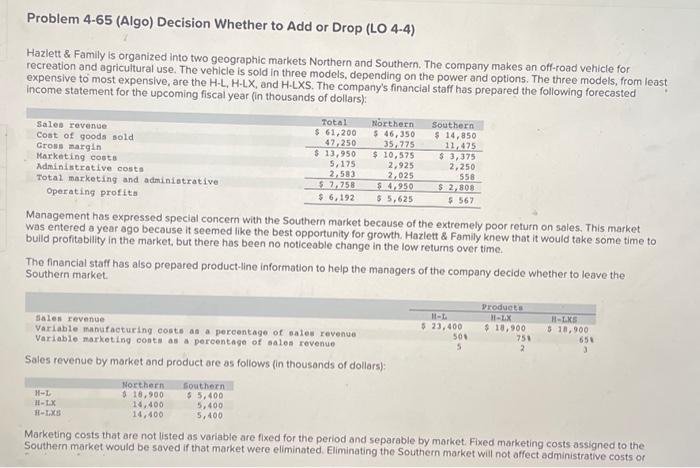

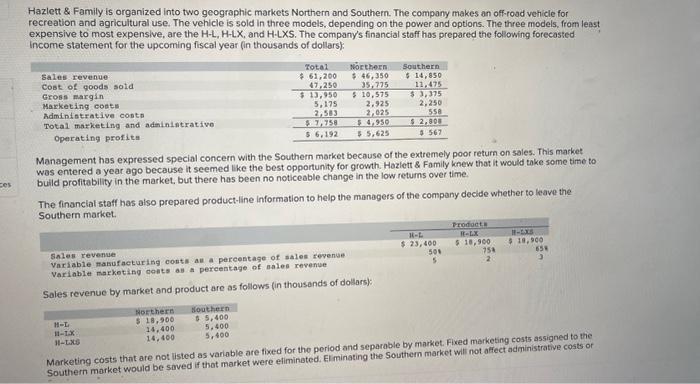

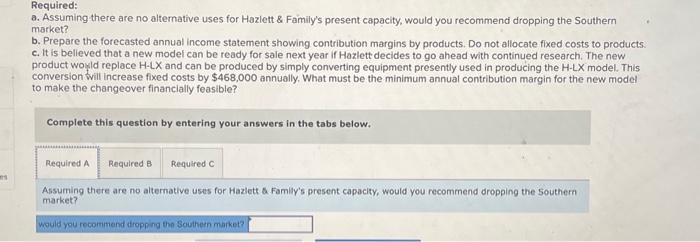

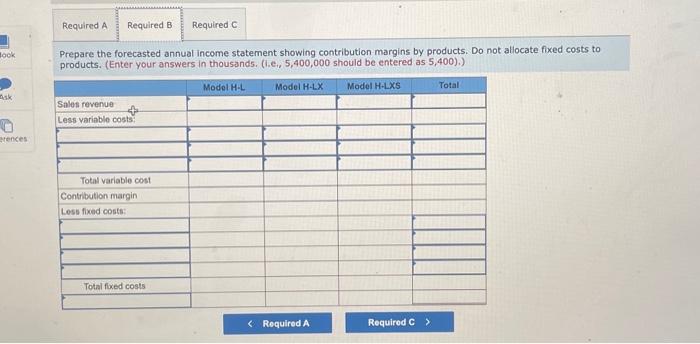

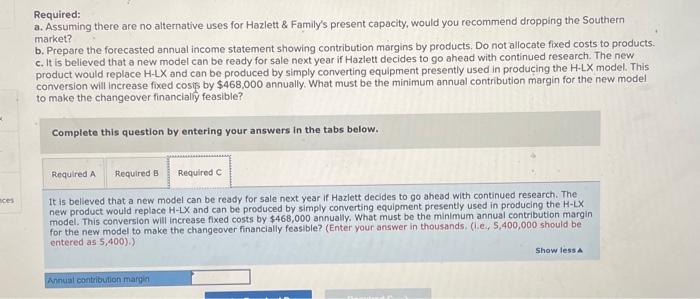

Prepare the forecasted annual income statement showing contribution margins by products. Do not allocate fixed costs to products. (Enter your answers in thousands. (1.e., 5,400,000 should be entered as 5,400), ) Problem 4-65 (Algo) Decision Whether to Add or Drop (LO 4-4) Hazlett \& Family is organized into two geographic markets Northern and Southern. The company makes an off-road vehicle for recreation and agricultural use. The vehicle is sold in three models, depending on the power and options. The three models, from least expensive to most expensive, are the H.L.H.LX, and H.LXS. The company's financial staff has prepared the following forecasted income statement for the upcoming fiscal year (in thousands of dollars): Management has expressed special concern with the Southern market because of the extremely poor roturn on sales. This market was entered a year ago because it seemed like the best opportunity for growth. Hazlett \& Family knew that it would take some time to bulid profitability in the market, but there has been no noticeable change in the low returns over time. The financial staff has also prepared product-line information to help the managers of the company decide whether to leave the Southern market. Sales revenue by market and product are as follows (in thousands of dollars): Marketing costs that are not listed as variable are fixed for the period and separable by market. Fixed marketing costs assigned to the Southern market would be saved if that market were eliminated. Eliminating the Southern market will not affect administrative costs or Required: a. Assuming there are no alternative uses for Hazlett \& Family's present capacity, would you recommend dropping the Southern market? b. Prepare the forecasted annual income statement showing contribution margins by products. Do not allocate fixed costs to product: c. It is believed that a new model can be ready for sale next year if Hazlett decides to go ahead with continued research. The new product would replace HLX and can be produced by simply converting equipment presently used in producing the HLX model. This conversion will increase fixed cosis by $468,000 annually. What must be the minimum annual contribution margin for the new model to make the changeover financially feasible? Complete this question by entering your answers in the