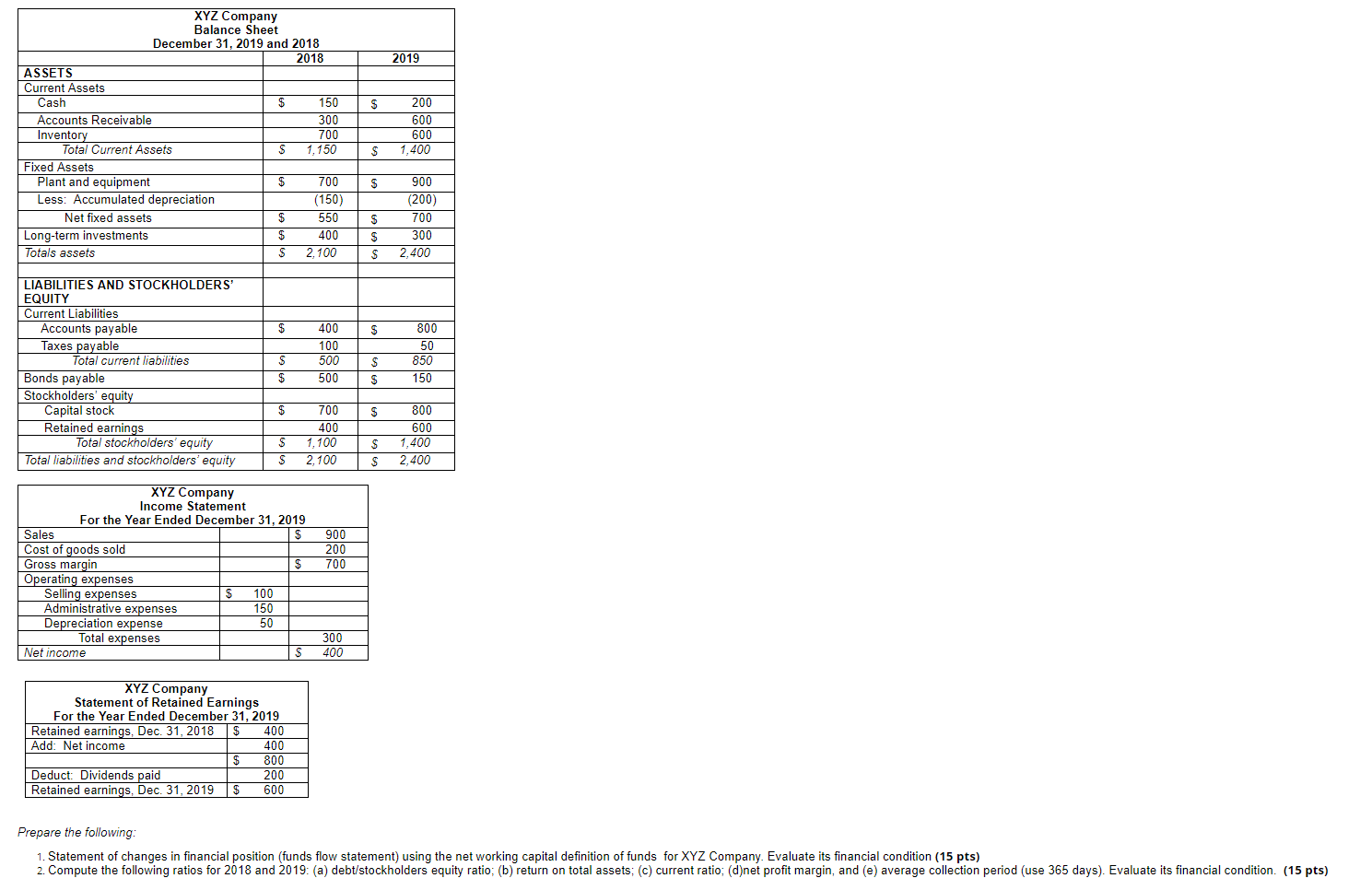

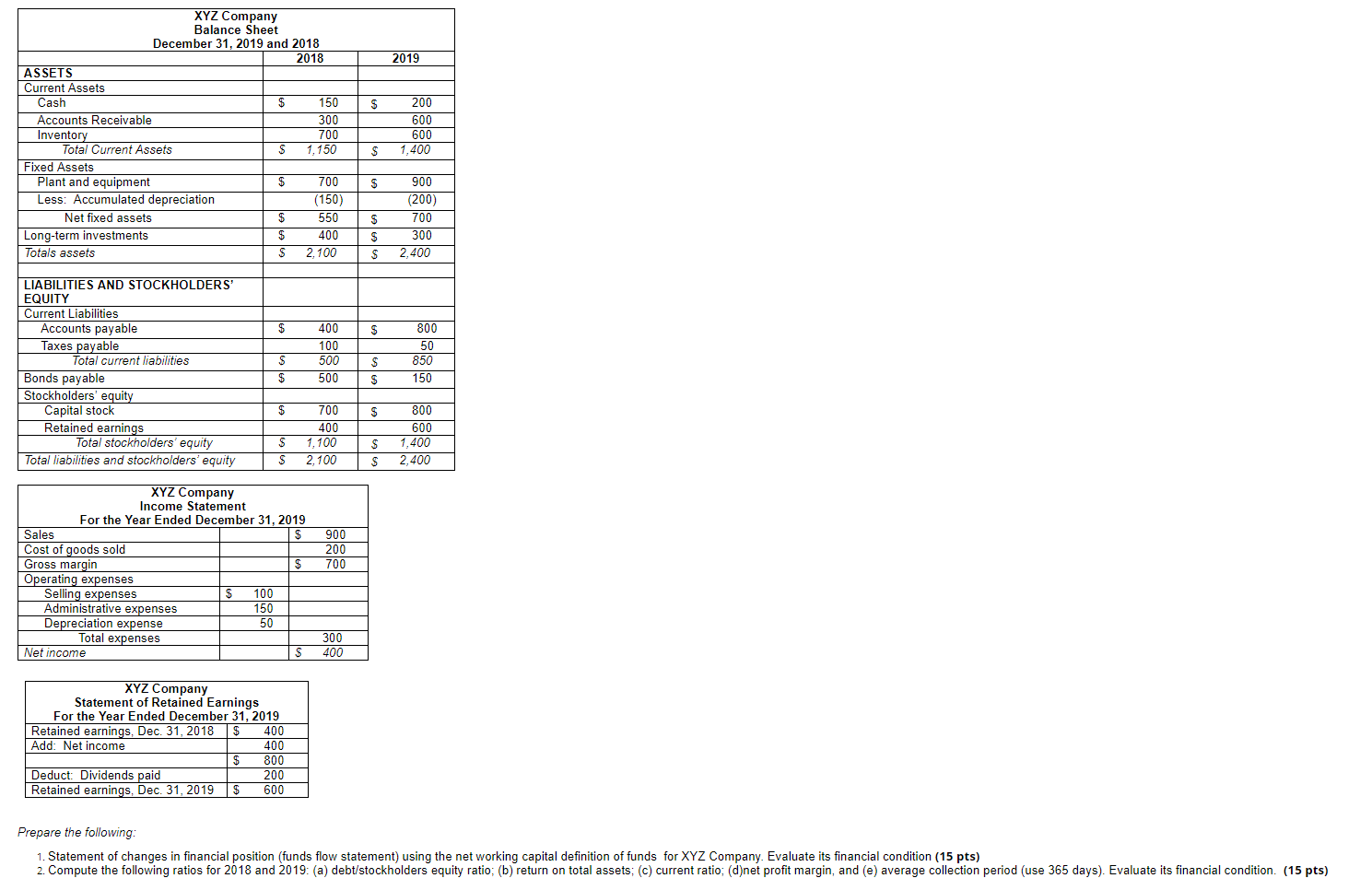

Prepare the following:

- Statement of changes in financial position (funds flow statement) using the net working capital definition of funds for XYZ Company. Evaluate its financial condition

- Compute the following ratios for 2018 and 2019: (a) debt/stockholders equity ratio; (b) return on total assets; (c) current ratio; (d)net profit margin, and (e) average collection period (use 365 days). Evaluate its financial condition.

