Prepare the general ledger journal entries for the transactions. (Govermerntal Accounting)

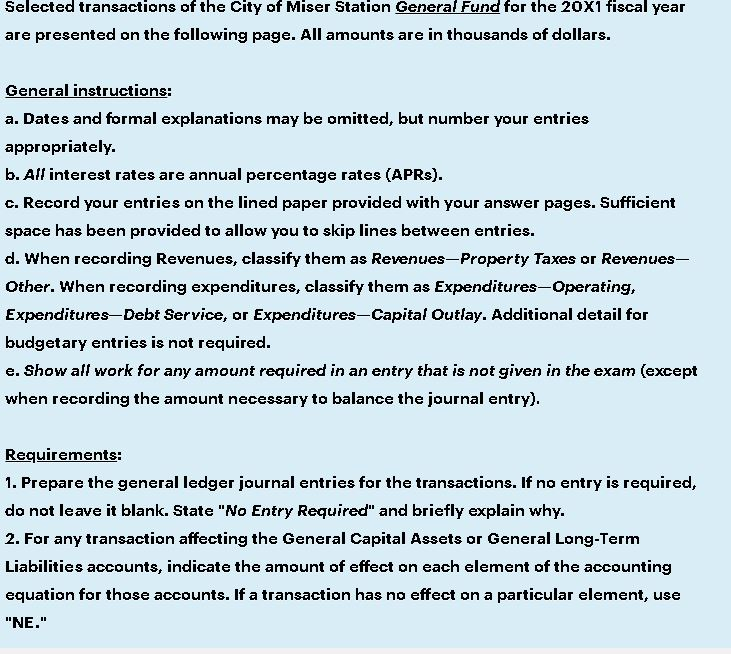

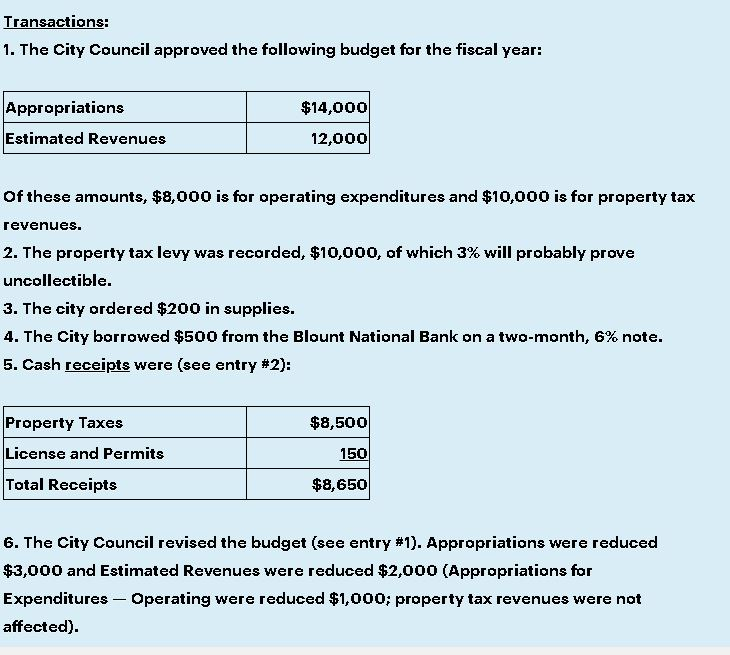

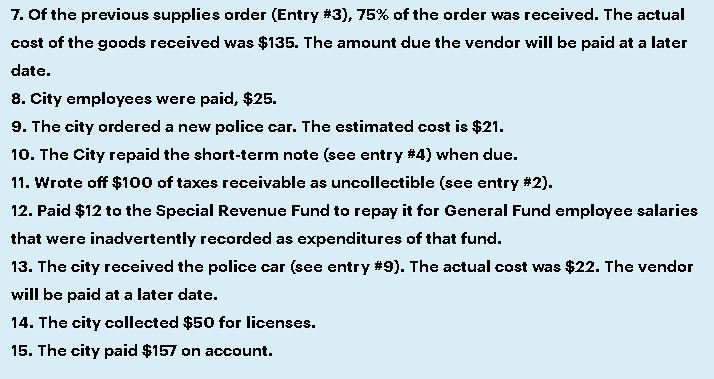

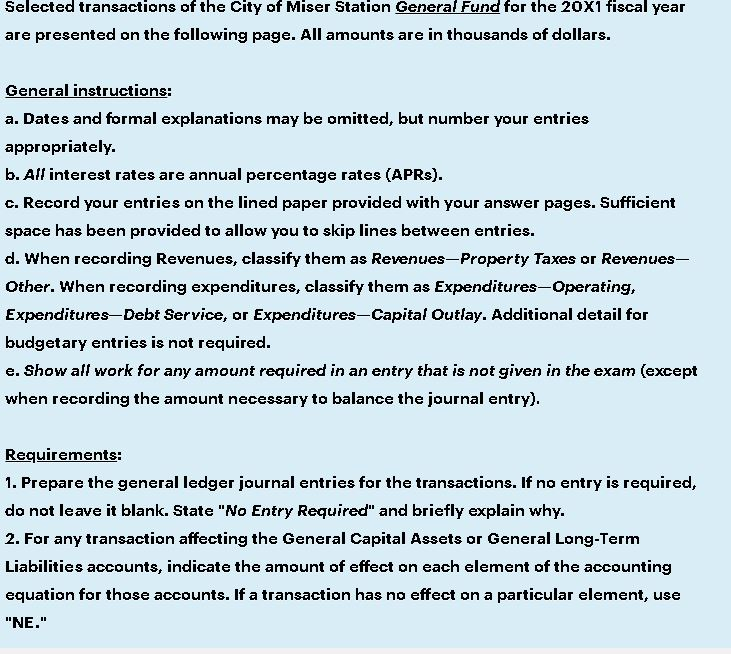

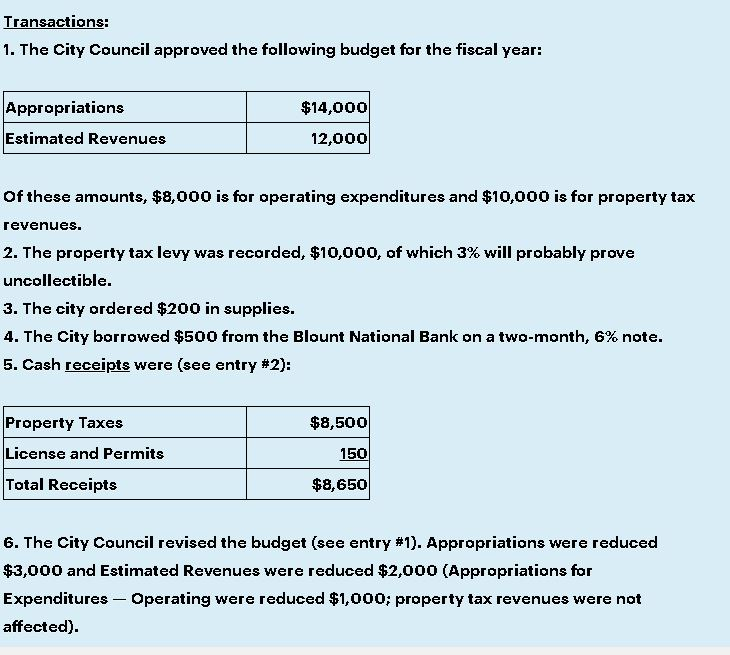

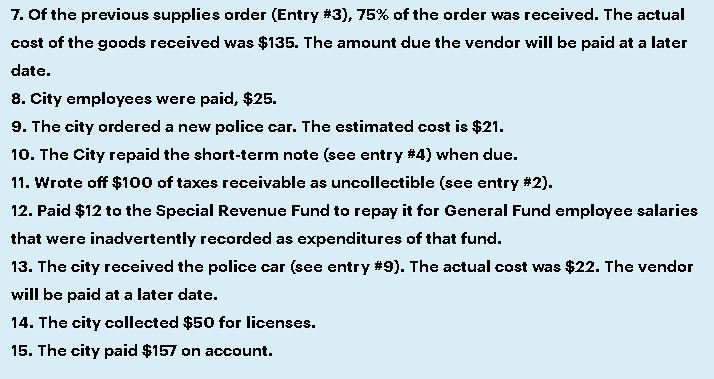

Selected transactions of the City of Miser Station General Fund for the 20x1 fiscal year are presented on the following page. All amounts are in thousands of dollars. General instructians: a. Dates and formal explanations may be omitted, but number your entries appropriately b. All interest rates are annual percentage rates (APRs) c. Record your entries on the lined paper provided with your answer pages. Sufficient space has been provided to allow you to skip lines between entries. d. When recording Revenues, classify them as Revenues-Property Taxes or Revenues- Other. When recording expenditures, classify them as Expenditures-Operating, Expenditures-Debt Service, or Expenditures-Capital Outlay. Additional detail for budgetary entries is not required. e. Show all work for any amount required in an entry that is not given in the exam (except when recording the amount necessary to balance the journal entry) Requirements: 1. Prepare the general ledger journal entries for the transactions. If no entry is required, do not leave it blank. State "No Entry Required" and briefly explain why. 2. For any transaction affecting the General Capital Assets or General Long-Term Liabilities accounts, indicate the amount of effect on each element of the accounting equation for those accounts. If a transaction has no effect on a particular element, use "NE." Selected transactions of the City of Miser Station General Fund for the 20x1 fiscal year are presented on the following page. All amounts are in thousands of dollars. General instructians: a. Dates and formal explanations may be omitted, but number your entries appropriately b. All interest rates are annual percentage rates (APRs) c. Record your entries on the lined paper provided with your answer pages. Sufficient space has been provided to allow you to skip lines between entries. d. When recording Revenues, classify them as Revenues-Property Taxes or Revenues- Other. When recording expenditures, classify them as Expenditures-Operating, Expenditures-Debt Service, or Expenditures-Capital Outlay. Additional detail for budgetary entries is not required. e. Show all work for any amount required in an entry that is not given in the exam (except when recording the amount necessary to balance the journal entry) Requirements: 1. Prepare the general ledger journal entries for the transactions. If no entry is required, do not leave it blank. State "No Entry Required" and briefly explain why. 2. For any transaction affecting the General Capital Assets or General Long-Term Liabilities accounts, indicate the amount of effect on each element of the accounting equation for those accounts. If a transaction has no effect on a particular element, use "NE