00 492.00 110.00 $8,950.00 900.00

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Answer To complete the federal income tax return for Carl and Carla Cox using Form 1040 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started