Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare the general journal entries to record the above independent scenarios The directors issued a prospectus offering 40,000 ordinary shares at an issue price of

Prepare the general journal entries to record the above independent scenarios

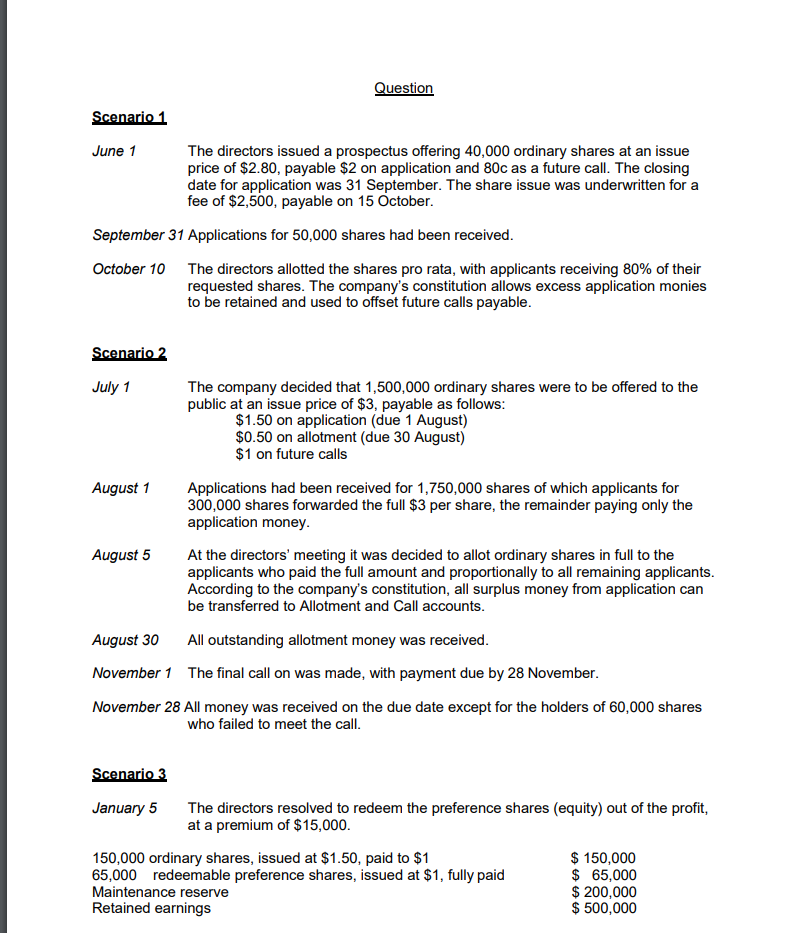

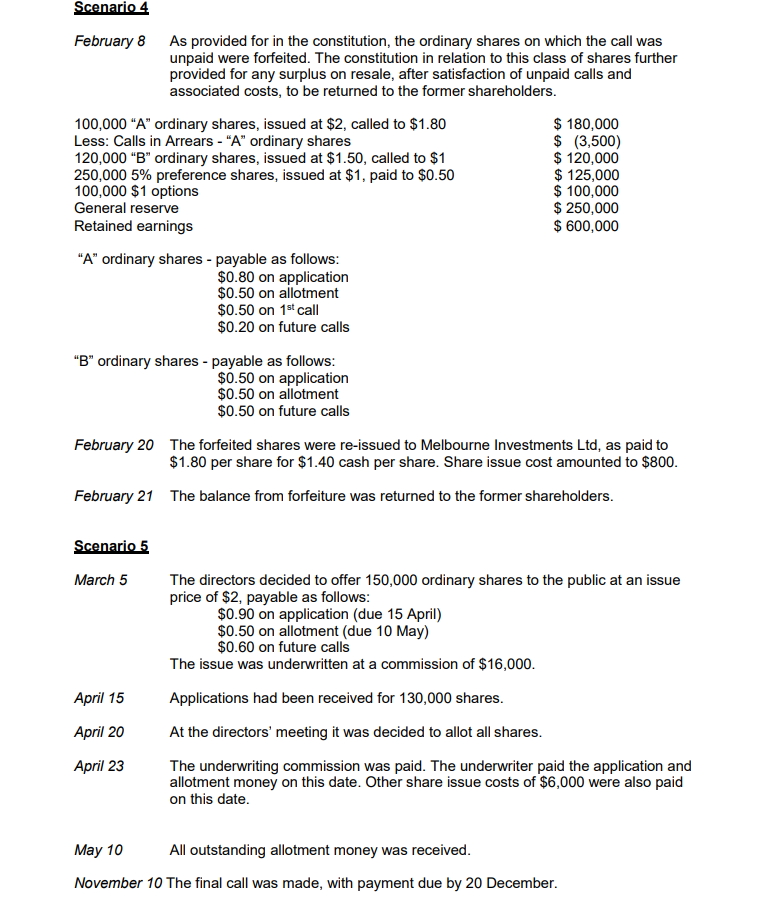

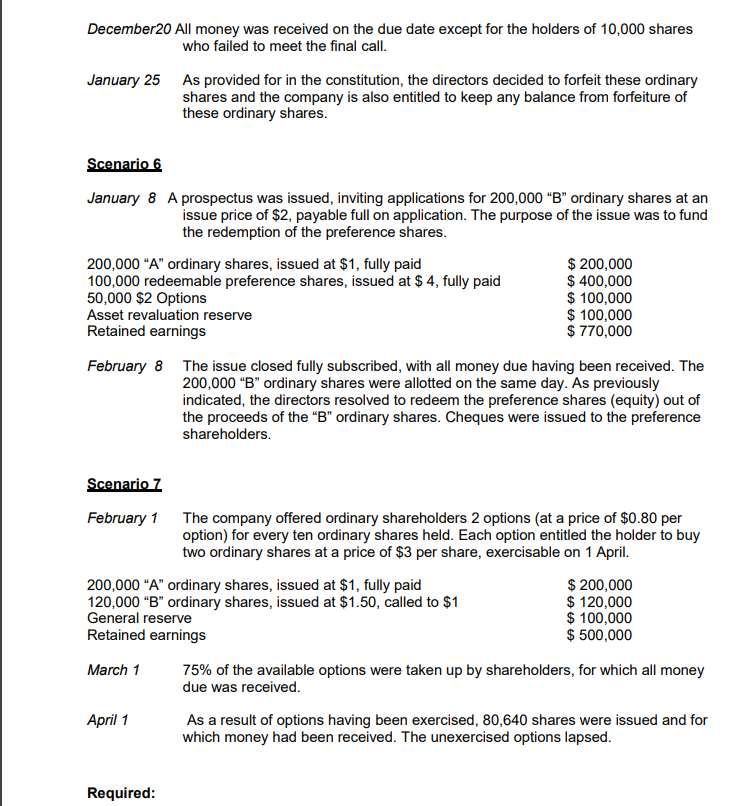

The directors issued a prospectus offering 40,000 ordinary shares at an issue price of $2.80, payable $2 on application and 80c as a future call. The closing date for application was 31 September. The share issue was underwritten for a fee of $2,500, payable on 15 October June 1 September 31 Applications for 50,000 shares had been received October 10 The directors allotted the shares pro rata, with applicants receiving 80% of their requested shares. The company's constitution allows excess application monies to be retained and used to offset future calls payable July 1 The company decided that 1,500,000 ordinary shares were to be offered to the public at an issue price of $3, payable as follows $1.50 on application (due 1 August) $0.50 on allotment (due 30 August) $1 on future calls August 1 Applications had been received for 1,750,000 shares of which applicants for 300,000 shares forwarded the full $3 per share, the remainder paying only the application money August 5At the directors' meeting it was decided to allot ordinary shares in full to the applicants who paid the full amount and proportionally to all remaining applicants According to the company's constitution, all surplus money from application can be transferred to Allotment and Call accounts August 30 All outstanding allotment money was received November 1 The final call on was made, with payment due by 28 November November 28 All money was received on the due date except for the holders of 60,000 shares who failed to meet the call January 5 The directors resolved to