tabs below. It is believed that a new model can be ready for sale next year if Hazlett decides to go ahead with continued research. The new product would replace HLX and can be produced by simply converting equipment presently used in producing the HLX model. This conversion will increase fixed costs by $468,000 annually. What must be the minimum annual contribution margin for the new model to make the changeover financially feasible? (Enter your answer in thousands. (1.e., 5,400,000 should be entered as 5,400).) Required: a. Assuming there are no altemative uses for Hazlett \& Family's present capacity, would you recommend dropping the Southern market? b. Prepare the forecasted annual income statement showing contribution margins by products. Do not allocate fixed costs to products. c. It is believed that a new model can be ready for sale next year if Hazlett decides to go ahead with continued research. The new product woyld replace HLX and can be produced by simply converting equipment presently used in producing the H-LX model. This conversion will increase fixed costs by $468,000 annually. What must be the minimum annual contribution margin for the new model to make the changeover financially feasible? Complete this question by entering your answers in the tabs below. Assuming there are no alternative uses for Hazlett \& Family's present capacity, would you recommend dropping the Southern market? Hazlett \& Family is organized into two geographic markets Northern and Southern. The company makes an off-road vehicle for recreation and agricultural use. The vehicle is sold in three models, depending on the power and options. The three models, from least expensive to most expensive, are the H-L, H-LX, and H.LXS. The company's financial stoff has prepared the following forecasted income statement for the upcoming fiscal year (in thousands of dollars): Management has expressed special concern with the Southern market because of the extremely poor return on sales. This market was entered a year ago because it seemed like the best opportunity for growh. Hazlett \& Family knew that it would toke some time to bulld profitability in the market, but there has been no noticeable change in the low returns over time. The financial staff has also prepared product-line information to help the managers of the company declde whether to leave the Southern market. Sales revenue by market and pros Marketing costs that are not listed as variable are fixed for the period and separable by market. Fixed marketing costs assigned to the