Question

Prepare the following budgets for each month (January, February and March) and for the quarter in total: Sales budget. Production budget. Direct materials purchase budget.

Prepare the following budgets for each month (January, February and March) and for the quarter in total:

Sales budget.

Production budget.

Direct materials purchase budget.

Direct labor budget.

Overhead budget.

.

Selling and administrative expense budget.

Ending FG budget.

Cost of goods sold budget. Assume that beginning inventory in January is valued at $70/unit and the company uses FIFO.

Budgeted income statement (ignore income taxes)

Cash budget.

i.e., for each budget you need to prepare four columns: January, February, March and Quarter 1 (total for all three months, i.e., total for the first quarter)

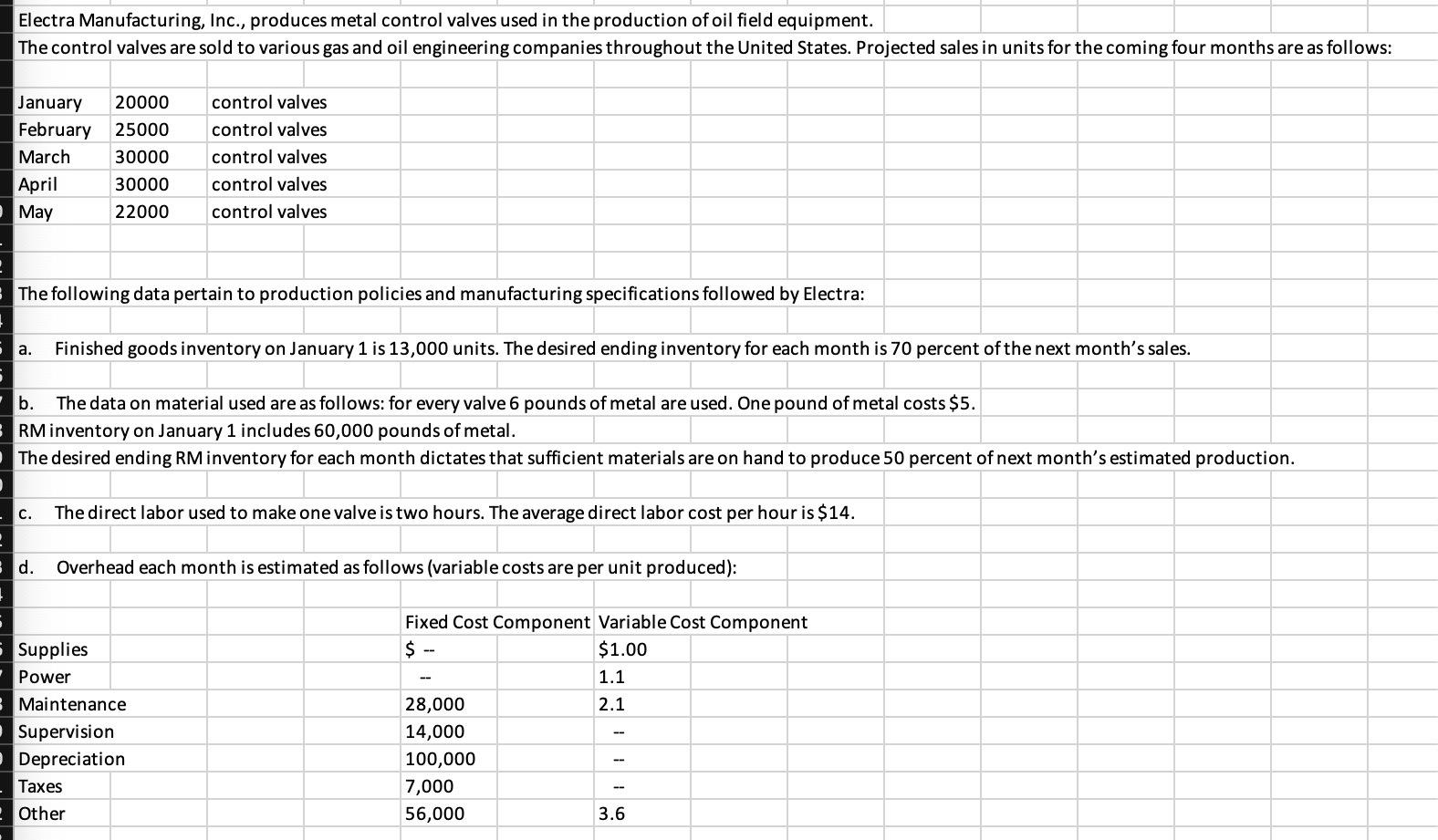

Electra Manufacturing, Inc., produces metal control valves used in the production of oil field equipment. The control valves are sold to various gas and oil engineering companies throughout the United States. Projected sales in units for the coming four months are as follows: \begin{tabular}{|l|l|l|} \hline January & 20000 & control valves \\ \hline February & 25000 & control valves \\ \hline March & 30000 & control valves \\ \hline April & 30000 & control valves \\ \hline May & 22000 & control valves \\ \hline \end{tabular} The following data pertain to production policies and manufacturing specifications followed by Electra: a. Finished goods inventory on January 1 is 13,000 units. The desired ending inventory for each month is 70 percent of the next month's sales. b. The data on material used are as follows: for every valve 6 pounds of metal are used. One pound of metal costs $5. RM inventory on January 1 includes 60,000 pounds of metal. The desired ending RM inventory for each month dictates that sufficient materials are on hand to produce 50 percent of next month's estimated production. c. The direct labor used to make one valve is two hours. The average direct labor cost per hour is $14. d. Overhead each month is estimated as follows (variable costs are per unit produced): Electra Manufacturing, Inc., produces metal control valves used in the production of oil field equipment. The control valves are sold to various gas and oil engineering companies throughout the United States. Projected sales in units for the coming four months are as follows: \begin{tabular}{|l|l|l|} \hline January & 20000 & control valves \\ \hline February & 25000 & control valves \\ \hline March & 30000 & control valves \\ \hline April & 30000 & control valves \\ \hline May & 22000 & control valves \\ \hline \end{tabular} The following data pertain to production policies and manufacturing specifications followed by Electra: a. Finished goods inventory on January 1 is 13,000 units. The desired ending inventory for each month is 70 percent of the next month's sales. b. The data on material used are as follows: for every valve 6 pounds of metal are used. One pound of metal costs $5. RM inventory on January 1 includes 60,000 pounds of metal. The desired ending RM inventory for each month dictates that sufficient materials are on hand to produce 50 percent of next month's estimated production. c. The direct labor used to make one valve is two hours. The average direct labor cost per hour is $14. d. Overhead each month is estimated as follows (variable costs are per unit produced)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started