redeem the preference shares (equity) out of the profit, at a premium of $15,000 150,000 ordinary shares, issued at $1.50, paid to $1 65,000 redeemable preference shares, issued at $1, fully paid Maintenance reserve Retained earnings $150,000 $65,000 $ 200,000 $ 500,000 February 8 As provided for in the constitution, the ordinary shares on which the call was unpaid were forfeited. The constitution in relation to this class of shares further provided for any surplus on resale, after satisfaction of unpaid calls and associated costs, to be returned to the former shareholders 100,000 "A" ordinary shares, issued at $2, called to $1.80 Less: Calls in Arrears - "A" ordinary shares 120,000 "B" ordinary shares, issued at $1.50, called to $1 250,000 5% preference shares, issued at $1, paid to $0.50 100,000 $1 options General reserve Retained earnings $180,000 $ (3,500) $120,000 $125,000 $ 100,000 $ 250,000 $ 600,000 "A" ordinary shares-payable as follows $0.80 on application $0.50 on allotment $0.50 on 1st call $0.20 on future calls "B" ordinary shares-payable as follows $0.50 on application $0.50 on allotment $0.50 on future calls February 20 The forfeited shares were re-issued to Melbourne Investments Ltd, as paid to $1.80 per share for $1.40 cash per share. Share issue cost amounted to $800 February 21 The balance from forfeiture was returned to the former shareholders March 5 The directors decided to offer 150,000 ordinary shares to the public at an issue price of $2, payable as follows $0.90 on application (due 15 April) $0.50 on allotment (due 10 May) $0.60 on future calls The issue was underwritten at a commission of $16,000 Applications had been received for 130,000 shares At the directors' meeting it was decided to allot all shares April 15 April 20 April 23 The underwriting commission was paid. The underwriter paid the application and allotment money on this date. Other share issue costs of $6,000 were also paid on this date May 10 All