2019 $ XYZ Company Balance Sheet December 31, 2019 and 2018 2018 ASSETS Current Assets Cash 150 Accounts Receivable 300 Inventory 700 Total Current Assets S 1,150 Fixed Assets Plant and equipment $ 700 Less: Accumulated depreciation (150) Net fixed assets $ 550 Long-term investments $ 400 Totals assets S 2,100 200 600 600 1,400 S $ 900 (200) S S $ 700 300 2,400 $ CA 400 100 500 500 LIABILITIES AND STOCKHOLDERS EQUITY Current Liabilities Accounts payable Taxes payable Total current liabilities Bonds payable Stockholders' equity Capital stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 800 50 850 150 S $ S S $ 700 400 S 1,100 $ 2,100 800 600 1,400 2,400 $ $ 900 200 700 XYZ Company Income Statement For the Year Ended December 31, 2019 Sales Cost of goods sold Gross margin $ Operating expenses Selling expenses 100 Administrative expenses 150 Depreciation expense 50 Total expenses Net income 300 400 XYZ Company Statement of Retained Earnings For the Year Ended December 31, 2019 Retained earnings, Dec 31, 2018 400 Add: Net income 400 800 Deduct: Dividends paid 200 Retained earnings, Dec 31, 2019 $ 600 Prepare the following: 1. Statement of changes in financial position (funds flow statement) using the net working capital definition of funds for XYZ Company. Evaluate its financial condition (15 pts) 2. Compute the following ratios for 2018 and 2019: (a) debt/stockholders equity ratio; (b) return on total assets; (c) current ratio; (d)net profit margin, and (e) average collection period (use 365 days). Evaluate its financial condition. (15 pts) 2019 $ XYZ Company Balance Sheet December 31, 2019 and 2018 2018 ASSETS Current Assets Cash 150 Accounts Receivable 300 Inventory 700 Total Current Assets S 1,150 Fixed Assets Plant and equipment $ 700 Less: Accumulated depreciation (150) Net fixed assets $ 550 Long-term investments $ 400 Totals assets S 2,100 200 600 600 1,400 S $ 900 (200) S S $ 700 300 2,400 $ CA 400 100 500 500 LIABILITIES AND STOCKHOLDERS EQUITY Current Liabilities Accounts payable Taxes payable Total current liabilities Bonds payable Stockholders' equity Capital stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 800 50 850 150 S $ S S $ 700 400 S 1,100 $ 2,100 800 600 1,400 2,400 $ $ 900 200 700 XYZ Company Income Statement For the Year Ended December 31, 2019 Sales Cost of goods sold Gross margin $ Operating expenses Selling expenses 100 Administrative expenses 150 Depreciation expense 50 Total expenses Net income 300 400 XYZ Company Statement of Retained Earnings For the Year Ended December 31, 2019 Retained earnings, Dec 31, 2018 400 Add: Net income 400 800 Deduct: Dividends paid 200 Retained earnings, Dec 31, 2019 $ 600 Prepare the following: 1. Statement of changes in financial position (funds flow statement) using the net working capital definition of funds for XYZ Company. Evaluate its financial condition (15 pts) 2. Compute the following ratios for 2018 and 2019: (a) debt/stockholders equity ratio; (b) return on total assets; (c) current ratio; (d)net profit margin, and (e) average collection period (use 365 days). Evaluate its financial condition. (15 pts)