outstanding allotment money was received November 10 The final call was made, with payment due by 20 December December20 All money was received on the due date except for the holders of 10,000 shares who failed to meet the final call January 25 As provided for in the constitution, the directors decided to forfeit these ordinary shares and the company is also entitled to keep any balance from forfeiture of these ordinary shares January 8 A prospectus was issued, inviting applications for 200,000 "B" ordinary shares at an issue price of $2, payable full on application. The purpose of the issue was to fund the redemption of the preference shares 200,000 "A" ordinary shares, issued at $1, fully paid 100,000 redeemable preference shares, issued at $ 4, fully paid 50,000 $2 Options Asset revaluation reserve Retained earnings $ 200,000 $ 400,000 $ 100,000 $ 100,000 $770,000 February 8 The issue closed fully subscribed, with all money due having been received. The 200,000 "B" ordinary shares were allotted on the same day. As previously indicated, the directors resolved to redeem the preference shares (equity) out of the proceeds of the "B" ordinary shares. Cheques were issued to the preference shareholders. February 1 The company offered ordinary shareholders 2 options (at a price of $0.80 per option) for every ten ordinary shares held. Each option entitled the holder to buy two ordinary shares at a price of $3 per share, exercisable on 1 April 200,000 "A" ordinary shares, issued at $1, fully paid 120,000 "B" ordinary shares, issued at $1.50, called to $1 General reserve Retained earnings $ 200,000 $ 120,000 $ 100,000 $ 500,000 March 1 75% of the available options were taken up by shareholders, for which all money due was received April 1 As a result of options having been exercised, 80,640 shares were issued and for which money had been received. The unexercised options lapsed RequiredStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started